Innovation Push: Bitcoin's New Age of JPEGs

Blockstream's CEO advocates for the inevitable integration of JPEGs on Bitcoin, suggesting it will drive innovation and adoption of solutions like the Lightning Network.

Alex

Alex

Author: Tang Jun Kang Kai

Unprecedented legislative endorsement in various countries and regions has given stablecoins a higher standard of development space than their predecessor Bitcoin. It will impact traditional cross-border payments. This is not only a business competition, but also related to the status of future sovereign currencies.

A virtual carnival in the marginal world has finally extended to reality.

On June 5, Eastern Time, Circle Internet Group, Inc. (hereinafter referred to as "Circle"), the issuer of the world's second largest stablecoin USDC (US Dollar Coin), was officially listed on the New York Stock Exchange. It opened up 122.58% on the first day. During the trading session, due to excessive fluctuations in stock price increases, a temporary circuit breaker was triggered.

As of the close of the day, Circle's stock price rose 168.5%, with a total market value of over $18 billion. The next day, Circle's stock price continued to rise, and its current market value has exceeded $23.8 billion.

The enthusiasm of the capital market comes from the unprecedented endorsement of cryptocurrencies by sovereign states and regions, which has given stablecoins a higher standard of development space than their Bitcoin predecessors.

Two weeks ago, the U.S. Senate voted to pass the Guidance and Establishment of the United States Stablecoin National Innovation Act (hereinafter referred to as the "GENIUS Act"), and the Legislative Council of Hong Kong, China passed the Stablecoin Bill (hereinafter referred to as the "Bill") in the third reading, just two days apart.

Earlier, major economies such as the European Union, Singapore, and Japan have also included stablecoins in their regulation.

As a special cryptocurrency (CryptoCurrency), stablecoins have the advantages of blockchain technology such as decentralization, peer-to-peer, low cost and high efficiency. Unlike cryptocurrencies such as Bitcoin, stablecoins are usually linked to reference assets such as legal tender to maintain a relatively stable currency value and serve as a medium for crypto asset transactions.

In 2014, Tether issued the first stablecoin USDT (Tether), marking the birth of stablecoins. In recent years, with the characteristics of stable value, high efficiency and low cost, stablecoins have gradually penetrated into traditional financial fields such as cross-border payments.

In sync with official legislative actions, global payment giants Visa and MasterCard announced that they would include stablecoins in their global payment systems. This means that stablecoins are expected to become the mainstream payment and settlement options in global transactions.

Since the resumption of customs clearance between Hong Kong and the mainland of China in 2023, Chinese financial technology giants such as Ant, JD.com, and Tencent have gathered in Hong Kong to explore new opportunities in the wave of Hong Kong's Web3 (third-generation Internet) industry.

"It's very exciting." Ten days after the passage of the "Regulations", Ant Group Vice President and Ant Digital Blockchain Business President Bian Zhuoqun lamented in an interview with "Caijing" that stablecoin compliance is expected to open a window for the large-scale development of Web3 asset transactions.

"The "Regulations" provide a good institutional environment for the healthy and sustainable development of Hong Kong's stablecoin market. At the same time, this is also a major milestone event in the global cryptocurrency industry." Liu Peng, CEO (Chief Executive Officer) of JD Coin Chain Technology, said.

Note: The implementation of stablecoins in Hong Kong, China is characterized by flexibility, openness and user-friendliness. The city intends to emphasize the construction of an innovative digital financial system. Photography/Kang Kai

Stablecoins are issued and traded based on blockchain, and naturally have technical characteristics such as globalization, real-time transactions, 24-hour operation, and "peer-to-peer" decentralization. At the same time, stablecoins achieve value stability by being linked to legal tender.

From official legislation to commercial layout, the high attention paid by all walks of life to stablecoins stems from its own rapid development in the past few years.

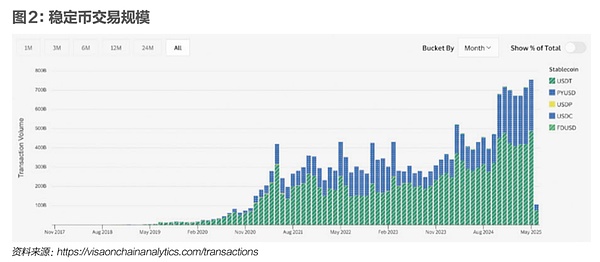

In 2024, the transaction volume supported by stablecoins will reach 27.6 trillion US dollars, exceeding the total transaction volume of Visa and Mastercard.

In the same year, Tether, the world's largest stablecoin USDT issuer, had no more than 200 employees, but achieved a net profit of 13.7 billion US dollars, with an average profit of more than 68 million US dollars per person, making it the company with the highest per capita revenue in the world.

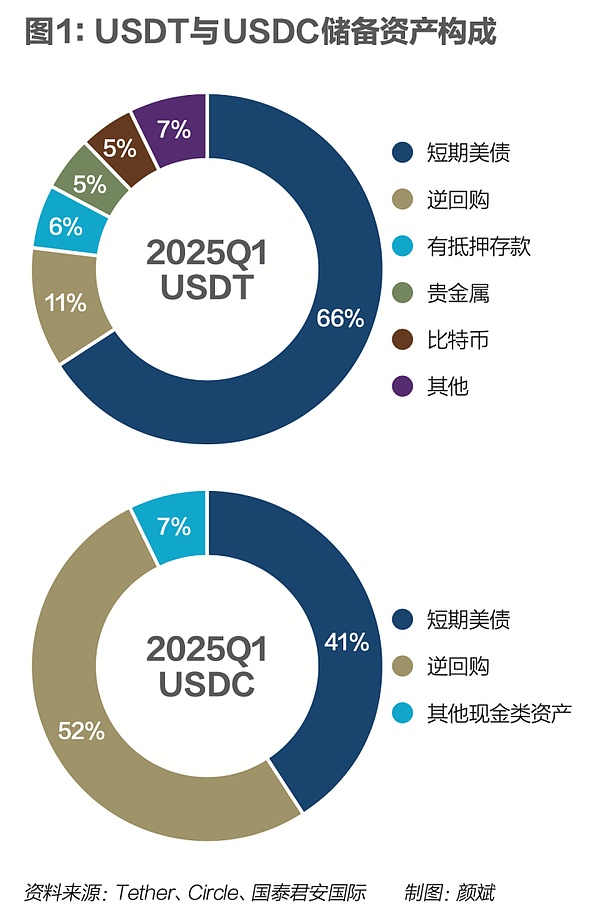

The financial reports of Tether and Circle show that their revenue mainly comes from the investment income of stablecoin reserve assets. After achieving compliance, how stablecoins can be applied in more scenarios has become the focus of market attention.

