Trump's tariff war panic triggered a sell-off in the capital market, driving stablecoin allocations to a record high, and the crypto market remains positive in the long run.

Crypto Market Summary

1. With the implementation of the tariff war, Trump immediately stated that it would come to an end and would not continue. The negative impact of tariffs in the short term has been released. This year's crypto legislation is gradually benefiting the entire crypto track, especially after Trump signed the US Bitcoin strategic reserve, the moat is more solid and the general direction is more certain.

2. The funding situation in the crypto market improved significantly this week, with net inflows of ETF funds reaching US$3.014 billion, and stablecoins issuing an additional US$2.17 billion with a slight rebound in premiums,indicating that market sentiment has warmed up but has not yet overheated.

3. Citi predicts that the market value of stablecoins will reach 1.6 trillion US dollars by 2030 under the baseline scenario, and 3.7 trillion US dollars under the optimistic scenario. Citi said that this year may become the "ChatGPT moment" of blockchain, and pointed out that if the regulatory framework is in place, stablecoin issuers may become one of the largest holders of U.S. debt.

Macroeconomic Summary

1. The current Sino-US trade war presents typical Chicken Game characteristics. Both sides are unwilling to make concessions first, resulting in the continuous escalation of tariff barriers and the continuous increase in economic costs. This deadlock not only puts pressure on the economies of the two countries, but also has spillover effects on the global economy through channels such as trade contraction and supply chain disruptions. Since the attitudes of about 80 countries are of strategic significance in the game between China and the United States, the choices these countries make in supply chain adjustments, reshaping of trade rules, and regional economic cooperation will directly affect the distribution of chips and dynamic balance in the game between China and the United States.

2. As the situation evolves, the form of the game may shift from a simple "mutual non-compromise" to a more complex "Hawk-Dove Game". If more countries tend to support one side (such as by joining a trade alliance or a technology camp), it may break the current deadlock and prompt China and the United States to ease the conflict through compromise or unilateral concessions; on the contrary, if global forces are dispersed or continue to wait and see, the confrontation cycle may be prolonged. This process not only concerns the bilateral relations between China and the United States, but is also likely to reshape the global trade order, industrial chain layout and economic growth path. Its final result will have a profound impact on the stability and sustainable development of the international economic system.

3. Trump claimed that the reciprocal tariff war was progressing smoothly, especially the positive negotiations between the US and China, but China denied that the two sides had started consultations. In fact, it is still negotiating with Japan and South Korea, and Japan and South Korea are more likely to make concessions as a demonstration to China. Therefore, there has been no substantial progress in the US-China negotiations, and the market rebound space is limited. Powell reiterated the independence of the Federal Reserve and its insistence on data-driven policies. Although he hinted that policies might be adjusted if inflation or employment data changed, the probability of a rate cut in June has now dropped to 62.7% (down from two weeks ago). The Federal Reserve's Beige Book showed that economic growth was slowing down, businesses reacted strongly to tariff policies, manufacturing was shrinking, consumer confidence was hit, and inventories were piling up. Although the labor market was stable, hiring was weakening, highlighting the negative impact of tariffs. Although Trump and the Federal Reserve made dovish statements to ease market panic, the US dollar rebounded and stabilized, US Treasury yields fell back to a neutral range, and risk assets rebounded (Nasdaq rose 6.73% and S&P 500 rose 4.59%), gold fell due to yield fluctuations. The market is still suppressed by tariff uncertainties and it is difficult to be optimistic in the short term.

4. With the sharp rebound in Bitcoin prices this week, the scale of on-chain selling increased significantly to 197,040.26 coins, of which short-hand selling dominated (190,568.61 coins), while long-hand selling only 6,471.65 coins. At the same time, the outflow of funds from the exchange hit a new high in this cycle, reaching 62,696.12 coins, which not only eased the market selling pressure but also reflected the strong demand for buying. It is worth noting that about US$7 billion of long-term funds entered the market to buy at the bottom, pushing Bitcoin's weekly increase to more than 10% (04.21~04.27). In addition, long-term holders (long hands) increased their holdings by more than 120,000 BTC, while the shark group (addresses with 100 to 1,000 BTC) increased their holdings by nearly 30,000 BTC in a single week, indicating that institutions and medium and large investors are optimistic about the market outlook.

5. This week, as the policies of the Federal Reserve and Washington became more rational, stablecoin and ETF funding channels attracted a total inflow of nearly US$7 billion, coupled with about US$7 billion of long-term funds entering the market to buy shares, pushing Bitcoin (BTC) up more than 10% for the week (04.21~04.27). Data shows that net inflows were recorded on 6 out of 7 trading days, indicating that medium and long-term funds are accelerating their layout in the crypto market. However, as the price of BTC rebounded to the $95,000 mark, the market remains divided on the continued impact of the tariff war, the risk of recession, and the postponement of interest rate cut expectations (as early as one month later), and short-term volatility adjustments may be inevitable.

