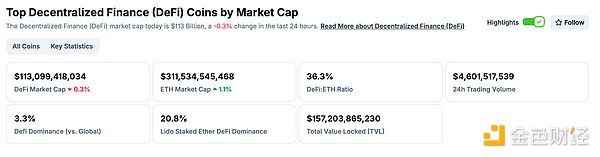

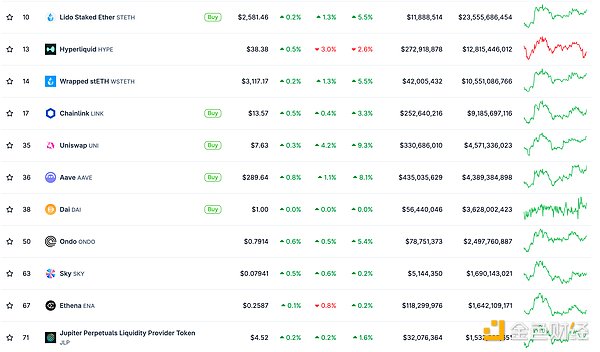

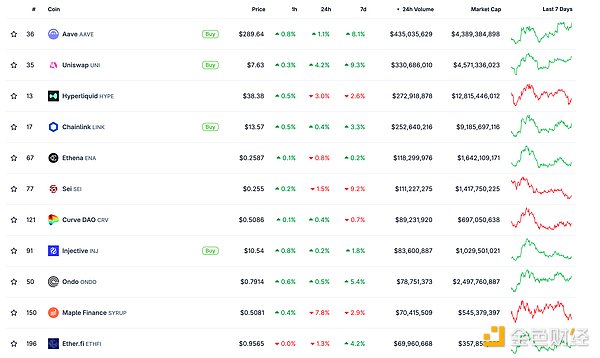

DeFi data

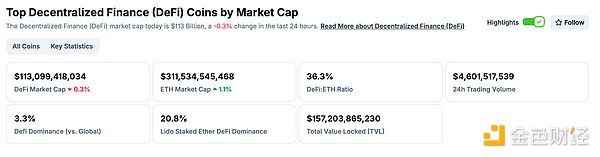

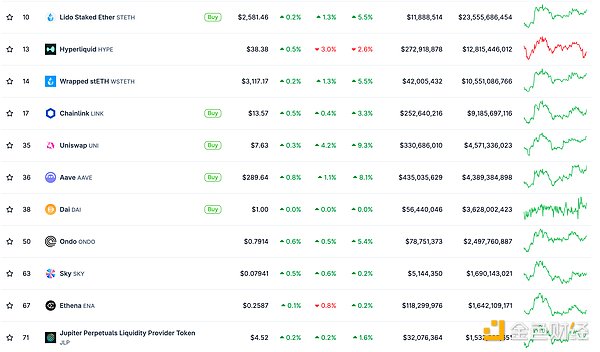

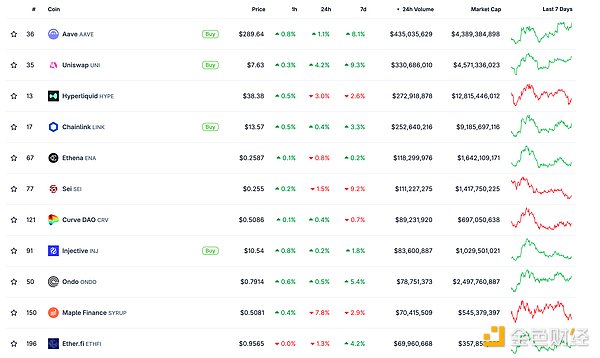

1. Total market value of DeFi tokens: US$113.099 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was 4.601 billion US dollars

