On May 21, 2025, the Legislative Council of Hong Kong unanimously passed the Stablecoin Ordinance, becoming the world's first jurisdiction to establish a comprehensive regulatory framework for legal currency stablecoins, which has attracted widespread attention in the market. On the surface, stablecoins are still anchored by the US dollar and reserve US debt, which seems to strengthen the global status of the US dollar; but in fact, it is "unbinding" the US dollar from the traditional bank clearing system, allowing global funds to bypass the SWIFT network and multi-layer supervision and complete cross-border flows directly on the chain.

Stablecoins have not challenged the credit ontology of the US dollar, but are quietly rewriting the circulation path of the US dollar, the choice of capital landing point and the pricing method of global capital - this is a revolution about "path" rather than "currency". This article takes the new Hong Kong regulations as a starting point to systematically dismantle the institutional logic behind stablecoins, the impact path on the US dollar and US bonds, and the investment opportunities that truly benefit.

Stablecoins:The institutional interface and credit mapping of "on-chain dollars"

In essence, stablecoins are not a new form of currency, but an extension of the existing monetary system under the conditions of digital technology. It is based on the logic of "anchoring real assets and circulating on the blockchain", mapping the value of legal currency to the chain through technical means, forming a financial instrument that has both digital transmission efficiency and legal currency payment capabilities.

The emergence of stablecoins fills the gap of the lack of connection channels between the traditional financial system and the crypto asset system, making digital assets have stronger transaction stability and cross-border payment capabilities.

In the consensus of mainstream global regulatory agencies and research institutions, stablecoins are generally divided into three categories: legal currency reserve type, crypto asset collateral type and algorithmic stablecoin. Each type of stablecoin has obvious differences in issuance mechanism, stabilization method and risk exposure.

The first category is legal currency reserve stablecoin, such as USDT and USDC. The basic mechanism is: the issuer issues stablecoins according to market demand and deposits equivalent legal currency reserves (usually US dollars or short-term government bonds) off-chain simultaneously. Every stablecoin unit held by users is backed by real fiat assets.

This type of stablecoin is closest to the traditional monetary system, with a clear credit basis and strong stability, but it is also the most dependent on the reserve transparency and audit credibility of the issuer. For example, Circle, the issuer of USDC, regularly publishes reserve reports audited by a third party to enhance market trust.

The second type is crypto-asset collateralized stablecoins, such as DAI. Its operating logic is to collateralize mainstream digital assets such as Ethereum on the chain and generate stablecoins at a certain ratio. This model does not rely on the banking system and is completely executed by smart contracts.

However, due to the fluctuation of its collateral price, the system needs to set a higher collateral ratio (such as 150%) and monitor the liquidation risk at any time. This mechanism guarantees the independence of decentralization, but also brings stability risks when the price of collateral assets fluctuates violently.

The third category is algorithmic stablecoins, such as the widely discussed UST. This type of stablecoin maintains the stability of the currency price by setting a set of currency quantity adjustment mechanisms (usually a "dual currency model"), and in theory does not require any physical or encrypted asset reserves.

However, the UST crash in 2022 proved that this type of stabilization mechanism is highly dependent on market expectations and arbitrage motivation. Once confidence is lost, it is easy to fall into a vicious cycle, causing the price of stablecoins to quickly de-anchor or even clear.

Overall, the reason why stablecoins are widely used is that they open up the circulation path between digital assets and real legal currencies. It has significant efficiency advantages in scenarios such as OTC transactions, cross-border payments, and DeFi applications-supporting all-weather clearing, low handling fees, and no need for intermediary institutions to participate. For example, the average daily on-chain transfer volume of USDT ranks among the top in the crypto market all year round, reflecting its high activity as a trading medium.

However, it should be emphasized that stablecoins do not operate independently from the existing financial system, and their stability essentially still depends on the credit status and institutional environment of the underlying assets. Whether it is the US dollar, crypto assets, or market sentiment, once the supporting conditions change, it may trigger the risk of stablecoin de-anchoring or bank runs.

