Original title: buy mkr now thank me later

Author: Ponyo, Four Pillars; Translation: Golden Finance xiaozou

Abstract of this article:

Sky (formerly MakerDAO) token prices have returned to their early levels, which were between $1,100 and $1,300 before last year's brief bull run. This downward trend is mainly due to the recent poor performance of the DeFi and Ethereum sectors, the uncertainty of its rebranding, and the emergence of a strong competitor, Ethena.

However, the time is ripe for change. Sky’s strategic initiatives are gathering traction, with near-term catalysts poised to drive momentum, including the Seal module (activating the fee switch), strictly deflationary token economics, Sky’s Solana launch, and the much-anticipated Sky Aave Force integration.

Sky continues to lead the decentralized stablecoin space with strong revenue growth and an attractive valuation. Now is the time to take notice: As the DeFi renaissance unfolds, Sky is poised to be at the forefront.

1. Introduction

While the crypto market continues to be dominated by AI and meme coins, Sky (formerly MakerDAO) appears to have fallen from its former perch. This shift is reflected in the price of MKR, which has fallen to the $1,100-$1,300 range as of November 5, 2023, levels prior to last year’s brief bull run. This downward trend underscores the view that MKR may no longer be able to attract investor attention. However, it is worth reconsidering whether this view accurately reflects Sky’s current and future potential. This article will delve into the underlying reasons for MKR’s recent performance and make the case for Sky’s return to attention. By examining Sky’s recent achievements, its upcoming tokenomics shift, and its enduring position as the oldest and most trusted decentralized stablecoin, we aim to make a compelling case for Sky’s well-deserved revaluation.

2. What are the factors that have led to MKR's recent poor performance?

2.1 Different reactions of the community to the rebrand

On September 18, 2023, MakerDAO completed the long-awaited rebranding of Sky, which also marked a milestone in the project's Endgame roadmap. Sky's long-term roadmap Endgame was approved by the company's management in August 2022, aiming to consolidate Sky's leading position in the DeFi field and ultimately expand DAI issuance to $100 billion. During this period, MakerDAO launched a revamped front-end, optimized UI/UX, renamed MKR to SKY, renamed DAI to USDs, and set the exchange rate of MKR and SKY to 1:24,000 on Sky.money. To further encourage the exchange of DAI to USDs, the project also introduced incentives such as Sky token rewards.

However, the community’s reaction to the rebrand was mixed. Some members valued the existing trust in the MakerDAO brand and chose to keep their original tokens, but MKR and SKY coexisted with DAI and USDs, leading to confusion about the utility of all tokens.

“It’s clearer now than ever how much love and trust the DeFi community has for the Maker brand. People love what it represents - stability, security, and DeFi scale. Many are insisting on continuing to hold MKR and will not upgrade to SKY.” - Sky founder Rune Christensen

To complicate the situation, Sky founder Rune Christensen confirmed that the original MKR and DAI tokens will continue to be valid, which brings more uncertainty to the role and utility of the new and old tokens. To make matters worse, centralized exchanges such as Coinbase announced that they would not support the SKY migration, exacerbating market concerns about whether the rebranding would be widely accepted.

In response to this situation, Rune Christensen initiated a governance vote on November 4, 2024 to decide whether to revert to the MakerDAO brand. The vote ended on November 8 and the decision was to support the rebranding, and everything went according to plan. Therefore, Sky will remain the core brand of the Sky ecosystem and protocol, and the transition from MKR to Sky and from DAI to USDs will take place without further brand-related adjustments. Although the initial community reaction was mixed, the community's decision to support the rebranding shows that Sky is now ready to move into a new phase with greater focus and clearer direction.