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

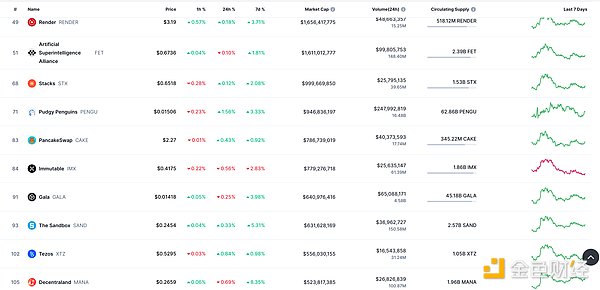

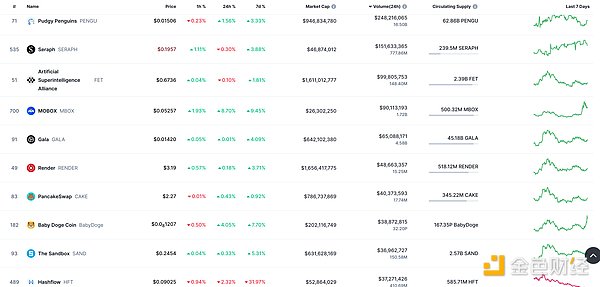

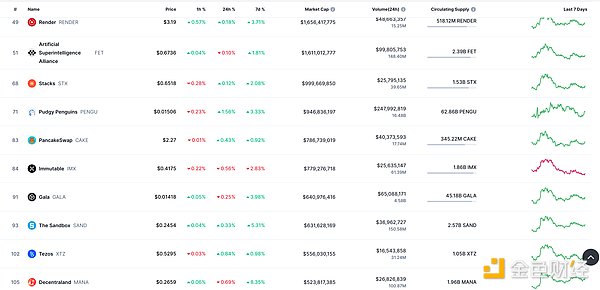

NFT data

1. Total market value of NFT: US$17.178 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

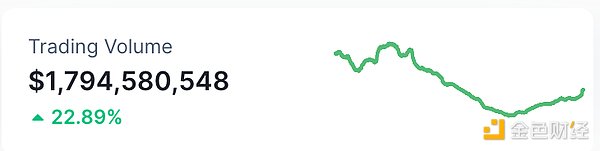

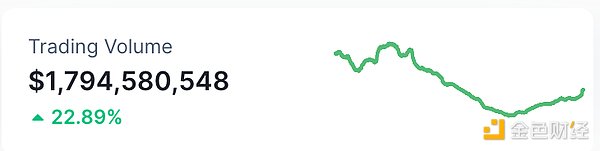

2. 24-hour NFT trading volume: 1.794 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

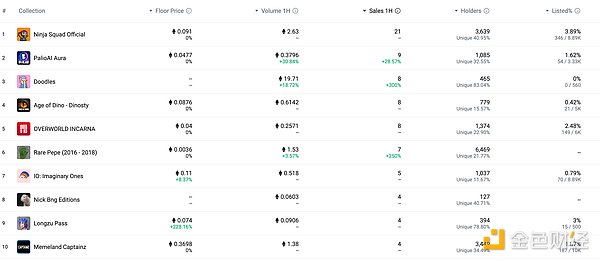

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Trump officially extended the suspension period of "reciprocal tariffs" to August 1

Golden Finance reported that on the 7th local time, US President Trump signed an executive order to extend the so-called "reciprocal tariff" suspension period, postponing its implementation time from July 9 to August 1. On April 2, Trump announced the imposition of so-called "reciprocal tariffs," triggering a sharp drop in U.S. financial markets. Under pressure from multiple parties, Trump announced on April 9 that he would suspend the imposition of high "reciprocal tariffs" on some trading partners for 90 days, but maintain the 10% "base tariff."

MEME Hotspots

1. The number of BONK holding addresses is about to exceed 1 million

On July 8, the BONK community announced that it will usher in an important milestone of 1 million BONK holders, and currently has 949,892 holders. When the number of holders reaches 1 million, 1 trillion BONK tokens will be destroyed, worth about 22.81 million US dollars.

DeFi Hotspot

1.Truth Social submits S-1 application for cryptocurrency blue chip ETF

Golden Finance reported that according to the official website of the US SEC, Truth Social submitted S-1 application for cryptocurrency blue chip ETF.

2.Tether strategically invests in blockchain forensics company Crystal Intelligence

Golden Finance reported that Tether announced a strategic investment in blockchain forensics company Crystal Intelligence to combat cryptocurrency crimes. The specific investment amount has not been disclosed. With the increase in cryptocurrency-related scams and frauds, Tether is committed to curbing the illegal use of its USDT stablecoin.

3. Solana trading robot platform Axiom has achieved $150 million in revenue in just 5 months since its launch

Golden Finance reported that Axiom, a trading robot platform on Solana, has earned more than $150 million in fee income since its launch in February this year. Axiom has become the fastest company in Y Combinator's history to achieve $100 million in revenue, and its revenue growth rate has exceeded Cursor, which took 12 months to achieve $100 million in ARR. According to Dune's dashboard, the platform currently accounts for 72% of all Solana robot trading volume, compared with only 2% in early February. According to DefiLlama data, Axiom earned about $1.75 million on July 7 alone.

Axiom connects users to Solana-based platforms such as Pump.fun and supports trading on Hyperliquid's perpetual futures exchange. Axiom currently charges each user a fee of 0.75% to 1% of the transaction volume per transaction. However, some of this can be offset by rewards and points. According to its official documentation, Axiom also adopts a points system, including future airdrops. Users can earn points through trading volume and referrals.

4. The Ethereum Foundation development team internally transferred 1,000 ETH, worth about $2.55 million

Golden Finance reported that according to PeckShield monitoring, the Ethereum Foundation development team has internally transferred 1,000 ETH (worth about $2.55 million) to the relevant address 0xc061...0B6d. The address currently holds 13,000 ETH, worth about $33 million. Among them, 0xc061...0B6d has transferred 7,000 ETH (about $17.56 million) to the Gnosis Safe Proxy address 0x247B...583c.

5.Draper Dragon announced investment in Coffer Network

Golden Finance reported that Draper Dragon announced its investment in Coffer Network, a programmable smart account infrastructure protocol. Coffer Network has established cooperation with Kernel under Draper Dragon.

Coffer Network's core source of income is a 30% management fee on the asset income on the platform. The company began to generate revenue shortly after its establishment in 2024, showing an early adaptation between the product and the market. Its product design takes into account retail investors, institutions and DAO users.

Draper Dragon originated from DFJ Fund in Silicon Valley. It was co-founded in 2005 by the world's most influential venture capitalists and the first generation of domestic venture capital leaders. It is the core fund and governing unit of the global early venture capital network alliance "Draper Venture Network".

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to raise your risk awareness.

Davin

Davin