Author: Grayscale Research; Compiler: ALMan@黄金财经

The cryptocurrency sector is a proprietary framework we developed in partnership with FTSE Russell Indexes to organize digital asset markets and measure returns. In the second quarter of 2025, price returns and changes in fundamental indicators across cryptocurrency sectors performed differently.

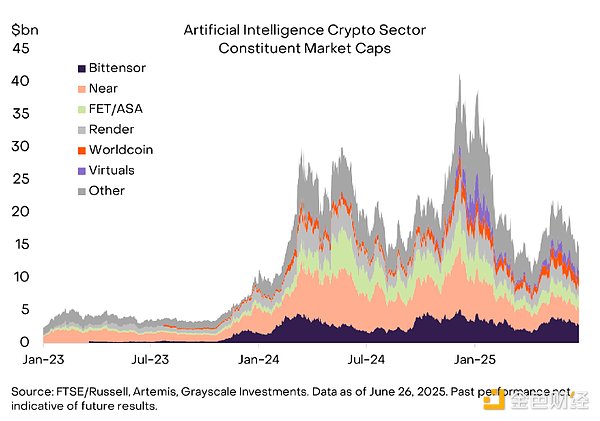

We recently launched the AI Crypto sector, which contains 24 assets with a total market value of $15 billion. Based on the index methodology, the sector rose 10% in the second quarter.

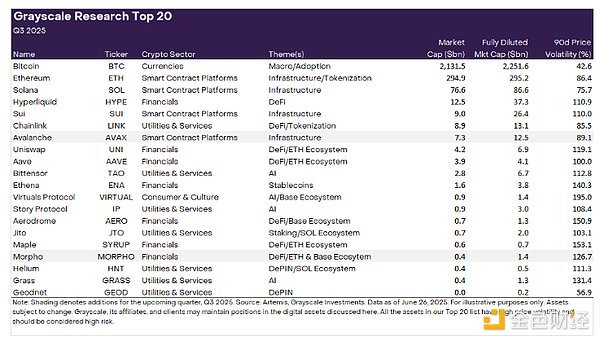

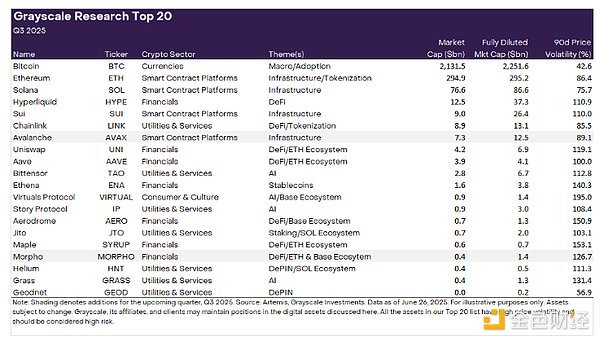

We updated the Grayscale Research Top 20 Tokens list. The Top 20 list covers a diverse range of assets in the cryptocurrency space, which we believe have great potential in the coming quarters. Newly added assets this quarter include Avalanche (AVAX) and Morpho (MORPHO). All of the assets in our Top 20 tokens list have high price volatility and should be considered high-risk assets.

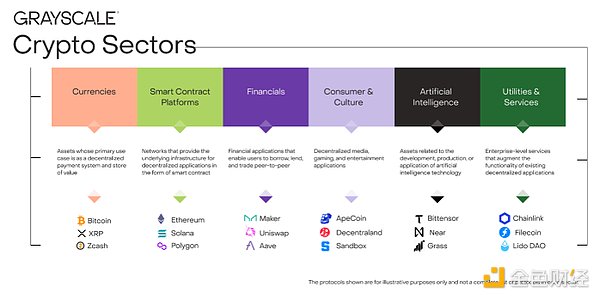

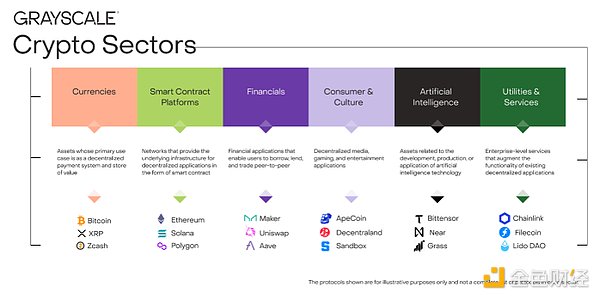

Every asset in crypto has some connection to blockchain technology and shares the same basic market structure—but that’s where the commonality ends. The asset class covers a wide variety of software technologies with applications in consumer finance, artificial intelligence (AI), media and entertainment, and more. To make the data clear, Grayscale Research uses a proprietary taxonomy and index series developed in partnership with FTSE/Russell called “Crypto Sectors” (see Figure 1). As of the latest revision, the Crypto Sectors framework now covers six different market segments, including the AI Crypto Sectors discussed below. Together, they include 261 tokens with a total market capitalization of $3 trillion.