1. Market Overview

1.1 Analysis of FMG RWA and AI Index

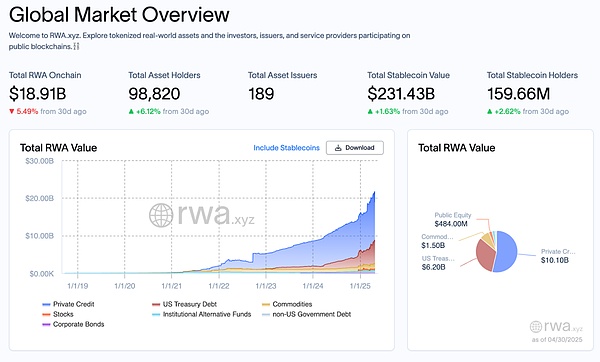

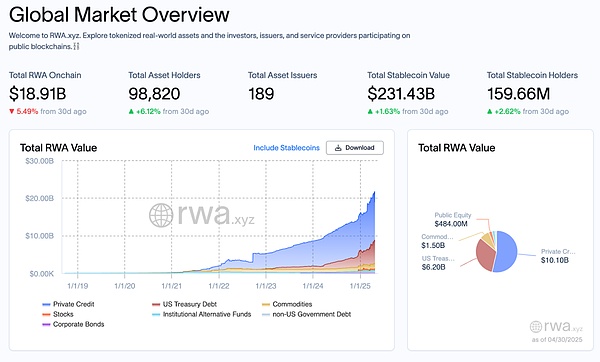

In the second half of April 2025, among the many indexes monitored by FMG, the RWA Index trend declined, with a monthly return drop of about 5.49%. This is due to the delay in the altcoin season, fewer Web 3 investment opportunities and over-concentration on BTC and stablecoins. OTC funds are turning their attention back to DeFi, asset management and strategy sectors. However, DeFi in a single Web 3 market is also highly risky, so products that are anchored to real-world assets and have DeFi attributes are currently gaining favor.

1.2 FMG RWA and AI Index Analysis

As of April 30, 2024, the total market value of cryptocurrency is 297 trillion, which continues to rise compared with 2.68 trillion US dollars in the second half of March.

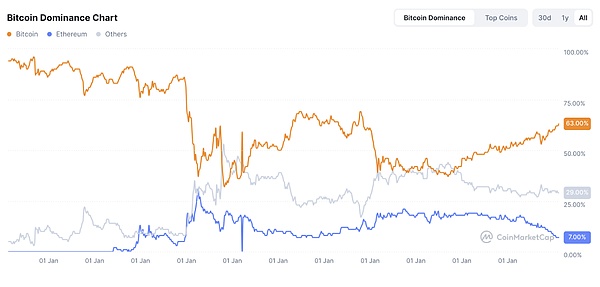

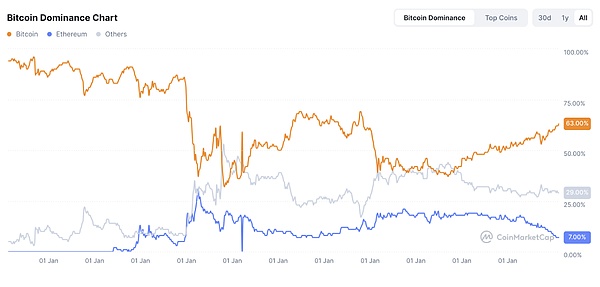

BTC Dominance Index: As of April 30, the current BTC dominance index is 63%, which continues to rise.

Altcoin Season Arrival Index:As of April 30, the current Altcoin Season Arrival Index is 16, which has risen compared to 14 in early April, which means that the current altcoin opportunities are gradually increasing.

1.3 Judgment of the market based on CPI and other data and market reactions

According to CME's "Federal Reserve Watch": The probability of the Federal Reserve keeping interest rates unchanged in May is 92.3%, and the probability of a 25 basis point rate cut is 7.7%. The probability that the Federal Reserve will keep interest rates unchanged by June is 75.1%, the probability of a cumulative interest rate cut of 25 basis points is 60.2%, and the probability of a cumulative interest rate cut of 50 basis points is 4.8%.

2. Hot Market News

2.1B² Network will be subscribed on Binance Wallet from 16:00 to 18:00 Beijing time on April 30

Currently,Binance Wallet announced on X that the next TGE project in cooperation with PancakeSwap is B² Network. The subscription time is from 16:00 to 18:00 on April 30, 2025 (Eastern Time Zone 8). The required Alpha Points will be subscribed on April 30. Announced before subscription date. B² Network is the leading Layer 2 project on BTC, which is an EVM-compatible ZK Rollup. Rollup dataand ZK proof verification commitments are recorded on the BTC network and ultimately confirmed through a challenge-response mechanism.

