Written by Yanz, Liam

“A good financial man, ‘the Robin Hood’ of finance”, a friend once described Vladimir Tenev in this way.

Later, it was this nickname that became the name of a company that changed the financial industry. However, this is not the beginning of the story.

Vladimir Tenev and Baiju Bhatt, the two founders with backgrounds in mathematics and physics at Stanford University respectively, met during a summer research project when they were undergraduates at Stanford University.

Neither of them expected that the future would be deeply bound to a generation of retail investors. They thought they had chosen retail investors, but in fact, it was the times that chose them.

While studying at Stanford, Tenev questioned the prospects of mathematical research. He was tired of the academic life of "spending several years to study a problem, and the result might be nothing", and he could not understand the obsession of his doctoral classmates who were willing to work hard for a meager income. It was this reflection on the traditional path that quietly planted the seeds of his entrepreneurship.

In the fall of 2011, the "Occupy Wall Street" movement was at its peak, and public dissatisfaction with the financial industry reached its peak. In Zuccotti Park in New York, protesters' tents were scattered all over the place. Tenev and Bart, who were far away in San Francisco, could also see the aftermath of this scene from their office windows.

In the same year, they founded a company called Chronos Research in New York to develop high-frequency trading software for financial institutions.

However, they soon realized that traditional brokerages had blocked ordinary investors from the financial market with their high commissions and cumbersome trading rules. This made them start to think:

Can the technology that serves institutions also serve retail investors? At that time, emerging mobile Internet companies such as Uber, Instagram, and Foursquare were emerging, and products designed specifically for mobile terminals began to lead the trend. In contrast, in the financial industry, low-cost brokers such as E-Trade still had difficulty adapting to mobile devices.

Tennev and Bart decided to follow this wave of technology and consumption, transforming Chronos into a free stock trading platform for millennials and applying for a broker-dealer license.

Millennials, the Internet, and free trading - Robinhood has gathered the three most subversive elements of this era.

At that time, they did not expect that this decision would usher in an extraordinary decade for Robinhood.

Hunting Millennials

Robinhood set its sights on a blue ocean market that was ignored by traditional brokers at the time - the millennials.

A survey conducted by traditional financial management company Charles Schwab in 2018 showed that 31% of investors would compare the level of handling fees when choosing an intermediary. Millennials are particularly sensitive to "zero handling fees", and more than half of the respondents said that they would turn to platforms with more price advantages because of this.

Zero commission trading was born in this context. At that time, traditional brokers usually charged $8 to $10 per transaction, but Robinhood completely waived this fee and did not set a minimum account fund threshold. The model of trading with only one dollar quickly attracted a large number of novice investors. With its simple and intuitive interface design that even has a "game feel", Robinhood successfully increased the trading activity of users and even cultivated a group of young users who are "addicted to trading".

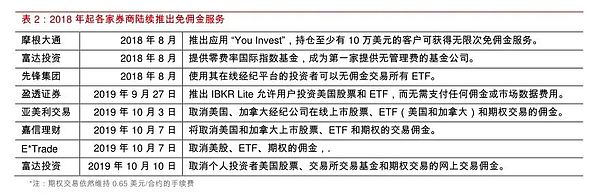

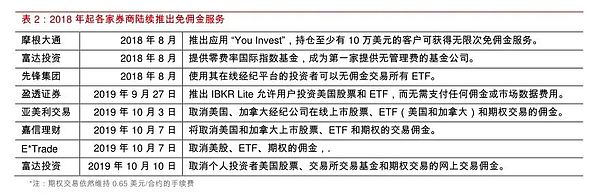

This change in the charging model eventually forced the industry to transform. In October 2019, Fidelity, Charles Schwab and E-Trade successively announced that they would reduce the commission for each transaction to zero. Robinhood became the "first person" to carry the banner of zero commission.

Source: Orient Securities

Using the Material design style launched by Google in 2014, Robinhood's gamified interface design even won an Apple Design Award, becoming the first financial technology company to win the award.

This is part of the success, but it is not the most critical part.

In an interview, Tenev described the company's philosophy by paraphrasing a line from Gordon Gekko, a character in the movie Wall Street: "The most important commodity that I have is information."

This sentence reveals the core of Robinhood's business model - payment for order flow (PFOF).

Like many Internet platforms, Robinhood's seemingly "free" service actually comes at a more expensive price.

It makes a profit by selling the user's trading order flow to market makers, but users may not be able to get the best price in the market, and they think they are taking advantage of zero-commission transactions.

