Author: Grayscale Research; Translation: Golden Finance xiaozou

As the dual drivers of macro demand and regulatory benefits continue to drive the crypto bull market, the price of Bitcoin hit an all-time high in May 2025.

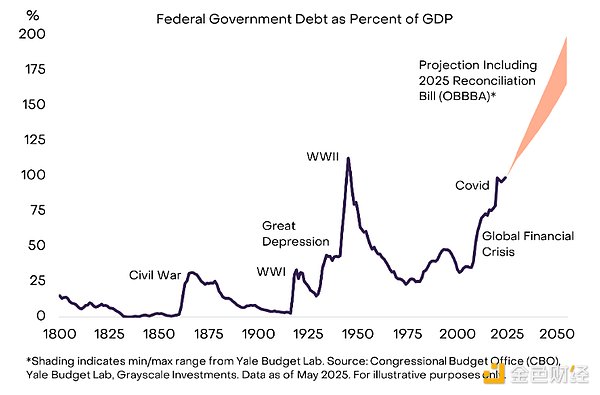

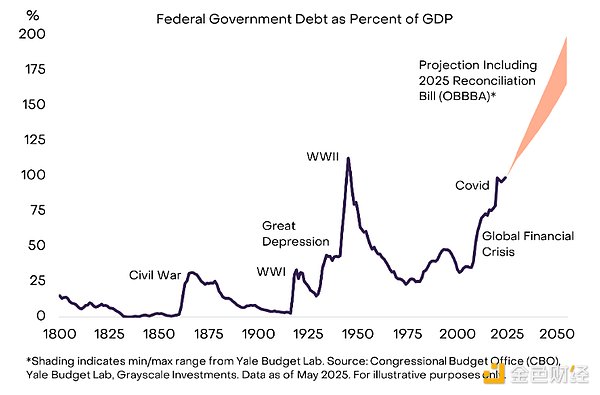

Investor demand for Bitcoin is partly due to macroeconomic imbalances in the United States, including persistent fiscal deficits. While deficits are not a new phenomenon, the comprehensive tax and spending bill that is advancing in Congress is likely to keep the US fiscal situation on an unsustainable path.

US fiscal risks appear to be spurring demand for Bitcoin, as reflected in the rise of "Bitcoin vault" companies (i.e., public companies that hold Bitcoin on their balance sheets).The valuation premiums such companies receive indicate that there is widespread interest in crypto asset allocation among traditional stock market investors. But we believe that the "crypto vault" strategy for tokens other than Bitcoin has limitations, as investors will eventually have more access to allocation channels through spot crypto exchange-traded products (ETPs).

This month also saw the following developments: breakthroughs in stablecoin and market structure legislation; decentralized exchange Hyperliquid performed well; and blockchain-based identity verification project Worldcoin appeared on the cover of Time magazine.

Stocks rebounded in May as the United States and China reached a temporary detente in their tariff conflict. But the rise came after three consecutive declines in the previous three months, and the S&P 500 is still about 4% below its peak. Compared with the relatively healthy stock market, the bond market (especially the high-quality sector) has negative returns, which seems to be due to high government deficits and the corresponding issuance of long-term government bonds. According to the market capitalization-weighted FTSE Grayscale Crypto Sector Index, the risk-adjusted returns of Bitcoin and the entire crypto asset class are comparable to global stocks (Figure 1). Bitcoin rose 11% that month to a record high of $112,000; ETH, the native token of the Ethereum blockchain, rose 44%, partially recovering its previous weak performance against Bitcoin.

Figure 1: Risk-adjusted crypto market performance is on par with the stock market

The Big Beautiful Bill

Demand for Bitcoin tends to rise when investors are concerned about the credibility of the fiat currency system. During May, such concerns once again became a focus. On May 22, the U.S. House of Representatives passed the comprehensive tax and spending bill, now officially named OBBBA (One Big Beautiful Bill Act). Budget experts estimate that if implemented as is, the bill would add about $3 trillion to the federal deficit over the next decade; if certain expiring provisions are extended, the deficit could be as high as $5 trillion. If the bill goes into effect, its revenue and expenditure mix would put the U.S. national debt on an unsustainable path (Figure 2). Partly due to the direction of U.S. fiscal policy, Moody's downgraded the U.S. sovereign credit rating from AAA to AA on May 16. While the U.S. government will not default in the short term, an unsustainable debt path will increase the long-term risk of macro mismanagement, thereby increasing investor interest in non-sovereign stores of value such as gold and Bitcoin.

