DeFi data

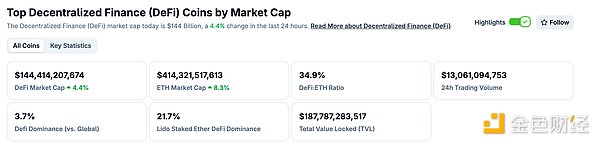

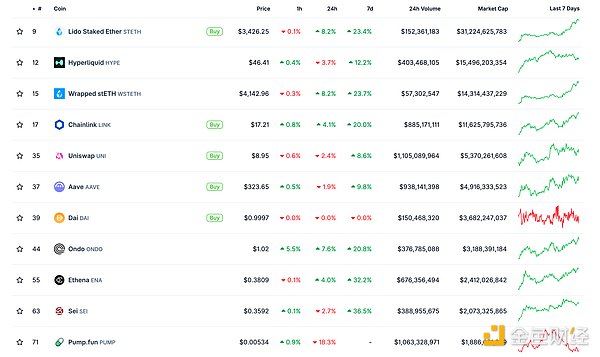

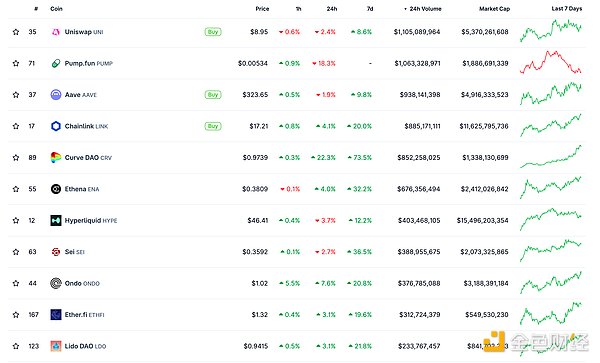

1. Total market value of DeFi tokens: US$144.414 billion

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 13.061 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

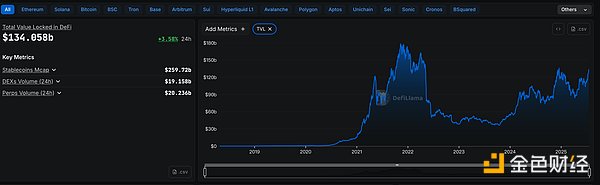

3. Assets locked in DeFi: 134.058 billion US dollars

src="https://img.jinse.cn/7384216_watermarknone.png" title="7384216" alt="taLarYezI25wgmoOuHcu2RNUn95Xu3WJZHRj9P4R.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

NFT data

1. Total market value of NFT: US$20.848 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

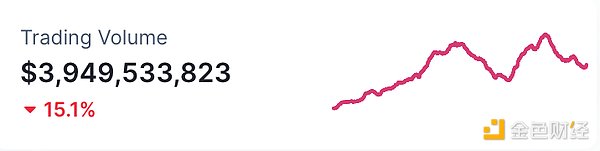

2. 24-hour NFT trading volume: 3.949 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

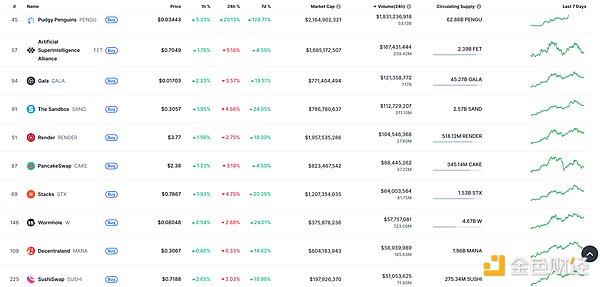

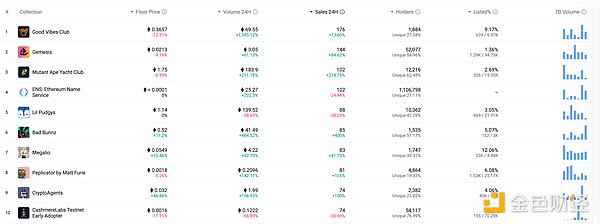

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Bank of America plans to launch stablecoins and is waiting for legal clarity

Golden Finance reported that Bank of America CEO Brian Moynihan said the bank is preparing to launch stablecoins, and investors can expect Bank of America to take action in the field of cryptocurrency, but Brian Moynihan did not provide a specific timetable.