For this reason, regulators in various countries have begun to formulate special rules for stablecoins. Take Hong Kong as an example. In May 2025, the Hong Kong Monetary Authority launched the world's first full-chain stablecoin supervision regulations, requiring stablecoins to have 100% legal currency reserves, strictly prohibiting anonymous transactions and leverage operations, and incorporating them into the existing payment system supervision. This not only establishes a legal identity for stablecoins, but also provides an institutional basis for their integration with the traditional financial system.

In summary, the core significance of stablecoins is not to replace legal tender, but to provide a digital and efficient cross-border circulation method for it. While improving payment efficiency, it also brings a series of deep-seated challenges such as blurring the boundaries of sovereign currencies and redistribution of capital paths.

Dollar hegemony: The three-tier mechanism of global "financial rent collection"

To understand the structural impact of stablecoins, we cannot stay at the surface features of convenient payment and advanced technology. What it shakes may be the path of the US dollar in global capital flows.

From the essence of the dollar's hegemony, in the contemporary international financial system, the dollar's dominance does not only come from being the most widely used trading currency in the world, but more importantly, it has built a complete capital circulation system with the United States as the core.

This system allows the United States to not only continue to export currency, but also rely on external capital inflows to maintain domestic fiscal operations, thereby achieving a stable "low-cost financing-asset appreciation-capital return" positive cycle.

This circulation system can be roughly divided into three core mechanisms:

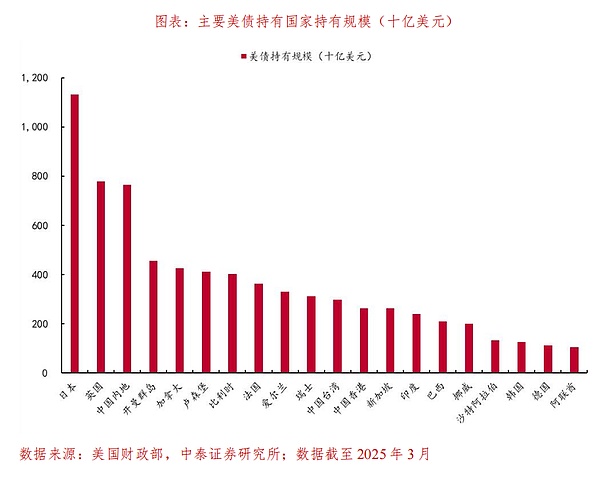

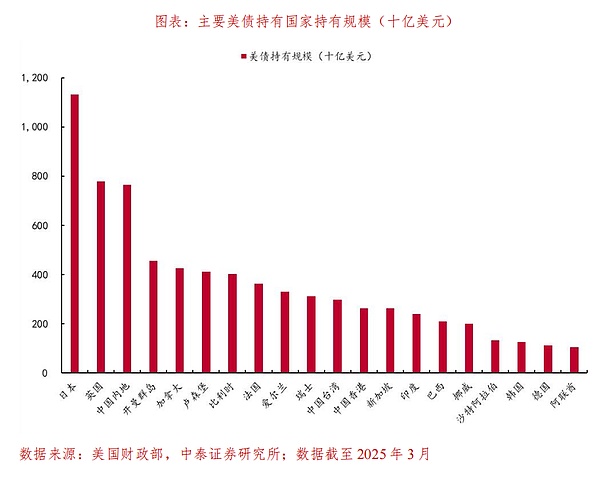

The first layer is the global money supply mechanism dominated by U.S. debt. The US government maintains a huge fiscal deficit every year and continues to issue treasury bonds for this purpose. Since the US dollar is an international reserve currency, central banks, sovereign funds, and financial institutions around the world passively or actively purchase US debt to ensure their external payment, investment and trade needs.

This means that the United States can turn its domestic deficit into a global burden by issuing treasury bonds and achieve continuous absorption of external funds. This "debt-to-currency" approach makes the United States the only country that can borrow global capital in its own currency for a long time.

The second layer is the financial asset pricing system dominated by the US dollar. The world's major commodities and financial assets are all denominated in US dollars. For example, crude oil, gold, copper and other commodities are settled in US dollars; at the same time, assets such as US stocks and US bonds occupy an important position in the asset allocation of global investors.

Whether it is the energy imports of developing countries or the asset allocation of global institutions, the US dollar is inevitable. This pricing power makes global capital often "flow back to the United States" when risk preferences shift, making US stocks and US bonds a "safe haven" or liquidity pool.