2.2 The emergence of a strong competitor

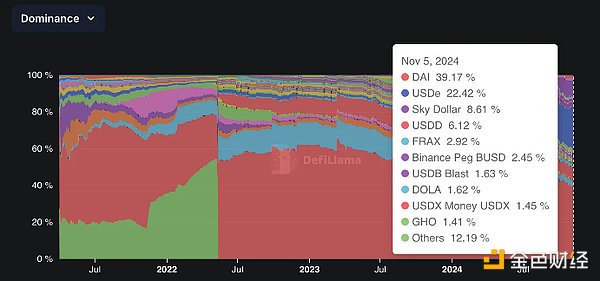

The launch of Ethena in February 2024 increased the pressure on DAI's market share, leading to the recent decline in MKR prices. Ethena is an Ethereum-based synthetic dollar asset protocol that has reached a market cap of $3 billion in just four months after its launch. As of November 5, 2023, Ethena's USDe accounts for 22.4% of the decentralized stablecoin market. This rapid growth is largely driven by Ethena's attractive interest rates, which are mainly maintained by three major revenue sources.

l Staking Rewards: Ethena uses Ethereum's PoS mechanism to earn interest on staked tokens like stETH.

l Market Strategy: By adopting a delta-neutral strategy, Ethena uses funding and basis profits in the perpetual futures and derivatives markets, that is, holding long positions in spot assets and short positions in perpetual futures to monetize funding rates.

l Stablecoin Interest Rates: Ethena also generates revenue through two major stablecoin investments - one is from 295 million USDC through Coinbase's royalty program, and the other is from Sky's 400 million USDs of interest earned through borrowing fees.

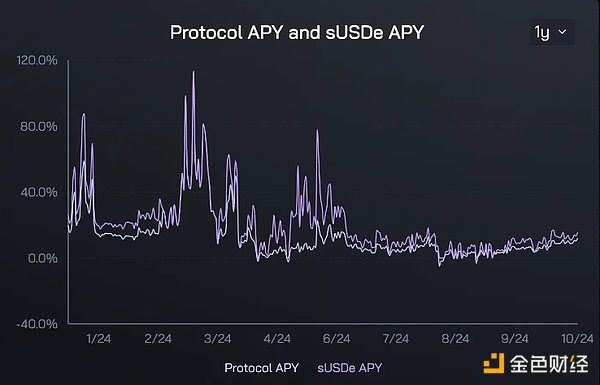

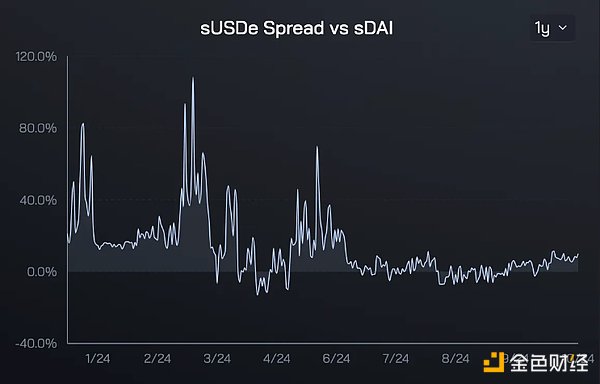

As of the end of October, USDe's yield was 13.3%, much higher than Sky SSR's 6.5%. Although there are still questions about the sustainability of such high rates and the overall stability of Ethena, the protocol has been running smoothly so far.

Fortunately, Ethena and Sky go beyond competition as they have several complementary aspects to each other. Ethena has seen great success with its on-chain tokenization of its spot-futures spread strategy, largely due to the high-yield ENA rewards program. To support this demand, Sky has established a credit line through Spark's Morpho Vault. Currently, a total of $400 million DAI is allocated to the vault, with an annual yield of $35 million, and Sky benefits from the borrowing interest paid by Ethena users.

Even if Ethena's rewards program shrinks, demand for Sky loans may remain strong. Ethena's protocol is primarily built around spot-futures spread strategies, which can maintain demand for loans even if incentives are reduced. This will allow Sky to consolidate its position as a major credit provider and further accelerate the adoption of DAI. DSR/SSR has become a benchmark interest rate for various third-party protocols, enhancing the utility of DAI and expanding Sky's influence in the DeFi ecosystem. As DAI establishes itself as an important backend for on-chain services, Sky's market share and usage are expected to grow further.