Moynihan said, "As the second largest bank in the United States, Bank of America believes that both the industry and itself will take action. We have done a lot of work and are still trying to figure out the scale of stablecoins, because the scale of capital flows in some areas is not large. Bank of America is trying to understand customer needs and will launch stablecoins at the right time, possibly in cooperation with other institutions. Banks are still waiting for legal clarity, which is why progress is slower than some investors expected." Morgan Stanley Chief Financial Officer Sharon Yeshaya also said today that she is paying close attention to the development of stablecoins. "We are examining the market and the potential uses of stablecoins for our customer base, but it is too early."

MEME Hotspots

1. CME considers implementing 24-hour cryptocurrency trading, explicitly excluding Meme coin products

DeFi hotspots

1.Bitmine Ethereum holdings valued at US$1 billion, used for Ethereum treasury strategy

Golden Finance reported that BitMine Immersion Ethereum holdings valued at US$1 billion, used for Ethereum treasury strategy.

2. Cryptocurrency legislation has made progress, and Ethereum ETF has set records for capital inflows and trading volume

Golden Finance reported that as key cryptocurrency legislation supported by Trump has made progress, U.S. exchange-traded funds tracking Ethereum have set records for capital inflows and trading volume. After a sluggish performance at the beginning of the year, investors injected $727 million into these nine ETFs on Wednesday; at the same time, as the price of Ethereum rose, the trading volume of these ETFs reached $2.6 billion. The open interest of Ethereum futures on the Chicago Mercantile Exchange also hit a new high, a sign that institutional demand for the second largest cryptocurrency is increasing in the market. The rise of Ethereum has further strengthened the momentum of cryptocurrency bulls. Since the November election, bulls have bet that Trump's second term will usher in a new era of loose cryptocurrency regulation, and have therefore entered the market in large numbers. Overall, their bets have paid off: the mainstream cryptocurrency Bitcoin soared to a record high of $123,205 on Monday.

3. Tether issues 1 billion USDT on the Ethereum network

Golden Finance reported that according to Whale Alert monitoring, Tether issued 1 billion USDT on the Ethereum network at 16:51:11 Beijing time today.

4. Privacy Pools expands to multiple assets for the first time, integrating Sky's USDS stablecoin

Golden Finance reported that Privacy Pools, an on-chain privacy protocol supported by Vitalik Buterin, announced the integration of Sky's USDS stablecoin, marking its first expansion to a multi-asset privacy pool. The protocol was developed by the startup 0xbow and is based on zero-knowledge proof and the "association set" mechanism to ensure that funds are compliant and anonymous. Officials said that more assets and ecosystems will be supported in the future, taking into account privacy protection and regulatory compliance.

5. The open interest of Ethereum futures contracts on the entire network hit a record high, equivalent to about 48.28 billion US dollars

Golden Finance reported that according to Coinglass data, market participants increased their bets on the trend of Ethereum. The open interest of Ethereum futures contracts on the entire network was 14.73 million ETH, equivalent to about 48.28 billion US dollars, a record high, with a 24-hour increase of 8.84%.

Among them, Binance Ethereum contract open interest was 8.9 billion US dollars, ranking first;

CME Ethereum contract open interest was 5.08 billion US dollars, ranking second.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to raise your risk awareness.

Miyuki

Miyuki

Miyuki

Miyuki Brian

Brian Joy

Joy Joy

Joy Alex

Alex Joy

Joy Davin

Davin Joy

Joy Brian

Brian Weiliang

Weiliang