Source: Grayscale Research; Compiled by: AIMan@黄金财经

Key Points

Sui is a next-generation blockchain designed for scale, designed to support mass-market consumer applications (among other applications). Grayscale Research believes that Sui has the perfect combination of technical advantages and support strategies to stand out in the competitive smart contract platform cryptocurrency field.

In order to attract billions of users, blockchain-based applications need to provide features that are at least as compelling as current Web 2.0 applications. This means both high transaction throughput and lowering the entry barrier for mainstream users. While this is not easy to do, we think Sui may have what it takes.

Founded by key contributors to Facebook's Diem blockchain project, Mysten Labs is the core team of Sui. Mysten has top expertise and takes an aggressive vertically integrated development approach, building not only at the blockchain level but also across the entire application stack.

The blockchain's native token, SUI, currently has a market cap of approximately $10 billion. Sui is a relatively early project with only 33% of the total supply in circulation; more than 50% of the token supply will not be released until after 2030.

The SUI token provides early-stage investment opportunities in a next-generation blockchain that is expected to achieve breakout success in mainstream consumer applications. Grayscale offers investment opportunities in Sui to qualified accredited investors* through the Grayscale Sui Trust.

Sui was founded in 2023 by key members of Facebook's Diem blockchain project. Their mission at Facebook was to create a crypto platform that could support billions of users; in other words, they had their eyes on global scale from day one. After leaving Facebook to start Sui, the team continued to expand on what they had previously developed.

Sui is a next-generation blockchain that prioritizes two things: usability and scalability. It aims to provide an unparalleled user experience, surpassing the best Web 2.0 technology companies, while enabling on-chain ownership and global instant value transfer. As a result, we believe that the next consumer "killer app" in the cryptocurrency space may come from the Sui ecosystem.

Sui Network's native token SUI can be found in the Grayscale Smart Contract Platform Cryptocurrency section. Sui Network mainly competes with high-throughput, low-cost blockchains for fee income and market share, including Solana, Ethereum Layer 2, The Open Network (TON), etc. In this highly competitive field, not all projects can succeed. Therefore, the network needs differentiated features to stand out.

Grayscale Research believes Sui may have a range of differentiated features, including:

1. Technology: The Move programming language and blockchain architecture enable Sui to be uniquely used for use cases such as payments and games

2. Team: The team originated from Facebook and now operates as Mysten Labs, with deep expertise in product, computer science, and cryptography; backed by a16z and Apollo Global

3. Strategy: The Mysten team takes a coordinated approach to building a fully decentralized vertical product stack — in other words, developing not only at the blockchain level, but also at the application layer to help emerging ecosystems grow

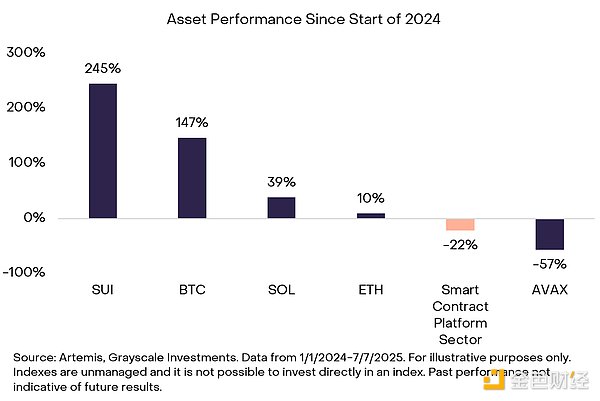

Since the beginning of 2024, SUI has been one of the best performing assets in the cryptocurrency space, outperforming Bitcoin, as well as its broader industry and direct competitors: Solana (SOL), Ethereum (ETH), and Avalanche (AVAX) (Figure 1).

Exhibit 1: SUI is one of the best performing crypto assets over the past year or so

In the following sections, we will explore what makes Sui unique, the underlying key elements necessary to grow its ecosystem and network effects, advancement and adoption, value accrual and fees, token supply, and key risks.

Why Sui stands out

Every blockchain aspires to achieve usability and scalability within certain constraints. Sui is unique in its technology, strong support team, and vertically integrated strategy.

1. Technology: Blockchain Design and Programming Language

Blockchain Design: Sui’s technical architecture is designed for global scalability and is particularly well suited for high-frequency, low-latency use cases such as payments and gaming.

