Source: Galaxy; Compiled by: Jinse Finance

Over the past week, the hot topic in the cryptocurrency world has been Changpeng Zhao's latest project, Aster. The decentralized exchange's token, ASTER, launched a week ago and has already vaulted to the top of the revenue-generating protocols in the cryptocurrency space.

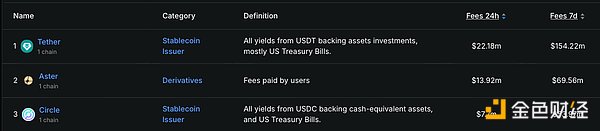

Data from DefiLlama on September 27th showed that Aster's 24-hour revenue reached nearly $14 million, surpassing Circle and Hyperliquiquit and second only to Tether ($22 million).

This is remarkable, considering that most people had no idea what Aster was before last week. AsterDEX was born in late 2024, formed through the merger of yield infrastructure provider Astherus and perpetual swap exchange APX Finance. Aster offers a range of services: an advanced orderbook perpetual swap exchange (Aster Pro) based on BNB Chain, Ethereum, Solana, and Arbitrum; one-click, MEV-resistant perpetual swaps with 1001x leverage; a companion spot exchange (Aster Spot); and yield infrastructure (Aster Earn), including a yield-generating stablecoin (USDF). Aster's roadmap extends further, including the Aster Chain designed for low-friction transactions. The market is clearly taking notice. On September 17, Binance founder Changpeng Zhao tweeted about Aster, when the token was trading at $0.17; as of this writing, its price has risen to $1.60, a 1,015% increase. Our Take: Aster's perpetual swaps business directly taps into one of the largest market opportunities in the cryptocurrency space. According to Coinglass, perpetual swaps currently account for over a trillion dollars in monthly trading volume, primarily concentrated on centralized exchanges (CEXs) including Binance, Bybit, and OKX. In contrast, the ratio of decentralized exchanges (DEXs) to centralized exchanges (CEXs) for spot trading has steadily increased. Hyperliquid has proven that streamlined perpetual swaps infrastructure can scale rapidly; it is one of the biggest winners of this cycle. If the profit potential of perpetual swaps decentralized exchanges (DEXs) is substantial relative to their construction costs, new competitors will inevitably flock to the scene. This is precisely what we are seeing. Lighter, BULK, edgeX, Drift, Pacifica, and Zeta all take different approaches to execution and fee routing. We expect Hyperliquid to experience further vampire attacks and the entry of new players. Given the significant interest in on-chain perpetual swaps, the DEX/CEX ratio for derivatives is likely to rise. Against this backdrop, Aster's strategy appears to be to widen its moat through integration. Backed by YZi Labs (the venture capital arm of Binance's founder), the project aims to capture the entire user "session," not just the transaction itself, by integrating perpetual swaps, spot trading, yield farming, and stablecoin settlement into one place. More broadly, the attention generated by the project has ignited user activity on Binance's BNB Smart Chain. The ripple effects of competition are already evident. Hyperliquid's HYPE token has fallen approximately 30% since Aster's launch. Even the "kings" are vulnerable to competitors that can attract significant attention. Aster's surge was largely driven by rumors and speculation that CZ and YZi Labs would stop at nothing to promote the project. But this is also reality. Doubling revenue in 24 hours is no joke.

The challenge now is sustainability. It’s easier to soar in revenue when the story is fresh and hot, but maintaining traction is much harder.

Weatherly

Weatherly