The third layer is the cross-border payment and settlement system controlled by the US dollar. At present, the vast majority of cross-border capital flows in the world rely on the SWIFT system, which is essentially a "financial communication network" dominated by the West, in which the United States has an important influence.

This not only means that the US dollar settlement has a circulation advantage, but also means that the United States has the ability to monitor and even interrupt the global capital path. A typical case is that the financial sanctions imposed by the United States on Iran, Russia and other countries directly restrict their use of the US dollar system for international trade.

Through these three mechanisms, the United States has achieved a wide range of global financial resources. Capital flows from the world to the United States, and then brings a larger scale of reflux through investment returns or financial product exports, forming a continuous "dollar export-US debt repurchase-financial service income" cycle.

Many investors in the market call this system the "financial rent collection mechanism of the US dollar", that is, the United States collects "financial rent" from global capital through institutionalized means without directly providing goods or services.

Under this framework, the core advantage of the US dollar hegemony is not the issuance of currency itself, but the ability to control the path of how currency flows, how capital is priced, and how transactions are settled. The United States controls the channel, not just the currency unit itself.

But it is precisely on these paths and channels that the challenge of stablecoins lies not in replacing the US dollar itself, but in changing the way the US dollar "flows" in the global system.

Specifically, although the current mainstream stablecoins (such as USDT and USDC) still use the US dollar as their value anchor, and even use US bonds as their main reserve assets, they have not directly impacted the credit of the US dollar itself, but they are gradually changing the model of "how the US dollar circulates".

Stablecoins bypass the SWIFT system and implement peer-to-peer transactions on the blockchain network, no longer requiring bank accounts or clearing banks. Although its reserve structure is still dominated by the US dollar, in theory it can be gradually diversified to introduce gold, euros, Hong Kong dollars and even digital RMB as anchor assets.

More importantly, stablecoins shift the circulation of US dollars from official channels to on-chain paths dominated by market institutions or smart contracts. This means that the transaction paths and settlement nodes originally controlled by the US banking regulatory system have been transferred to technical networks and private institutions.

This trend of "dollar outsourcing" will not cause the collapse of the US dollar's credit, but will begin to disperse the control of the US dollar's circulation path.

Therefore, stablecoins have not subverted the monetary status of the US dollar, but they are changing the way the US dollar plays a global role. This is a quiet change in the way the US dollar system operates, and the impact may be more profound than what is seen on the surface.

