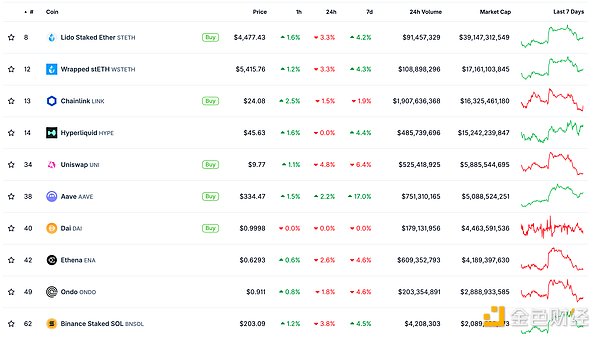

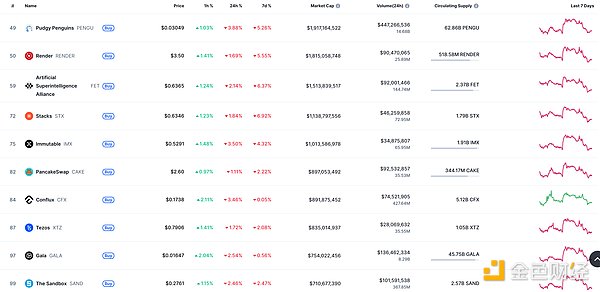

DeFi data

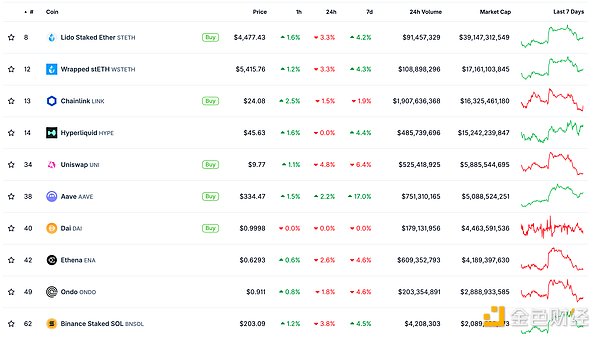

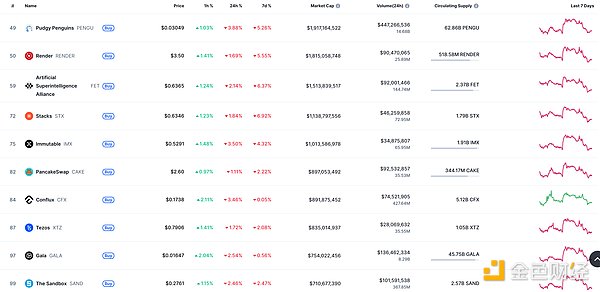

1. Total market value of DeFi tokens: 165.927 billion US dollars

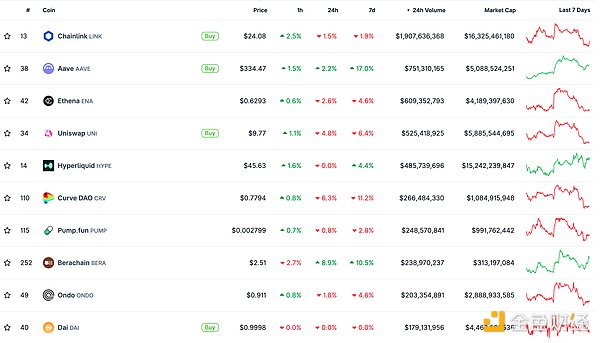

2. The trading volume of decentralized exchanges in the past 24 hours is US$99.8

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

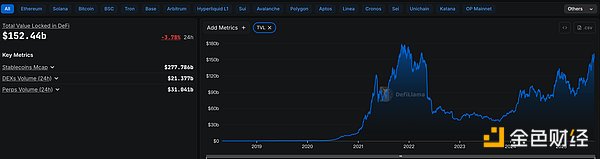

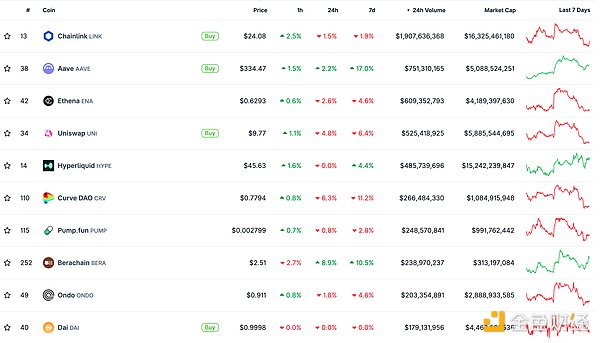

3. Assets locked in DeFi: US$152.44 billion

