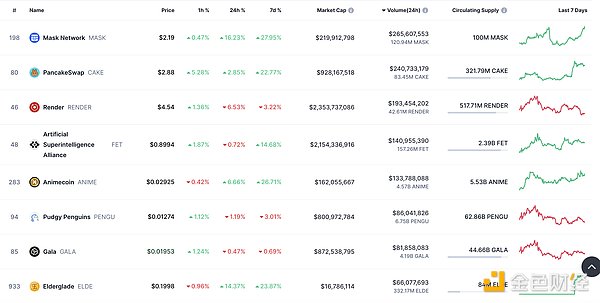

DeFi data

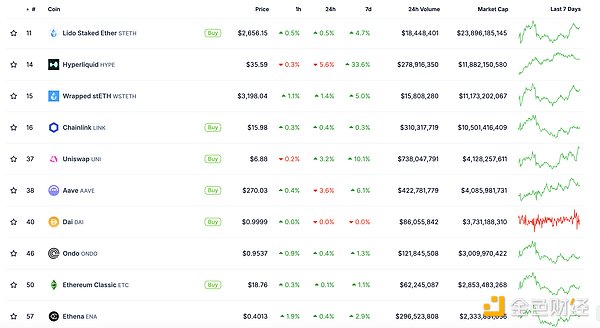

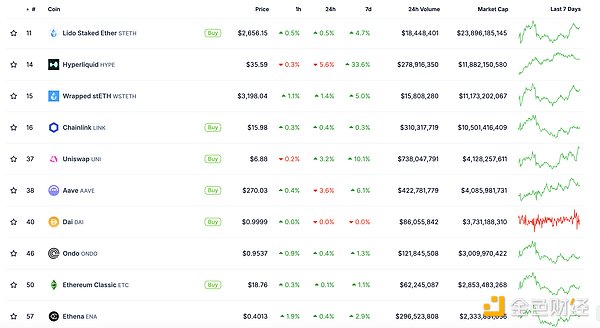

1. Total market value of DeFi tokens: 122.989 billion US dollars

DeFi total market value data source: coingecko

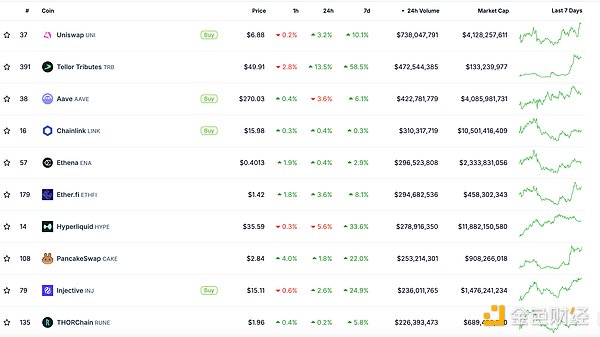

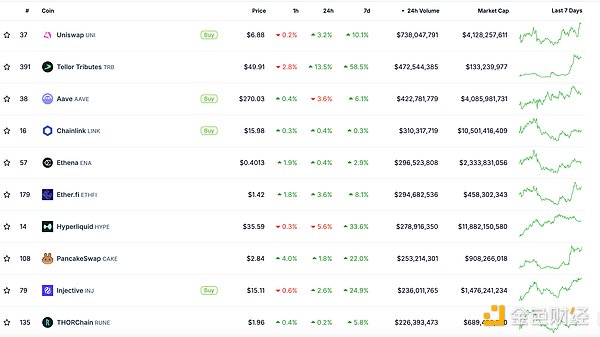

2. The trading volume of decentralized exchanges in the past 24 hours was US$7.314 billion

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

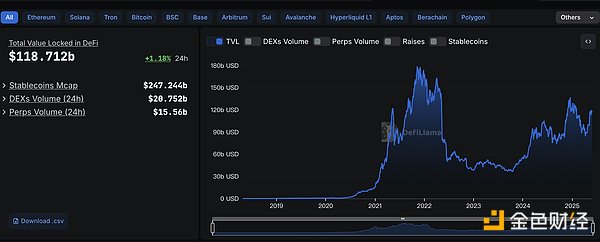

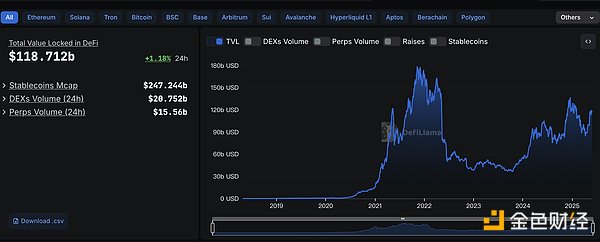

3. Assets locked in DeFi: 118.712 billion US dollars

src="https://img.jinse.cn/7372383_watermarknone.png" title="7372383" alt="slIShKnBFfZssPEDcqoBuuBAFwVPDeWTiScbrf4j.png">