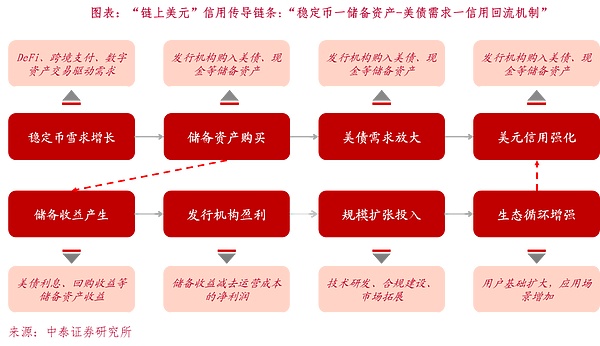

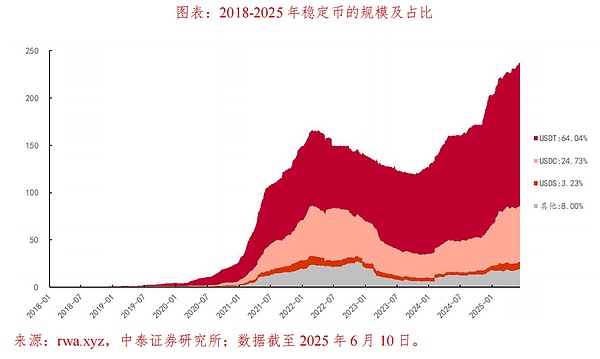

Stablecoin impact: New buyers of US debt, old order of the US dollar

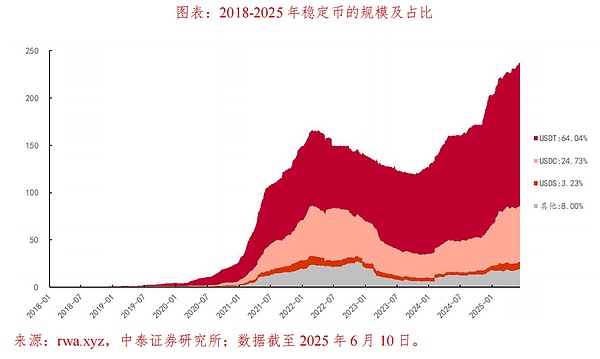

At the current stage, stablecoins are amplifiers of the circulation capacity of the US dollar. Fiat-reserve stablecoins represented by USDT and USDC are widely circulated in global crypto trading platforms, DeFi protocols, and OTC payment channels, allowing US dollar assets to enter gray areas and marginal markets that are difficult to cover in the traditional financial system. For example, in countries and regions with strict capital controls or restricted US dollar clearing, stablecoins have become an alternative carrier of "digital dollars", improving the availability of US dollars.

This "on-chain dollar" has three outstanding advantages: first, low transaction costs, not dependent on the banking system or SWIFT network; second, high execution efficiency, 7×24 hours real-time arrival; third, freer cross-border transfers, and can circulate between multiple main chains. For this reason, stablecoins actually build an "offshore payment network" for the US dollar, improving the technical adaptability of the US dollar as a transaction medium.

At the same time, among the reserve assets of most stablecoins, short-term US Treasury bonds, reverse repurchase agreements and cash assets dominate. Take Tether as an example. Its public reserve data in 2024 shows that about 70% of its assets are allocated to US Treasury bonds and bank time deposits due within three months. This means that while stablecoins strengthen the use of US dollars, they also objectively provide new marginal buyers for the US Treasury market and alleviate some of the capital structure pressure.

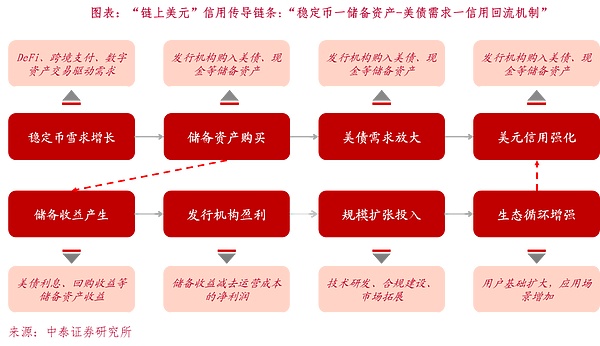

This new channel of "stablecoin-US dollar-US Treasury bonds" essentially forms a US dollar credit recycling mechanism of "on-chain issuance-off-chain configuration". The US dollar flows into the market in the form of stablecoins, and the market's holding of stablecoins in turn requires its reserves to be allocated to US Treasuries, thus forming a new scenario of US Treasuries demand driven by technology.

For example, recently, the Bank for International Settlements (BIS) released a research report entitled "Stablecoins and Safe Asset Prices", which systematically quantified the marginal impact of stablecoins on the US short-term Treasury market for the first time. The study found that stablecoins represented by USDT and USDC have become a new type of buyer of US short-term Treasury bonds (3-month T-bill), and there is a clear quantitative relationship between their capital inflows and changes in US Treasury yields.

Specifically, the report tracks the changes in the net subscription of major global stablecoins from 2021 to early 2025, and conducts a regression analysis with the daily yield of 3-month US Treasuries. The results show that when the stablecoin market has a net subscription of about US$3.5 billion (equivalent to an inflow of about 2 standard deviations), the short-term US Treasury bond interest rate can be lowered by 2-2.5 basis points within 10 days; when there is an equal amount of redemption outflow, the corresponding interest rate increase is 6-8 basis points. Especially at a time when the Federal Reserve is still in a high interest rate range and the banking system is limited in its willingness to hold bonds, the flow direction of the US dollar on the chain is becoming more sensitive to the impact on short-term yields.

It is foreseeable that after the rapid development of stablecoins, stablecoins will become marginal buyers of US debt. If the scale becomes larger and larger, it will have a significant impact on US debt interest rates.