Circle asserted in its prospectus that its stablecoin network has the potential to disrupt the international remittance and cross-border payment markets. Bian Zhuoqun also believes that the biggest use case for stablecoins is cross-border payments, which can achieve low-cost, T+0 (real-time) cross-border payment experience.

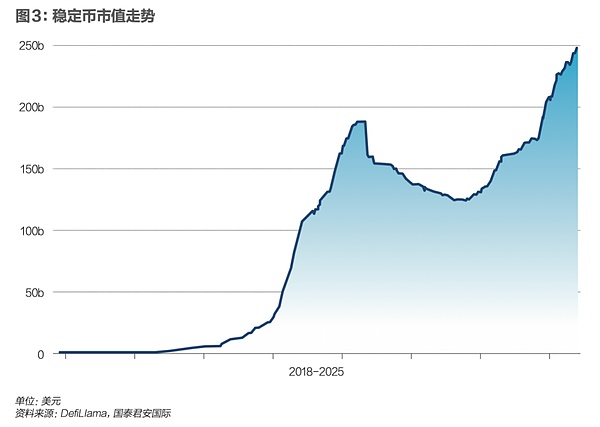

As the application of stablecoins in the field of cross-border payments expands, sovereign currency competition will also unfold. Public data shows that as of May 2025, the global stablecoin stock will be approximately US$250 billion, of which 99% are US dollar stablecoins, which is much higher than the 49.68% share of the US dollar in global payment currencies.

Public data shows that as of May 2025, the global stablecoin stock size is about 250 billion US dollars, of which 99% are US dollar stablecoins, which is much higher than the 49.68% proportion of the US dollar in global payment currencies.

"US dollar stablecoins have been widely used in cross-border trade settlement, inter-enterprise payment, consumer payment, employee salary payment and corporate investment and financing activities."

Zou Chuanwei, director of the Frontier Financial Research Center of the Shanghai Financial and Development Laboratory, told Caixin that the strengthening effect of US dollar stablecoins on the status of the US dollar is emerging.

Zou Chuanwei, director of the Frontier Financial Research Center of the Shanghai Financial and Development Laboratory, told Caixin that the strengthening effect of US dollar stablecoins on the status of the US dollar is emerging.

“The United States has introduced a stablecoin bill, which is equivalent to endorsing the dollar stablecoin. The dollar stablecoin will undoubtedly usher in greater growth in the future.” Xia Le, chief economist for Asia at Spanish Banco BBVA, told Caixin that this may further strengthen the status of the dollar.

“The rapid development of the dollar stablecoin has brought new challenges to the cross-border payment and clearing of the RMB. If the payment efficiency and clearing costs cannot surpass the dollar stablecoin, then the cross-border payment and international development of the RMB will face great constraints. "Wang Yongli, former vice president of the Bank of China, wrote.

In view of this, many professionals, including Wang Yongli, suggested that research on stablecoins should be strengthened, and consideration should be given to launching offshore RMB stablecoins in Hong Kong, China, to conduct relevant explorations.

In addition, Zhao Binghao, dean of the Financial Technology and Law Research Institute of China University of Political Science and Law, told Caixin that since 2017, China has adopted relatively stringent regulatory measures on cryptocurrencies, and encrypted digital currency-related businesses have been classified as illegal financial activities.

"This has to some extent put the stablecoins that exist in large numbers in domestic economic life and judicial practice in a regulatory vacuum, which is not conducive to China's participation in the construction of global crypto asset rules. "Said Zhao Binghao.

"Technological participants can travel around the world, but institutional shaping can only be accomplished by sovereign states." Zhao Binghao bluntly stated that China needs to move from "lack of supervision" to "institutional construction", and change from a "global follower" to a "shaper of future rules." This is a challenge and an opportunity. The key lies in whether one is really willing to face reality and dare to take responsibility.

Zhao Binghao bluntly stated that China needs to move from "lack of supervision" to "institutional construction", and change from a "global follower" to a "shaper of future rules." This is a challenge and an opportunity. The key lies in whether one is really willing to face reality and dare to take responsibility.

"Now, the field of stablecoins and encrypted assets has become a battleground for large businesses and even countries. China needs to adjust its relevant policies on crypto assets and stablecoins, at least it should actively participate in the development of crypto assets and stablecoins abroad, accelerate the improvement of its own international competitiveness, and enhance the influence of international cooperation in this field. "Wang Yongli said in the aforementioned article.

China needs to adjust its relevant policies on crypto assets and stablecoins, at least it should actively participate in the development of crypto assets and stablecoins abroad, accelerate the improvement of its own international competitiveness, and enhance the influence of international cooperation in this field." Wang Yongli said in the aforementioned article.

The United States has endorsed legislation, and Hong Kong, China has issued the "Regulations". The European Union, Singapore, Japan and other economies have included stablecoins in their supervision; payment giants have positioned themselves... Stablecoins are impacting the traditional cross-border payment system. This is not only a commercial competition, but also about the status of sovereign currencies in the future.

In the stable currency chess game, commercial institutions have already made moves.

On April 29, New York time, Mastercard's official website issued a press release stating that in view of the increasingly clear global regulation of digital assets such as cryptocurrencies that are usually pegged to legal currencies, it will soon add a "stable currency settlement" option for merchants.

