DeFi data

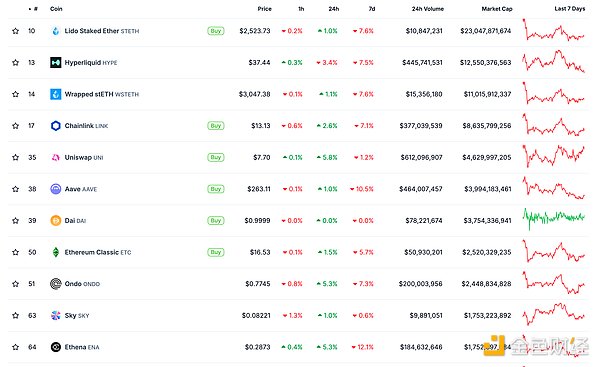

1. Total market value of DeFi tokens: 114.685 billion US dollars

DeFi total market value data source: coingecko

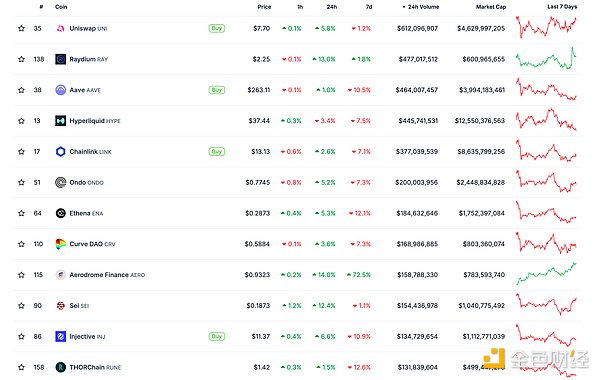

2. The trading volume of decentralized exchanges in the past 24 hours was 6.873 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

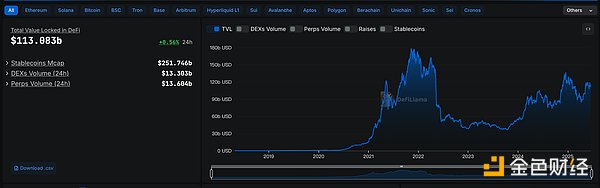

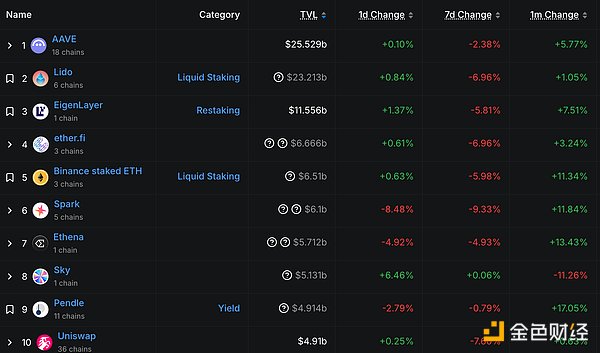

3. Assets locked in DeFi: 113.083 billion US dollars

3. Assets locked in DeFi: 113.083 billion US dollars

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

NFT data

1. Total market value of NFT: US$17.487 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 2.157 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

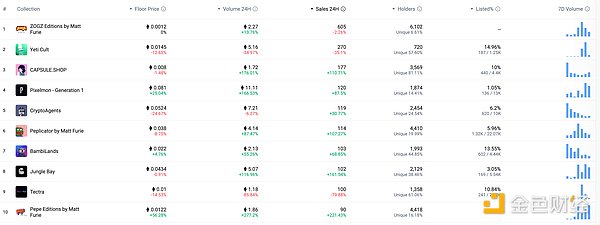

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Delphi Digital Report: Stablecoin Supply Exceeds US$250 Billion for the First Time

Golden Finance reported that the Delphi Digital report stated that the total supply of stablecoins exceeded the US$250 billion mark for the first time, and the market structure has changed significantly compared to 2022. Tether and Circle continue to dominate the market, accounting for a total of 86% of the circulating supply. It is worth noting that the growth of income-based stablecoins is rapid, among which Ethena has reached nearly $6 billion since its launch. At the same time, the trend of diversification of stablecoin issuers is obvious, and more than 10 stablecoins have a circulation of more than $100 million. According to Delphi Digital data, more than $120 billion of U.S. Treasury bonds are locked in stablecoins, forming a liquidity black hole outside the traditional market.