However, it is more noteworthy that the strengthening of this US dollar credit recycling mechanism is limited and there are structural risks. Once observed from the perspective of the US dollar control path rather than the amount of use, it will be found that the development of stablecoins may be "eating away" the institutional foundation of the US dollar system.

First, the issuance and liquidation rights of stablecoins have been transferred from official institutions to private companies and on-chain protocols. USDT is led by Tether, and USDC is issued by Circle. Its reserve operations, clearing standards and compliance execution are not directly regulated by the U.S. Treasury or the Federal Reserve. The U.S. government has lost its real-time control over this type of "on-chain dollars", which means that the use of the dollar has gradually deviated from its traditional financial regulatory system.

Secondly, the credit basis of stablecoins has changed from "national sovereignty" to "corporate credit" and "market confidence". Once a redemption crisis or reserve shrinkage occurs, the on-chain dollar will face a liquidity run, forming a chain reaction of "de-anchoring-conduction-collapse". USDT has faced redemption doubts many times in 2021 and 2023, all of which have caused short-term market fluctuations. Such events show that although the circulation of stablecoins is convenient, their credit support is extremely fragile.

Finally, the reserve assets of stablecoins are highly concentrated in short-term US Treasury bonds and repurchase instruments. This structure pushes the US dollar debt system to a higher liquidity sensitivity. Once the issuer of a stablecoin encounters large-scale redemption, it must quickly liquidate US Treasury assets, which may lead to amplified volatility in short-term US Treasury prices and increased liquidity risks.

In the longer term, once some stablecoins begin to introduce non-US dollar reserve assets, such as gold, Hong Kong dollars, CNH or other sovereign currencies, the dollar's sole position as a stable anchor will also be challenged. Once this multi-currency anchoring mechanism is scaled up, it will fundamentally weaken the dollar's monopoly in cross-chain payments and DeFi systems.

As mentioned above, stablecoins have magnified the transaction convenience of the US dollar, but weakened its institutional control, presenting a structural dislocation of "more use and less control". On the surface, stablecoins make the US dollar easier to use and more globally penetrating, expanding its transaction coverage. At the bottom, it partially removes the issuance and supervision of the US dollar from the sovereign system, making the US dollar a "pricing tool in market contracts" rather than a "clearing currency controlled by the state".

Once the scale of stablecoins continues to grow in the future, the logic of its value anchoring to the US dollar may be reversed: it is not the US dollar that supports stablecoins, but stablecoins that dominate the circulation path of the US dollar.

For US Treasuries, stablecoins are both a source of short-term funds and a potential risk of credit transfer. On the one hand, stablecoins are used to allocate short-term US Treasuries to form demand support; on the other hand, the extreme volatility of stablecoin liquidity may become a potential destabilizing factor in the US Treasury market.

Cross-border channels: How do stablecoins reconstruct the structure of global capital flows?

In the traditional financial system, the flow of cross-border funds is highly dependent on the banking system and national regulatory paths. If companies or individuals want to make international payments, they often need to rely on the SWIFT network to complete wire transfers, which have long payment cycles, high fees, and complex reviews. The emergence of stablecoins provides another path for global capital flows.

Relying on blockchain technology, stablecoins have natural cross-border versatility. Whether in Asia, Africa or Latin America, coin holders only need to have a blockchain wallet to complete point-to-point transfers at any time, regardless of bank business hours, geographical location or traditional compliance channels. This mechanism, which operates around the clock, has transparent on-chain records and irreversible transactions, greatly reduces the technical threshold for cross-border transfers of funds.