On April 30, San Francisco time, Visa's official website announced a partnership with the financial technology company Bridge to provide users with card products linked to stablecoins. Cardholders can directly use the stablecoin balance for daily consumption at any merchant accepting Visa worldwide.

Visa Chief Product and Strategy Officer Jack Forestell said: "We are focused on integrating stablecoins into Visa's existing network and products in a frictionless and secure way."

In addition, American online payment institutions such as Paypal and Stripe have already launched stablecoin payments.

In Hong Kong, China, financial technology giants such as Ant and JD.com are closely following the progress of the stablecoin license.

In July 2024, JD.com's JD CoinChain Technology was selected into the Hong Kong Monetary Authority's stablecoin issuer sandbox along with two other companies.

In an interview with Caijing, Liu Peng revealed that JD.com's stablecoin has entered the second phase of sandbox testing. The testing scenarios mainly include cross-border payments, investment transactions, retail payments, etc. In the future, it will provide mobile and PC application products for retail and institutions.

"The issuance of payment-type stablecoins through blockchain technology can not only solve the problems encountered in its own cross-border settlement, but also effectively serve other enterprises and the real economy, and can produce huge economic and social effects for companies and society." Liu Peng told Caijing.

Next, Liu Peng said, "It can be foreseen that the Hong Kong Monetary Authority is vigorously promoting the licensing, and we are also cooperating with the supervision to complete the sandbox test. The specific licensing time is still waiting for the supervision's notification."

Ant Digits hopes that compliant stablecoins can open up the growth entrance for its RWA (Real World Assets tokenization) business.

In August 2024, under the guidance of the Hong Kong Monetary Authority, Ant Digits supported the mainland new energy listed company Langxin Technology to successfully complete RWA cross-border financing, that is, to tokenize the income rights of new energy charging pile assets (i.e., tokenization), making them on-chain assets, and selling them to global investors on the blockchain platform for financing.

"Hong Kong legislation gives stablecoins a legal identity, which is equivalent to issuing a 'birth certificate' for Web3's on-chain transactions."Bian Zhuoqun said that compliant stablecoins will provide legal transaction currencies for on-chain transactions such as RWA, which means that regulators have recognized the exploration of related businesses. After obtaining legal status, stablecoins, RWA and other businesses are expected to usher in large-scale development.

Bian Zhuoqun said that compliant stablecoins will provide legal transaction currencies for on-chain transactions such as RWA, which means that regulators have recognized the exploration of related businesses. After obtaining legal status, stablecoins, RWA and other businesses are expected to usher in large-scale development.

"I believe that the combination of our RWA and Hong Kong stablecoin will give birth to a wide range of application scenarios and promote the development and growth of Hong Kong dollar stablecoins." Bian Zhuoqun said.

Banking financial institutions have also joined the game.

As early as 2019, JPMorgan Chase launched its own stablecoin-JP.M coin (Morgan Coin).

Recently, according to media reports, the largest banks in the United States are exploring whether to jointly issue a joint stablecoin. Companies participating in the discussion include JPMorgan Chase, Bank of America, Citigroup, Wells Fargo and other large commercial banks. At the same time, some regional banks and community banks in the United States are also considering whether to establish an independent stablecoin alliance. But for smaller banks, such projects will be more difficult.

Among the first three companies selected for the Hong Kong Monetary Authority's stablecoin issuer sandbox, there is a joint venture established by Standard Chartered Bank (Hong Kong), Ansai Group, and Hong Kong Telecom (HKT). It is reported that Standard Chartered Bank is one of the three note-issuing banks in Hong Kong, China, which will help the joint venture to fully utilize the construction of banking infrastructure and rigorous governance.

In Japan, the country's largest bank, Mitsubishi UFJ, is reportedly preparing to issue a yen stablecoin.

"Since 2025, the integration and development of stablecoins and traditional financial systems has been fully promoted."JD Group Chief Economist Shen Jianguang and others said in a signed article published in Caijing that on the one hand, this is reflected in the continuous expansion of cooperation between stablecoin issuers and payment institutions, and on the other hand, banking institutions are also entering the stablecoin business.

JD.com Chief Economist Shen Jianguang and others said in a signed article published in Caijing that on the one hand, the cooperation between stablecoin issuers and payment institutions is constantly expanding, and on the other hand, banking institutions are also entering the stablecoin business.

With Trump's re-election as US President, the cryptocurrency industry has been redefined. Behind this, the world is conducting a legislative competition for stablecoins.

On May 21, the Hong Kong Monetary Authority said that it welcomes the Hong Kong Legislative Council's passage of the "Regulations" to establish a licensing system for issuers of legal currency stablecoins in Hong Kong, China, and improve the regulatory framework for virtual asset activities in Hong Kong, China, in order to maintain financial stability and promote financial innovation. This means that Hong Kong, China will legally issue stablecoins.

After the implementation of the regulations, anyone who issues legal currency stablecoins in Hong Kong, China during the course of their business, or issues legal currency stablecoins in Hong Kong, China or outside that claim to be anchored to the value of the Hong Kong dollar, must apply for a license from the Monetary Authority.

"From the perspective of legislation, supervision, technology, and the global stablecoin legislation trend, the Regulations have arrived at a very good time to be launched." Bian Zhuoqun told Caixin, "The Regulations have been planned for more than a year, and we can see that they have undergone sufficient preparations at the legislative level; last year, the Hong Kong Monetary Authority launched a sandbox for stablecoin issuers to test relevant processes and rules, and has a certain foundation at the regulatory and technical levels; internationally, countries and regions such as the United States have taken frequent actions, and stablecoin legislation is a general trend to a certain extent."

Hong Kong, China's move echoes the United States across the ocean. Just a few days later, the U.S. Senate voted to pass the GENIUS Act on May 19, which is the first federal-level stablecoin regulatory framework in the United States.

