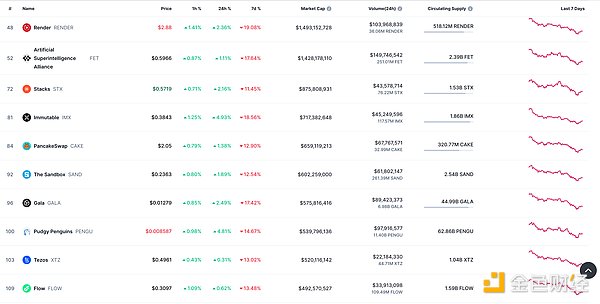

DeFi data

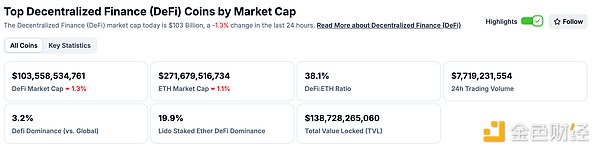

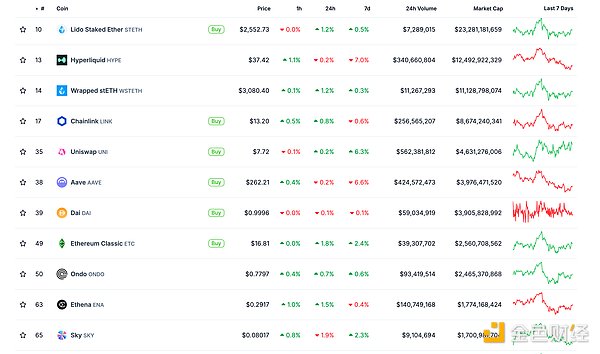

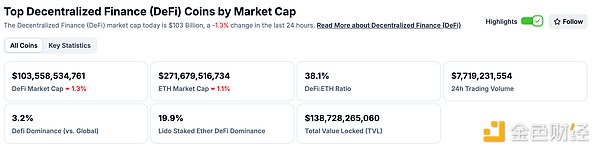

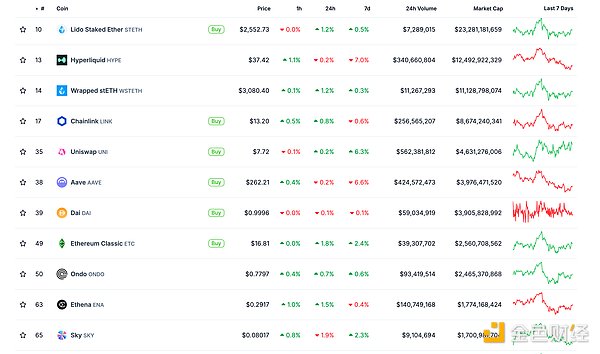

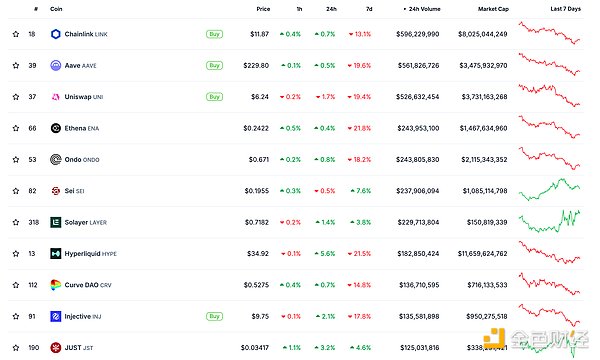

1. Total market value of DeFi tokens: 103.558 billion US dollars

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$7.719 billion

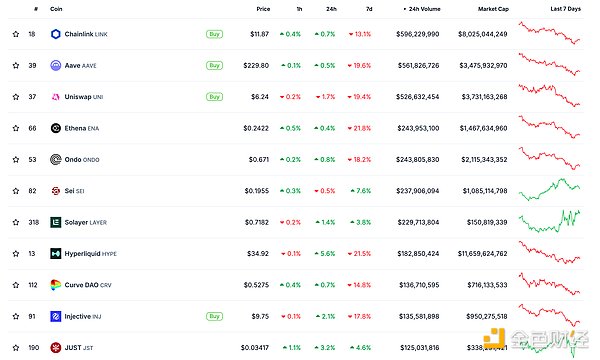

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

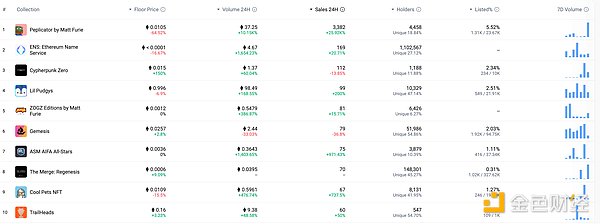

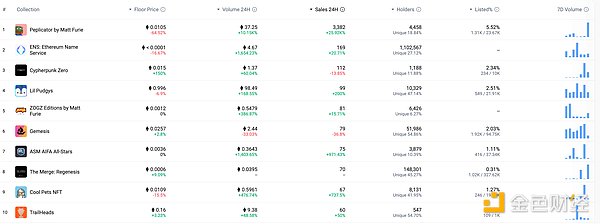

NFT data

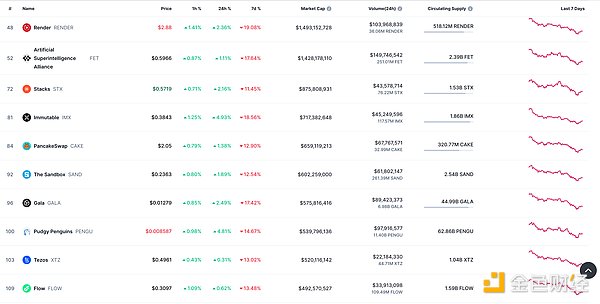

1. Total market value of NFT: US$15.801 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2.24-hour NFT trading volume: 22.903 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Source: OKX is considering an IPO in the United States

On June 23, according to The Information encryption reporter Yueqi Yang, the cryptocurrency exchange OKX is considering an initial public offering (IPO) in the United States after returning to the U.S. market in April this year.

DeFi hotspots

1. Kazakhstan and Solana cooperate to establish a blockchain economic zone

Golden Finance reported that according to News.Bitcoin, the Solana Foundation and the Kazakhstan government signed a memorandum of understanding to establish the first blockchain economic zone in Central Asia, aiming to promote the development of tokenized capital markets, cultivate Web3 talents and attract blockchain companies to settle down.

2. Mango Network announces MGO token economics: total supply of 10 billion, testnet airdrop accounts for 5%

Golden Finance reported that Multi-VM full-chain network Mango Network announced MGO token economics, with a total token supply of 10 billion and the following token distribution: 20% POS equity pool; 20% foundation; 17% ecosystem innovation fund; 15% team and early contributors; 5% testnet airdrop; 15% investors; 5% mainnet airdrop; 3% consultants.

3. South Korean payment service provider Kakao announced the launch of the "Korean won stablecoin" business

On June 23, according to the Seoul Economic Daily, South Korean payment giant Kakao Pay has officially launched the Korean won stablecoin business. The company applied for 18 trademark rights to the Korean Patent Office on June 17. These trademarks combine "KRW" (the Korean won symbol) with letters such as "K" and "P" representing Kakao Pay, such as "KRWKP", "KWRP" and "KPKRW", etc. These trademarks are classified in the fields of virtual asset financial transactions, electronic transfers and intermediary businesses.

