US stocks, A-shares continue to have good news, AI has strong momentum, and the entire Web3 cycle is still in a bull market cycle.

Encryption market summary

1. September 15 By October 7, BTC experienced a sharp rise, rising from around US$57,000 to a maximum of around US$66,000. The main reason was the news of the US government's interest rate cut. In addition, the AI sector associated with Web3 has remained strong, and the entire cycle of Web3 is still in a bull market cycle, so OTC funds still maintain a bullish sentiment towards cryptocurrencies.

2. U.S. stocks rose, U.S. non-farm employment data significantly exceeded expectations, the number of employed people increased by 254,000 (expected to be 150,000), and the unemployment rate fell back to 4.05 %, unemployment benefits data continue to remain low, which will bring benefits to the future rebound of the entire market.

3. In terms of supervision, the chairman of the US SEC continued his consistent strategy and did not show a narrower regulatory strategy. However, as the U.S. election approaches, it is still uncertain whether Gary Gensler can continue to be re-elected as SEC Chairman, which also brings uncertainty to the subsequent development of the cryptocurrency industry.

Market Overview

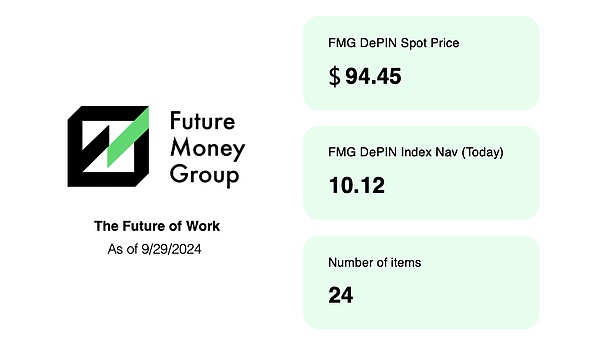

1.1 FutureMoney Group DePIN Index

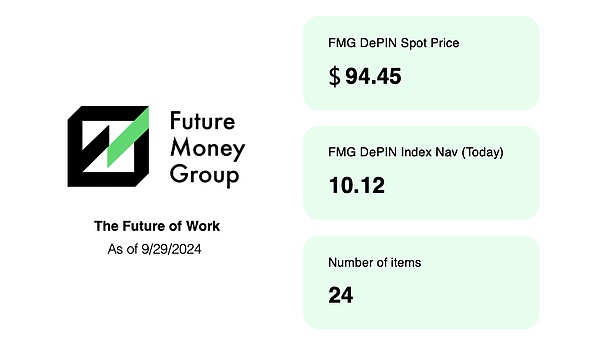

FutureMoney Group DePIN Index is a DePIN high-quality portfolio token index constructed by FutureMoney, which selects the most representative 24 DePIN projects for sex. Compared with the last report, the NAV value has increased slightly, from 9.07 to 10.12; while the Spot Price has increased significantly due to the rapid rise of TAO tokens. It rose from around $300 to $600.

1.2 Crypto market data

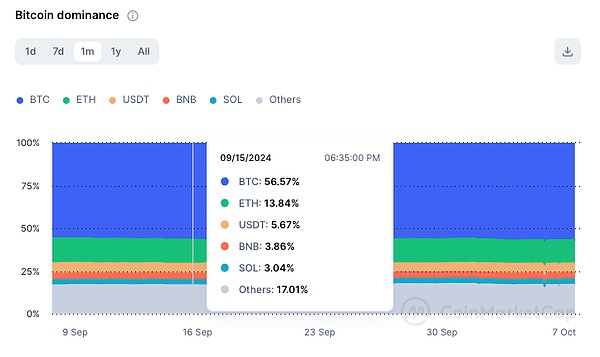

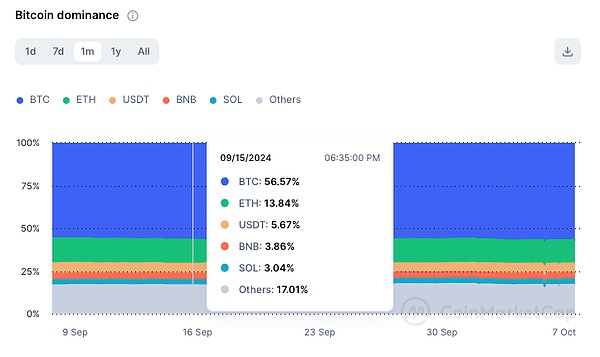

From September 15th to October 7th, stablecoins were generally stable and remained at 159 billion Around USD. In addition, the proportion of BTC to the total market value of cryptocurrencies is generally stable, with a slight increase from early September and is currently 56.57%.