"The legislation of Hong Kong, China and the United States reflects the strategic positioning of both sides in digital finance. Both places are unwilling to be absent from the formulation of rules for digital financial infrastructure. Improving the regulatory system can take the lead in the global market." Li Ming, associate researcher of AIoT at the Hong Kong Polytechnic University, chairman of the IEEE Computer Society Blockchain and Distributed Ledger Standardization Committee, and executive president of the Hong Kong WEB3.0 Standardization Association, said in an interview with Caixin.

Xiao Feng, chairman and CEO of Hong Kong HashKey Group, also told Caixin that Hong Kong, China, followed the United States and started the "ChatGPT" moment of financial asset tokenization in 2025. This marks that the new generation of financial market infrastructure based on blockchain distributed ledgers has begun to gradually integrate with traditional finance.

This marks that the new generation of financial market infrastructure based on blockchain distributed ledgers has begun to gradually merge with traditional finance.

Stablecoins are an emerging thing in the development of the financial industry, and the world is moving forward in exploration. All parties seem to have a consensus on the basic institutional construction of the market, which is first reflected in the provisions on licenses and issuers.

According to the "Regulations" of Hong Kong, China, three types of activities related to stablecoins must obtain licenses. First, issuing legal currency stablecoins in Hong Kong, China; second, issuing Hong Kong dollar stablecoins in or outside Hong Kong, China; third, actively promoting the issuance of its legal currency stablecoins to the public in Hong Kong, China. The regulations only allow designated licensed institutions to sell legal currency stablecoins in Hong Kong, China, and only legal currency stablecoins issued by licensed issuers can be sold to retail investors.

In the United States, only "licensed payment stablecoin issuers" can legally issue payment stablecoins. Licensed payment stablecoin issuers must be subsidiaries of insured deposit institutions, federally approved non-bank entities, or state-approved entities. In addition, compliant stablecoin issuers include not only entities registered in the United States, but also entities registered in foreign countries can register with the U.S. Office of the Comptroller of the Currency.

Stablecoins are seen as a bridge between cryptocurrencies and legal tender, and are linked to stable reserve assets such as the U.S. dollar or gold, which means that Hong Kong, China and the United States regulators have strict requirements for the adequacy of stablecoin reserve assets.

The Hong Kong Regulations require issuers to have a minimum paid-in capital of HK$25 million and to hold highly liquid reserve assets equal to the par value of the circulating stablecoins. In the United States, stablecoins must be backed by highly liquid assets at a ratio of at least 1:1, including US dollar cash, notice deposits, US Treasury bonds due within 93 days, repurchase agreements, etc. Reserve assets must not be repeatedly pledged or misappropriated, and issuers must publicly disclose redemption policies.

However, beyond the consensus, different countries and regions still have different development strategies for stablecoins, which may lead to a divergence in the development of national markets. In Li Ming's view, the implementation of stablecoins in Hong Kong, China is characterized by flexibility, openness and user-friendliness. The place aims to emphasize the construction of an innovative digital financial system.

First, the US bill stipulates that stablecoins can only be pegged to the US dollar, while the Hong Kong bill allows pegs to legal currencies such as the Hong Kong dollar, US dollar or RMB. Secondly, regarding reserve assets, the US bill clearly stipulates that US dollar cash or short-term US Treasury bonds can be used as reserves. The Hong Kong bill allows a variety of low-risk assets such as cash, short-term Treasury bonds, and commercial paper, and does not specify specific reserve asset categories.

"Hong Kong, China promotes stablecoins, which are linked to more assets. To a certain extent, this can consolidate Hong Kong's position as an international financial center and accelerate Hong Kong's development towards digital finance." Li Ming said.

In the view of Hong Kong Legislative Council member Wu Jiezhuang, the legal issuance of stablecoins will become an important step for Hong Kong, China to become an international Web3 center. "In the future, we will focus on promoting two directions: one is to expand the application scenarios of stablecoins in physical retail, cross-border trade and other fields; the other is to improve the market attributes of stablecoins, including releasing stablecoin interest to holders to enhance market competitiveness."

"In comparison, the United States emphasizes maintaining the dominance of the US dollar. Stablecoins may become a strategic tool for the United States to maintain the status of the US dollar, which will alleviate the pressure on the US dollar and US debt to a certain extent." Li Ming further said.

Earlier, U.S. Treasury Secretary Bensont said that stablecoins will strengthen the dollar's position as the world's leading reserve currency.

However, in the view of some market participants, although the GENIUS Act has been passed by the Senate, there may still be obstacles in the future implementation process. For example, although the bill strengthens anti-money laundering and national security clauses, it does not resolve the conflict of interest controversy brought about by Trump, which may cause disputes between the Republicans and the Democrats again. Generally speaking, it takes a long political struggle for the U.S. Congress to introduce a new law. During the deliberations of the Senate and the House of Representatives, the procedure requires multiple rounds of consultation and compromise.

In the global chess game of stablecoins, countries and regions such as the European Union, Japan, and Singapore are also involved, which reflects that all countries are unwilling to lose at the starting line.

In 2024, the EU's "Markets in Crypto-Assets Regulation Act" (MiCA) officially came into effect. This solves the fragmentation and regulatory arbitrage problems in the EU and EEA countries in crypto-asset regulation, and is the world's largest cryptocurrency regulatory law. The Monetary Authority of Singapore issued stablecoin regulatory regulations in August 2023. Under this framework, stablecoins can be used as a medium of exchange to connect the legal currency and digital asset ecosystems.

"Stablecoins need to provide financial collateral, and they are becoming an important bridge between the current financial world and the digital world. Behind this, the trends of major global economies such as the United States and the European Union are most worthy of attention. With the gradual implementation of applications such as cross-border payments, supply chain finance, and remittances, stablecoins in various countries will play a greater role in the financial field, and this will even rise to an issue of international political economy." Li Ming said.