Kakao Pay said that although "no specific plans have been determined", this is "pre-registration of trademark rights for stablecoin business." Industry insiders believe that Kakao Pay's move is to seize the market, especially in the context of the "Basic Law on Digital Assets" proposed by South Korean politicians, which will allow private companies to issue Korean won stablecoins.

4. Binance adjusts multi-asset collateral ratio and contract leverage

Golden Finance reported that according to the official announcement, Binance will adjust the combined margin collateral ratio of 12 assets including KAVA at 06:00 (UTC) on June 27, 2025, and adjust the SOLUSDT contract at 06:30 (UTC) on June 23, and adjust the leverage and margin level of 6 USDⓈ-M perpetual contracts including ICXUSDT at 06:30 (UTC) on June 27.

5.Matrixport: Ethereum's current price is mainly driven by futures positions, and downward pressure remains high

Golden Finance reported that Matrixport released a daily chart analysis saying that although Bitcoin has tried to rebound, seasonal patterns (refer to our daily chart on June 2) indicate that a sustained breakthrough is unlikely to occur. For this rise to remain technically valid, Bitcoin needs to remain above $105,000. However, the bigger concern is Ethereum, as we described in our report on June 11, leveraged traders have pushed up prices without fundamental support.

We still believe that Ethereum's current price is mainly driven by futures positions, which makes it vulnerable to further declines. This position risk helps explain the extraordinary decline in Ethereum in the past few days. Given that leverage is still high, further downward price pressure remains huge.

Game Hotspots

1. Blockchain game developer Endless Clouds completed $6.25 million in financing and launched the token END

Golden Finance reported that according to Immutable’s announcement on the X platform, the blockchain game developer Endless Clouds completed $6.25 million in financing, with institutional investors such as Animoca Brands and IdeoCo Labs, as well as a group of angel investors in the industry such as Robbie Ferguson (Immutable), Luca Netz (Pudgy Penguins), and Stani Kulechov (founder of AAVE) participating in the investment. At the same time, Endless Clouds also announced the launch of the token END, which will power the Endless Clouds ecosystem (especially Treeverse).

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to raise your risk awareness.

Kikyo

Kikyo