In simple terms, when users place orders on Robinhood, these orders are not sent directly to the open market (such as Nasdaq or NYSE) for execution, but are first forwarded to market makers that cooperate with Robinhood (such as Citadel Securities). These market makers will match buys and sells with extremely small price differences (usually a difference of one thousandth of a cent) to make a profit. In return, market makers will pay Robinhood a "flow fee", which is order flow payment.

In other words, Robinhood's free trading is actually making money "invisibly" by users,

Although founder Tenev has repeatedly claimed that PFOF is not the source of Robinhood's profits, the reality is: In 2020, 75% of Robinhood's revenue came from trading-related businesses. By the first quarter of 2021, this figure rose to 80.5%. Even if the proportion has declined slightly in recent years, PFOF is still an important pillar of Robinhood's revenue.

Adam Alter, a professor of marketing at New York University, said bluntly in an interview: "For a company like Robinhood, it is not enough to simply have users. You have to keep them clicking the 'buy' or 'sell' button and reduce all the obstacles people may encounter when making financial decisions. ”

Sometimes, this ultimate experience of "removing thresholds" brings not only convenience, but also potential risks.

In March 2020, 20-year-old American college student Kearns found that his account showed a loss of up to $730,000 after trading options on Robinhood - far exceeding his $16,000 principal debt. The young man eventually chose to commit suicide, and the note he left for his family read:

"If you read this letter, I'm gone. Why can a 20-year-old with no income use nearly $1 million ofleverage? ”

Robinhood accurately hits the psychology of young retail investors: low threshold, gamification, and social attributes, and also enjoys the rewards brought by this design. As of March 2025, the average age of Robinhood users remained stable at around 35 years old.

But everything given by fate has a price tag, and Robinhood is no exception.

Robin Hood, robbing the poor to help the rich?

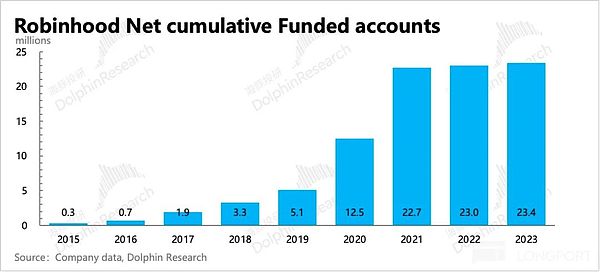

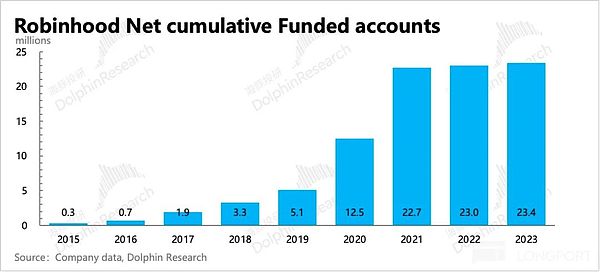

From 2015 to 2021, the number of registered users on the Robinhood platform increased by 75%.

Especially in 2020 In 2020, with the COVID-19 pandemic, the US government's stimulus policies and the national investment boom, the platform's users and trading volume both soared, and the custodial assets once exceeded US$135 billion.

With the surge in the number of users, disputes have followed.

At the end of 2020, the Massachusetts securities regulator accused Robinhood of using "gamification" to attract users with little investment experience, but failed to provide the necessary risk control during market fluctuations. Soon after, the U.S. Securities and Exchange Commission (SEC) also launched an investigation into Robinhood, accusing it of failing to obtain the best trading prices for users.

In the end, Robinhood chose to pay $65 million to settle with the SEC. reached a settlement. The SEC bluntly pointed out that even considering the commission-free offer, users still lost $34.1 million overall due to price disadvantages. Robinhood denied the allegations, but this storm is destined to be just the beginning.

What really got Robinhood involved in the whirlpool of public opinion was the GameStop incident in early 2021.

This video game retailer, which carries the childhood memories of a generation of Americans, fell into trouble under the impact of the epidemic and became the target of massive short selling by institutional investors. However, thousands of retail investors were unwilling to watch GameStop being crushed by capital. They gathered on the Reddit forum WallStreetBets and used Robinhood

GameStop's stock price soared from $19.95 on January 12 to $483 on January 28, an increase of more than 2,300%. A financial carnival of "grassroots resistance to Wall Street" shook the traditional financial system.