In fact, the global legislative race is laying the institutional foundation for the market and promoting the continuous development of the stablecoin industry. "Stablecoins are the tokenization of legal tender. Perhaps ten years later, all financial assets may be tokenized, because the transaction settlement system based on the blockchain distributed ledger is more efficient, lower cost, and has fewer links than the traditional transaction settlement system. This allows payment settlement based on stablecoins to do more with less funds, and because it reduces the time that funds are in transit, it also improves the efficiency of fund use and allows funds to obtain more interest income. This is exactly what the financial director of any institution dreams of." Xiao Feng said.

Capital story: Related concept stocks soared

The first stable currency license has not yet been issued, and digital currency concept stocks have already taken over and risen.

Wind data shows that as of June 6, the A-share digital currency index reported 2135.19 points, up 17% from two weeks ago. On May 29, digital currency concept stocks such as Lakala, Xiongdi Technology, and Sifang Jingchuang all hit their daily limits.

Digital currency concept stocks are also hot in the Hong Kong stock market. As of June 6, in the Hong Kong stock market, ZhongAn Online (06060.HK) and LianLian Digital (02598.HK) rose by 41% and 20% compared with two weeks ago. As of the close of the day, ZhongAn Online and LianLian Digital reported HK$17.50/share and HK$8.96/share.

The market's enthusiasm for digital currency is not limited to the policy level. They are more looking forward to the possibility of its commercial landing, which has become the key to the outbreak of digital currency concept stocks in recent times.

As a subsidiary of ZhongAn Online, ZhongAn Bank will become the first digital bank in Hong Kong, China to provide reserve bank services for stablecoin issuers in 2024. At present, ZhongAn Bank has provided commercial banking services to more than 80 Web3 companies and is the banking partner of local licensed virtual asset trading platforms HashKey and OSL.

By the end of 2024, DFX Labs, a subsidiary of LianLian Digital, has obtained the Hong Kong Virtual Asset Trading Platform (VATP) license and is one of the ten licensed VATPs in Hong Kong. In addition, the company also has a cooperative relationship with Yuanbi Technology, which has been selected for the Hong Kong Stablecoin Issuer Sandbox.

"The share prices of listed companies involving digital currency and blockchain concepts in A-shares and H-shares have risen sharply, which reflects the market's collective consensus on the revaluation of structural assets.The institutional progress of policies has sent a clear signal that stablecoins, as the technical form closest to the real financial system in the digital asset market, are gaining regulatory recognition and beginning to be embedded in the sovereign financial architecture." Yu Jianing, co-chairman of the Blockchain Committee of the China Communications Industry Association and honorary chairman of the Hong Kong Blockchain Association, told Caixin.

The institutional progress of policies has sent a clear signal that stablecoins, as the technical form closest to the real financial system in the digital asset market, are gaining regulatory recognition and beginning to be embedded in the sovereign financial architecture. "Yu Jianing, co-chairman of the Blockchain Committee of the China Communications Industry Association and honorary chairman of the Hong Kong Blockchain Association, told Caixin.

From the perspective of changes in the financial architecture, some market participants believe that the application scenarios of stablecoins are roughly divided into two parts. The first is the enterprise part (to B), which is mainly used for cross-border clearing and settlement, supply chain finance; the second is the consumer part (to C), which is mainly used for consumption, transfers, remittances, etc.

"The C-end scenario has a relatively mature user base, but it still needs to rely on the advantages of traditional industries to promote it on a large scale in the market. At the same time, the B-end scenario needs to rely on the upgrade of traditional financial services to allow more traditional institutions to accept innovative business models. Both scenarios require upgrading and transformation of existing financial infrastructure, which will be a huge market opportunity. For enterprises, from the perspective of time and cost, using stablecoins for payment and settlement can improve service efficiency and reduce usage costs. "Li Ming said.

He further stated that with the advancement of technology and the implementation of business scenarios, stablecoin system providers, operators and financial service institutions can all benefit. This can not only provide payment, settlement and custody services for enterprises and consumers, but also give rise to new infrastructure, services and investment opportunities. Not only that, stablecoins will also promote the gradual maturity of the RWA industry and form a new Web3.0 ecosystem.

Not only the secondary market, the trend of stablecoins has also driven the enthusiasm of the primary market.

In April, Circle, the issuer of the world's second largest stablecoin USDC, officially submitted an IPO (initial public offering) application to the US Securities and Exchange Commission.

According to the company's prospectus updated on June 2, its IPO issuance scale has expanded from 24 million shares to 32 million shares, and the pricing range has increased from US$24-26 per share to US$27-28 per share. The issuance results show that Circle ultimately raised approximately US$1.1 billion at a price of US$31 per share, exceeding the previous pricing cap.

From a fundamental perspective, Circle's profit model is mainly "interest-eating." That is, each USDC issued is backed by a US$1 fiat currency reserve. Circle stores these reserves in safe short-term assets, such as US bank deposits and short-term US Treasury bond funds managed by BlackRock. In this way, it can generate considerable interest income in a high-interest environment.

That is, every USDC issued is backed by a $1 fiat currency reserve. Circle stores these reserves in safe short-term assets, such as U.S. bank deposits and short-term U.S. Treasury bond funds managed by BlackRock. In this way, it can generate considerable interest income in a high-interest environment.

According to the prospectus data, in 2024, Circle's total revenue will be approximately US$1.676 billion, of which 99% (approximately US$1.661 billion) will come from interest income generated by USDC reserves. In the same year, its net profit reached US$156 million.

In the view of market participants, compared with Tether, Circle's biggest advantage is compliance and transparency. With the implementation of the U.S. GENIUS Act, the volume of compliant stablecoins will become larger and larger in the future, and Circle's advantages may be expanded.

Although digital assets are being favored by the market, digital assets including stablecoins are facing multiple challenges such as regulation, technology and business, which also arouses market concerns.

“At present, the complexity of regulatory risks is particularly prominent, and there are obvious differences in the pace of legislation in various countries. In addition, stablecoins have macro-spillover problems, which may pose a potential impact on the country's monetary sovereignty and capital controls. In the future, stablecoins must strike a balance between efficiency and compliance. "Yu Jianing said.