MEME hot spots

1. Trump's company quietly reduces its holdings in the crypto project WLFI

June 19 news, according to Forbes, based on an analysis of the details of the World Liberty official website, in the past 11 days, a company owned by Donald Trump has reduced its stake in the crypto project World Liberty Financial from 60% to 40%. This change, without any public publicity, is another sign that Trump himself or those acting on his behalf are still secretly engaging in behind-the-scenes transactions during his tenure.

2. WLFI consultant Ogle has accumulated a loss of $472,000 in TRUMP token transactions

Golden Finance reported that according to monitoring by chain analyst Aunt Ai (@ai_9684xtpa), WLFI consultant Ogle (@cryptogle) has accumulated a loss of $472,000 in TRUMP token transactions, and the 1.35 million USDC in his account currently has only $866,000.

Data shows that after Ogle opened a 10x leveraged short position in TRUMP on June 6, Eric announced that TRUMP had reached a cooperation with WLFI. The subsequent rise in the price of the currency caused Ogle to liquidate his position and lose $186,000. On June 7, Ogle turned to open a 4x leveraged long position on TRUMP, with a current floating loss of $280,000, an opening price of $10.29, a liquidation price of $6.77, and a position size of $2.78 million.

3. Binance Wallet Launches Meme Rush Function

Golden Finance reported that Binance Wallet has launched a new function "Meme Rush List" to help users get a sneak peek at the latest Meme tokens from external Meme coin issuance platforms. The list integrates the token lists of BNB Smart Chain platform Four.Meme and Solana platform Pump.Fun, allowing users to quickly discover, track and trade Meme tokens in Binance Wallet.

DeFi hotspots

1. Ford Motor will serve as an advisor to Cardano's decentralized cloud service protocol Lagon

Golden Finance reported that according to Cointrust, Ford Motor Company announced that it will serve as an advisor to Lagon, a decentralized cloud service based on the Cardano blockchain. The partnership marks another step for the auto giant to enter the blockchain space. This time, Ford will work with legal technology company CloudCourt to conduct a proof-of-concept (PoC) project, focusing on the digitization and security of legal data. The program aims to solve a long-standing problem faced by large enterprises: managing and protecting sensitive legal documents, such as court records, testimonies, and compliance reports. The project combines the Cardano blockchain with AI technology to provide an unalterable audit trail for legal documents under a zero-trust architecture.

2. Vitalik cooperates with marketing company Etherealize to release Ethereum bull argument content

Golden Finance reported that Ethereum co-founder Vitalik posted content on social media: Ethereum's bull argument: digital oil, value storage, and global reserve assets for the digital economy. The tweet was forwarded from the relevant content previously released by Etherealize, a business development and marketing company for the Ethereum ecosystem, but Vitalik changed the image of Ethereum digital oil in the original tweet to the image of Ethereum bull.

3.Consensys CEO: Ethereum Layer 1 will become the world's main ledger

Golden Finance reported that Consensys CEO Joseph Lubin wrote: "Ethereum Layer 1 will become the world's main ledger. It allows anyone to view, use, and add data or functions without permission. It has credible neutrality and is censorship-resistant. It has the characteristics of tamper-proof and verifiable tampering (achieved through penalty mechanisms and transparency), and continues to advance its own decentralization process. It has a top-notch and large community that is always highly vigilant because there will always be patient and well-resourced participants trying to disrupt the system. Fortunately, as Ethereum develops and matures, it will become increasingly difficult to disrupt the system."

4.Upbit adds Solana network to support USDC deposits and withdrawals

Golden Finance reported that South Korean exchange Upbit announced that it will support USDC deposit and withdrawal services on the Solana network from 11:00 (KST) on June 20, 2025. Users need to obtain a new deposit address for the Solana network and cannot use the existing Ethereum network address for deposits.

The minimum deposit amount of USDC on the Solana network is 3USDC, the minimum withdrawal amount is 0.7USDC, and the withdrawal fee is 0.7USDC.

5.Binance will perform wallet maintenance on BNB Smart Chain on June 19

Golden Finance reported that according to the official announcement, Binance officially announced that it will perform wallet maintenance on BNB Smart Chain (BEP20) at 14:00 (Beijing time) on June 19, 2025, and the maintenance time is expected to be about one hour. During the maintenance period, the deposit and withdrawal services of the BEP20 network will be suspended from 13:55 (Beijing time), but it will not affect the trading function of related tokens.

Binance said that after the maintenance is completed and the network is stable, the deposit and withdrawal services will be automatically restored without further notice.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Weatherly

Weatherly Alex

Alex Miyuki

Miyuki Catherine

Catherine Anais

Anais Weiliang

Weiliang Kikyo

Kikyo