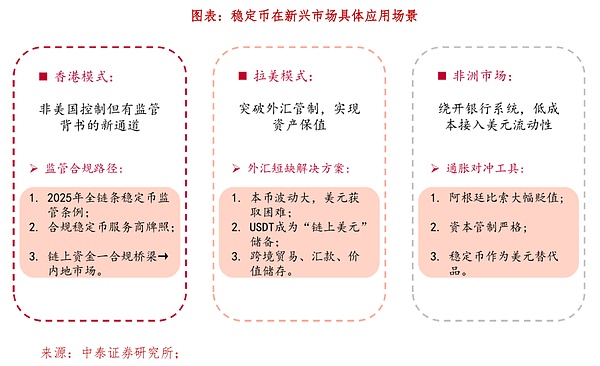

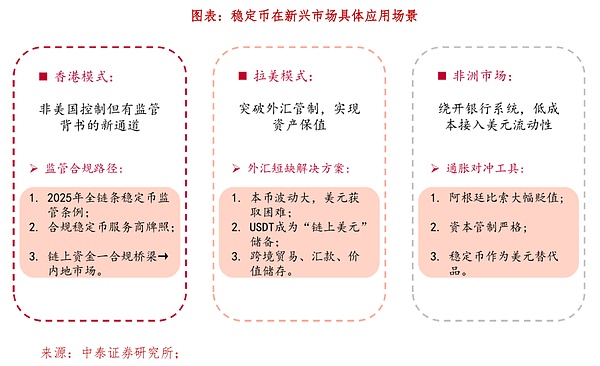

For emerging markets, stablecoins provide a low-cost access to US dollar liquidity. In many regions, due to insufficient foreign exchange reserves or large fluctuations in local currencies, traditional US dollar channels are strictly restricted or have high market costs. In this context, stablecoins such as USDT and USDC have become alternative options for "on-chain dollars", allowing local merchants, cross-border traders, and individual investors to bypass the banking system and indirectly obtain and transfer US dollars.

Not only that, stablecoins are also becoming the liquidity basis of the on-chain financial system (DeFi). In multiple decentralized exchanges, stablecoins are the most common trading pairs and collateral assets, playing a role similar to a "US dollar current account". Global funds can enter the on-chain protocol through stablecoins, conduct operations such as lending, market making, and contract trading, and then transfer back to the off-chain. This cycle of "on-chain absorption-off-chain release" has built a capital flow network parallel to traditional finance.

However, the institutional significance of stablecoins is not only about improving efficiency, but also about changing the "regulatory process" of global capital flows.

Under the traditional model, international funds entering a country must pass regulatory licenses, foreign exchange approvals, and cross-border settlement systems, and the country can control the pace of capital inflows and outflows. The stablecoin path bypasses these entrances, and the funds go directly to the local wallet after the transaction is completed on the chain, making it difficult for regulators to track the source and use in real time.

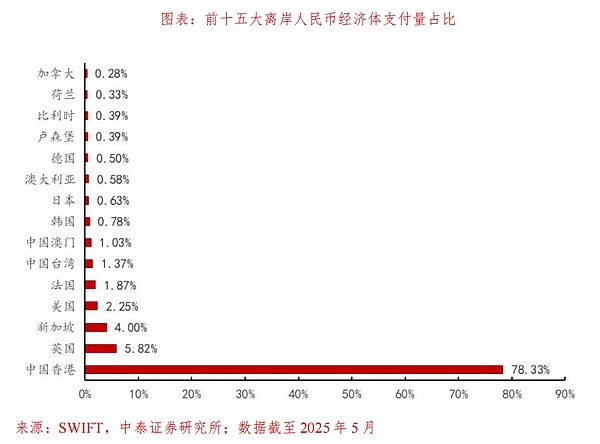

In 2025, Hong Kong officially launched the world's first full-chain stablecoin regulatory regulations, marking that this "path bypass" gray area has been partially incorporated into the compliance system. Hong Kong regulators no longer deny the existence of stablecoins, but try to define them as compliant trading tools and incorporate them into the local financial architecture. This provides a new channel for international funds that is "non-US controlled, non-traditional path but with regulatory endorsement."

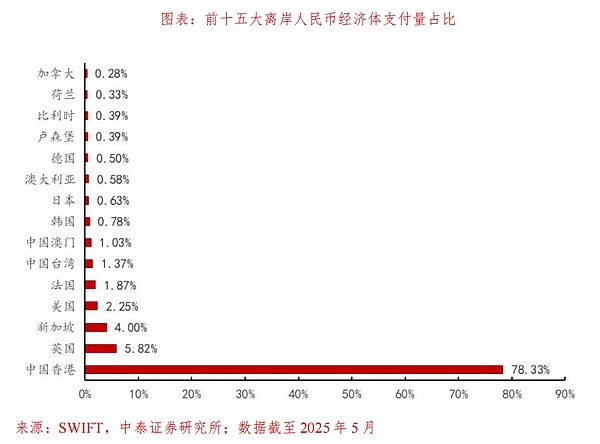

Its potential impact should not be underestimated. In the past, when US dollar funds flowed into the Asian market, they often had to go through the New York clearing system or London financial institutions. Now, they may flow directly from European and American wallets to Hong Kong through on-chain stablecoins, and then flow to mainland China or other Southeast Asian countries through local compliance bridges. This means that stablecoins are no longer just a tool to replace the US dollar, but also a new type of capital bridge connecting the financial systems of different countries.

