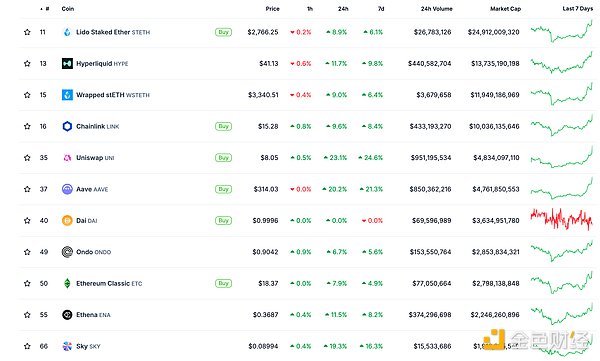

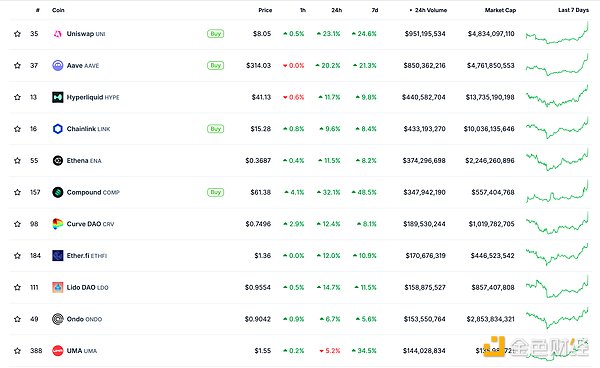

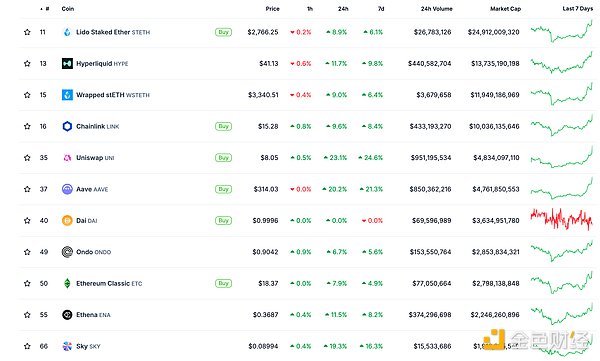

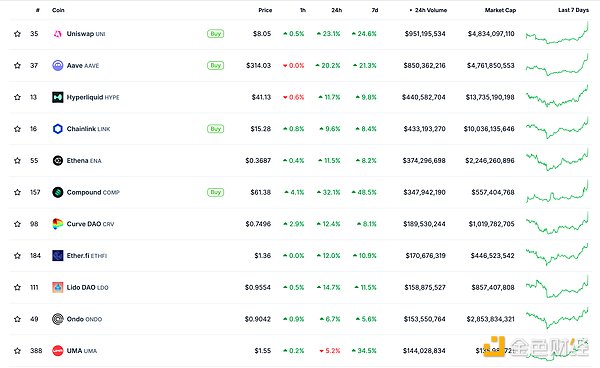

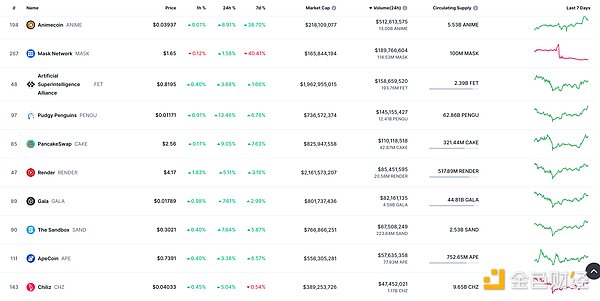

DeFi data

1. Total market value of DeFi tokens: 126.829 billion US dollars

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$8.231 billion

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

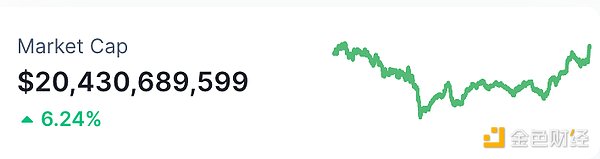

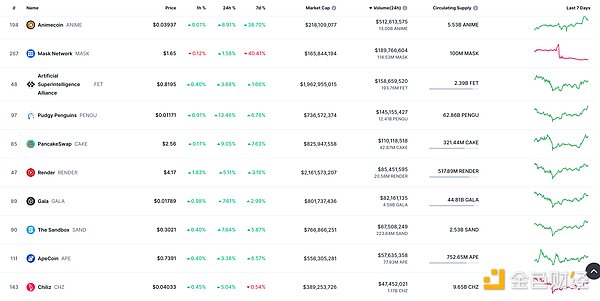

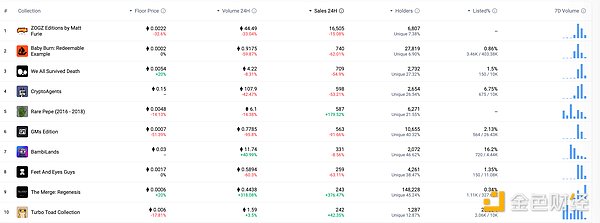

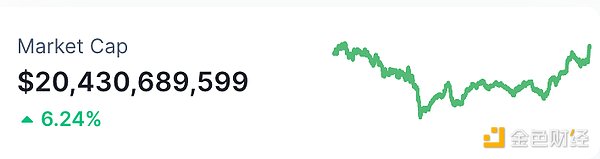

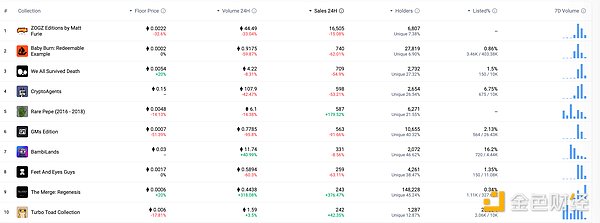

NFT data

1. Total market value of NFT: US$20.43 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 2.684 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Forbes Rich List: CZ once again became the richest Chinese with assets of 65.7 billion US dollars

Golden Finance reported that according to the Forbes Rich List data, Changpeng Zhao (CZ) once again became the richest Chinese with assets of 65.7 billion US dollars.

MEME hot spots

1.WLFI deposited multiple tokens into Aave V3 2 hours ago and borrowed 7.5 million USDT

Golden Finance reported that according to Onchain Lens monitoring, 2 hours ago, World Liberty Finance had:

- Deposited 7,900 ETH (US$21 million), 162.69 WBTC (US$17.91 million) and 5,010 stETH (US$13.31 million) into Aave V3.

- Borrowed 7.5 million USDT from Aave V3.

- Transferred 7.5 million USDT to the BitGo wallet, which may be used to withdraw USD1.

DeFi Hotspots

1. JackYi, founder of LD Capital, reiterated his bullish view on ETH and its ecological tokens

Golden Finance reported that JackYi, founder of LD Capital, once again reiterated his firm bullish view on Ethereum and its ecological tokens. He said that he currently holds 100,000 ETH options and believes that the Ethereum ecosystem is undervalued for the following reasons: ETH tokens themselves are undervalued, and the ETH/BTC exchange rate pair is optimistic about the rebound during the bull market; after the encryption policy is relaxed, projects with real income, users, and products will benefit first from the inflow of traditional capital; Wall Street funds are flowing into Ethereum to build positions recently.

Trend Research, a subsidiary of LD Capital, is openly bullish on ETH, currently holding 142,000 ETH and making a floating profit of US$42.35 million.

2.QCP: Ethereum regains market attention, limited progress in US-China trade negotiations