Predictable Low Transaction Fees: Low costs and smooth, predictable fees help reduce friction and optimize user experience.

Object-based approach and parallel processing: Unlike Ethereum, Solana, and other account-based blockchains that update a global smart contract ledger, Sui adopts an object-based model. In this model, each asset is a unique object linked to a wallet, allowing transactions to be processed in parallel. By updating only relevant objects rather than a shared global state, this model reduces computation, improves efficiency, and enhances network scalability.

“Fast Path” Execution: Sui distinguishes between simple asset transfers and complex smart contract calls. Simple peer-to-peer asset transfers are handled via a “fast path” that allows for near-instant finality. This makes Sui well suited for payments use cases.

Horizontal Scalability: Unlike most blockchains, Sui’s network capacity grows as computing power grows. Sui validators can add servers to boost performance as demand is limited. Thus, an 8x increase in hardware capacity means an 8x increase in throughput with no increase in latency, according to the team.

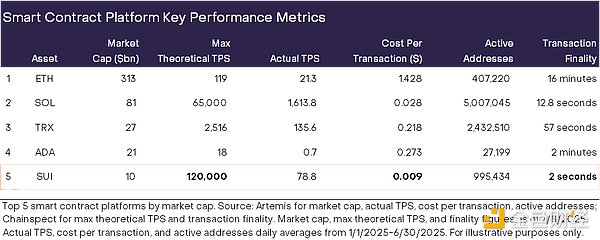

These features give Sui the highest theoretical blockchain throughput, lowest cost, and fastest finality time of the top five smart contract platforms by market cap (Exhibit 2). As of July 2025, Sui’s actual transactions per second (TPS) lags behind Solana, based on current adoption rather than theoretical capacity at maturity. As such, we believe Sui’s numbers are likely to improve with further ecosystem adoption.

Figure 2: Key blockchain metrics for the top five smart contract platforms by market cap

Programming Language: Sui’s programming language Move was originally developed by Mysten Labs team members during their tenure at Facebook. The Move language is an adaptation of Rust, one of the most popular programming languages in the world. As a high-level programming language, Move provides strong safeguards for smart contract development, significantly reducing the likelihood of common programming errors and vulnerabilities. In contrast, Solidity (Ethereum’s programming language) lacks these built-in protections, placing a greater burden on developers to manually enforce security best practices when writing smart contracts.

2. Team: Experienced top entrepreneurs

Mysten Labs brings together award-winning technical experts with expertise in product, computer science, and cryptography, including the following co-founders:

Evan Cheng: CEO of Mysten, formerly Director of Engineering at Facebook/Meta

Sam Blackshear: Chief Technology Officer of Mysten. Created the Move language while at Facebook/Meta, formerly Chief Engineer at Facebook/Meta, responsible for the Diem project.

Adeniyi Abiodun: Chief Product Officer of Mysten. formerly Head of Product, responsible for Facebook/Meta cryptographic projects, including Diem and Move language.

George Danezis: Chief Scientist of Mysten. Computer Lab Ring Award

Kostas Chalkias: Chief Cryptographer of Mysten. Former Chief Cryptographer at Facebook/Meta, and three-time winner of the Best Paper Award in Cryptography Research

The Mysten Labs team has over 100 members, with over 75 PhDs in total. We believe that in addition to its technical prowess, Mysten stands out for its ability to translate technical expertise directly into products. In contrast, competing network foundations typically take a more academic approach.

3. Strategy: Vertical Integration

Mysten is not only involved in the blockchain infrastructure layer, but also in Sui's application layer, building products, tools, and consumer applications for the entire network. This holistic approach includes:

Walrus

Walrus is a novel decentralized storage solution designed for performance and cost-effectiveness. Unlike centralized providers such as AWS, decentralized storage eliminates single points of failure and enables trustless data integrity. Among the many decentralized storage solutions, Walrus stands out as an attractive potential option. Its proprietary erasure coding technology significantly reduces storage overhead, delivering up to 80% cost savings over traditional solutions like Filecoin and Arweave. Leading crypto media platforms like Decrypt and Unchained Podcast trust Walrus to store their content, and Plume Network trusts Walrus to store real-world asset (RWA) data. Designed for scalability, Walrus is built to handle high-throughput, data-intensive applications from RWA datasets to large language models.

