DeFi data

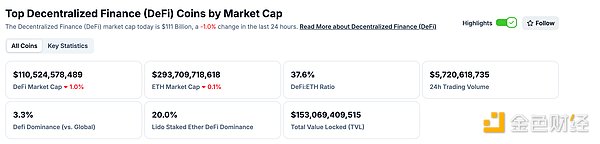

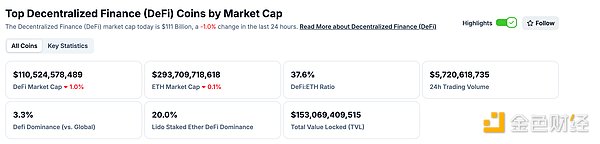

1. Total market value of DeFi tokens: 110.752 billion US dollars

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was 5.72 billion US dollars

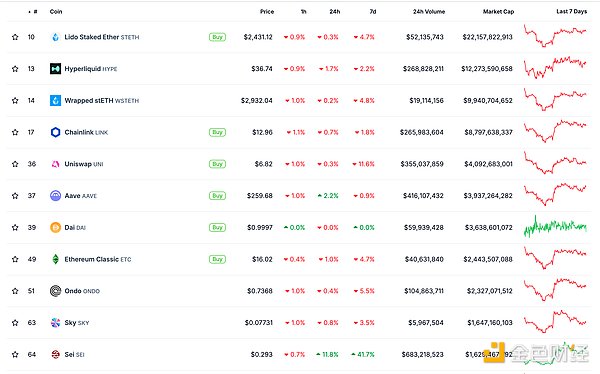

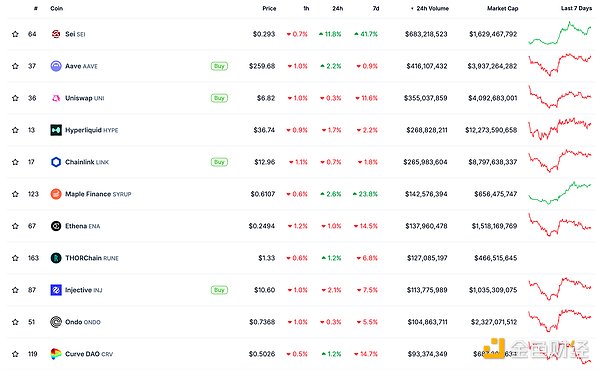

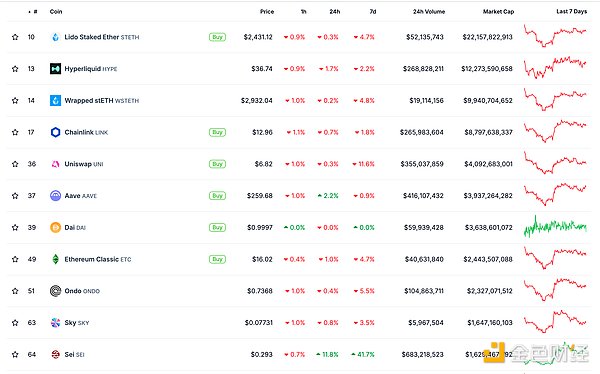

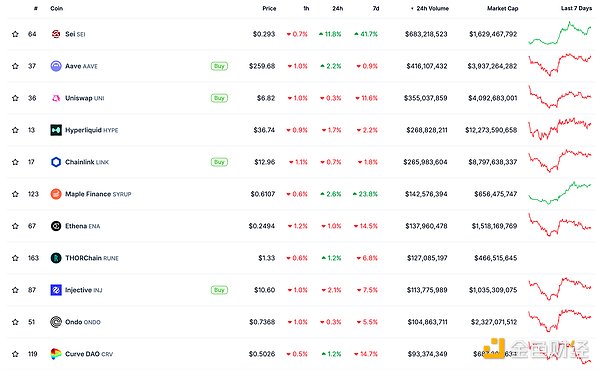

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

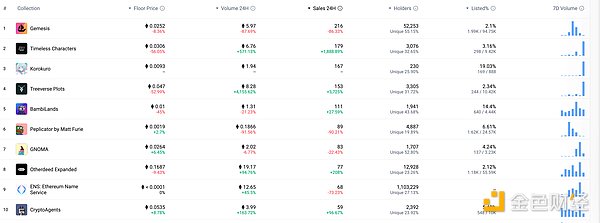

NFT data

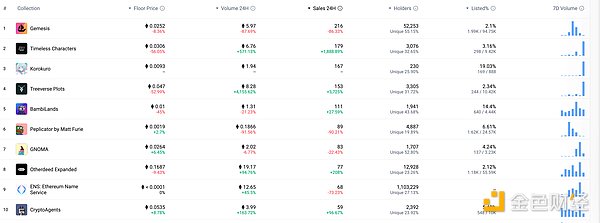

1. Total market value of NFT: US$16.396 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 1.967 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Coinbase stock price hit a record closing high, soaring 40% in the past month