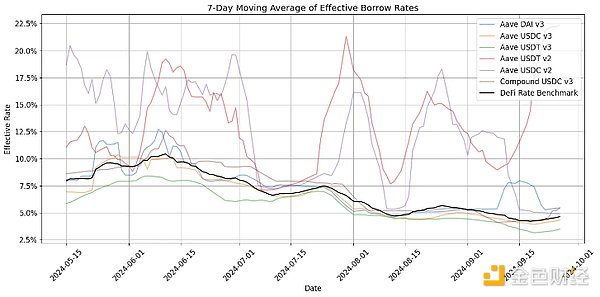

2.3 Potential Impact of Fed Rate Cuts on Stability Fee Income

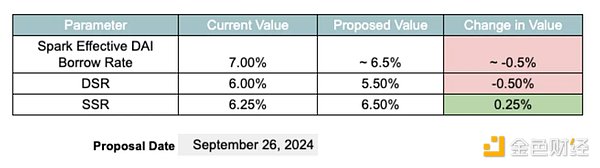

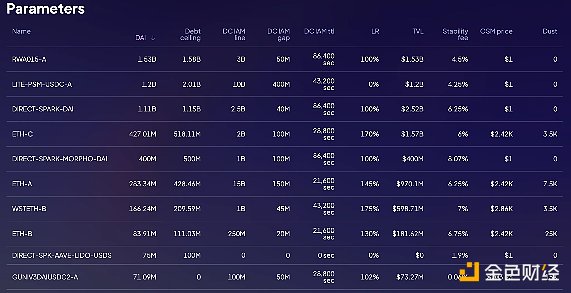

Finally, the Fed’s recent rate cuts could be another factor contributing to MKR’s underperformance, although the connection is weak. On October 18, the Fed cut its benchmark interest rate by 0.5 percentage points, from 5.25%-5.5% to 4.75%-5.0%. Typically, rate cuts are bullish for risk assets such as cryptocurrencies, however, for Sky, which operates as a DeFi lending protocol, the move could be detrimental. This is because Sky’s main source of revenue is the stability fee collected through CDPs (collateralized debt positions) when users borrow DAI or USDs. This stability fee accounts for a significant portion of Sky’s revenue, accounting for $309 million (98%) of its $313 million annualized revenue. In order to cooperate with the Fed’s rate cuts, Sky may find it necessary to continue to reduce its stability fee. The benchmark interest rate in the DeFi space has also reflected this trend, falling from 5.44% in September to 4.76%, leading Sky to reduce the lending rate of Spark from 7% to 6.5% and the DSR (DAI Savings Rate) from 6% to 5.5% on September 26. At the same time, the SSR (Sky Savings Rate) has been increased by 0.25%, and it is possible that people will be willing to exchange DAI for USDs.

As market interest rates fall, borrowing costs across the industry fall. If Sky does not adjust its charges accordingly, borrowers may switch to services with more competitive interest rates, which increases the risk. This could directly affect Sky's profitability, as stability fees account for a large portion of its revenue. Therefore, a reduction in stability fees could hurt Sky's revenue, which in turn weakens Sky's investment attractiveness. Currently, the stability fees for most of Sky's lending pools range from 4.5% to 8%.