Compared to stablecoins, central bank digital currencies (CBDCs) are also a means for countries to regulate and promote digital currencies.Massimiliano Castelli, head of global sovereign market strategy and consulting at UBS Asset Management, told Caixin that at present, the form of central bank digital currencies may have obvious advantages. It is issued by central banks of various countries, which can control the amount of currency issuance and prevent inflation caused by excessive currency issuance. In addition, central banks of various countries can monitor capital flows, provide legal protection, and prevent risks in advance.

Many interviewees told Caijing that, up to now, the main application scenario of stablecoins is crypto asset trading, that is, "cryptocurrency speculation".

In fact, the birth of stablecoins in 2014 was to solve the problem of deposit and withdrawal of cryptocurrencies. On the one hand, crypto asset transactions mostly occur in non-compliant offshore exchanges and decentralized exchanges. Such exchanges often cannot access the mainstream banking system, and investors lack channels for inflow and outflow of funds; on the other hand, the prices of cryptocurrencies such as Bitcoin fluctuate frequently and cannot assume the function of trading currency.

Against this background, stablecoins with stable value and the ability to connect to the traditional financial system came into being. Taking Bitcoin investment as an example, investors need to buy stablecoins first, and then use stablecoins to buy and sell Bitcoin in exchanges. text="">For this reason, stablecoins are considered to be a bridge between legal tender and the Web3 digital ecosystem.

Driven by the enthusiasm of cryptocurrency investors to "speculate on coins", the efficiency and cost advantages of stablecoins in cross-border payments are fully reflected.

According to Zou Chuanwei, in traditional cross-border transaction scenarios, transaction funds flow overseas through the bank account system, and transaction information is transmitted through message systems such as SWIFT (Society for Worldwide Interbank Financial Telecommunication). The payment settlement can only be completed after the two meet. At the same time, cross-border payments often involve cross-time zones, cross-systems, cross-networks, and cross-bank settlements. Each link must undergo compliance reviews such as KYC (know your customer), anti-money laundering, and anti-terrorist financing. The overall cost is high and the efficiency is low.

"The capital flow and information flow of stablecoins are combined into one, and they are all running on a blockchain system, running 24 hours a day, without any intermediate links, and of course faster. "Zou Chuanwei said.

Shen Jianguang mentioned in a previous article that according to data from the World Bank, existing bank cross-border remittances usually take about five working days to settle, with an average cost rate of 6.35%.However, blockchain-based stablecoin payments support global "7×24" real-time payments, and the fees are very low.For example, the average cost of sending stablecoins through blockchains such as Solana is about US$0.00025, and Binance Pay's stablecoin transfers only charge a fee of US$1 when the transfer amount exceeds 140,000 USDT.

It is worth noting that Zhao Yao, a guest researcher at the Payment and Clearing Research Center of the Institute of Finance of the Chinese Academy of Social Sciences, stated in his signed article that the fixed cost of a typical B2B cross-border payment is between US$25 and US$35, of which account liquidity costs, financial operation costs and compliance costs account for the majority. "In the future, after stablecoins enter the regulatory compliance framework, the various costs that traditional cross-border payments should pay will also be imposed on stablecoins. Only practice can verify the cost advantage of stablecoin cross-border payments. "Said Zhao Yao. The ability and stability of stablecoin payments are also constantly improving. Shen Jianguang said that the actual TPS (transactions per second) continuously processed by main networks such as Solana has reached 2,000-3,000 times, and is rapidly approaching mainstream payment institutions such as Visa and Mastercard. Shen Jianguang said that the actual TPS (transactions per second) continuously processed by main networks such as Solana has reached 2,000-3,000 times, and is rapidly approaching mainstream payment institutions such as Visa and Mastercard. In the stablecoin sandbox test conducted by JD.com, cross-border payments also showed the characteristics of fast transaction speed, low cost, and uninterrupted service throughout the year. "This makes it very suitable for current international trade settlement applications. "Liu Peng said.

With the characteristics of 24-hour operation, natural cross-border, instant settlement and low cost, the application prospects of stablecoins in the field of cross-border payments have become a consensus.

Circle asserted in its prospectus that its stablecoin network has the potential to subvert the international remittance and cross-border payment markets. McKinsey's "2024 Global Payments Report" shows that international remittances and cross-border payment revenues will be approximately US$288 billion in 2023.

Bian Zhuoqun also told Caixin that "the biggest use scenario for stablecoins is cross-border payments, which can achieve a low-cost, T+0 (real-time) cross-border payment experience. ”

This also leads to a question: to what extent will stablecoins replace the existing cross-border payment and settlement system?

"Stablecoin payment network is a non-bank payment system based on blockchain, which certainly has its development space and prospects. But it is different from existing payment systems, such as the global payment network based on bank accounts and message systems such as SWIFT. The two are not comparable." Zou Chuanwei said.

"According to the provisions of the mainstream stablecoin bill, stablecoins are more defined as payment tools, which are essentially similar to the WeChat payment and Alipay balances we are familiar with. It is hard to imagine that ordinary people do not use bank cards (especially credit cards), but instead charge their money into Alipay and WeChat. "Zou Chuanwei believes that the natural characteristics of stablecoins determine that it is a system that focuses more on retail payments, and is also used more in retail payment scenarios in cross-border payments, including cryptocurrency speculation.

Zou Chuanwei believes that the natural characteristics of stablecoins determine that it is a system that focuses more on retail payments, and is also used more in retail payment scenarios in cross-border payments, including cryptocurrency speculation.

In international trade settlement, the "peer-to-peer" transaction model of stablecoins is not necessarily a better choice.