img src="https://img.jinse.cn/7394573_watermarknone.png" title="7394573" alt="FzDwHEx6TNsjrtho3lrcfrjgWtzqaLZJ9BuXwdl0.png">

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

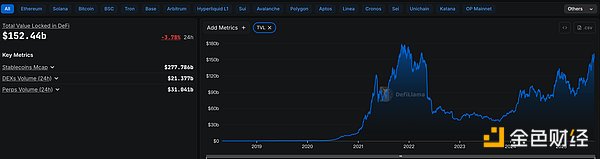

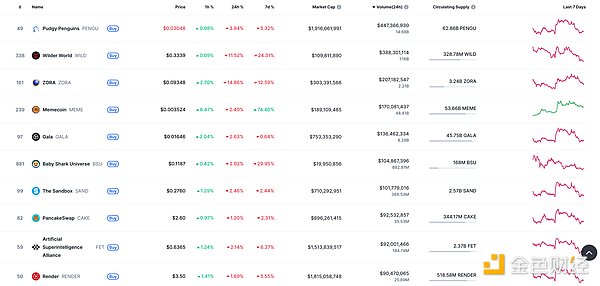

NFT Data

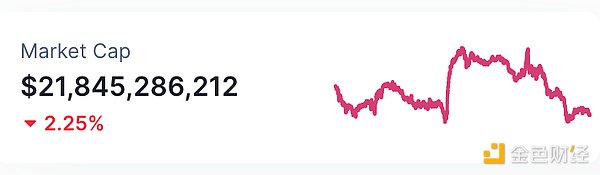

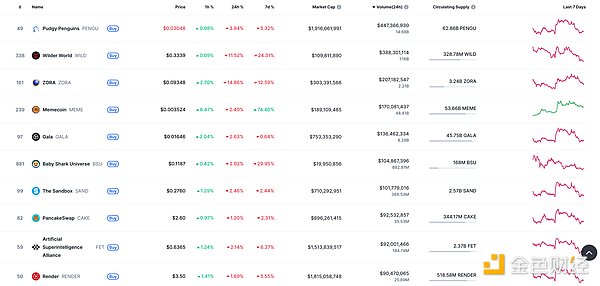

1. Total NFT Market Value: US$21.845 Billion

NFT total market value, top ten projects by market value Data source: Coinmarketcap

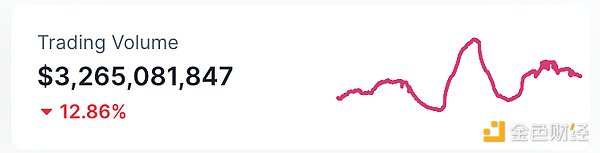

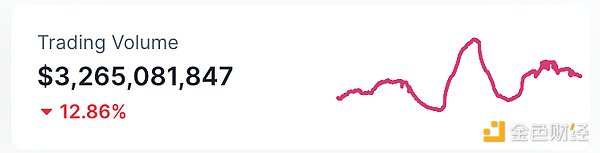

2. 24-hour NFT trading volume: 3.265 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

