Foreword

On May 21, 2025, the Legislative Council of Hong Kong, China officially passed the Stablecoin Bill in the third reading, and then officially gazetted it on May 30, marking that the Stablecoin Bill has officially become law and is expected to take effect this year.

The stablecoin defined in the Ordinance refers to the "legal currency collateralized stablecoin", that is, a token that uses legal currency (such as Hong Kong dollars and US dollars) as an anchor asset to maintain a stable value. After the implementation of the Ordinance, three types of stablecoin-related activities must obtain a license: first, issuing stablecoins in Hong Kong; second, issuing stablecoins anchored to the Hong Kong dollar in or outside Hong Kong; third, actively promoting the stablecoins issued by them to the Hong Kong public.

The Ordinance also stipulates that stablecoin issuers must apply for a license from the Hong Kong Monetary Authority (HKMA), with a minimum registered capital of HK$25 million. There are four requirements for licensees: First, in terms of reserves, licensees must maintain a robust stablecoin mechanism to ensure that the reserve assets of stablecoins are composed of high-quality and highly liquid assets, and are equal to the denomination of the circulating legal currency stablecoins at any time, and are properly separated and kept; second, stablecoin holders have the right to redeem stablecoins at face value from the issuer, and redemption requests must be free of charge and processed within a reasonable time. Third, a series of requirements on combating money laundering, risk management, disclosure, and audit of appropriate persons must be met; fourth, transactions must be conducted on licensed virtual asset trading platforms.

The entry into force of the Stablecoin Ordinance marks that Hong Kong, China has officially incorporated stablecoins into the financial regulatory system. Hong Kong, China has become the world's first jurisdiction to establish a comprehensive regulatory framework for "fiat-collateralized stablecoins". Compliant Hong Kong stablecoins are expected to be officially launched before the end of this year.

Hong Kong Stablecoin Issuer Sandbox

In addition to legislating on the stablecoin licensing system, the HKMA also launched the Stablecoin Issuer Sandbox in March 2024 as one of the HKMA's initiatives to promote the sustainable and responsible development of the Hong Kong stablecoin ecosystem. Through the "Sandbox", the HKMA allows institutions that intend to issue stablecoins in Hong Kong to test their operating plans and conduct two-way communication on the proposed regulatory requirements to formulate a fit-for-purpose and risk-based regulatory system. Therefore, the participants in the "Sandbox" are likely to obtain the first batch of stablecoin licenses.

On July 18, 2024, HKMA announced three groups of participants in the Stablecoin Issuer Sandbox, namely JD CoinChain Technology (Hong Kong), Yuanbi Innovation Technology, and Standard Chartered Hong Kong, Animoca Brands, and Hong Kong Telecom (HKT).

JD CoinChain Technology (Hong Kong) is a subsidiary of JD Technology Group, and its main businesses include digital currency payment systems and blockchain infrastructure construction. JD Technology Group is a subsidiary of JD Group that focuses on technology-based industry services. Relying on cutting-edge technology capabilities such as artificial intelligence, big data, cloud computing, and the Internet of Things, JD Technology has created products and solutions for different industries to help enterprises in all industries in the society reduce supply chain costs, improve operational efficiency, and become a digital partner worthy of industry trust. JD CoinChain Technology CEO Liu Peng talked about the current status of JD Stablecoin: JD Stablecoin is a stablecoin based on the public chain and pegged 1:1 to legal currencies such as the Hong Kong dollar (HKD) or the US dollar (USD). It has entered the second phase of sandbox testing and will provide mobile and PC application products for retail and institutions. The test scenarios mainly include cross-border payments, investment transactions, retail payments, etc.; it is cooperating with leading compliant exchanges; in retail payment scenarios, it is docking and testing with acquiring scenarios such as JD Hong Kong and Macau Station.