In many ways, Walrus does for decentralized storage what Sui did for blockchain execution: it removes friction, reduces costs, and opens up new areas of real-world applications. As more and more applications on Sui require storage for AI models, video content, or off-chain proofs, Walrus is poised to become a core part of the evolution of the Sui network’s data layer.

DeepBook

DeepBook is an on-chain central limit order book (CLOB) on Sui designed for institutional-grade trading. Today, most decentralized finance (DeFi) runs on automated market maker (AMM) pools. Compared to AMMs, DeepBook enables precise order control, reduced slippage, and lower spreads, features favored by professional traders and market makers. As the shared liquidity layer of the Sui ecosystem, DeepBook allows numerous DeFi applications to access a unified order book, thereby improving capital efficiency and reducing liquidity fragmentation.

DeepBook currently serves the first and second largest decentralized exchanges on Sui, as well as other applications ranging from lending to derivatives. As institutional adoption of Sui continues to grow, we believe DeepBook's trading volume and number of users are likely to grow in tandem. We believe that DeepBook is becoming a key liquidity layer and foundational component of the financial infrastructure on the Sui chain, and has the potential to become a key catalyst for the growth of DeFi on Sui.

Other

zkLogins: A patented technology that allows users to sign up using Google or Twitch, eliminating the complex steps to access on-chain cryptocurrencies.

SuiNS: A decentralized domain naming service, similar to Ethereum's ENS or GoDaddy.

Ika: A brand new network that allows any crypto asset (from Bitcoin to Ripple) to be traded directly on Sui, without bridges, token wrapping or other steps. The Ika token is expected to go live in mid-July.

Together, Sui's ecosystem - including Sui's blockchain itself, zkLogins, DeepBook, Walrus, SuiNS, and Ika - represents the first fully vertically integrated application suite in crypto.

The Sui project is less decentralized than some other blockchains, but this can be an advantage in terms of its specific goals (e.g., mainstream consumer applications). As the Sui network is still in its early stages (only two years old), the Mysten team is actively working to deliver products for a variety of use cases to reduce friction between consumers and developers. This proactive approach can accelerate application adoption and ultimately lead to a stronger ecosystem.

Growth Factor

Compared to more established networks like Ethereum or Solana, Sui is still early in its lifecycle, both in terms of developer traction and ecosystem maturity. However, given its high scalability and user-centric design, the SUI token stands out as a compelling growth investment with its current market cap of ~$10 billion (~12% of SOL and 3% of ETH).

For users, Sui provides a low-friction onboarding experience to cryptocurrencies through its zkLogin technology. In an age where getting started with cryptocurrency often requires entering confusing seed phrases, zkLogin allows users to access cryptocurrency wallets using familiar Web 2.0 credentials, such as a Gmail account. This removes common friction points while protecting user privacy, ensuring identity providers are unaware that users are logging into cryptocurrency wallets. This feature is unique to Sui.

For application developers, Sui offers Sponsored Transactions, which can be thought of as a “customer acquisition cost.” Sponsored Transactions allow application developers to offer “gas-free” transactions (i.e. transactions with no associated fees). zkLogin and Sponsored Transactions combined enable a full Web 2.0 experience: users don’t need to open a wallet or even own cryptocurrency, while user interactions are still recorded on-chain.

We believe these elements — frictionless user onboarding, a gas-free application experience, and an intuitive experience in a secure development environment — can serve as a solid foundation for onboarding users and developers and expanding network effects.

Despite being in its early stages of development, Sui has demonstrated strong network growth momentum in the first half of this year. Monthly active users (MAUs) surged from around 10 million to over 40 million (second among smart contract platforms) earlier this year, but have fallen slightly over the past few months. In addition to Mysten Labs’ products, Sui has attracted a number of third-party applications, including Recrd (a video platform for creators to earn revenue, with 490,000 daily addresses) and Fan TV (a video sharing platform that has access to 5 million cryptocurrency wallets).

Fees and Value Accumulation

The key to long-term competition in the smart contract platform space is value accumulation and the ability of blockchains to generate network fee revenue. Sui generates network revenue through transaction fees, which accrue value to stakers in the form of rewards, rather than accruing value to token holders in the form of token burn.

Transaction fees on Sui are split into two parts: computation and storage, and the rates are largely anchored to a reference price determined by validators every 24 hours. As a result, transaction costs remain relatively stable throughout the day, allowing for smoother and more predictable pricing. This price stability makes Sui less susceptible to gas price spikes when network activity is high, unlike networks like Solana and Ethereum, which experience large intraday fee fluctuations.