In the future, as more regions establish local stablecoin regulatory frameworks, a global capital circulation network coexisting with the traditional clearing system may gradually take shape. This network is not centered on banks, nor does it rely on negotiations between sovereign currencies, but is based on a set of disintermediation systems with crypto assets as the medium and smart contracts as the rules. It will promote the further diversification of capital paths and will also bring unprecedented challenges to the supervision of various countries.

Hong Kong Stablecoin Ordinance:Institutionalized landing rights of US dollars on the chain

Hong Kong Stablecoin Ordinance was first gazetted on December 6, 2024 (Stablecoins Bill), and was passed by the Legislative Council on May 21, 2025, and is expected to take effect on August 1, 2025. This is the world's first stablecoin institutional arrangement established at the central bank level, covering the entire chain of issuance-platform-custody supervision.

It clearly defines stablecoins as "payment tools", requires issuers to hold 100% legal currency reserves, operate with a license, and prohibit anonymity, leverage and algorithmic coins. This move is not to relax cryptocurrency trading, but to build a "compliant dollar channel" in Asia, providing a legal path for US dollar stablecoins to enter the Chinese market without challenging its monetary sovereignty.

From the perspective of the global US dollar payment system, the greatest significance of this regulation is that it provides a legal circulation place for US dollar stablecoins outside the United States. At a time when the US regulatory environment is becoming stricter, if companies including Circle and Tether want to enter Asia, Hong Kong will become their preferred "channel". This not only solves the compliance obstacles faced by US dollar assets when going overseas, but also allows some US dollar funds to enter the wider Asian market through Hong Kong.

For the Hong Kong dollar, this regulation is also of great significance. The Hong Kong dollar is pegged to the US dollar, which is itself an "extension" of the US dollar. If the reserve assets of stablecoins in the future can include Hong Kong dollars, or stablecoins are settled and managed locally in Hong Kong, then the Hong Kong dollar will change from an auxiliary currency to a "landing currency" for the US dollar on the chain. This will increase the frequency of use and market value of Hong Kong dollar assets.

From the perspective of strategic research, the greater changes brought about by the Hong Kong "Stablecoin Ordinance" are in the Hong Kong stock market.

In the past, although payment companies, identity authentication service providers, and data security vendors have certain technical capabilities, they are often regarded as auxiliary tool companies in valuation models. However, after the compliance of stablecoins, their roles have changed. As long as these companies can provide payment interfaces, real-name authentication services or transaction monitoring systems for the circulation of stablecoins, they will have the ability to allow global funds to land in compliance locally.

For example, , companies such as Alipay Hong Kong and Hang Seng Electronics, if they can connect with the HKMA's compliance standards and provide transaction verification, fund custody, and risk control services, they may rise from auxiliary roles to "necessary nodes" in the stablecoin system. The value of such companies no longer depends on their current revenue scale, but on whether they have the technology and qualifications to make stablecoins "land in compliance". This change means that their valuation logic will be rewritten.

This is also why the stock prices of some Hong Kong-listed companies have seen significant changes after the policy was announced recently. The market is not hyping a certain concept, but pricing in advance who can really take over the new path of the flow of US dollars on the chain, and who can play a key role in key links such as stablecoin clearing, identity auditing, and fund tracking in the future.

In contrast, the "stablecoin theme" performance of the A-share market is still more conceptual. Since capital accounts are still strictly controlled, stablecoins cannot become a widely used payment tool. Therefore, the "stablecoin concept stocks" in A-shares are more short-term games stimulated by news. The reason is that few companies in A-shares have the ability to actually participate in the stablecoin system on the chain, lack cross-border clearing interfaces, and have not yet established close cooperation with Hong Kong or international compliance platforms.