Circle Coin Innovation Technology is a subsidiary of Circle Coin Technology. Circle Coin Technology uses innovative financial technology to build a trusted and interconnected business world. Circle Coin Technology is based in Hong Kong and its mission is to make cross-border payments and financial services easier and cheaper for businesses. Circle Coin Technology has a background in DeFi, digital payments and financial technology. The board of directors includes former Hong Kong Monetary Authority Chief Executive Norman Chan, HashKey Group Chairman Xiao Feng, ZhongAn International President Xu Wei, Sequoia China Managing Director Wang Hao, senior investor Zheng Tuo, HashKey Group CCO Zhang Dayong and Circle Coin CEO Liu Yu. On September 30, 2024, Yuanbi Technology received US$7.8 million in Series A1 financing, including strategic investments from well-known industry companies such as Sequoia China, Hivemind Capital, Aptos Labs, Hash Global, SNZ Capital, Solana Foundation, Anagram and Upward Capital. Yuanbi Innovation Technology is testing its Hong Kong dollar stablecoin operation plan in the HKMA sandbox. At the same time, Yuanbi Wallet Technology, another subsidiary of Yuanbi Technology, has obtained a stored value payment facility (SVF) license issued by the HKMA and will be officially operational by the end of 2023. With the platforms and capabilities of each subsidiary, Yuanbi Technology is actively building a trusted and compliant financial platform network.

Standard Chartered Bank is a leading international banking group headquartered in London, UK, and is one of the international banks with the longest history in China. Standard Chartered Bank has been operating in Hong Kong since 1859 and is currently one of the three note-issuing banks in Hong Kong. Anti Group is headquartered in Hong Kong and focuses on blockchain games and digital entertainment. It is the parent company of the metaverse game platform The Sandbox. Hong Kong Telecom Limited was established in 1925 and is one of the largest integrated telecommunications service providers in Hong Kong. Regarding the cooperation on stablecoins, the Ansai Group said: HKT will strive to explore how stablecoin innovation can support local and cross-border payments through the sandbox, bringing greater benefits to consumers and merchants; Standard Chartered Bank will actively participate in the stablecoin issuer sandbox to explore how to support the vigorous development of Hong Kong's digital asset ecosystem in the most effective way, and deeply understand the opportunities and risks brought by the evolution of the stablecoin market to this ecosystem; while the Ansai Group is committed to promoting the popularization and application of digital assets, and applying blockchain-related technology solutions to physical assets and traditional economy.

Why Hong Kong is obsessed with stablecoins

It is better to unblock than to block

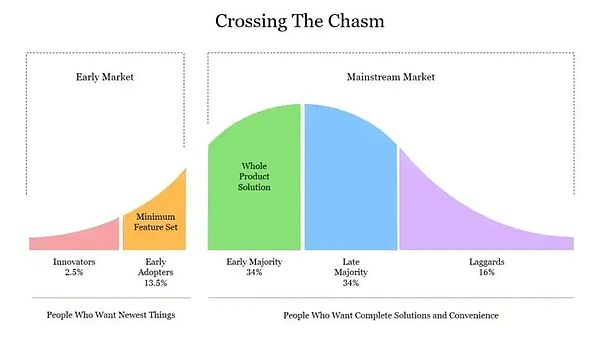

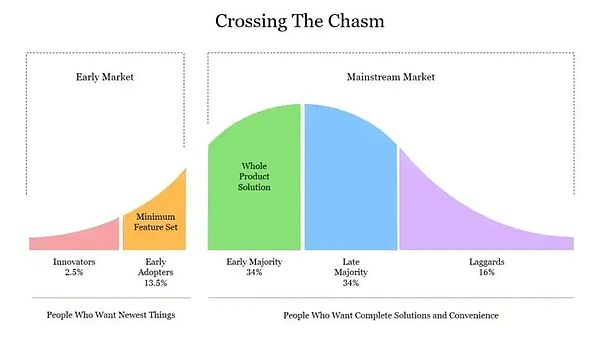

As of May 31, 2025, the total market value of cryptocurrencies is approximately US$3.25 trillion, of which the market value of Bitcoin is approximately US$2.07 trillion, and Bitcoin's market share is 63.7%. The high market share of Bitcoin shows the silence of the altcoin market. Geoffrey A. Moore's "Chasm Theory" may explain this phenomenon: there is a huge "chasm" between the early market and the mainstream market for high-tech products. Whether a company can successfully cross the chasm and enter the mainstream market becomes the key to its growth.