Figure 2: OBBBA makes the US fiscal path unsustainable

Crypto vault companies surge

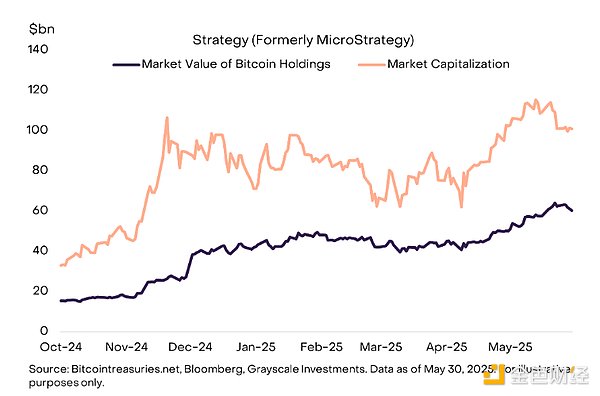

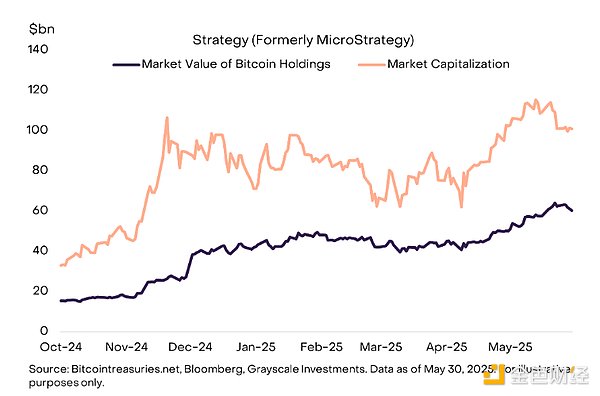

Spot ETPs listed in the United States are arguably the most important source of new demand for Bitcoin since its launch. During May, these products continued to maintain high net inflows, totaling $5.2 billion. In the coming months, the amount of Bitcoin purchased by "Bitcoin vault" companies (i.e., listed companies buying Bitcoin for their balance sheets) may be equal to or even exceed the purchases of spot Bitcoin ETPs. Strategy (formerly MicroStrategy), a pioneer in corporate bitcoin investment, increased its holdings by about 27,000 bitcoins (about $2.8 billion) in May. Strategy's market value far exceeds the value of bitcoin on its balance sheet, indicating that there is excess demand in the market for bitcoin exposure through equity instruments (Figure 3).

Figure 3: Strategy's market value is at a premium to its bitcoin holdings

Because the stock market pays a premium for bitcoin in this structure, more companies are beginning to adopt this strategy, and some companies have expanded it to other digital assets besides bitcoin. For example, a consortium consisting of Tether, Bitfinex and SoftBank created Twenty One Capital, which will initially hold 42,000 bitcoins (about $4.4 billion), mainly provided by Tether. Similarly, Bitcoin Magazine CEO David Bailey transformed the existing listed company KindlyMD into a bitcoin treasury company Nakamoto Holdings. The company plans to issue about $700 million in shares and convertible bonds in the U.S. market to purchase bitcoin, and will subsequently replicate this strategy in other countries around the world. Finally, Trump Media & Technology Group, the holding company of Trump's social app Truth Social, announced that it would raise $2.5 billion to allocate bitcoin to its balance sheet.

