Author: Brayden Lindrea, CoinTelegraph; Compiler: Wuzhu, Golden Finance

Investment bank Goldman Sachs increased its spot Ethereum exchange-traded fund (ETF) holdings by 2,000% in the fourth quarter of 2024, while increasing its Bitcoin ETF reserves to more than $1.5 billion.

According to the company's Form 13F filed with the U.S. Securities and Exchange Commission on February 11, Goldman Sachs increased its Ethereum ETF exposure from $22 million to $476 million, almost evenly divided between BlackRock's iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH), while investing $6.3 million in the Grayscale Ethereum Trust ETF (ETHE).

Goldman also increased its Bitcoin ETF holdings by 114% to $1.52 billion. It bought nearly $1.28 billion worth of iShares Bitcoin Trust (IBIT) shares, up 177% from the third quarter, and also bought $288 million worth of Fidelity Wise Origin Bitcoin Fund (FBTC) shares.

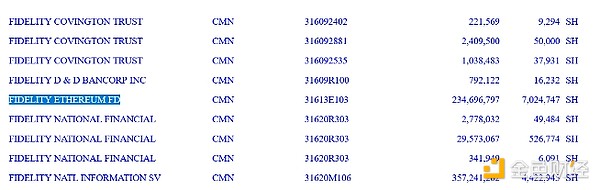

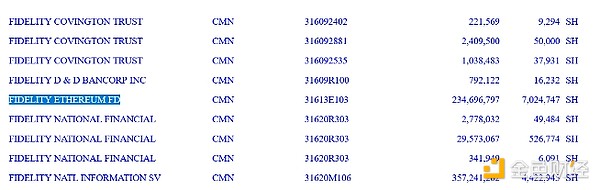

In the fourth quarter, Goldman reported holdings of $234.7 million worth of the Fidelity Ethereum ETF. Source: SEC

The filing, which investment managers holding more than $100 million worth of securities must file quarterly, shows that Goldman also owns $3.6 million worth of Grayscale Bitcoin Trust (GBTC).

The increased exposure takes into account the market price gains for BTC and ETH, which rose 41% and 26.3%, respectively, from the beginning of the fourth quarter to the end, according to CoinGecko data.

Goldman also appears to have closed positions in Bitcoin ETFs from Bitwise and WisdomTree, as well as joint products from Invesco and Galaxy and ARK and 21Shares.

Goldman first entered the spot cryptocurrency ETF market in the second quarter of 2024, when it disclosed the purchase of $418 million worth of Bitcoin ETFs, further consolidating its larger position.

Goldman's recent purchases of Bitcoin and Ethereum ETFs highlight a growing trend of institutional cryptocurrency adoption on Wall Street, helped by an increasingly favorable regulatory environment.

The investment bank is also considering launching its own crypto platform for partners to trade financial instruments on blockchain rails, Bloomberg reported in November.

However, Goldman has been critical of Bitcoin and the broader industry since 2020, saying that cryptocurrencies are not an asset class and are "not suitable" for clients to invest in.

Sharmin Mossavar-Rahmani, chief investment officer of Goldman Private Wealth Management, expressed a similar view in April last year, when Goldman bought its first Bitcoin ETFs.

"We do not view it as an investment asset class," Mossavar-Rahmani said at the time, comparing the recent crypto enthusiasm to the tulip mania of the 17th century. "We do not believe in cryptocurrencies."

Kikyo

Kikyo