3. Why is Sky ready to lead the DeFi revival?

3.1 Solid Profitability and Attractive Valuation

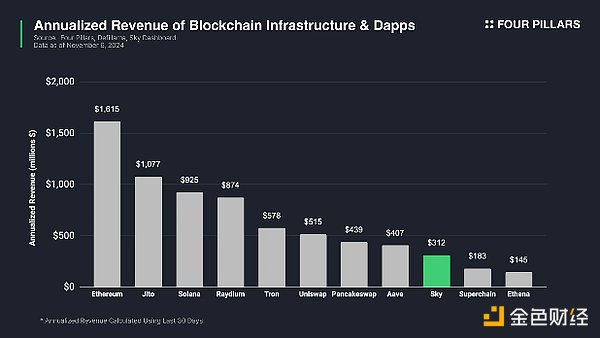

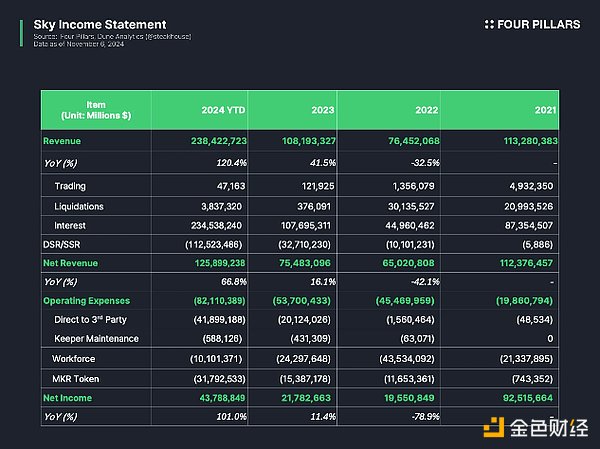

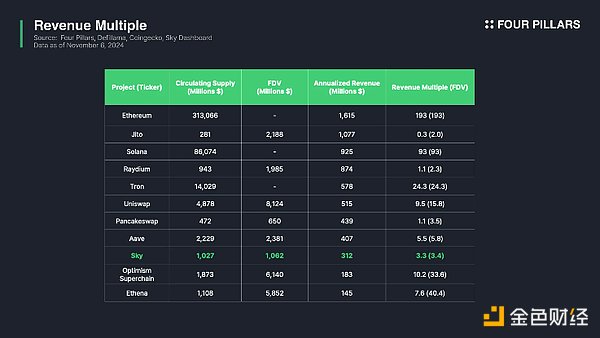

Sky's annualized revenue over the past 30 days is approximately $312 million, making it one of the top ten protocols in the entire blockchain and dApp ecosystem. In Ethereum's DeFi landscape, Sky is the third highest-earning protocol after Uniswap and Aave. Notably, Sky's net revenue for the year to date in 2024 is approximately $125 million. After deducting $82 million in operating expenses, net profit is estimated to be $44 million. Given that most crypto projects struggle to achieve profitability, Sky's amazing financial performance has firmly established it among the best performing protocols in the industry.

Since 2022, Sky's revenue and net income metrics have maintained steady growth, with revenue increasing from $76 million in 2022 to $240 million in 2024, a 213% increase in two years, and net income soaring from $19 million to $44 million in the same period, an increase of 131%. More importantly, these 2024 figures only cover 10 months, which means that the actual annual growth rate is likely to be higher. In addition, a large portion of net income is dedicated to direct distribution to token holders through the MKR token burning mechanism and Seal engine, which will be detailed below.

As of November 6, Sky's revenue growth was approximately 3.3 times, significantly lower than Uniswap, Aave, and Ethena. This valuation reflects the market's continued concerns about the uncertainties and biases discussed previously, which creates an attractive valuation opportunity. However, we believe this underestimation is unlikely to continue, as the factors discussed below are expected to prompt Sky to usher in a re-rating in the crypto market.

3.2. Strong Catalysts for Short-Term Momentum

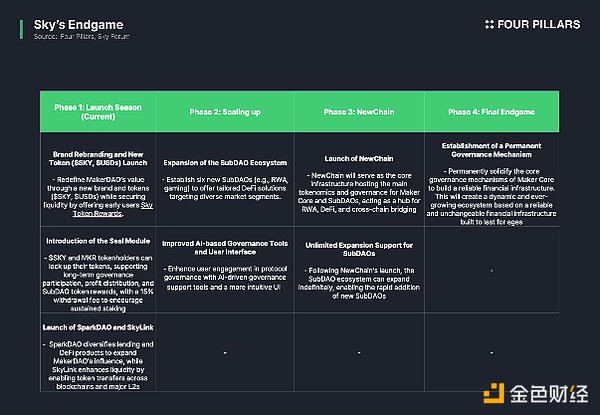

As mentioned above, Endgame is Sky’s ambitious long-term roadmap to scale up DAI issuance to $100 billion. Endgame spans four phases, including brand and token rebranding, introducing the Seal module (fee switch), expanding the SubDAO ecosystem, launching an independent L1 blockchain, and finally establishing a fully decentralized autonomous governance system. Each phase has key initiatives as outlined below.

While Endgame has transformative potential for Sky, its long timeline makes an immediate market re-rating challenging, especially given that the first phase alone took more than two years to implement. However, several ongoing initiatives provide strong short-term catalysts following the recent rebranding and main product launch.