However, this victory that seemed to belong to retail investors soon turned into Robinhood's "darkest moment".

The financial infrastructure of that year could not withstand the sudden trading frenzy. According to the settlement rules at the time, stock transactions required T+2 days to complete settlement, and brokers had to reserve risk margin for user transactions in advance. The surge in trading volume caused Robinhood to pay a straight line in margin to the clearing agency.

On the morning of January 28, Tenev was awakened by his wife and learned that Robinhood had received a notice from the National Securities Clearing Corporation (NSCC) requiring it to pay a risk margin of up to 3.7 billion US dollars. Robinhood's capital chain was instantly pushed to the limit.

He contacted venture capitalists overnight and raised funds everywhere to ensure that the platform would not be dragged down by systemic risks. At the same time, Robinhood was forced to take extreme measures: limiting the purchase of "Internet celebrity stocks" such as GameStop and AMC, and users can only sell .

This decision immediately sparked public outrage.

Millions of retail investors believe that Robinhood has betrayed its promise of "financial democratization" and criticized it for bowing to Wall Street forces. There are even conspiracy theories accusing Robinhood of secretly colluding with Citadel Securities (its largest order flow partner) to manipulate the market to protect the interests of hedge funds.

Cyberbullying, death threats, and malicious reviews followed one after another. Robinhood suddenly went from being a "retail investor friend" to a target of public criticism. The Tenev family was forced to take shelter and hired private security.

On January 29, Robinhood It announced that it had urgently raised $1 billion to maintain operations, and then raised several rounds of financing, eventually raising a total of $3.4 billion. At the same time, congressmen, celebrities and public opinion pursued it relentlessly.

On February 18, Tenev was summoned to attend a U.S. Congressional hearing. Facing the questioning of congressmen, he insisted that Robinhood's decision was under settlement pressure and had nothing to do with market manipulation.

Despite this, the doubts have never subsided. The Financial Industry Regulatory Authority (FINRA) launched a thorough investigation of Robinhood and eventually issued the largest single fine in history - $70 million, including a fine of $57 million and 13 million customer compensation.

The GameStop incident became a turning point in the history of Robinhood.

left;">This financial storm severely damaged Robinhood's image as a "retail investor escort", and its brand reputation and user trust suffered heavy losses. For a time, Robinhood became a "survivor in the cracks" that was both dissatisfied by retail investors and watched by regulators.

However, this incident also prompted US regulators to reform the clearing system,promoting the shortening of the settlement cycle from T+2 to T+1, which had a long-term impact on the entire financial industry.

After this crisis, Robinhood pushed forward its long-prepared IPO.

On July 29, 2021, Robinhood was listed on the Nasdaq with the code "HOOD" and the issue price was set at 38

However, the IPO did not bring Robinhood the expected capital feast. On the first day of listing, the stock price fell at the opening and finally closed at $34.82, down 8% from the issue price. Although it rebounded briefly due to the retail boom and institutional buying (such as ARK Invest), the overall trend was under pressure for a long time.

The disagreement between Wall Street and the market is obvious - whether they are optimistic about it as the "financial entrance in the retail era" or worried about its controversial business model and future regulatory risks.

Robinhood stands at the crossroads of trust and suspicion, and has officially entered the reality test of the capital market.

leaf="">But at that time, few people noticed a signal hidden between the lines of the prospectus - in the S-1 document submitted by Robinhood, the word "Crypto" was mentioned 318 times.

This inadvertent high frequency of appearance is a declaration of a strategic shift.

Crypto is the new narrative that Robinhood has quietly opened.

Running into encryption

As early as 2018, Robinhood It has quietly tested the cryptocurrency business and was the first to launch Bitcoin and Ethereum trading services. At that time, this layout was more like a supplement to the product line and was far from becoming a core strategy.

But the enthusiasm of the market soon changed all that.

In 2021, The New Yorker described Robinhood as follows: "A zero-commission platform that offers both stocks and cryptocurrencies, committed to becoming an enlightened version of Wall Street, with the mission of 'democratizing finance for all.' ”

The growth of data also confirms the potential of this track:

In the fourth quarter of 2020, about 1.7 million users traded cryptocurrencies on the Robinhood platform. By the first quarter of 2021, this number soared to 9.5 million, an increase of more than 5 times in a single quarter.

In the first quarter of 2020, crypto trading revenue accounted for about 4% of the company's total trading revenue. By the first quarter of 2021, this figure surged to 17%, and in the second quarter it exploded to 41%.