Zhao Yao said,The disintermediation of "point-to-point" ignores the dual information asymmetry of time and space in international trade settlement, ignores the experience and system accumulated by mankind in long-term international trade activities, and ignores the inherent need of international trade for various types of intermediary service agencies such as insurance, notarization, and inspection. It is precisely because of the complexity of international trade settlement that people have developed various trade settlement tools such as letters of credit (L/C), collections (Collection), and telegraphic transfers (T/T), and there are very few trade scenarios that can be applied to telegraphic transfers that are close to "point-to-point" payments.

An article published by Zhao Binghao in the "Political and Legal Forum" in 2022 pointed out that "The convenience and globality of stablecoins have also brought many regulatory challenges such as cross-border money laundering and evasion of foreign exchange supervision. ”

“Electronic fraud, drugs, money laundering, etc., all illegal and criminal activities involving fund transactions use stablecoins to evade supervision.” Zhao Binghao told Caixin, “Take electronic fraud as an example. After the fraudster succeeds, he quickly converts the fraud funds into stablecoins and transfers them. Stablecoins have strong anonymity and fast fund transfer speed, which brings great challenges to judicial organs from a technical point of view. ”

A relevant person in charge of the Ministry of Public Security once introduced at the "Press Conference on the Work of Combating and Governing Telecom Network Fraud Crimes" that fraud groups use new technologies and new formats such as blockchain and virtual currency to continuously update and upgrade their criminal tools, and their offensive and defensive confrontations with public security organs in communication networks and transfer money laundering have continued to intensify and escalate. From the perspective of funding channels, the proportion of traditional third-party payment and public account money laundering has decreased, and a large number of running points platforms and digital currencies are used for money laundering, especially the use of USDT, which is the most serious.

"Stablecoins and traditional payment and settlement systems will remain in parallel for a considerable period of time in the future." Zou Chuanwei concluded.

"Payment is only a link in the operation of market entities, and the ultimate goal is to obtain benefits denominated in legal currency and reflected in legal currency. "Stablecoins must eventually be cashed in as legal tender and credited to bank accounts to earn interest income," said Liu Xiaochun, deputy director of the Shanghai Institute of New Finance, in his signed article. ”

In Liu Xiaochun's view, the exchange of different currencies in cross-border payments cannot be solved by stablecoins, and it must ultimately be achieved through the bank clearing system. It can be seen that the real success of stablecoins is not to break away from the banking system, but to efficiently and seamlessly connect with the banking system.

Currency wrestling: Is dollarization making a comeback?

Behind the legislative and commercial competition surrounding stablecoins, there is an implicit struggle for sovereign currencies.

A key background for the Trump administration to push the GENIUS Act is that the status of the US dollar is declining.

IMF (International Monetary Fund) data show that as of the end of 2024, the share of the US dollar in global official foreign exchange reserves has fallen to 57.80%, a record low since statistics were collected in 1995.

In April and May 2025, U.S. Treasury bonds experienced sharp fluctuations for two consecutive months, and the market's trust in U.S. Treasury bonds as the "safest asset" has loosened.

At the same time, stablecoins denominated in US dollars account for more than 99% of the total market value of stablecoins, and their reserve assets are mainly US Treasuries. As of the end of 2024, Tether directly or indirectly held US$113 billion in US Treasury bonds, becoming one of the largest holders of US Treasury bonds.

Deutsche Bank believes that the stablecoin bill formally established the role of stablecoin issuers as quasi-money market funds. This not only supports the US short-term debt market, but also guides non-US dollar liquidity to the US dollar.

According to the Federal Reserve data, as of the end of April 2025, the scale of US dollar cash in circulation (M0) is 5.8 trillion US dollars. The Federal Reserve previously estimated that about 60% of the US dollar circulates outside the United States. According to this calculation, the scale of US dollar cash currently circulating outside the United States is 3.48 trillion US dollars.

“Stablecoins and cash have a substitution relationship. If US dollar stablecoins replace US dollar cash circulating outside the United States, it will also be a trillion US dollars. "Xia Le said that this means that the US dollar stablecoin may bring trillions of dollars in purchasing power for US debt.

Standard Chartered Bank's report predicts that by the end of 2028, the issuance of stablecoins will reach 2 trillion US dollars, which will bring an additional 1.6 trillion US dollars in demand for purchasing US short-term Treasury bonds.

In the view of some industry insiders, the Trump administration is trying to build a "Bretton Woods system on the chain" through the GENIUS Act, but the anchor of the US dollar has changed from gold to US debt.

Some people disagree with this.

In Zou Chuanwei's view, the so-called "Bretton Woods system on the chain" exaggerates the role of stablecoins. "The total amount of U.S. national debt exceeds 36 trillion U.S. dollars, and the total amount of stablecoins is only 250 billion U.S. dollars, and it mainly reserves short-term U.S. debt. It is not enough to solve the problem of U.S. national debt, especially the problem of long-term U.S. debt."

"From another perspective, assuming that the U.S. debt held by the issuer of stablecoins can be expanded to 10 times the current amount, is this a good thing for the United States, or a potential risk point for financial stability? It remains to be seen. "Zou Chuanwei said that in theory, users of stablecoins can redeem them at face value at any time, and the issuer will sell the reserve assets accordingly. Once users redeem them in a concentrated manner, the issuer of stablecoins will sell U.S. bonds in a concentrated manner, which may cause market turmoil." "In theory, the U.S. dollar stablecoin faces an 'impossible triangle': large-scale issuance of U.S. dollar stablecoins, large-scale investment of reserve assets in U.S. Treasuries (especially long-term Treasuries), and users can redeem them flexibly. These three goals cannot be achieved at the same time." Zou Chuanwei said. Despite this, it has almost become an industry consensus that the U.S. dollar stablecoin will strengthen the status of the U.S. dollar. "It is mainly because the U.S. dollar stablecoin will strengthen the use of the U.S. dollar worldwide. "Xia Le said that in some countries where sovereign currencies are not strong enough, the US dollar stablecoin may largely replace the local sovereign currency, enter daily payments, and impact a country's monetary system, which is the so-called "dollarization" problem.