3.2.1 Introducing a revenue distribution mechanism via the Seal module

The Seal module is a fee conversion module for SKY and MKR holders, similar to shareholder dividends. Participants can stake SKY and MKR to earn USDs rewards, and use the staked assets as collateral to generate additional USDs. With Sky about to launch its first SubDAO and lending platform Spark, holders can also choose to receive SPK rewards instead of USDs.

The Seal module distributes 25% of Sky's net revenue to holders, and reserves 15% for SPK issuance for the module. This transforms MKR/SKY from a governance token with only vague utility to a revenue-generating asset that directly shares in the protocol's revenue. This could mean issuing approximately $10 million to $15 million to MKR holders in the first half of 2024.

The initial exit fee for the Seal module is 5%, increasing by 1% every 6 months to 15% after 5 years. This structure incentivizes early participants to commit to long-term investment at a lower fee.

3.2.2 Convert MKR to a Strictly Deflationary Token

On October 31, Rune Christensen proposed converting MKR to a deflationary token. If implemented, additional MKR tokens will cease to be issued, and the tokens will be continuously burned and destroyed through the Smart Burn Engine (SBE) launched in July 2023, gradually reducing the total supply. Adjustments will only be made when liquidity shortages threaten the stability of DAI and USDs. This shift to a deflationary model is expected to create long-term scarcity and increase the value of MKR/SKY.

3.2.3 Expanding to the Solana Ecosystem

Sky plans to deliver USDs and Sky to Solana via the Wormhole bridge, initially distributing up to 2 million Sky per week through the LP incentive program. This move enables Solana-based DeFi protocols such as Kamino Finance and Solend to adopt the SSR integration program pioneered by Aave (see Section 3.2.4), potentially positioning USDs as the leading stablecoin in the Solana ecosystem. In addition, this move is also expected to support the launch of SkyLink in the future.

3.2.4 Launch of Sky Aave Force Flagship Program

Sky will launch the "Sky Aave Force" flagship program in partnership with Aave. With this program, Sky will launch a USDs market on Aave, overlaying Sky's USDs Savings Rate (SSR) with Aave's market rate. This integration allows depositors to benefit from the reward mechanisms of both protocols, with enhanced incentives from Aave and SPK airdrops once Spark goes live. The Sky Aave Force program is expected to significantly increase the issuance and liquidity of USDs and may play a key role in the DeFi ecosystem.

3.3 Unforkable Moat

Sky has built a strong brand in the crypto industry with years of mature experience and has won strong trust from investors and market participants. As Ryan Watkins, co-founder of Syncracy Capital, said, DAI has a monetary premium as a core indicator of its network effect and value capture potential. This monetary value is a critical asset that can only be achieved through years of sustained use and stable performance.

The sustainability of the agreement is not evaluated by theoretical design, but by proven performance in the actual market. Over the past eight years, Sky has withstood various economic shocks and fluctuations, continuously demonstrated resilience, and established credibility. DAI remains the longest-running decentralized stablecoin, creating a moat that no other project can easily fork or copy in this open source ecosystem. Thanks to this lasting stability, Sky has long been a leader in the decentralized stablecoin field, and the total market value of DAI and SKY has now exceeded US$5.6 billion.

Sky's market leadership is further strengthened by its broad adoption and deep market penetration. DAI is not only the most widely listed decentralized stablecoin, but also deeply integrated with countless DeFi protocols and dApps. Its lower capital cost is supported by prudent risk management and currency functionality across different use cases. Finally, Sky's ability to generate real demand without relying on incentive programs further highlights its sustainable competitive advantage.

4. Conclusion

Two years after announcing the Endgame strategy, Sky is emerging from its dormant period with new momentum. Major initiatives are showing results, and a series of short-term catalysts are driving growth together. Given these developments, the reasons to refocus on Sky are compelling. As the pace of the DeFi renaissance accelerates, Sky is ready to be at the forefront.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Alex

Alex Alex

Alex Catherine

Catherine Kikyo

Kikyo Catherine

Catherine Kikyo

Kikyo Catherine

Catherine