Most mainstream altcoins actually represent the "innovative technology" of Web3. "Early adopters" are still a small circle of Web3 believers, who agree more with the narrative of Web3. However, once they move towards "mainstream adopters" - a kind of pragmatists in the middle position, the first problem they encounter is what specific problems the product can solve, and whether it can bring real value compared with the advantages of similar products (in Web2). Only when the product truly has more comprehensive advantages can it be adopted. However, it is difficult for altcoins to give an answer, because most of the scenarios described by altcoins do not exist at all, or exist under the premise of large-scale adoption of blockchain (this premise is not met at this stage), and naturally cannot bring real value.

But the performance of stablecoins is completely opposite to that of altcoins, and the total market value has been hitting record highs. According to Coingecko data, the total market value of stablecoins has exceeded US$250 billion, an increase of 70% compared with the same period last year. Among them, Tether (USDT) has a market value of more than US$153 billion, accounting for about 61.2%, ranking first; USDC has a market value of more than US$61 billion, ranking second.

Stablecoins are expected to become the first Web3 product accepted by "mainstream adopters". In the global payment field, stablecoins have become an important infrastructure. Although the current payment field is still dominated by intermediaries who control high fees, in fact, stablecoins have become the biggest disruptor in the payment field. In 2024, stablecoins processed US$27.6 trillion in transactions, exceeding Visa and Mastercard. Active stablecoin wallet addresses increased from 22.8 million in February 2024 to more than 35 million in February 2025, an increase of 53%.

When this market has grown to a certain scale, from a regulatory perspective, "blocking is not as good as unblocking" - it is more effective to establish a clearer regulatory framework than to completely ban it.

The arrow is on the string

Coincidentally, the U.S. Senate passed the procedural vote of the 2025 United States Stablecoin Innovation Guidance and Establishment Act (GENIUS Act) by 66:32 on May 19.

The GENIUS Act is to establish a federal regulatory system, clarify the legal status of stablecoins, balance innovation and risk prevention and control, and strengthen the dominance of the US dollar. Unlike the stablecoins defined in the Stablecoin Ordinance, which can be anchored to any fiat currency (including Hong Kong dollars, US dollars, etc.), the stablecoins defined in the GENIUS Act must be anchored to the US dollar, emphasizing the dominant position of the US dollar in global stablecoins. Here is a fact to add: in the crypto market, 99% of stablecoins are 1:1 anchored to the US dollar. The cryptocurrency trading ecosystem and decentralized finance (DeFi) platforms mainly use US dollar stablecoins, which consolidates and expands the crypto hegemony of the US dollar. Although the GENIUS Act restricts the compliance of non-US dollar stablecoins in the United States, it does not restrict the compliance of US dollar stablecoins abroad, which in disguise has stimulated the further dependence and use of US dollar stablecoins around the world. This undoubtedly poses a challenge to the legislation of stablecoins in other regions. If the anchoring degree with the US dollar stablecoin is too shallow, it will be out of touch with the actual market, but if the anchoring degree is too deep, it will quickly lose the financial market independence of its own stablecoin. Here is another fact to add: in some small and medium-sized countries with relatively weak sovereign currencies (such as Ghana and Nigeria), US dollar stablecoins have partially replaced the status of sovereign currencies among young people.

In short, due to the overwhelming market advantage of the US dollar stablecoin, other fiat stablecoins will face higher transaction costs in actual applications, and the relatively loose regulatory policy shown in the "GENIUS Act" will further impact the market of other fiat stablecoins.

Therefore, Hong Kong, China's rapid passage of the "Stablecoin Bill" was also stimulated to a certain extent by the "GENIUS Act", and regulatory agencies in countries such as Japan, Singapore and Dubai are also following up on relevant legislation. The so-called "the arrow is on the string and it has to be shot."

Thinking

Does the crypto market need regulation?

From the perspective of a legislator, the answer to this question is that it needs regulation. From the perspective of a Web3 researcher, the author will actually come to the conclusion that it needs a certain form and degree of regulation. The crypto market has been developing for fifteen years since the establishment of the first Bitcoin exchange Mt.Gox. The decentralization of blockchain has not brought an open, transparent and fair market environment. On the contrary, you can see almost all "securities" crimes in this market: illegal fundraising, false information disclosure, market manipulation, insider trading, and fraudulent issuance.