Golden Finance reported that QCP published an article saying that Bitcoin once exceeded $110,000 against the backdrop of the restart of US-China trade negotiations, but market enthusiasm quickly faded due to the lack of substantive breakthroughs. At the same time, Ethereum is quietly regaining narrative dominance, with rising implied volatility, options skew turning bullish, and significant ETF inflows ($281 million last week, $52.7 million yesterday), indicating a rebound in institutional investor interest. With the GENIUS Act advancing in the US Senate, the restart of Circle IPO discussions, and regulatory support for stablecoins, Ethereum's role as a tokenization and settlement infrastructure may usher in structural upside opportunities.

3. Community feedback: Inactive wallet funds of Bitcoin Lightning Network Wallet Alby were transferred away without reason

Golden Finance reported that according to community feedback, inactive wallet funds of Bitcoin Lightning Network Wallet Alby were transferred away without reason. It was found through the Alby terms that Alby claimed to reserve the right to deduct all remaining balances from the shared wallets of users' old Alby accounts that have been inactive for 12 consecutive months (i.e. no transactions during the period), which applies to inactive old Alby accounts of shared wallets created in 2023 and before.

4. Uniswap Labs CEO: The US SEC has publicly acknowledged that DeFi is a national priority

Golden Finance reported that Paul Atkins, chairman of the US Securities and Exchange Commission, announced at the Crypto Roundtable that he was formulating an "innovation exemption" policy for DeFi platforms, which attracted the attention of the crypto community. Hayden Adams, CEO of Uniswap Labs, wrote that it is incredible that DeFi has developed so fast. Maker, Compound and Uniswap were launched in 2018, which promoted the start of the DeFi movement. Before that, the word "DeFi" did not even exist. Now the attitude of the chairman of the US SEC shows that US government agencies have publicly acknowledged that DeFi is a national priority.

5.ZK Nation releases announcement on ZK token unlock

On June 10, when ZK tokens are issued in 2024, Matter Labs team members and investors will receive a total of about 33.3% of the total supply. On June 18, up to 25% of the vested team member token allocations and 10% of the vested investor token allocations will be unlocked. The token allocations received by Matter Labs team members and investors at the TGE will be unlocked within 4 years, with a 1-year vesting period.

According to current calculations, 3.6% (about 760 million) of the total token supply (21 billion) will be unlocked in June. Starting from July 2025, it is expected that 0.8% of the total token supply (about 167 million tokens) will be unlocked each month until June 2028. (Note: About 33.3% of the total token supply is allocated to Matter Labs team members and investors, and Matter Labs itself is not specifically allocated).

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Catherine

Catherine