Golden Finance reported that Coinbase (stock code: COIN) stock price closed at its highest level since its listing in April 2021 on Thursday. According to COIN price data from The Block, the stock closed at $375.07 per share, up 5.5%.

Coinbase shares have been soaring recently, up nearly 24% in the past five trading days alone and 40% in the past month. Coinbase's previous all-time high closing price was $357.39 in November 2021. The company's market value has soared to $89 billion.

MEME Hotspots

1. American electric car company Mullen announced that it will accept Bitcoin and TRUMP Meme coins for payment

Golden Finance reported that according to Globenewswire, American electric car company Mullen (NASDAQ: MULN) announced that it will accept cryptocurrencies including Bitcoin and TRUMP Meme tokens as payment methods for its Mullen and Bollinger commercial electric vehicles, becoming one of the few automakers to accept cryptocurrency payments. Mullen also plans to expand its payment acceptance to other mainstream cryptocurrencies.

Mullen CEO David Michery said the move will help the company expand its commercial and consumer markets.

News on June 27, OpenZK Network will launch OZK staking on July 14, and users can earn network rewards to empower OZK. The launch of the staking function will further empower the functionality of OZK, effectively increase usage scenarios, and enhance community confidence. At the same time, OpenZK announced the exploration of a dual-token gas fee model. In addition to using ETH as the network gas fee, users can also use OZK as the network gas fee to further empower tokens. Related research and development is in progress.

2. Draper Dragon officially announced investment in AllScale

On June 27, Draper Dragon officially announced its investment in AllScale. It is reported that AllScale (allscale.io) focuses on opening up the last mile of enterprise-level stablecoin payments, helping companies to use stablecoins in a compliant, safe, and simple manner to complete collection, sales, payroll, and other needs. AllScale's founding team includes payment products and compliance legal core members from Kraken, Block, CapitalOne, OKX, TikTok, etc. Project investors and supporters include Draper Dragon, Amber Group, Metaverse Capital, KuCoin Ventures, Oak Grove Ventures, Blockbooster, Movemaker, etc. It is also a member of the Hong Kong Cyberport incubator.

Draper Dragon originated from DFJ Fund in Silicon Valley. It was co-founded in 2005 by the world's most influential venture capitalists and the first generation of venture capital leaders in China. It is the core fund and governing unit of the global early venture capital network alliance "Draper Venture Network".

3. Sui Name Service announced that it has obtained the "sui.eth" domain name.

Golden Finance reported that Sui Ecological Domain Name Service Sui Name Service announced that it has successfully obtained the "sui.eth" domain name. The official said that this move is an important step in further promoting the construction of a cross-chain digital identity system after the launch of the cross-chain portal "The Portal".

4. Across Co-founder denies the allegations of misappropriation of funds and manipulation of votes made by the founder of Glue

Golden Finance reported that Across Co-founder Hart Lambur denied the allegations of misappropriation of funds and manipulation of votes made by the founder of Glue.

In response to the accusation of "self-withdrawing $23 million for personal gain", Hart said that Risk Labs is a non-profit foundation subject to Cayman law, and the funds are used for protocol development. Hart's annual salary is only $100,000, and he has not received token rewards. The use of funds is in line with DAO practices and has promoted the development of Across v3 and v4.

In response to the accusation that "the governance process is manipulated by insiders", Hart said that team members are free to use the tokens they purchased to vote, Kevin's wallet (maxodds.eth) is public, Reinis' vote is also legal, the proposal was passed without a dissenting vote, and the process is transparent.

5.Hazeflow founder: Polychain made more than $80 million in profit by selling Celestia staking rewards

Golden Finance reported that according to Hazeflow founder Pavel Paramonov disclosed that Polychain invested about $20 million in the Celestia project. Polychain obtained tokens worth more than $80 million by selling Celestia staking rewards, making a profit of more than 4 times.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Brian

Brian