Exhibit 1: Crypto Sectors Framework Helps Organize Digital Asset Markets

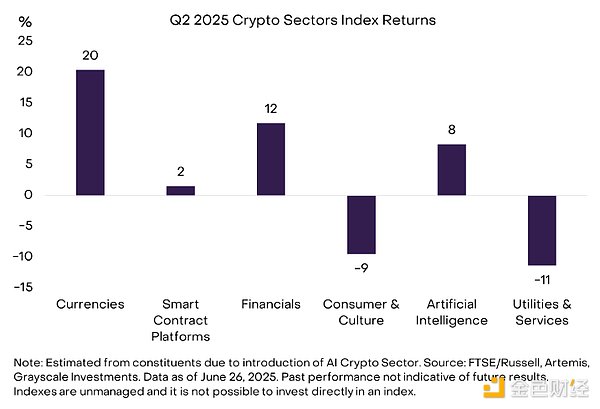

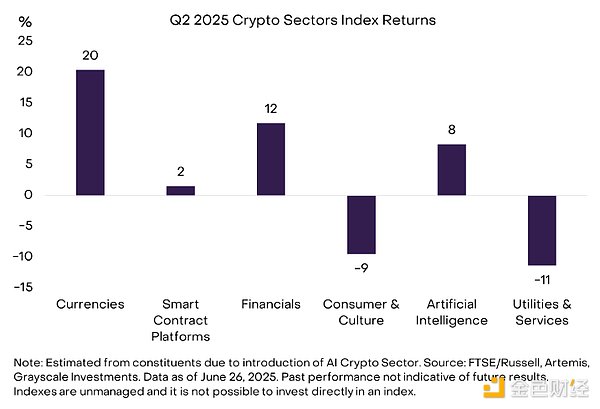

Q2 2025 saw mixed returns, a quarter marked by both the “Liberation Day” tariff announcement and U.S. military action in the Middle East. Our market-cap-weighted composite FTSE/Grayscale Cryptocurrency Sector Total Market Index was essentially unchanged during the quarter (Exhibit 2). The Currency Cryptocurrency Sector Index outperformed as the price of Bitcoin rose 30% during the period. The FTSE/Grayscale Financial Cryptocurrency Sector Index and the FTSE/Grayscale Artificial Intelligence Cryptocurrency Sector Index also saw small gains. In contrast, the FTSE/Grayscale Consumer & Culture Cryptocurrency Sector Index fell due to weakness in certain meme coins and gaming-related tokens. The FTSE/Grayscale Utilities & Services Cryptocurrency Sector Index also fell, reflecting broad weakness among its constituents.

Figure 2: Mixed returns across cryptocurrency sectors in Q2 2025

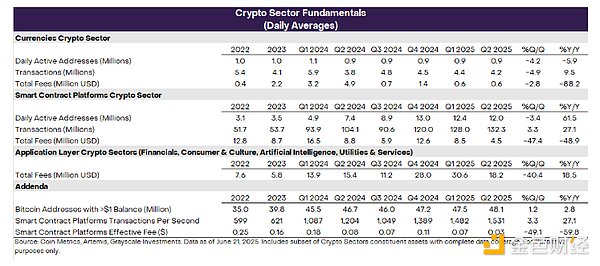

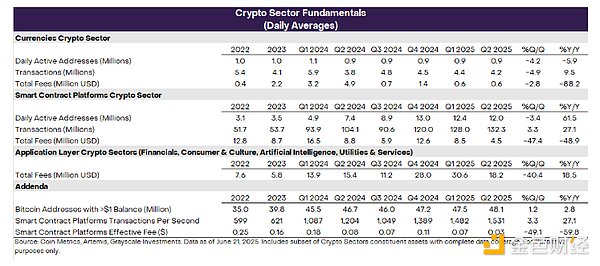

Blockchains are not businesses, but their economic activity and financial health can be measured in a similar way. The three most important indicators of on-chain activity are users, transactions, and transaction fees. Because blockchains are anonymous, analysts often use "active addresses" (blockchain addresses with at least one transaction) as an imperfect proxy for the number of users.

Similar to token price returns, indicators of blockchain financial health in the second quarter of 2025 were mixed. On the one hand, the average number of transactions processed by smart contract platforms climbed to more than 130 million, or about 1,500 transactions per second; transaction volume increased by nearly 30% over the past year (Exhibit 3). On the other hand, transaction fees paid by users fell across the board. This partly reflects a further cooling of memecoin trading activity on Solana, which was the main source of transaction fees in previous quarters. Across the blockchains included in this analysis, actual transaction fees for smart contract platforms are about $0.03 (or 3 cents per transaction). Although application layer fees have fallen quarter-on-quarter, they have still grown at an annualized rate of $5 billion to $10 billion over the past four quarters.

