DeFi data

1. Total market value of DeFi tokens: US$123.437 billion

DeFi total market value data source: coingecko

< 2. The transaction volume of decentralized exchanges in the past 24 hours was 10.658 billion US dollars. img.jinse.cn/7336111_watermarknone.png" title="7336111" alt="NklOxkjUS72X9f8hhEUgkLZoWq1Ktab9U5duUFOQ.png">

Trading volume of decentralized exchanges in the past 24 hours Source: coingecko< /p>

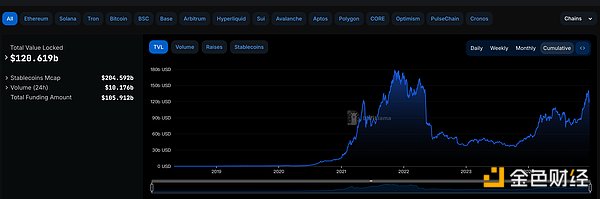

3. Assets locked in DeFi: 120.619 billion US dollars

The top ten rankings of DeFi projects’ locked assets and locked-in amount data source: defillama

NFT data

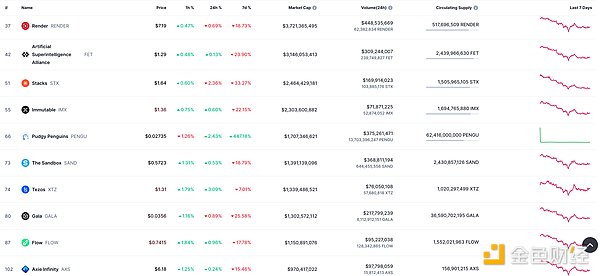

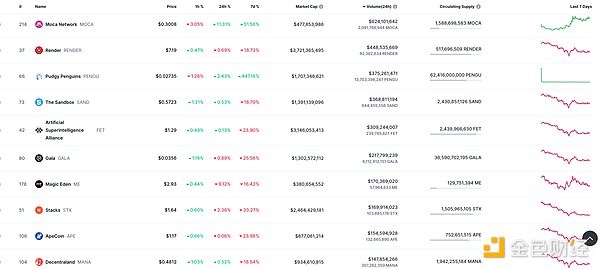

1. NFT total market value: 37.527 billion US dollars

NFT total market value, top ten projects by market value data source: Coinmarketcap

2.24-hour NFT trading volume: 5.275 billionUSD

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

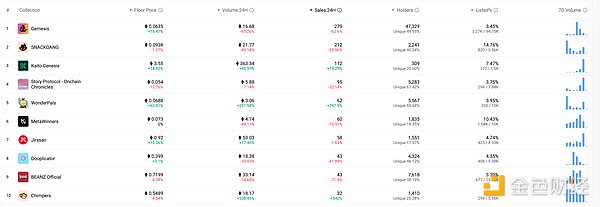

3. Top NFTs in 24 hours

< /p>

< /p>

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Sui enables Bitcoin re-collateralization through SatLayer integration

Bitcoin re-collateralization Staking platform SatLayer announced Wednesday that it will expand bitcoin’s use in decentralized finance to Sui, the fast layer 1 blockchain launched last year.

In a statement, SatLayer said that because Sui focuses on fast transaction speeds, SatLayer’s integration will enable developers to take advantage of Bitcoin’s $2.1 trillion market size to build DeFi applications that are designed to exclude third parties from the process of trading. In addition to transactions in areas such as trading and lending.

NFT Hotspots

< p style="text-align: left;">

1. Two NFT founders face charges for alleged $22 million fraudGolden Finance reported that two 23-year-old young men from California were arrested in Los Angeles. They are suspected of defrauding investors of more than $22 million in crypto assets through NFT and are currently facing fraud charges. The U.S. Department of Justice’s Office of Public Affairs said in a news release Gabriel Hay and Gavin Mayo were charged with one count of conspiracy to commit wire fraud, two counts of wire fraud and one count of stalking, the release said. The two individuals allegedly sponsored and promoted NFT and digital asset projects and conducted publicity activities in support of the project. The Department of Justice charged the two individuals with making or causing others to make “materially false and misleading statements” about digital asset projects. ". In addition, prosecutors allege that Hay and Mayo provided misleading and false project roadmaps containing future plans for NFT and digital asset projects that they had no intention of implementing. The indictment alleges that Hay and Mayo promoted Vault of Gems NFT project, which it said would be the first NFT project “pegged to a hard asset.” Despite the promises, prosecutors allege the duo abandoned the projects after raising millions of dollars from investors.

DeFi Hotspots /h2>

1. Bio Protocol announces 2025 roadmap, will launch new BIO Launchpad, etc.

On December 23, the decentralized science (DeSci) management and liquidity protocol Bio Protocol announced its 2025 roadmap, including:

BIO tokens will conduct TGE on the Ethereum mainnet on January 3; BIO tokens will be available on Solana and Base networks;

New BioDAO launch;

BIO/BioDAO liquidity pool;

New BIO Launchpad Officially launched.

2.Lido releases Ethereum staking SDK, supporting cross-chain Chain staking function integration

Golden Finance reported that Lido announced the launch of the Ethereum Staking SDK, a TypeScript tool library for building off-chain integrations . The SDK supports developers to seamlessly integrate Lido staking functions into off-chain applications, providing core functions such as staking, reward tracking, withdrawals and packaging.

The newly released SDK has multi-chain support features, allowing for networks such as OP Mainnet Perform stake/unstake operations without cross-chain. This tool contains pre-built methods and complete documentation, which can be used to develop DeFi protocols, dashboards or new staking products.

3. CKB Ecological Fund makes strategic investment in SilentBerry

Golden Finance reported that CKB Ecosystem Fund is pleased to announce a strategic investment in SilentBerry, a decentralized publishing platform built on the innovative RGB++ protocol. Based on the RGB++ protocol, the author's book content can be engraved on Bitcoin, and the ownership and income rights of the book can be made into four types of digital assets: gold berries, silver berries, copper berries and blueberries. Users can purchase through BTC, ETH and CKB Digital assets, obtain the printing rights of books, and enjoy the royalties of books.

4. Sui Foundation appoints Christian Thompson as new director

strong>Golden Finance reported that according to official news, Sui Foundation announced the appointment of Christian Thompson as the new head. Before joining Mysten Labs and Sui Foundation, Thompson had Served as Deputy CISO at Meta and was an early member of the Libra/Diem project. He also founded Knowledge Preserve and On Detail and served in law enforcement for nearly a decade.

In addition, he also founded The Capital Thompson, who co-founded the Capitola Foundation for Public Safety and Community Services and founded Quorum, will use his extensive experience in technology, finance, and blockchain to drive engagement with Sui enthusiasts, developers, and its growing global community.

5.L1 blockchain aelf launches code-free AI agent framework aevatar intelligence

On December 23, L1 blockchain aelf launched a code-free AI agent framework aevatar intelligence, which will be supported by multiple large language models (LLMs). aevatar intelligence will Allow external developers to integrate their preferred LLM, thus forming a collaborative ecosystem that drives innovation and expands framework capabilities. In addition, the official will launch the first use case of aevatar intelligence, AI pumppad, in early January 2025.

Disclaimer: Golden Finance is a The articles published on the blockchain information platform are for information reference only and are not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX Nulltx

Nulltx