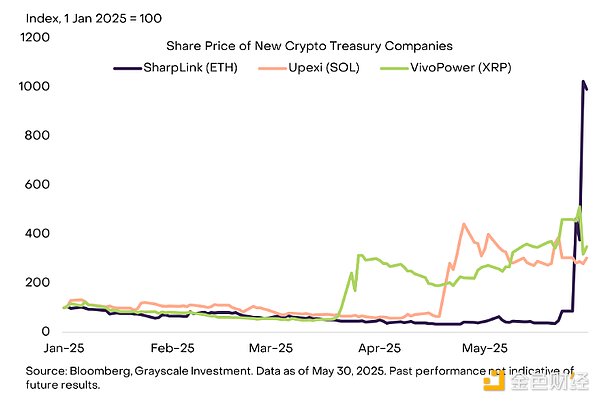

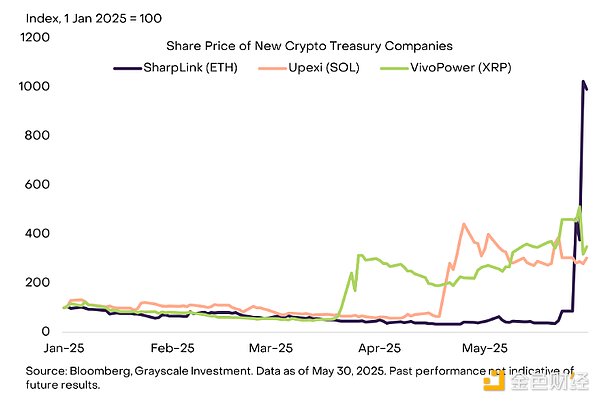

In addition to Bitcoin, SharpLink Gaming announced that it would transform into an Ethereum Treasury Company with the support of crypto investors such as Consensys (Figure 4). Other entrepreneurs have further expanded the model and created crypto treasury companies for Solana (Upexi), XRP (VivoPower) and even Trump-themed meme coins (Freight Technologies). The surge in crypto treasury companies shows that investors have a strong interest in exposure to crypto assets listed and traded on stock exchanges. But the popularity of spot crypto ETPs may eventually limit the demand for crypto vault companies, as ETPs can more efficiently track the price of the underlying token.

Figure 4: Crypto vault companies surge

Digital asset legislation

On the legislative front, the White House and Congress continue to advance U.S. digital asset regulatory legislation. On May 5, the House Financial Services Committee and the Agriculture Committee jointly released a draft of the Digital Asset Market Structure Act - a comprehensive financial services legislation comparable to the Dodd-Frank Act or the Sarbanes-Oxley Act in terms of regulatory scope. The House plans to hold a hearing on the updated draft on June 4. In addition, the GENIUS Act (Guidance and Establishment of a National Innovation Act for Stablecoins in the United States) passed the Senate debate on May 19 with bipartisan support and is about to enter the amendment process. Although the two pieces of legislation still need to go through several stages before they can officially take effect, the current progress and bipartisan support have released positive signals for their final passage.

Since the US election in November last year, the prospect of a clearer regulatory framework seems to have catalyzed institutional investors to increase their holdings in the industry. This trend continued in May, manifested in a number of major transactions and/or policy adjustments. The most important of these was Coinbase's acquisition of Deribit, a professional crypto options platform, for $2.9 billion, setting a record for the largest M&A transaction in the industry's history. Coinbase was also selected for the S&P 500 index this month, currently ranking 187th. Its competitor Kraken (also active in the field of mergers and acquisitions) announced that it would launch a tokenized stock service in non-US markets, while Robinhood said it would acquire Canadian crypto platform WonderFi. Other notable institutional developments include Brown University’s disclosure of its Bitcoin ETP position, New Hampshire’s passage of legislation allowing public funds to invest in crypto assets, and Morgan Stanley’s plans to launch crypto trading services in its E-Trade product.

