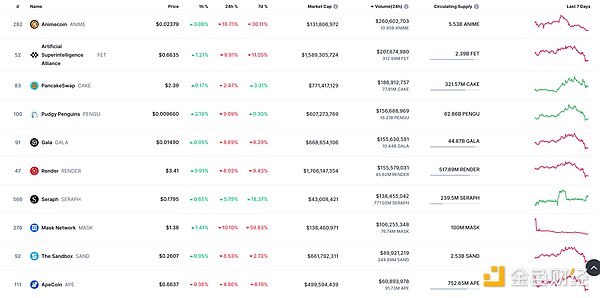

DeFi data

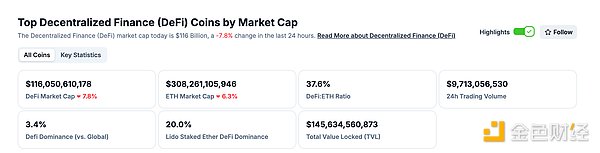

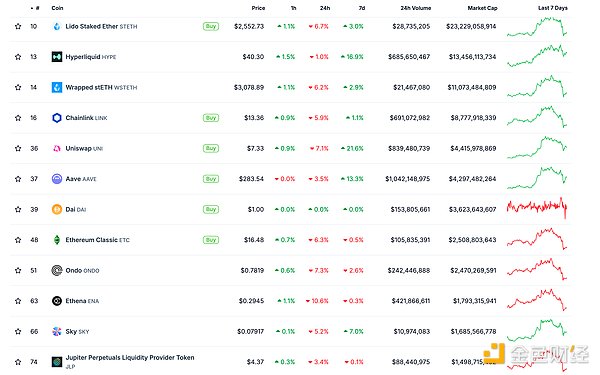

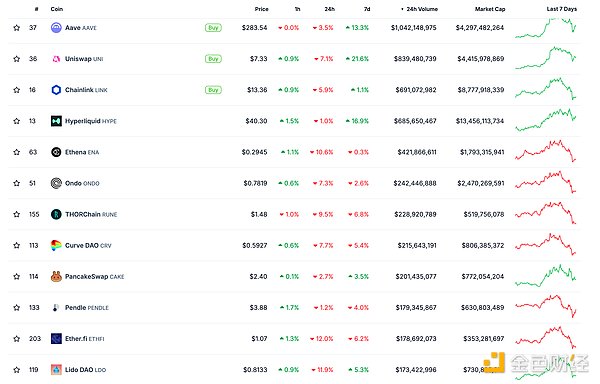

1. Total market value of DeFi tokens: $116.05 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$9.713 billion

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

3. Assets locked in DeFi: 111.203 billion US dollars

src="https://img.jinse.cn/7376309_watermarknone.png" title="7376309" alt="NGOQukmqGuDyR7AGutr41ECXpf2rLo8S1y6CqpuF.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

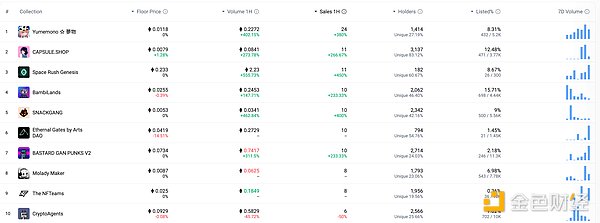

NFT data

1. Total market value of NFT: US$18.072 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 2.947 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Walmart and Amazon are planning to issue their own stablecoins

Golden Finance reported that according to the Wall Street Journal, Walmart and Amazon are exploring the issuance of their own stablecoins in the US market, or using them for payment and settlement in their own merchant ecosystems. According to sources, the move could move a large amount of cash and card transactions out of the traditional financial system, reduce billions of dollars in fees and speed up payments.

