Source: BitPush

After a small rebound yesterday due to mild inflation data, US stocks fell sharply again on Thursday, which seemed to drag down Bitcoin (BTC) as well. As of the close of the day, the Nasdaq index fell nearly 2% and the S&P 500 fell 1.39%. After hitting nearly $85,000 the day before, Bitcoin has fallen back below $81,000, down nearly 3% in the past 24 hours.

However, gold’s actual history has proven its safe-haven properties, with spot prices hitting record highs and, at the time of writing, just one step away from breaking $3,000 per ounce for the first time.

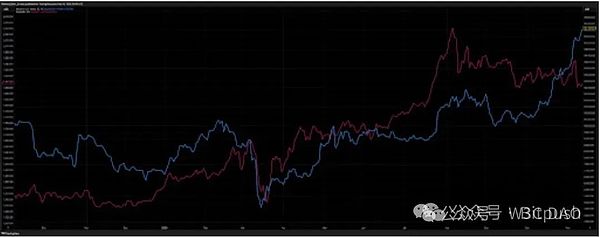

Since the Nasdaq peaked three weeks ago, the index has fallen nearly 15%. During the same period, gold has risen about 1% and Bitcoin has fallen nearly 20%.

Familiar scene

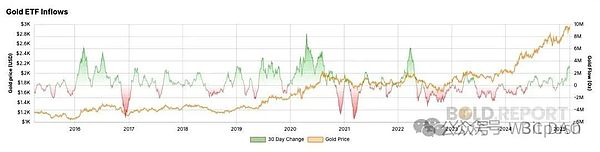

Gold's current performance may remind everyone of the scene in 2024. At that time, cryptocurrencies and US stocks were trading sideways, while gold hit new highs. Between March and October, Bitcoin fluctuated between $50,000 and $70,000, while gold rose nearly 40% to $2,800. With Trump's election, Bitcoin soared to more than $100,000, while gold's gains stagnated as funds flowed from safe-haven assets to risky assets.

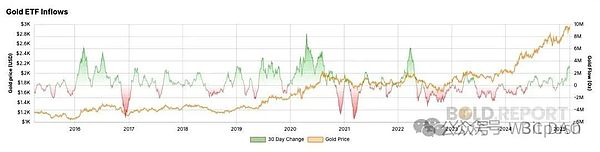

Things change over time. According to data from Bold.report, gold ETFs have recorded their largest inflows since the beginning of 2022 in the past 30 days, adding 3 million ounces of gold holdings.

In contrast, data from SoSoValue shows that U.S. spot Bitcoin ETFs have lost $5 billion since February, the worst outflow in a year.

Both crypto market trading volume and futures activity have fallen sharply. According to CoinDesk statistics, trading activity on centralized exchanges (CEX) is coming, with spot and derivatives trading volumes falling 20.6% to $7.20 trillion, equivalent to the lowest level since October last year.

Chicago Mercantile Exchange (CME) Bitcoin futures trading volume also plummeted 20.3% to $175 billion, leading to an overall increase of 19.9% in CME cryptocurrency trading to $229 billion. This is the first decline since May, consistent with the downward trend of BTC CME's annualized basis. The CME annualized basis fell to 4.08%, the lowest level since March 2023.

Bitcoin = adolescent gold?

This is not the first time that Bitcoin has deviated from the definition of a safe-haven asset. In the market crash caused by the 2020 COVID-19 pandemic, Bitcoin plummeted by more than 50% in two days. Despite this, the trend of digital gold has been adjusted repeatedly in recent years.

In particular, the Trump administration mentioned the safe-haven function of Bitcoin in its executive order and plans to establish a national potential Bitcoin reserve.

The core of this view is that by reserving Bitcoin, financial instability can be hedged, which is similar to the logic of reserving gold and oil.

However, some people hold a more rigorous attitude. Bloomberg Intelligence analyst Eric Balchunas once compared Bitcoin to "hot pepper sauce" in investment, believing that it can add some "flavor" to traditional stock and bond portfolios. Compared with other high-risk assets, what attracts him to Bitcoin is "the narrative behind it about the depreciation of the US dollar." Balciunas believes: "For me, Bitcoin is like gold in adolescence." Some market observers also pointed out that Bitcoin's performance is an over-glorified technology stock, not digital gold. Nate Geraci, president of the store, said on the X platform: "If Bitcoin is considered equivalent to 'digital gold', then it should behave like gold.

Otherwise, this will strengthen the argument that Bitcoin is just a high-volatility asset. In my opinion, most cryptocurrencies are technology stocks, so for now they will continue to be affected by the sell-off in technology stocks."

Balanced allocation

It is not surprising that gold's performance supports Bitcoin. After all, gold has a history of wealth preservation for decades and is a globally recognized safe-haven asset. In contrast, although Bitcoin has performed poorly recently, its long-term potential is still worth paying attention to. For investors who want to diversify their investment risks, synchronous allocation may be an effective strategy.

Gold's appeal lies in its low volatility and as a tool for economic uncertainty. Data shows that the long-term volatility of gold was about 15% last year, while the volatility of Bitcoin was as high as 40%.

However, the volatility of Bitcoin has dropped significantly from the level of nearly 100% a few years ago. As the market matures, the price trend of Bitcoin will further stabilize.

In addition, the US spot ETF has been launched for more than a year, and in many countries, Bitcoin is no longer regarded as an investable asset. Despite this, Bitcoin's market position is gradually improving. From being initially banned by banks, to the rise of stablecoins, to the use of renewable energy in mining, and to the launch of investable ETFs, Bitcoin has overcome challenges step by step.

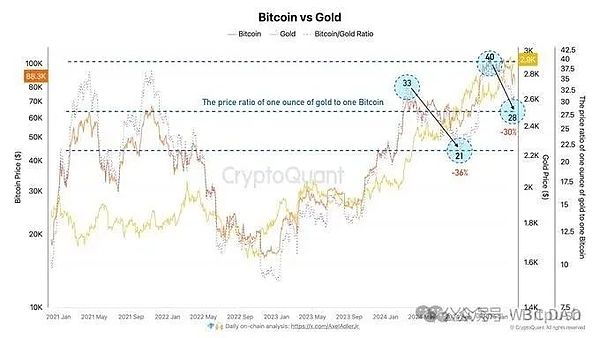

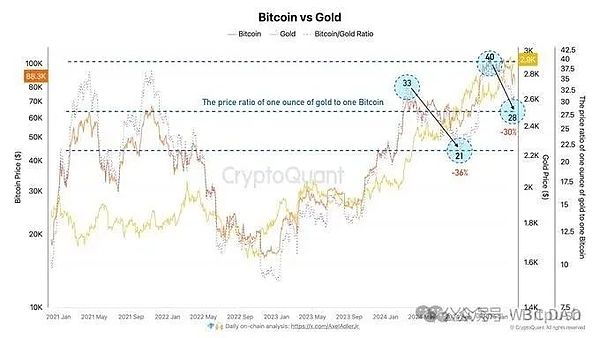

For Bitcoin's position in the current cycle, market analyst @AxelAdlerJr believes that one can pay attention to the BTC/gold ratio, which indicates how many ounces of gold one Bitcoin can buy.

Analysts believe that although the current macroeconomic outlook is unstable, the price of gold is relatively stable. Judging from the highest experience in the previous cycle (a 36% drop), if the current increase in Bitcoin against gold is a total drop of 36% relative to the historical point (assuming a 30% drop followed by another 6% drop), then this may focus on the fact that Bitcoin may be approaching or about to approach a stage bottom (local bottom) in this macro cycle, which may be a buy signal.

Weatherly

Weatherly