Because of the lack of supervision, financial crimes are permitted. If financial crimes are permitted, then not committing crimes becomes a crime. After all, there are only so many leeks. If you don't cut them, others will. History goes round and round, human nature remains unchanged, the unmanned sea hides sinister undercurrents, and the free order brings false promises.

However, supervision will bring three problems: the first is the degree, the second is the problem of centralized power constraints, and the third is the problem of decentralized conflicts. The latter two problems will not be discussed in this article, and the main focus will be on the degree of supervision.

Generally speaking, the higher the degree of regulation, the higher the compliance cost of the enterprise. Due to the particularity of the decentralized nature of the crypto market, it is relatively easy to circumvent regulation when the enterprise is small, and it is easier for local users to freely choose external enterprises, so non-compliant enterprises can also grow wildly. If the compliance means of traditional finance are often expensive, slow, and restrictive, then in a market where compliant and non-compliant enterprises coexist, compliant enterprises must be the ones to be expelled. Hashkey's recent rumored predicament is partly due to the high compliance costs in Hong Kong.

Therefore, the degree of supervision must be the first thing that Hong Kong legislators must think about, how to reduce the compliance costs of enterprises, help enterprises establish competitive advantages, and make supporting the development of crypto assets in Hong Kong not just a slogan.

Does the Hong Kong dollar stablecoin have a future?

As mentioned above, 99% of the stablecoins in the crypto market are US dollar stablecoins, so is there still a chance for the Hong Kong dollar stablecoin?

Yes, because the stablecoin itself is used as a price anchor and is the basis of transaction pricing and liquidity. Therefore, the focus is on creating a Hong Kong dollar stablecoin transaction scenario. Here we have to mention Hong Kong's RWA strategic layout.

The so-called RWA is to represent and trade real-world assets in a tokenized way. Hong Kong itself has many high-quality assets, such as blue-chip stocks in Hong Kong stocks, and backed by mainland China, it can help mainland assets issue RWA in Hong Kong or overseas. At present, there are three successful cases of domestic assets issuing RWA in Hong Kong, which were completed by Ant Digits in cooperation with Longsun Technology, GCL Energy and Patrol Eagle Group. The underlying assets of the three cases are all mainland new energy assets.

In my opinion, Hong Kong Stablecoin and RWA are two-in-one, representing the capital side and the asset side respectively. When the asset side is high-quality and strong enough, sufficient funds will naturally flow into the capital side to match it. This is actually an important direction for the crypto market to move from virtual to real. Of course, what is emphasized here is that the underlying assets of RWA must be high-quality and the pricing must be reasonable, because RWA is a means of asset tokenization, and it will not change the original attributes of the underlying assets, let alone become a bargaining chip for speculation.

Therefore, the simultaneous development of RWA is also something that Hong Kong legislators need to think about, embracing stablecoins and abandoning CBDC, attracting sufficiently high-quality assets to RWA, and establishing an open and real-based crypto market.

Summary

In this round of the crypto market cycle, it is obvious that there has been a huge change in the perception and use of cryptocurrencies. Bitcoin is extremely strong as a store of value, while altcoins are sluggish as technological innovations. However, stablecoins have quietly become the infrastructure of global payments and the target of legislation and supervision in various countries and regions, with Hong Kong, China, bearing the brunt.

Hong Kong, China has transitioned from a regulatory sandbox environment to formal regulations, and launched the Stablecoin Ordinance to attract global capital and diversified stablecoin projects with an open and innovative attitude, consolidating Hong Kong's position as an international financial center and crypto asset hub. While responding to the "dollar hegemony" of the US "GENIUS Act", it also provided proofing and publicity to other governments.

However, the regulation of stablecoins will also bring more compliance costs to enterprises. Legislators in Hong Kong, China should balance the policy pressure on enterprises and the competitive environment of the market to support the development of crypto assets in Hong Kong. At the same time, RWA, as an important trading target for promoting the development of stablecoins, should also be actively promoted to establish an open and real-based crypto market.

Catherine

Catherine