Exhibit 3: Sui transaction costs are low and relatively stable

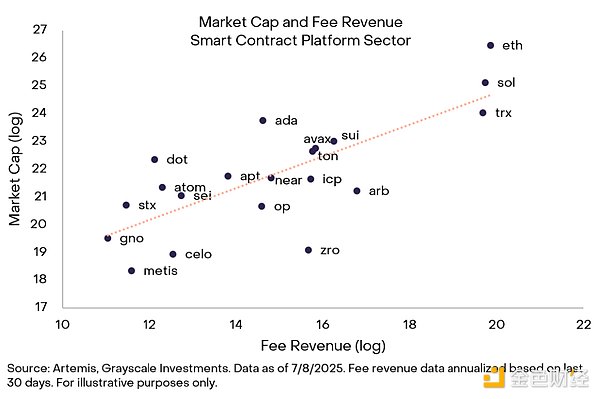

However, in terms of overall revenue generation capabilities, Sui is ahead of its larger competitors. Ethereum and Solana are expected to generate more than $500 million in annual network fee revenue by 2025, while Sui's expected revenue is only $15 million. This shows that Sui as a network is in the early stages of user monetization, in part due to Sui's low average transaction cost (about 3 times lower than Solana and about 150 times lower than Ethereum). The low cost of transacting on its network means that Sui will need to significantly scale network activity to achieve the same revenue as its largest competitor. Compared to its fee revenue, the valuation of the SUI token is roughly fair (based on circulating market capitalization) (Exhibit 4).

Figure 4: Market capitalization and fee income in the smart contract platform cryptocurrency space

Token supply is still expanding

Sui is a relatively early project with only 33% of its total supply in circulation. More than 50% of the supply will not be unlocked until after 2030. All else being equal, token supply inflation could be a headwind for valuations, but growth in network adoption could mitigate this effect.

SUI tokens will launch in May 2023 with a cap of 10 billion. The initial token distribution is as follows:

50% is allocated to the community reserve managed by the Sui Foundation. This includes delegation programs, validator subsidies, R&D, and grant programs.

20% to early contributors

14% is allocated to venture investors

10% is donated to the Mysten Labs treasury

6% is used for community access programs and application testers

Over the next year, SUI will have an inflation rate of 17.4% and will release approximately $1.7 billion worth of SUI tokens to the market (at current SUI prices).

Risks

While some Layer 1 networks take a "purist" approach to decentralization, Sui takes an incremental approach. Sui’s relatively small number of validators and more expensive validator staking requirements make it less decentralized and less censorship-resistant than other more established networks like Ethereum. Instead, Sui is more focused on hardware performance and scalability.

Another factor is the strong reach of Mysten Labs. We view this as an advantage in the short term — as Mysten is able to prioritize application development and release — but it could limit the blockchain’s addressable market if the ecosystem does not further decentralize in the long term. Mysten’s building on top of Sui at the infrastructure and application layers could cannibalize developers trying to build similar products in the same vertical as its products in the short term.

Sui also faces strong competition in the smart contract platform space. Incumbent networks like Ethereum and Solana have higher market share and on-chain assets. Other networks, such as Monad, offer alternative high-throughput options. Another potential competitor, TON, is able to leverage Telegram’s large user base for distribution. Nonetheless, we believe Sui’s technology and Mysten Labs’ approach can provide significant differentiation in specific use cases that require low latency, such as gaming, trading, and payments.

Conclusion

Sui is a next-generation blockchain designed for scalability and ease of use. Its architecture is designed to support consumer applications, with low fees, near-instant finality, and intuitive onboarding features - key elements to attract a large number of users to the chain. Compared with competitor networks that focus on speculative use cases or unresolved throughput challenges, Sui is built for scalability, while Mysten is focused on enabling the next "killer application".

With a current market cap of $10 billion and a large amount of token supply still to be released, Sui is still in the early stages of its life cycle, but this also means that its upside potential has not yet been fully tapped. We believe that SUI is a high-conviction growth investment that can provide diversified investment opportunities and fully understands the concept of scalable consumer applications on the chain. With strong technical strength, Mysten's top team, and vertically integrated strategy, Sui is fully capable of realizing this vision.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk decrypt

decrypt dailyhodl

dailyhodl dailyhodl

dailyhodl decrypt

decrypt Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph