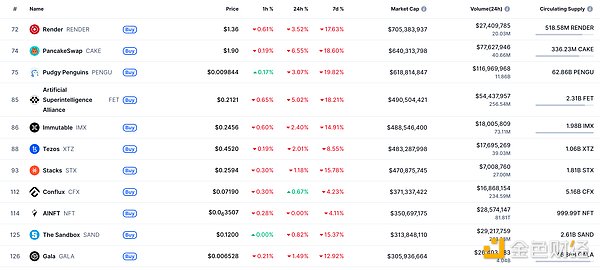

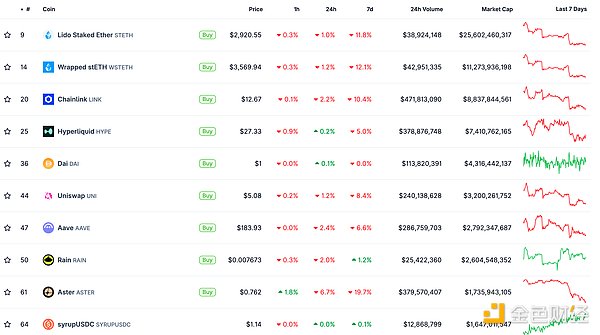

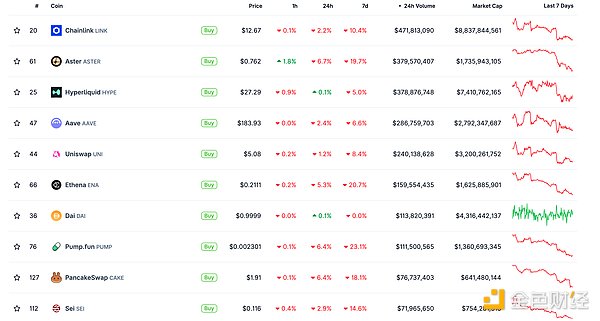

DeFi data

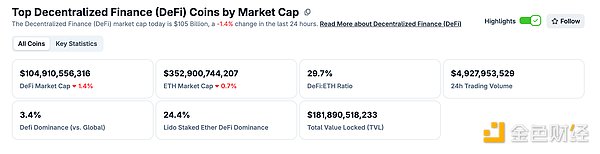

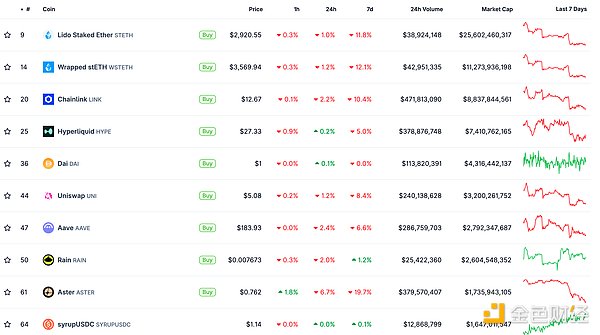

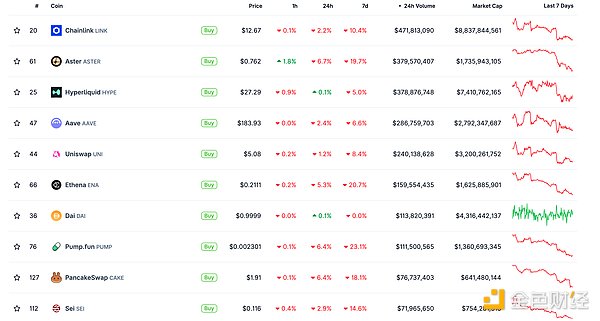

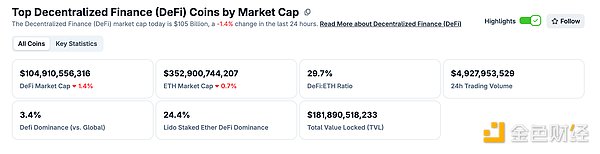

1. Total market value of DeFi tokens: $104.91 billion

DeFi Total Market Cap Data Source: coingecko

2. Trading volume of decentralized exchanges in the past 24 hours: $49.27

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

3. Assets locked in DeFi: $118.44 billion$118.44 billion

![]() Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

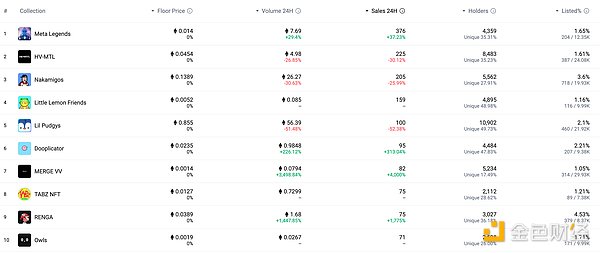

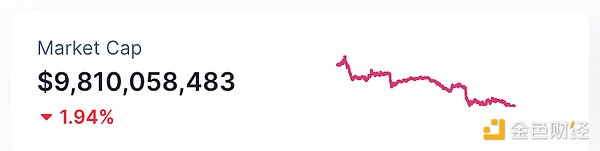

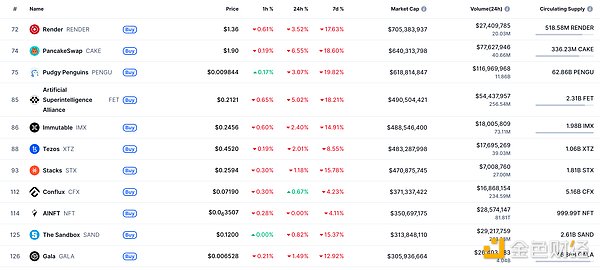

NFT Data

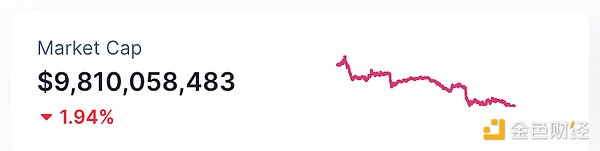

1. Total Market Cap of NFTs: $9.81 Billion

alt="KQapQW5CFiVvT54cDHvgGdUtnj2c8L9F4EvygO9F.png">

NFT Total Market Capitalization, Top Ten Projects by Market Capitalization Data Source: Coinmarketcap

2.24-hour NFT transaction volume: 9.785 billion USD [Image of NFT total market capitalization and top ten NFTs by market capitalization. Data source: Coinmarketcap] [Image of top NFTs in 24 hours]

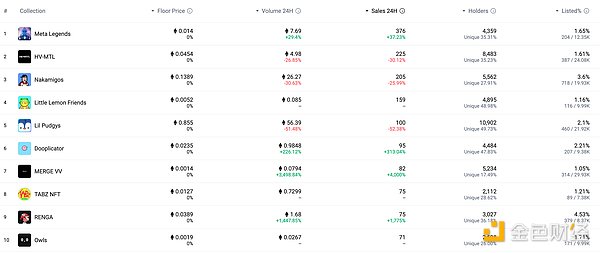

Top 10 NFTs by Sales Increase in the Last 24 Hours. Data Source: NFTGO

Toutiao

Bitcoin Decline Driven by Derivatives Liquidation

According to on-chain data, the recent decline in Bitcoin prices was mainly driven by forced liquidation in the derivatives market, rather than a sell-off in the spot market. The fundamental reason lies in the accumulation of highly leveraged long positions in the futures market. When the price fell below key levels, these positions triggered maintenance margin requirements and were forcibly liquidated.

DeFi Hotspot

1.Messari: BNB According to a report by Jinse Finance, citing the latest report from Messari, BNB Chain's market capitalization grew by 51.6% quarter-on-quarter to $140.4 billion in Q3 2025, ranking fifth in the crypto market capitalization. Total Value Locked (TVL) in DeFi increased by 30.7% to $7.8 billion, surpassing Tron to rise to third place. Stablecoin market capitalization grew by 32.3% to $13.9 billion, with USDT accounting for 57.4%, USDe surging more than tenfold quarter-on-quarter to $430 million, and USDF increasing to $360 million.

2. Binance Wallet Launches Web3 Loan On-Chain Lending Function

Jinse Finance reports that Binance Wallet has launched a new Web3 Loan on-chain lending function, allowing users to borrow crypto assets directly within the Binance Wallet using existing assets as collateral, expanding the on-chain lending experience. This function enables multi-asset collateralization and borrowing through the Venus protocol on the BNB chain. Currently, it supports collateralizing mainstream assets including BTCB, ETH, USDT, USDC, FDUSD, and WETH, and allows borrowing USDT, USDC, and BNB. Binance Wallet stated that it will launch an exclusive Venus rewards program based on this lending function, where users who borrow eligible assets can share a 400,000 USDT reward and enjoy preferential interest rates, aiming to improve the liquidity and yield potential of on-chain wealth management and lending services within the wallet.

3. Binance Releases Project Listing Path Framework and Application Guidelines

According to Jinse Finance, Binance has released its project listing path framework, including options for different stages such as Binance Alpha, Binance Futures, and Binance Spot.

The announcement details the different listing paths from early-stage projects to mature projects, such as Launchpool, Megadrop, and direct spot listing, and lists key evaluation areas. Project teams must apply directly through official channels. Binance emphasizes that it does not recognize any third-party intermediaries and remains vigilant against fraudulent activities, providing a reporting channel.

4. Polygon Network's November transaction volume reached a record high of $7.12 billion

According to Jinse Finance, Sandeep Nailwal, co-founder of Polygon and CEO of the Polygon Foundation, posted on the X platform that Polygon Network's P2P business is experiencing accelerated growth, achieving four consecutive months of growth, with November's transaction volume once again reaching a record high of $7.12 billion.

5.Delphi Digital: L1 Valuation Premium Has Disappeared, Market Demand for Homogeneous Infrastructure is Weakening

According to Jinse Finance, Delphi Digital published an article on X stating that the valuation premium for Layer 1 is disappearing. The transformation from "fat protocols" to "fat applications" has been ongoing for some time, but the market is only now beginning to price it in. Market demand for homogeneous infrastructure is weakening, and investor expectations have shifted.

Major public chains are facing greater pressure to demonstrate real and sustainable recurring revenue. Stablecoins may be a way out. Currently, over $30 billion worth of USDC and USDT are deployed on various alternative Layer 1 and Layer 2 networks, generating over $1 billion in revenue annually for Circle and Tether.

The ecosystem that truly drives demand for these stablecoins has a total transaction fee revenue of approximately $800 million.

Joy

Joy