Previously, sovereign states mainly ensured the status of sovereign currencies through legislation and law enforcement, but stablecoins, as online payment tools, have also brought considerable challenges to local government supervision.

In fact, Zou Chuanwei told Caixin that there are also residents and institutions in mainland China who hold and use US dollar stablecoins. The application scenarios include daily payments, trade settlements, investment and financing, and even capital flight, forming a "dollar enclave."

Take the cross-border e-commerce scenario as an example. A domestic cryptocurrency investor and researcher told Caijing that he found in his field research in Yiwu and other places that some cross-border e-commerce companies collect US dollar stablecoins during the sales process to reduce the cost of collection, improve the efficiency of collection, and circumvent foreign exchange controls. In domestic transactions, there are also cases of using US dollar stablecoins.

Another person from a cross-border payment institution told Caijing that there are indeed very few cross-border e-commerce companies and some traditional cross-border traders who use US dollar stablecoins for transactions. This phenomenon may be concentrated in countries and regions such as Africa and South America where the foreign exchange environment is complex and the cross-border processing capabilities of traditional banks are weak (local banks cannot handle foreign exchange exchange or the processing time is too long).

In this regard, many interviewees said that the RMB is a strong currency, and the secret circulation of US dollar stablecoins in the country will not shake the sovereign currency status of the RMB, but attention should be paid to its impact on the internationalization of the RMB.

Wang Yongli wrote that "the rapid development of the US dollar stablecoin has brought new challenges to the cross-border payment and settlement of the RMB. If the payment efficiency and settlement costs cannot be surpassed by the US dollar stablecoin, then the cross-border payment and international development of the RMB will face great constraints."

In view of this, professionals including Wang Yongli suggested that research on stablecoins should be strengthened, and consideration should be given to launching offshore RMB stablecoins in Hong Kong, China, and conducting relevant explorations.

"At present, the RMB is actually used for daily payments in some countries. The offshore RMB stablecoin can replace this part of the demand, which is a good choice for promoting the internationalization of the RMB. "Xia Le said that in the face of the possible spillover effects of the US dollar stablecoin in the future, China must try to issue the RMB stablecoin to know how to deal with it.

Under the current rules, there are also some obvious challenges in issuing offshore RMB stablecoins.

"The biggest challenge is the lack of a sufficiently deep offshore RMB money market."Xia Le said, "Currently offshore RMB currency products are limited, and short-term interest rates fluctuate greatly. Can they provide sufficient liquidity and stability for offshore RMB stablecoins? ”Xia Le said, "Currently, offshore RMB currency products are limited, and short-term interest rates fluctuate greatly. Can they provide sufficient liquidity and stability for offshore RMB stablecoins?" In addition, stablecoins themselves may also face risks such as price decoupling. In May 2022, UST, the world's third largest US dollar stablecoin, decoupled due to a sharp drop in the price of its anchored assets, and eventually collapsed systemically, with its market value of more than US$18 billion returning to zero. Risks in the traditional financial system are also infiltrating stablecoins. In March 2023, Silicon Valley Bank collapsed after a run on its deposits, and Circle failed to successfully withdraw part of its cash reserves deposited in the bank. As a result, USDC was panic-sold by investors. The price of USDC was once unpegged and fell to around $0.87.

In March 2023, Silicon Valley Bank collapsed after a run on its deposits, and Circle failed to successfully withdraw part of its cash reserves deposited in the bank. As a result, USDC was panic-sold by investors. The price of USDC was once unpegged and fell to around $0.87.

"Stablecoins may face various risks during operation, including liquidity risk, market risk, technical risk, compliance risk, etc." A technology person who has been deeply involved in the Hong Kong market told Caixin that in this regard, the "Regulations" have made detailed provisions on the issuance and management of stablecoins from a legislative level, including liquidity management, reserve asset management, technical risk management, and compliance management such as KYC, anti-money laundering, and anti-terrorist financing.

"In the actual supervision process, it is expected that relevant measures will be more detailed and implemented to strictly control risks." The aforementioned person said.

Blockstream's CEO advocates for the inevitable integration of JPEGs on Bitcoin, suggesting it will drive innovation and adoption of solutions like the Lightning Network.

Alex

AlexManta Network's New Paradigm sees a 125% surge in TVL to $45M in 24 hours, drawing global attention and substantial investments, powered by a unique revenue model.

Kikyo

KikyoMiss IMX 2023, powered by iSHANG's cutting-edge Web3 solutions, marked a revolutionary shift in voting dynamics, ensuring transparency and engagement. The collaboration showcased a seamless blend of technology and glamour, redefining traditional voting systems and leaving a lasting impact on the automotive industry.

Joy

JoyBored Gen DMCC (BG), the parent entity of Islamic Coin, had been under VARA's scrutiny regarding the legal issuance, marketing, and distribution of the token.

Alex

AlexBinance to pay $2.7 billion, ex-CEO CZ faces $150 million penalty in US court-approved settlement with Commodity Futures Trading Commission.

Hui Xin

Hui XinPayBito, the Singapore-based cryptocurrency exchange, is set to bolster its staff, eyeing a 50% increase in its Dubai and Singapore offices. The move is part of the company's strategy to double its workforce in the upcoming year, aligning with its commitment to delivering cutting-edge technological solutions to clients globally.

Joy

JoyBloXroute Labs decides to censor Ethereum blocks with OFAC-sanctioned transactions, sparking debate over blockchain ethics and regulatory compliance.

Alex

AlexRepubliK partners with TON to integrate familiar social media aspects into a user-friendly Web3 platform, emphasizing engagement and flexibility.

Alex

Alex2023 marked a significant year for blockchain in finance, with key players like Franklin Templeton and JPMorgan showcasing the technology's efficiency and growth potential.

Kikyo

KikyoTaiwanese authorities issue a stern warning against cryptocurrency betting, citing legal repercussions and ongoing investigations into activities involving platforms like Polymarket.

Hui Xin

Hui Xin