2.2 ARK raises Bitcoin's 2030 bull market target price to US$2.4 million

According to Bitcoin Magazine, ARK Invest has raised Bitcoin's 2030 bull market scenario target price from US$1.5 million to US$2.4 million, with an estimated average annual growth rate of 72%. The price is estimated at $1.2 million in the base case (53% CAGR) and $0.5 million in the bear case (32% CAGR). The forecast takes into account the 6.5% penetration rate of institutional investment in the global market portfolio, Bitcoin's replacement of 60% of gold's market value, the safe-haven demand in emerging markets and the growth of on-chain financial services, and adjusts the model based on Bitcoin's "active supply". ARK points out that most valuation models do not reflect Bitcoin's scarcity and lost supply.

According to the "Big Ideas 2025" report previously released by ARK Investment Management, ARK expects the price target of Bitcoin by 2030 to be approximately US$300,000 in a bear market scenario, approximately US$710,000 in a baseline scenario, and approximately US$1.5 million in a bull market scenario.

2.3 Dissecting Vitalik's strategic ambition to reconstruct the Ethereum execution layer with RISC-V

Compared to the major upgrades at the core level of Ethereum in the past few years (such as the consensus layer upgrade from PoW to PoS), ideally, the entire process requires rigorous design, extensive testing and strong community support, and it is estimated that it will take at least 2-3 years.

However, Vitalik emphasized backward compatibility in his proposal, and perhaps existing EVM contracts will continue to exist through RISC-V interpreter operation or parallel support mechanisms, which is crucial to reducing the transition costs for developers and users. This strategy of gradual change is also the steady strategic iteration style that Ethereum, as a secure and decentralized old blockchain, must possess.

Vitalik’s proposal to replace EVM with RISC-V is not only a simple technical architecture adjustment, but also an innovative strategy for Ethereum to proactively respond to competition from high-performance public chains. This proposal is closely related to upgrades such as Verge and Purge in the Ethereum roadmap. In essence, they all revolve around the underlying SNARKs, with the goal of establishing a more efficient and flexible execution environment to support diversified application scenarios in the future.

2.4 Citi predicts: the total supply of stablecoins may reach 3.7 trillion US dollars in 2030

According to The Block, citing a Citibank report, Citi predicts that the market value of stablecoins will reach 1.6 trillion US dollars by 2030 under the baseline scenario, and 3.7 trillion US dollars under the optimistic scenario. Citi said that this year may become the "ChatGPT moment" of blockchain, and pointed out that if the regulatory framework is in place, stablecoin issuers may become one of the largest holders of U.S. debt. The bank also warned that if adoption is slow, the market value may reach only $500 billion.

Three,Regulatory environment

ESMA finalized EU regulators' guidance on detecting and preventing abuse in the crypto market

According to Finance Magnates, the European Securities and Markets Authority (ESMA) has issued the "Final Guidance on Anti-Abuse Regulation in Crypto Asset Markets". This document, as a supporting rule for the MiCA regulations, will be fully implemented within three months after its publication. The guidelines require the regulatory authorities of the 27 EU member states to establish a unified market monitoring system, focusing on preventing three types of violations: insider trading, illegal information disclosure and market manipulation. They particularly emphasize the need to strengthen supervision of the spread of false information on online platforms such as social media and blogs. The document requires professional trading institutions (PPAETs) to deploy automated monitoring tools and establish a tiered processing mechanism for suspicious transaction reports (STORs). Regarding cross-border supervision, ESMA explicitly requires regulators of various countries to share regulatory cases of non-EU crypto companies and report cross-border collaboration obstacles to ESMA on a regular basis.

It is worth noting that no public consultation was conducted during the guideline development process. ESMA explained that this is due to the clear authorization in Article 125 of the MiCA Regulation and the guidelines are only aimed at regulators and not market participants. Regulatory authorities in each country must submit a compliance commitment to ESMA within two months, and if they choose partial exemptions, they must provide specific details. The Trump administration has taken a number of positive measures in cryptocurrency regulation, aimed at promoting the United States to become a global leader in cryptocurrency. Despite the economic uncertainty caused by trade policies, the development of cryptocurrencies is still being actively promoted in terms of policies and regulations, and progress in stablecoin legislation is being made. In the next few months, there will be more favorable regulatory releases, including: ETH pledge ETFs, more crypto ETFs, clarification of DeFi financial regulatory bills, and tax rate legislation for Bitcoin and the crypto track.

2. Interest rate cut cycle: We are currently in ainterest rate cut cycle.Although the market expectations for interest rate cuts have increased, the reaction of the cryptocurrency market is more complicated. Bitcoin prices fell to about $75,000 in early April, but then rebounded to around $95,000.Although the Trump administration has actively promoted interest rate cuts and has a friendly attitude towards cryptocurrencies, the market still faces many challenges, including inflationary pressures, a slowing global economy and policy uncertainty.

3. Track benefits:Three main core tracks in the long term future:DEFI, stablecoins and U.S. stock tokenization will leadcryptoto a new height in line with the globalization of U.S. finance. Hype track: The combination of AI, depin and crypto is also a hype track worthy of attention in this cycle.

Weatherly

Weatherly