MEME Hotspots

1. A PEPE whale is suspected of selling 609 billion PEPEs worth $6.43 million that it had opened a position a month ago.

Golden Finance reported that according to the monitoring of on-chain analyst @ai_9684xtpa, the PEPE whale 0x6ea...41FE0 is suspected of selling 609 billion PEPEs worth $6.43 million that it had opened a position a month ago. If it is sold, it will lose $1.185 million. The whale withdrew 2.2 trillion PEPEs (US$27.63 million) from the exchange at an average price of $0.0000125 during the period from May 17 to May 18. It is suspected that 160 million PEPEs have been sold and it has lost $2.042 million.

2. A whale once again deposited $6.55 million worth of PEPE into Binance, with a total floating loss of $3.26 million

According to Golden Finance, according to OnchainLens monitoring, a whale deposited 609 billion PEPE into Binance, worth about $6.55 million. The whale deposited a total of 1.6 trillion PEPE into Binance, worth about $18.1 million, and faced a loss of about $3.26 million. The wallet still holds 600 billion PEPE, worth about $6.39 million.

DeFi hotspots

1. The Ethereum Foundation internally transferred 1,000 ETH to relevant addresses

Golden Finance reported that according to PeckShield monitoring, the Ethereum Foundation has internally transferred 1,000 ETH (worth approximately US$2.5 million) to the relevant address 0xc061...0B6d.

2. President of The ETF Store: Firmly believe that BlackRock will eventually apply for spot XRP ETF

According to Golden Finance, Nate Geraci, president of The ETF Store, said that he firmly believed that BlackRock would eventually apply for spot XRP ETF. Geraci pointed out in his recent comments that BlackRock has been in the lead in Bitcoin and Ethereum ETFs, so it has no reason to let other companies take the lead in XRP or Solana.

He also expects BlackRock to launch an index-type crypto ETF. It is worth noting that the industry commentator recently said that the Grayscale Digital Large Cap Fund, which includes XRP, could be the next ETF to be approved.

Geraci's recent comments follow a series of early predictions. As early as March 2025, he said that BlackRock might submit an application as soon as Ripple's legal battle with the SEC ended. At the time, he believed that major institutions like BlackRock and Fidelity would not want to let other companies dominate the growing altcoin ETF space.

Meanwhile, last month, he also highlighted a milestone that could support a spot XRP ETF: the launch of regulated XRP futures on the Chicago Mercantile Exchange. Geraci believes this is an important step in making the XRP ETF more likely, as futures contracts typically pave the way for spot ETF applications.

3. Encrypted intent engine protocol Enso token sale has been launched on CoinList

On June 13, according to official news, the encrypted intent engine protocol Enso token sale has been launched on CoinList. Users can log in to the sales page to buy tokens. According to the official website, Enso is an encrypted connection layer and intent engine that connects all ecosystems into a network, enabling application developers and users to express their desired results as intents, so that truly composable applications can be built without building manual integrations.

4. Spark announced that the qualification check tool for the first phase of the Ignition airdrop plan has been launched

Golden Finance reported that according to Spark's official social media, the DeFi project Spark announced that the qualification check tool for the first phase of the Ignition airdrop plan has been launched.

5. The US SEC officially abolished the harsh proposals against DeFi and custody proposed in the Gary Gensler era

Golden Finance reported that according to crypto journalist Eleanor Terrett, the US Securities and Exchange Commission (SEC) has just officially abolished the expanded "Custody Rule" proposal and Rule 3b-16, as well as other Gensler-era rules.

The "Custody Rule" is designed to cover all customer assets, including cryptocurrencies, expands the definition of "custody", and raises concerns about whether certain state-chartered entities should be considered qualified custodians. Rule 3b-16 proposes to regulate decentralized finance (DeFi) exchanges/platforms as if they were national securities exchanges.

The SEC also abandoned its proposal to require listed companies to comply with enhanced environmental, social and governance (ESG) reporting requirements.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish the correct investment philosophy and be sure to increase risk awareness.

Brian

Brian

Brian

Brian Hui Xin

Hui Xin Brian

Brian Hui Xin

Hui Xin Joy

Joy Joy

Joy Joy

Joy Joy

Joy Joy

Joy Joy

Joy