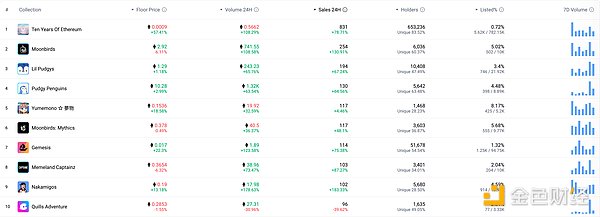

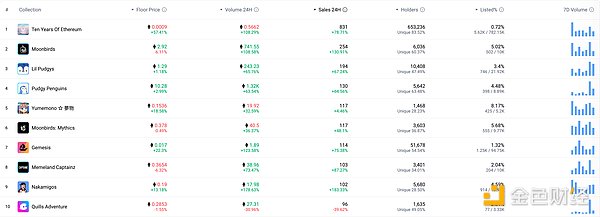

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

US President Trump: Dismissal of Federal Reserve Board Member Cook

Golden Finance reported that US President Trump signed a document to remove Federal Reserve Board Member Cook from his position, effective immediately. In the document, Trump stated: "By virtue of the authority vested in me by Article II of the Constitution of the United States and the Federal Reserve Act of 1913, as amended, I hereby remove Mr. Cook from his position on the Board of Governors of the Federal Reserve System.

Given Mr. Cook's dishonest conduct in financial matters, which may involve criminal offenses, I cannot have confidence in your integrity. At the very least, these actions reveal serious negligence in your financial transactions and call into question your competence and credibility as a financial regulator."

NFT Hotspots

1. Pudgy Penguins to Launch Soul-Bound Tokens Early to the Party

Golden Finance Report, NFT Series Pudgy Penguins will be launching a Soulbound Token Early to the Party. Users will need to pre-download Pudgy Party and complete the registration process. Tokens will be distributed to eligible wallets after the game launches.

DeFi hotspot

1.21Shares renamed its spot Ethereum ETF product to 21Shares Ethereum ETF (TETH)

Golden Finance reported that 21 Shares US announced that it would change the name of its spot Ethereum exchange-traded fund product 21 Shares Ethereum Core ETF (CETH) to "21 Shares Ethereum ETF (TETH)". The name change will take effect on The change will take effect on August 28, 2025, and will not affect investment objectives, primary investment strategies, or any other operational aspects. Client holdings will not be affected by the name change. 2. Blockchain payment infrastructure Kira completes $6.7 million in seed funding. Golden Finance reports that blockchain payment infrastructure Kira has announced the completion of a $6.7 million seed funding round, with participation from Blockchange Ventures, Vamos Ventures, Stellar Blockchain, Grit Ventures, Credibly Neutral Ventures, Michael Seibel, and Oso Trava. The company currently utilizes the Stellar blockchain to enable fast, low-cost payment services, focusing on the Latin American market and supporting large enterprises and startups in launching embedded financial products. 3. Guotai Junan International Completes Cross-Chain Issuance of First Batch of Structured Product Tokens on Ant Chain and Ethereum Golden Finance reports that Guotai Junan International, a subsidiary of Cathay Haitong Group, recently successfully launched its first batch of structured product tokens, including redeemable fixed-income tokens and principal-guaranteed tokens linked to US stock ETFs. These tokens leverage Ant Digital's blockchain technology and RWA solutions, innovatively enabling the secure cross-chain transfer of structured product tokens from Ant Chain to Ethereum. All transaction data is transparent and tamper-proof, allowing investors to independently verify them at any time.

4. Nano Labs CEO Kong Jianping increases holdings in the company by 480,000 shares

Golden Finance reported that Nano Labs Ltd (NASDAQ: NA), a provider of Web3 infrastructure and product solutions, announced that its Chairman and CEO, Mr. Kong Jianping, purchased 480,000 Class A common shares through open market transactions in August using personal funds. Previously, Mr. Kong purchased shares twice in May and September 2024. The above transactions strictly abide by the company's insider trading policy and fully comply with all applicable laws and regulations. 5. Bitlayer Announces BTR Token Economics, 40% for Ecosystem Incentives Jinse Finance reports that according to official Bitlayer news, the BTR token's initial public offering (TGE) is about to launch. BTR is the governance token of the Bitlayer ecosystem, with a fixed total supply of 1 billion and an initial circulation of 261.6 million, representing 26.16% of the total supply.

The token will be minted on the Bitlayer network and distributed via the Ethereum mainnet and BNB Smart Chain, enabling cross-chain compatibility. BTR token uses include staking and node voting, on-chain governance, and a fee distribution mechanism.

The token distribution plan is as follows: 40% for ecosystem incentives, 20.25% for investors and advisors, 12% for the core team, 11% for public distribution, 7.75% for node incentives, 6% for the treasury, and 3% for liquidity.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

Anais

Anais