From a medium-term perspective, the A-share companies that are really worth paying attention to should have the following three points at the same time: first, they have a business foundation for participating in cross-border payment or data authentication systems; second, they have the technical ability of on-chain identity recognition, compliance audit or fund custody; third, they have actual project cooperation with the Hong Kong financial management system. Only such companies can potentially gain substantial benefits when the on-chain stablecoin channel is opened in the future.

Therefore, the introduction of the stablecoin regulations in Hong Kong will not bring about a "general rise in sectors" in the traditional sense. Those companies that are in the core service links and can cooperate with the HKMA or large issuers will be the first to gain market attention. At a deeper level, this round of changes is not just about stablecoins themselves, but about the redistribution of where global funds land and who can participate in the landing process. As the global circulation of the US dollar system faces tightening regulation, the Hong Kong Stablecoin Ordinance is essentially providing a "compliant transit point outside the United States" for global capital, providing a more efficient and neutral outlet for global capital flows.

For investors, judging who truly has the ability to provide on-site services is the real investment direction under the development of the stablecoin market. From this perspective, even if a traditional financial technology company currently has meager profits, if it has established a first-mover advantage in areas such as stablecoin payments and on-chain asset custody, its valuation logic should be repriced according to the "new path infrastructure provider."

That is, the capital pricing logic shift from "profit-oriented" to "path-oriented"——Whoever can find their "position" in the global capital flow network reshaped by stablecoins will benefit more from the development of stablecoins.

Investment advice

The establishment of a stablecoin regulatory system marks that US dollar assets have gained a new legal landing channel in the Asian market. From an investment perspective, the core of this change is not the rise and fall of stablecoins themselves, but the identification of who can become the "key node" on the new capital flow path. When the investment logic shifts from "profit-oriented" to "path-oriented", infrastructure providers with the ability to "take on new paths" will have a historic opportunity to reshape their valuations.

Against this background, it is recommended that the investment strategy revolve around three main lines:

The first main line: on-chain financial service infrastructure companies, focusing on targets with practical application capabilities in the fields of issuance, payment, identity authentication, and fund custody. In the Hong Kong stock market, companies such as Alipay Hong Kong and Hang Seng Electronics are expected to become key fulcrums for the cross-border circulation of stablecoins. Their value no longer depends on the current revenue scale, but on whether they can provide technical interfaces and service capabilities for the compliance implementation of stablecoins.

In the A-share market, companies with cross-border payment qualifications, blockchain technology reserves, or cooperation with the Hong Kong financial system are worth tracking in the medium term. Once such companies are able to meet the compliance standards of the HKMA and provide transaction verification, fund custody, and risk control services, they may rise from a supporting role to an "essential node" in the stablecoin system.

The second main line: institutional pilot opportunities for RMB stablecoins. Pay attention to potential pilot opportunities for RMB stablecoins in Hong Kong. If Chinese banks or financial technology companies obtain policy authorization in the future to pilot the issuance of RMB stablecoins in Hong Kong, relevant service providers will be the first to benefit from this institutional breakthrough.

Enterprises with on-chain identity systems and audit compliance modules will gain substantial development opportunities in the cross-border application of digital RMB. This direction represents a forward-looking layout combining RMB internationalization with stablecoin technology, which deserves long-term attention.

The third main line: The strategic revaluation of Hong Kong dollar assets deserves attention. With the legalization of stablecoin clearing in Hong Kong, the Hong Kong dollar is expected to evolve from a simple "linked exchange rate currency" to an "on-chain underpinning asset" for US dollar funds, and its use scenarios as a reserve currency will be significantly expanded. Its use scenarios as a reserve currency will expand, and the valuation system of related financial and technology Hong Kong stocks is expected to be systematically adjusted upward.

Risk Warning:Stablecoin regulatory policies are still in a period of rapid evolution, and there is uncertainty in the regulatory attitudes of various countries; the implementation details of the Hong Kong Stablecoin Ordinance are not as expected; the intensification of global geopolitical risks affects cross-border capital flows; tight liquidity in the U.S. bond market affects the realization of stablecoin reserve assets; global liquidity tightens beyond expectations.

Anais

Anais