ETH and token performance

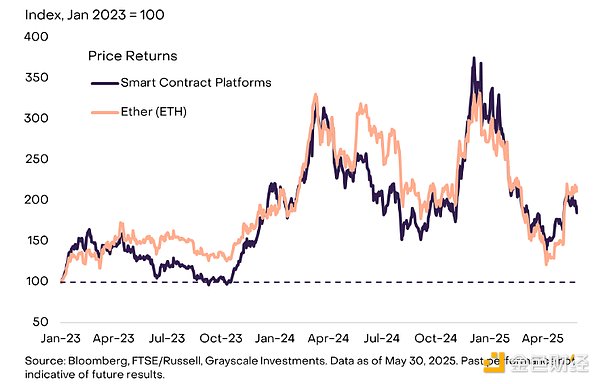

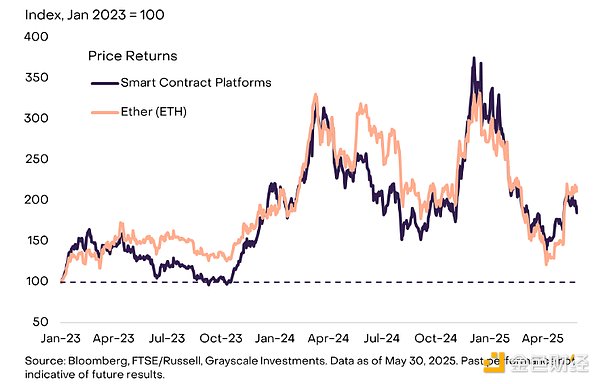

Ethereum (ETH) significantly outperformed Bitcoin in May, but part of the reason is the statistical timing: since the beginning of 2023, ETH’s price trend has been basically synchronized with the “smart contract platform” crypto sector (Figure 5). We expect smart contract platforms will benefit from U.S. regulatory reforms, which will promote wider adoption of stablecoins, tokenized assets, and decentralized finance—all of which rely on smart contract platform infrastructure. Although this is a highly competitive segment in the crypto market, Ethereum has the advantages of large on-chain funds, a decentralized culture, and emphasis on network security and neutrality. However, the price of ETH tokens is more dependent on the growth of activity on the Ethereum mainnet (Layer 1) rather than on many L2 networks (Layer 2). Although the Pectra upgrade implemented in May brought beneficial improvements, it will not immediately increase the activity of the mainnet.