When it started in 2019, Robinhood's cryptocurrency assets were only 4.15 million. By the end of 2020, this figure had soared to 35.27 million US dollars, an increase of more than 750%. Entering the first quarter of 2021, the custody scale soared to 1.16 billion US dollars, an increase of more than 2,300% year-on-year.

At this moment, cryptocurrency has changed from a marginal product to one of Robinhood's revenue pillars, and is clearly positioned as a growth engine. As they wrote in the document:

"We believe that cryptocurrency trading opens up new space for our long-term growth." ”

But what exactly happened to make Robinhood’s cryptocurrency business explode in just one or two quarters?

The answer also appears in the S-1 prospectus. Remember the crazy Dogecoin in 2021? Robinhood is the driving force behind the Dogecoin wave.

The S‑1 document clearly states:“In the three months ended June 30, 2021, 62% of crypto trading revenue came from Dogecoin, compared to 34% in the previous quarter”.

To cater to user demand, Robinhood launched Dogecoin in August 2021. In January, Robinhood announced plans to launch a cryptocurrency deposit and withdrawal function, allowing users to freely transfer assets such as Bitcoin, Ethereum, and Dogecoin into or out of their wallets. Half a year later, at the LA Blockchain Summit, Robinhood officially released a beta version of Robinhood Wallet that supports multiple chains, and it will be open to iOS users in September 2022 and fully launched in 2023. This move marks the beginning of Robinhood's official transformation from a "centralized brokerage" to a "digital asset platform." However, at the critical stage when Robinhood was accelerating its transformation with the help of the encryption boom, a legendary man at the time set his sights on it-Sam Bankman-Fried ( leaf="">SBF).

The then-popular founder and CEO of FTX is known for his aggressive expansion methods and subversive ambitions in the financial industry.

In May 2022, SBF, through its holding companyEmergent Fidelity Technologies, quietly bought about 7.6% of Robinhood's shares, worth about

648 million US dollars. After the news was made public, Robinhood's stock price soared more than 30% in after-hours trading.

SBF stated in the 13D document submitted to the U.S. Securities and Exchange Commission (SEC) that he bought Robinhood because he "believed it to be anattractive investment" and promised that there is no plan to seek control or intervene in management at present. However, the document also retains the statement that "the intention to hold shares may be adjusted according to circumstances in the future", leaving ample room for operation.

In fact, SBF's move is difficult to be simply interpreted as a financial investment.

At that time, FTX was actively laying out the US compliance market, trying to get rid of the identity of a "pure crypto exchange" and penetrate into traditional financial and securities businesses. Robinhood, with its huge retail user base and compliance qualifications, is the ideal bridge.

There were rumors in the market that SBF intended to promote deeper cooperation with Robinhood and even try mergers and acquisitions. Although SBF publicly denied the rumor, he never ruled out the possibility in the future.

However, SBF This layout did not bring the ideal "win-win" situation.

At the end of 2022, FTX collapsed, and SBF was accused of fraud, money laundering and financial crimes. In January 2023, the U.S. Department of Justice officially seized about 56 million shares of Robinhood held by SBF through its holding company, with a market value of about US$465 million at the time.

This equity, which originally symbolized the "Crypto Financial Alliance", eventually became a hot legal evidence.

It was not until September 1, 2023, that Robinhood repurchased the shares from the U.S. Marshals Service (USMS) for $605.7 million, which completely resolved the potential shareholding risks.

It is regrettable that based on Robinhood's current market value of $86 billion, the 7.6% stake that SBF once owned would be worth about $6.5 billion if it were maintained today, which is more than 10 times the original cost.

It turns out that this "attractive investment" that SBF considered was

Take off, stock price

If the GameStop incident is the baptism of Robinhood's crisis, then Robinhood in 2025 has officially ushered in its own highlight moment.

All this has been foreshadowed.

In the fourth quarter of 2024, Robinhood's key indicators all hit new highs:

Custody assets, net deposits, number of gold subscribers, revenue, net profit, adjusted EBITDA and earnings per share all exceeded expectations;

single-quarter revenue exceeded US$1.01 billion, net profit reached US$916 million, gold subscribers exceeded 2.6 million, adjusted EBITDA adjusted EBITDA reached

US$613 million...

cryptocurrency trading volume surged to

Encryption business revenue increased by 700% year-on-year, with single-quarter revenue reaching 358 million U.S. dollars.

