Author: Daniel Kim, Ryan Yoon, Jay Jo, Source: Tiger Research, Compiled by: Shaw Golden Finance

Key Points

Institutional adoption of Bitcoin accelerates - U.S. 401(k) investments unlock, exchange-traded funds (ETFs) and corporate entities continue to increase holdings on a large scale

The best environment since 2021 - Global liquidity is at a historical high, and major countries have cut interest rates

The shift from retail-led to institutional-led markets - Despite signs of overheating, institutional buying firmly supports the market's downside risks

Fundamental improvements are needed to activate the ecosystem through Bitcoin-based decentralized financial services (BTCFi) and other initiatives, but these are still in the early stages of development and will take time to have a significant impact.

Overbought, but institutions provide support

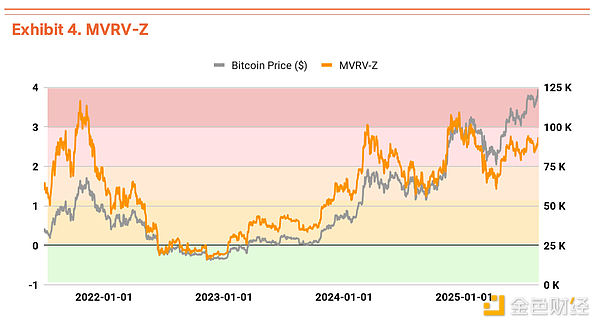

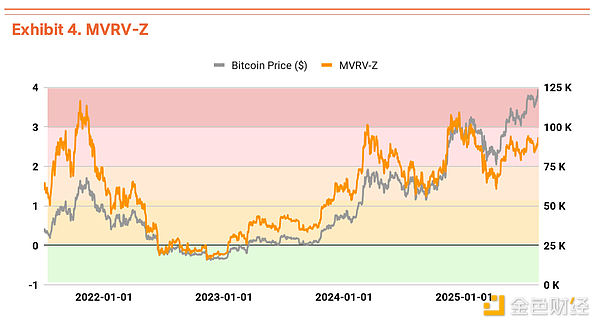

On-chain indicators show some overheating signals, but significant downside risk remains limited. The MVRV-Z indicator (which measures the ratio of current prices to investors' average cost basis) is currently in overheated territory at 2.49, having recently surged to 2.7, warning of a possible near-term correction (see Figure 4). However, tracking investors’ realized profits and losses Both the aSOPR (1.019) and the NUPL (0.558), a measure of market-wide unrealized gains and losses, are in stable ranges, indicating healthy overall market conditions (see Charts 5 and 6). In short, while current prices are elevated relative to the MVRV-Z indicator, the actual sell-off is occurring at modest profit levels (aSOPR), and the overall market has not yet entered excessive profit territory (NUPL). This strong momentum is underpinned by institutional buying exceeding retail activity. Continued accumulation by ETFs and strategic entities is providing solid support for prices. A short-term correction is possible, but a trend reversal appears unlikely. Target Price $190,000, 67% Upside Potential Our TVM approach derives its $190,000 target price through the following framework: We first establish a base price of $135,000 (removing extreme fear and greed from the current price) and then apply a 3.5% fundamental multiplier and a 35% macroeconomic multiplier. The fundamental multiplier reflects the improving network quality—higher transaction value despite fewer transactions. The macroeconomic multiplier captures three powerful forces: expanding global liquidity (e.g., M2 exceeding $90 trillion), accelerating institutional adoption (e.g., ETFs holding 1.3 million Bitcoins), and an improving regulatory environment (e.g., unlocking $8.9 trillion in 401(k) eligibility). From current levels, this implies a 67% upside potential. While this target may seem aggressive, it reflects the structural shift Bitcoin is undergoing, from a speculative asset to an institutional portfolio allocation.

Kikyo

Kikyo