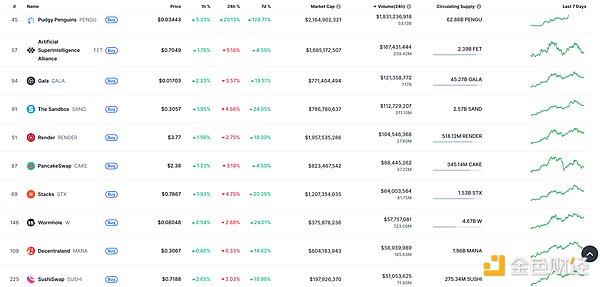

DeFi data

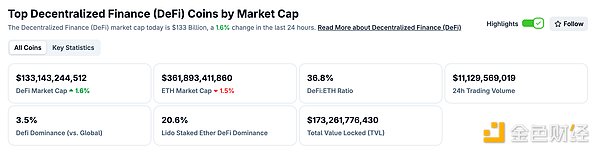

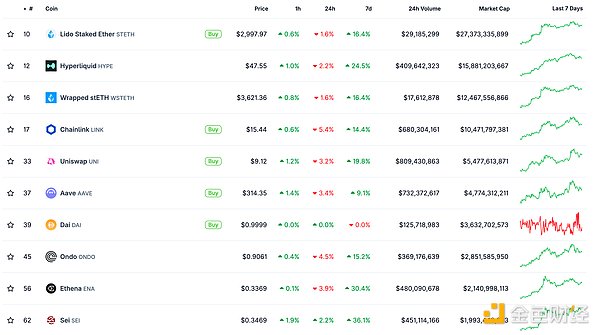

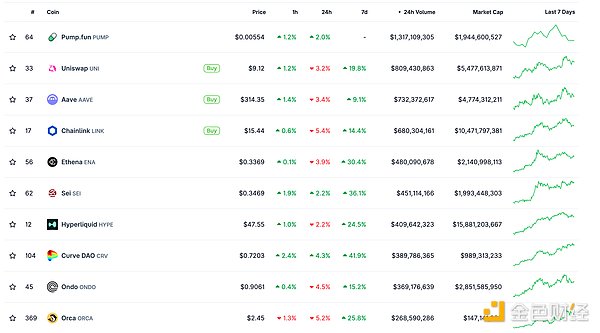

1. Total market value of DeFi tokens: 133.143 billion US dollars

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 11.121 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

3. Assets locked in DeFi: 126.19 billion US dollars

src="https://img.jinse.cn/7383979_watermarknone.png" title="7383979" alt="43IuJeOvOpijbRH0jO21lOz7rk9pc8LBdhBwKWA5.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

NFT data

1. Total market value of NFT: US$20.848 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

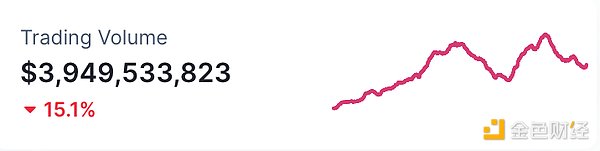

2. 24-hour NFT trading volume: 3.949 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

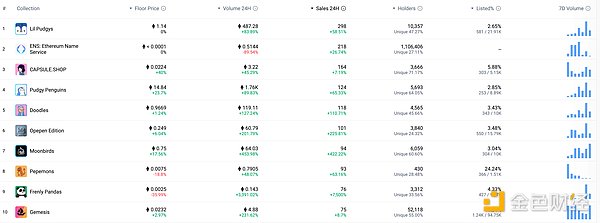

3. Top NFTs in 24 hours

Top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

JP Morgan Chase CEO may "go all in on cryptocurrency"

Golden Finance reported that CNBC financial celebrity Jim Cramer said, "JP Morgan Chase CEO Jamie Dimon will "go all in on cryptocurrency." Last year he called cryptocurrency a fraud and a Ponzi scheme."

MEME hot spots

1. BSC ecological meme coin quq plummeted by more than 50% in a short period of time, and the market value was temporarily reported to be 2 million US dollars

Golden Finance reported that the market showed that the BSC ecological meme coin quq plummeted by more than 50% in a short period of time, and the market value was temporarily reported to be 2 million US dollars. It is reported that quq is the third in Binance alpha trading volume.

2. A certain address mistakenly destroyed 10 million PUMPs, losing about 75,000 US dollars

Golden Finance reported that according to Lookonchain monitoring, a certain address accidentally destroyed 10 million PUMPs (about 75,000 US dollars) when using tools to clean up airdrop junk tokens.

DeFi hotspots

1. NYSE approves ProShares Ultra XRP ETF

Golden Finance reported that according to Cointelegraph, the New York Stock Exchange approved the ProShares Ultra XRP ETF (code: UXRP).

2. Crypto infrastructure company Function raised $10 million, led by Galaxy Digital

Golden Finance reported that crypto infrastructure company Function raised $10 million in a seed round of financing, led by Galaxy Digital, with participation from Antalpha and Mantle. Function's FBTC allows institutions and corporate finance departments to efficiently deploy Bitcoin while maintaining full custody control of their cryptocurrencies.

3.Vitalik: The best way to build L2 is to borrow more from the functions of L1

Golden Finance reported that Ethereum co-founder Vitalik Buterin said that the best way to build L2 is to rely more on the functions provided by L1 (security, anti-censorship, proof, data availability, etc.), and simplify the logic to only act as a sequencer and prover above the core execution layer (if based on the Base network, only as a prover).

Vitalik believes that this is a perfect combination of trust minimization and making L2 not require hard forks, which helps prevent risks and create a healthy ecosystem.

4. Ant Digits' L2 blockchain Jovay launches testnet, mainnet to be launched in Q4

Golden Finance reported that on July 15, Ant Digits' Layer 2 blockchain Jovay testnet was officially launched. As a blockchain platform built by Ant Digits for institutional-level application scenarios, it aims to serve various application scenarios including RWA. Jovay solves the core pain points of traditional Layer 2 solutions in performance, security, compliance and scalability through three technologies: parallel execution architecture, progressive hybrid verification mechanism and modular architecture, making large-scale high-frequency transactions on the chain possible. It is understood that Jovay plans to complete the mainnet launch in the fourth quarter of 2025.

It is reported that Jovay can significantly improve throughput while shortening user response time to within 1 second through a three-layer pipeline parallel architecture at the transaction level, block level and batch level, ensuring the real-time performance of scenarios such as transfers and RWA contract calls.

5. US spot Ethereum ETF had a net inflow of 259 million US dollars yesterday

Golden Finance reported that according to Farside Investors monitoring data, the US spot Ethereum ETF had a net inflow of 259 million US dollars yesterday.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Catherine

Catherine Alex

Alex Clement

Clement Jasper

Jasper Jixu

Jixu Jasper

Jasper Clement

Clement Jixu

Jixu Kikyo

Kikyo