Encryption business revenue increased by 700% year-on-year, with single-quarter revenue reaching 358 million U.S. dollars. leaf="">It is worth noting that in the fourth quarter financial report, Robinhood founder Tenev said: "We see huge opportunities in front of us,because we are working to enable anyone, anywhere to buy, sell or hold any financial asset and conduct any financial transactions through Robinhood. ”

This is probably a small foreshadowing.

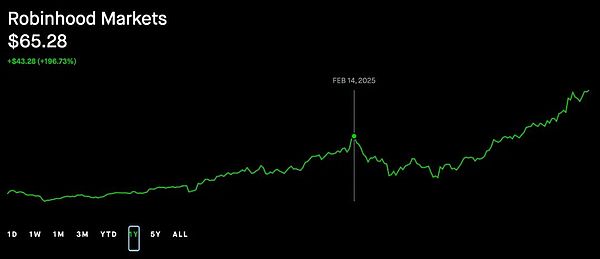

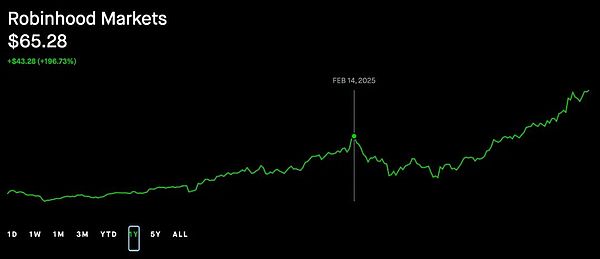

On February 14, 2025, just two days after the release of the financial report, Robinhood's stock price reached its first peak in 2025 at $65.28.

But what really ignited this stock price surge was the resonance of the global financial and encryption markets.

With Trump's election and the US policy shift to "encryption-friendly", Robinhood's regulatory risks have gradually been lifted.

On February 21, 2025, the U.S. SEC Enforcement Division formally notified Robinhood Crypto that it had ended a year-long investigation into its crypto business, custody processes, and payment order flows, and decided not to take any enforcement action. This letter not only cleared the policy barriers to Robinhood's future crypto business expansion, but also became an important catalyst for a breakthrough rebound in its stock price.

Immediately afterwards, Robinhood delivered a heavy blow.

On June 2, 2025, Robinhood Robinhood officially announced the completion of its acquisition of Bitstamp, one of the world's oldest crypto exchanges, for US$65 million. Bitstamp was renamed "Bitstamp by Robinhood" and fully integrated into the Robinhood Legend and Smart Exchange Routing systems. This strategic acquisition not only brought Robinhood access to compliant assets and global market layout, but also pushed it from a retail brokerage to the ranks of global crypto exchanges competing with Coinbase and Binance. leaf="">The next day, the stock price broke through 70 US dollars.

If the acquisition of Bitstamp is an important step for Robinhood to go overseas, then the next move announced Robinhood's big step into the Web3 capital market.

Remember Tenev's previous announcement? "Anyone, any time, any financial asset, any transaction is one step further. ”

On June 30, 2025, Robinhood announced its official entry into the field of blockchain securities, allowing European users to trade more than 200 US stocks and ETFs on the Arbitrum network through blockchain-based tokens, including stocks of well-known companies such as Nvidia, Apple and Microsoft.

Not only that, Robinhood also announced the development plan of its self-developed Layer-2 blockchain "Robinhood Chain

".

The market reacted significantly to this, with Robinhood's stock price soaring in a single day, with a monthly increase of 46%, and breaking through 100 intraday on July 2. US dollars, setting a record high.

Although the market experienced a brief correction due to the rumor that OpenAI's equity tokenization was debunked, analysts generally believe that Robinhood has completed its gorgeous transformation from a "retail brokerage" to a "financial technology platform", and blockchain securities will become its next long-term growth engine.

So far, Robinhood's stock price has stood firmly at around US$100, with a year-to-date increase of nearly 150%, and a market value of over US$88 billion (about 63 billion). 100 million RMB), far exceeding the imagination when it was listed.

From grassroots to today, Robinhood, with a market value of 86.7 billion, is no longer what it used to be. From the "target of public criticism" in the GameStop storm in 2021 to the trend-setter in the wave of financial and crypto integration in 2025, Robinhood has not only experienced the ultimate test of the capital market, but also completed its accelerated reconstruction in five years.

If history chose Robinhood back then, then at this moment, Robinhood has finally become the player who can leadhistory.

Today, Tenev can probably tell himself who was worried about mathematics as a career in college:“.

Joy

Joy