DeFi data

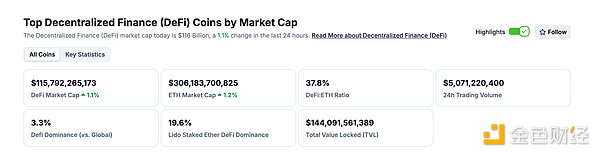

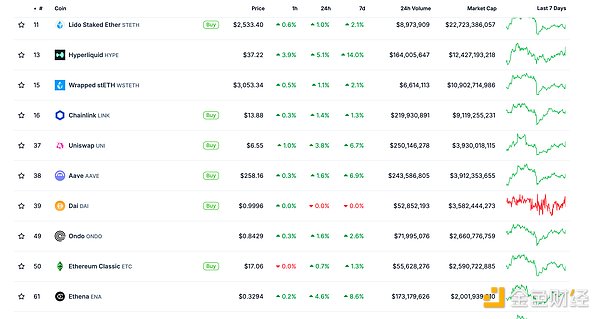

1. Total market value of DeFi tokens: US$115.792 billion

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 5.071 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

3. Assets locked in DeFi: 110.265 billion US dollars

src="https://img.jinse.cn/7374932_watermarknone.png" title="7374932" alt="xPlwbEF7ivsGOoptljkd137cUoqYUiYAxiS6K80J.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

NFT data

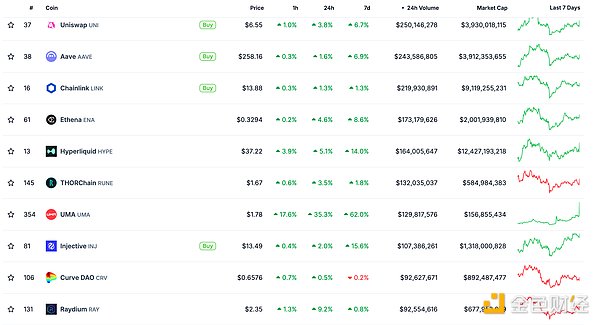

1. Total market value of NFT: US$19.193 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 1.822 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Tether minted 1 billion USDT on the Tron network

Golden Finance reported that according to Whale Alert monitoring, Tether Treasury minted 1 billion USDT on the Tron network at 17:21:09 Beijing time.

MEME Hotspot

1. Analyst: Active Meme ETF is expected to be launched next year

Golden Finance reported that according to Cointelegraph, Bloomberg ETF analyst Eric Balchunas said in an X (former Twitter) post on June 7 that an ETF that actively trades Meme coins is "very likely" to appear at some point in the future. He added: "First, we will see a series of active cryptocurrency ETFs" and expects that an active fund that invests only in Meme coins is likely to appear in 2026.

His comments were in response to a post on X by the Russian-focused Meme coin team "Vladcoin". The Vladcoin team said, "There should be an ETF that actively trades Meme coins, buying and selling based on performance."

They added that an active trading fund would "hold promising currencies and sell weaker currencies."

DeFi Hotspots

1. Bernstein: Ethereum is at a critical turning point from speculation to real financial innovation

Golden Finance reported that Bernstein analysts believe that Ethereum is at a critical turning point, as the crypto industry shifts from speculation to real financial innovation. Although Bitcoin ETF has achieved great success in the United States, with assets under management exceeding $120 billion, Ethereum ETF is relatively small, with only $9 billion.

Analyst Gautam Chhugani pointed out that the value of Ethereum lies in its status as a decentralized computer, supporting key applications such as stablecoins and asset tokenization. In the past 20 days, Ethereum ETF has received inflows of $815 million, and net inflows have turned positive since the beginning of the year, reaching $658 million.

2. Bithumb suspends ZETA deposit and withdrawal services

Golden Finance reported that according to the official announcement, in order to provide stable deposit and withdrawal services and cooperate with the Zeta Chain (ZETA) network (main network) upgrade, Bithumb will suspend Zeta Chain (ZETA) deposit and withdrawal services at 5:30 pm (Beijing time) on June 12, 2025 (Thursday).

3. Upbit announces changes to Berachain (BERA) distribution schedule

Golden Finance reported that Upbit announced that at the request of the Berachain (BERA) project team, the BERA distribution schedule has been changed. The distribution schedule before the change is until February 6, 2025, and the distribution schedule after the change is until June 9, 2025.

4. Binance will support Stratis (STRAX) network upgrade and hard fork

Golden Finance reported that according to the official announcement, Binance is expected to suspend the token recharge and withdrawal services of the Stratis (STRAX) network at 18:00 (Eastern Time Zone 8) on June 11, 2025 to support its network upgrade and hard fork. This move is aimed at providing users with a high-quality experience.

The project party will perform a network upgrade and hard fork at block height 2,587,200 (estimated at 19:00 on June 11, 2025, Eastern Time Zone 8).

5.Sky co-founder used staking rewards to repurchase 4.33 million SKY in the past two days

Golden Finance reported that according to the monitoring of on-chain data analyst Yu Jin, Sky (formerly Maker DAO) co-founder Rune Christensen's address used staking rewards to repurchase 4.33 million SKY (about 330,000 US dollars) in the past two days. Sky launched the staking SKY reward USDS a few days ago. Rune's address pledged 3.16 billion SKY (about 229 million US dollars), and currently can get about 100,000 USDS per day. He received two staking rewards on the 4th and early this morning, a total of 330,000 USDS, and then repurchased it at a price of 0.076 US dollars to become 4.33 million SKY.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to raise your risk awareness.

Clement

Clement

Clement

Clement Jixu

Jixu Jasper

Jasper Alex

Alex Hui Xin

Hui Xin Brian

Brian Joy

Joy YouQuan

YouQuan Aaron

Aaron Hui Xin

Hui Xin