Figure 5: Ethereum's performance is basically in sync with its crypto sector

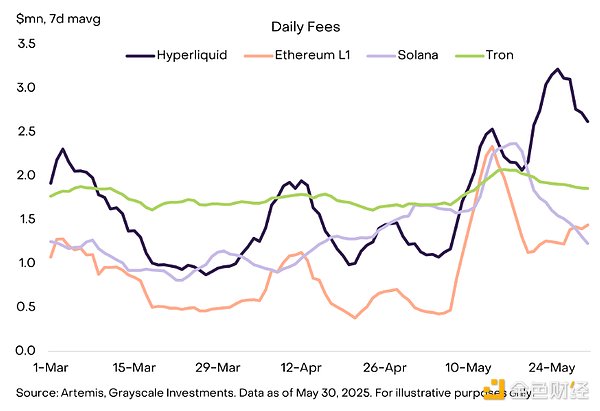

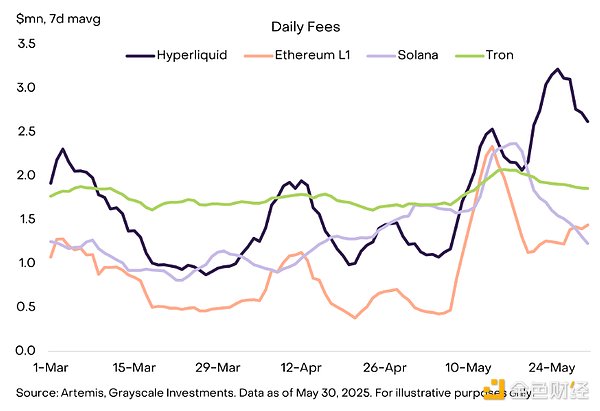

Despite ETH's strong performance that month, the most outstanding performance among large assets with a market value of more than $5 billion was Hyperliquid's HYPE token. Hyperliquid is both a professional perpetual contract decentralized exchange (DEX) and a general smart contract platform. The chain's Hypercore product currently accounts for more than 80% of the perpetual contract trading volume on the chain. During May, Hypercore's perpetual contract trading volume exceeded US$17 billion, and at the end of the month, its daily revenue even exceeded the three major smart contract platforms (in terms of fee income) Ethereum, TRON, and Solana (Figure 6). Last year, the protocol set a record for the largest airdrop in the history of cryptocurrencies - more than US$8 billion at current prices - prompting the entire industry to rethink token economics and financing models without venture capital support. Hyperliquid has always maintained a high organic usage rate and strong liquidity, and will increasingly compete with centralized derivatives exchanges such as Binance and Bybit in the future.

Figure 6: Hyperliquid's fee income surpasses the top smart contract platform

Performance of AI encryption sector

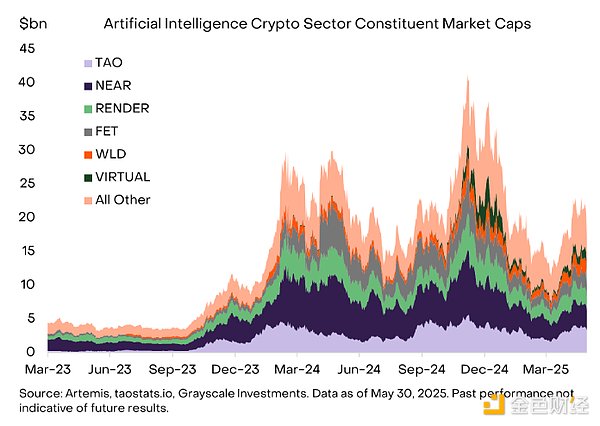

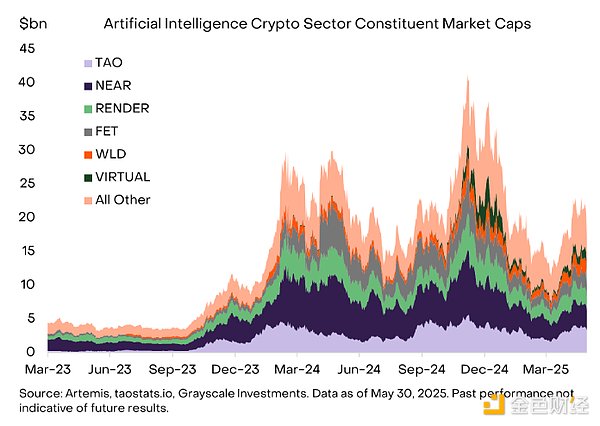

With the rapid development of blockchain AI technology, Grayscale Research recently added the "artificial intelligence encryption sector", which has become the sixth largest independent sector in our encryption industry classification framework. Currently, this sector includes 20 tokens with a total market value of approximately US$20 billion (Figure 7).

Figure 7: The current market value of the AI crypto sector is about $20 billion

Projects that have made significant progress in this sector recently include Worldcoin - the identity network founded by Sam Altman aims to establish a "personality proof" system to meet the increasingly severe challenges of real person/robot recognition in the AI era. This month, Worldcoin announced an important milestone: it completed a $135 million financing in the form of a16z and Bain Capital Crypto's acquisition of WLD tokens in the open market. The project has attracted widespread attention with its appearance on the cover of Time magazine, the promotion of the iris scanning device "Orb" and the crypto wallet World App in the US market, etc. Other important developments in the field of blockchain AI include: the Bittensor sub-network has gained more attention, and Tether, a leading stablecoin issuer, has disclosed plans to launch an AI agent network based on a crypto-native architecture.

In the coming months, the crypto market is likely to continue the current driving logic: the macro demand for Bitcoin driven by stagflation risks and tariff uncertainty, the continued improvement of the regulatory environment in the United States and overseas, and technological innovations in the fields of blockchain AI. This asset class has performed well over the past two years, and the supporting factors for fundamental improvement still exist.

Weatherly

Weatherly