Chart 3: Declining Transaction Fees in the Crypto Industry

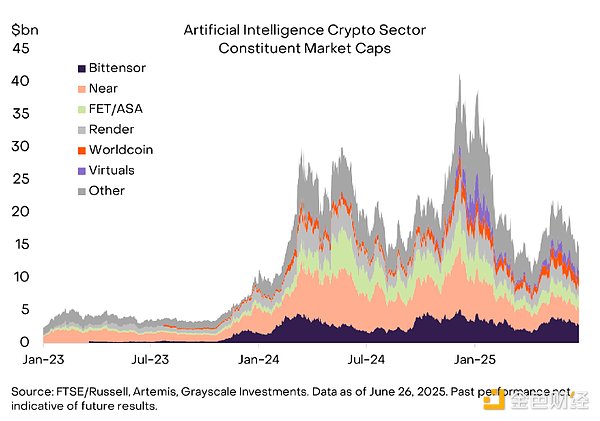

Last month, we launched the AI Crypto sector, a change that has been formally incorporated into the FTSE/Grayscale Crypto Sector Series Index in the latest index rebalancing. The AI Crypto sector currently consists of 24 tokens with a total market capitalization of approximately $15 billion, up from approximately $5 billion in 2023, but still less than 1% of Bitcoin's market capitalization (Chart 4). The largest asset in the AI Crypto sector is Bittensor, a platform designed to incentivize decentralized AI development.

Figure 4: AI Crypto Sector Has 24 Assets and $15 Billion Market Cap

Grayscale Research Top 20 Tokens

The Grayscale Research team analyzes hundreds of digital assets every quarter to inform the rebalancing process of the FTSE/Grayscale Crypto Sector Index Series. Based on this process, the Grayscale Research team generates a list of the top 20 assets in the cryptocurrency industry. This list covers a diversified portfolio of assets in the cryptocurrency industry that we believe have great potential in the coming quarter (Exhibit 5). Our methodology covers a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuations, token supply inflation, and potential tail risks.

Over the past quarter, the focus of the cryptocurrency market has included stagflation and other macroeconomic risks (which may be bullish for Bitcoin), as well as progress in the U.S. on stablecoins and market structure regulation (which also seems to support Ethereum and DeFi-related assets). These themes, as well as progress in decentralized artificial intelligence, are already well represented in the Top 20 list.

As a result, we are only making two changes this quarter, which are more related to the fundamentals of specific protocols rather than new themes. Specifically, we will add:

1. Avalanche (AVAX): Avalanche is a well-known smart contract platform blockchain - currently ranked sixth in its crypto space by market capitalization. This is a highly competitive market segment, and many high-quality projects are working hard to build the best platform for users and developers. In fact, it is difficult to determine which platform will gain the most lasting network effect based on technology alone. Therefore, Grayscale Research attaches great importance to de facto adoption trends. Avalanche has recently seen an increase in volume (as well as growth in users and fees), which is out of step with its ecosystem (this may be related to the addition of the video game MapleStory and the associated stablecoin volume). While we don't know if the increase in activity will continue, this growth in organic adoption bodes well for Avalanche's competitive position in the smart contract platform crypto space and could support its native AVAX token. 2. Morpho (MORPHO): Morpho is an overcollateralized decentralized lending protocol that features independent lending pools that pair one collateral asset with one loan asset. Built primarily on Ethereum and Base, Morpho has a simple structure that allows users to lock assets in customizable vaults. Morpho has grown rapidly over the past year, with annual fee revenue increasing to approximately $100 million and total locked value (TVL) more than doubling to over $4 billion, making it the second largest lending application by this metric. Last month, Morpho announced the launch of Morpho V2, which aims to bring DeFi to traditional financial institutions. Grayscale Research is optimistic about the future of on-chain lending activity, and Morpho seems well-positioned to potentially capture a piece of this growth (along with other lending-related protocols Aave and Maple Finance on the top 20 list).

Figure 5: AVAX and MORPHO Rank Among the Top 20 Tokens in Q3 2025

To make room for Avalanche and Morpho, we will remove Lido DAO (LDO) and Optimism (OP) this quarter. Both projects are leaders in their respective fields (staking and Layer 2, respectively) and are core to the Ethereum ecosystem. However, if US regulatory changes allow for wider use of staking services (e.g., in ETPs), Lido could face fee competition from centralized staking providers. Optimism’s technology is widely used by Ethereum Layer 2 networks, including Coinbase’s Base Chain, Uniswap’s Unichain, and the OP mainnet itself. However, the fee revenue generated by the OP token is limited. In addition, we are uncertain how the Optimism “superchain” vision will reconcile with the Ethereum Foundation’s own efforts to improve interoperability, perhaps through alternative rollup designs (i.e., “based” and “native” rollups). The long-term investment thesis for LDO and OP remains unchanged: Lido provides core liquidity staking services, while Optimism leads the way for Ethereum to scale. However, we are less certain about the near-term outlook and will therefore exit both assets in the next quarter.

Investing in the crypto asset class involves risks, some of which are unique to the crypto asset class, including smart contract vulnerabilities and regulatory uncertainty. Additionally, all of our top 20 assets are highly volatile and should be considered high risk, and therefore not suitable for all investors. Given the riskiness of this asset class, any digital asset investment should be considered in the context of a portfolio and taking into account the investor's financial objectives.

Catherine

Catherine