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

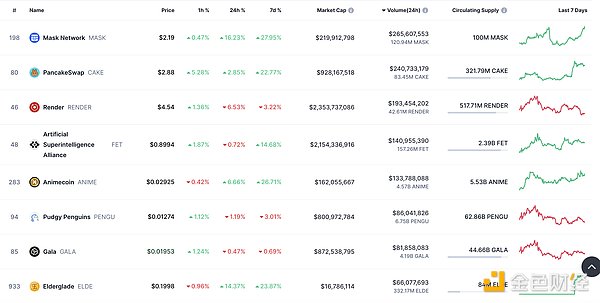

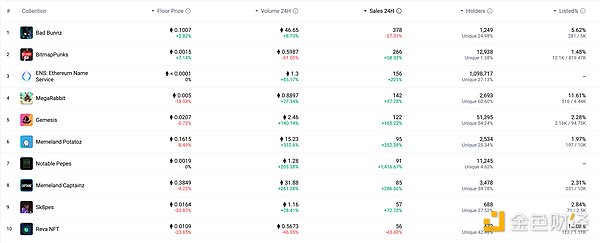

NFT data

1. Total market value of NFT: US$22.101 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2.24-hour NFT trading volume: 2.403 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

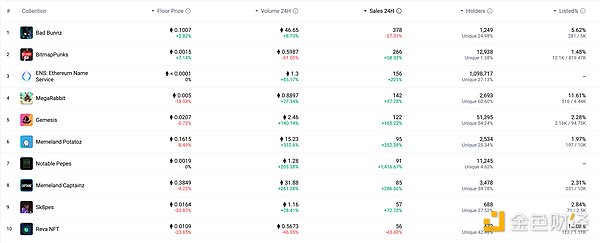

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Ripple submits new letter to SEC: detailing when tokens lose their securities properties

Ripple has submitted a supplemental letter to the U.S. Securities and Exchange Commission (SEC) aimed at clarifying a key issue: when should a token lose its securities properties. Ripple Chief Legal Officer Stuart Alderoty highlighted the letter in a post on the X platform. According to him, Ripple sent the letter to the SEC's Crypto Task Force, which is led by Commissioner Hester Peirce.

The letter focuses on Peirce's recent speech, "The New Paradigm," in which she posed the question, "When can a digital asset be separated from an investment contract?" In response to this question, Ripple cited existing securities law analysis from prominent legal experts such as Lewis Cohen. In that analysis, Cohen argued that current U.S. investment contract law does not classify routine transfers of most fungible crypto assets in secondary markets as securities.

Ripple emphasized that Judge Analisa Torres reinforced this view in her landmark July 2023 ruling in the Ripple vs. SEC case. Specifically, while the judge ruled that Ripple's sales of XRP to institutional customers constituted securities, she believed that the company's sales of XRP in the secondary market did not constitute investment contracts.

MEME Hotspot

1. Suspected of James Wynn sold 240 billion PEPE to fund his BTC long position

Golden Finance reported that according to Lookonchain monitoring, it is suspected that James Wynn has sold 240 billion PEPE in exchange for $3.32 million to fund his Bitcoin long position.

DeFi Hotspots

1.Cyvers Alerts: Cork Protocol is suspected of being attacked, with a loss of about $12 million

Golden Finance reported that Cyvers Alerts posted on the X platform that the system detected that Cork Protocol was suspected of being attacked, with a loss of about $12 million. The attacker deployed a malicious contract at 11:23:19 UTC on May 28, 2025, with funds provided by 0x4771…762B (probably a service provider). Just 16 minutes and 45 seconds later, the attacker launched the attack and successfully obtained 3,761.87 wstETH, which was quickly converted into ETH. The funds have not yet been transferred to other addresses.

2. Sophon has opened airdrop claims

Golden Finance reported that Sophon stated on the social platform that it has opened airdrop claims to eligible early contributors for a period of 60 days.

3. SlowMist: The core problem of the arbitrage attack on the Usual protocol originated from the usual Vault system

Golden Finance reported that according to SlowMist monitoring, the Usual protocol suffered a complex arbitrage attack. Analysis shows that the attacker took advantage of the price difference between the internal mechanism of the protocol and the external market.

The core problem originated from the usual Vault system, which allows USD0++ and USD0 tokens to be exchanged at a fixed 1:1 ratio, but these same tokens are traded at different prices on external decentralized exchanges. The attacker cleverly created a custom liquidity pool and manipulated the transaction path, causing the Vault to release USD0 tokens without receiving the expected sUSDS collateral. Subsequently, the attacker sold the obtained USD0 tokens in the external market at a price higher than the internal exchange rate, thereby obtaining arbitrage profits.

4.Cetus announces recovery plan, seeks bridge loan from SUI

On May 28, Cetus announced a recovery plan after suffering a $223 million vulnerability attack, aiming to forcibly recover $162 million of frozen funds from wallets controlled by hackers through protocol-level upgrades. Cetus has requested a community vote to restore the funds frozen after last week's hack. The Sui Foundation has released an on-chain community voting code, and Sui validators and holders can vote directly through staking delegation. The vote was launched at 1 pm Pacific Time on May 27 and lasted for up to seven days, requiring more than 50% participation and majority approval to pass.

Cetus said that with its cash and token reserves, it is now able to fully cover the stolen assets, including a significant loan from the Sui Foundation, which will enable all affected users to recover their losses 100%.

5. Starknet launches rune assets supported by USDC reserves 1:1

Golden Finance reported that Starknet announced the launch of Rune stablecoins supported by USDC reserves 1:1. Each USDC will be minted as a rune asset on Bitcoin, and users can redeem USDC trustlessly at the contract level through Starknet's Runes Bridge.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Kikyo

Kikyo