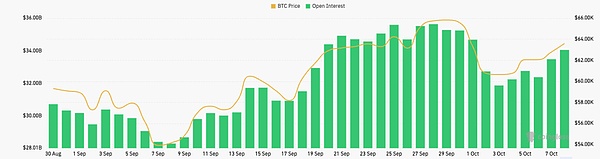

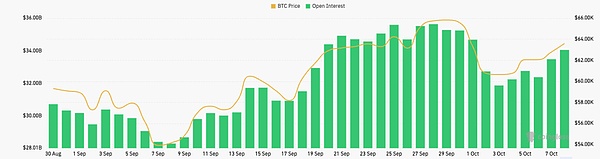

Observed from the trend changes of Coinglass contract positions, September Since the 15th, the open positions of BTC contracts across the entire network have increased, rising from US$30.9 billion on September 15 to US$34 billion. From September 15th to September 25th, BTC contract holdings experienced the first round of increase, rising to a maximum of 35.5 billion US dollars. After that, it began to fall sharply on October 1, falling to 31.8 billion US dollars, and continued to rise at the end of the National Day. .

The ETH contract holdings on the entire network follow the same trend as the BTC contract holdings, starting from US$10.3 billion on September 16 and rising to October 1 of US$12.5 billion and fell during the National Day holiday. As of now, ETH contract open interest is $11.5 billion.

Recently, it has been affected by factors such as the implementation of preliminary interest rate cuts, the lack of a new narrative in the Web3 environment, and the policy benefits of A-shares in the traditional financial market. In the past 15 days, the net outflow of BTC spot was US$162 million; the net outflow of contract was US$171 million.

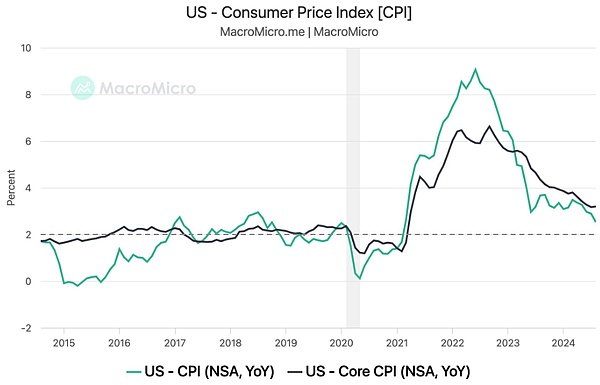

1.3 The impact of CPI and other data and market reaction on Market judgment

There are two relatively favorable macro data:

1. Macro: The macro data feedback this time is relatively good. Since late September, the three major U.S. stock indexes have collectively opened higher on many occasions. Among them, the Dow Jones Index continued to rise after testing below 40,000 points on September 11, rising from 41,153 points to 42,261 points. point.

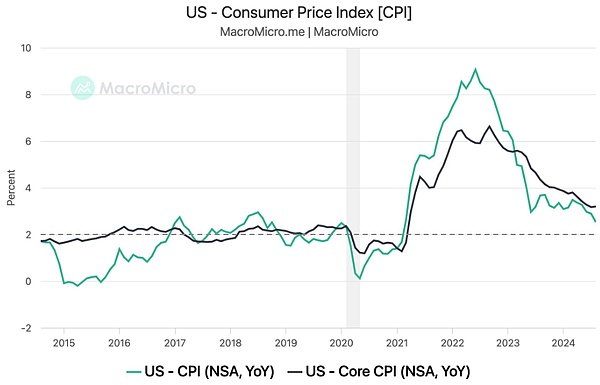

As of September 28, the number of people filing for unemployment benefits in the United States for the week was 225,000, which was expected to be 220,000, and the previous value was revised to 219,000. This value is the lowest in nearly 4 months. According to the US seasonally adjusted CPI index at the end of September, the actual value was 260.28, which was expected to be 260.33 and the previous value was 259.92.

Analysts at Saxo Bank said that if US Democratic candidate Joe Biden wins, inflation will be pushed higher. Next, we need to focus on the new round of CPI index in mid-October. The U.S. non-farm payrolls data significantly exceeded expectations. The number of employed people increased by 254,000 (expected to be 150,000), the unemployment rate fell back to 4.05%, and average hourly wages remained strong, triggering the market's opinion on the wisdom of the Federal Reserve's 50 basis point interest rate cut last month. doubts.

2. Encryption: The improvement in traditional market data has been relatively weak in the field of cryptocurrency. This may be due to the policy-related rise in US stocks and A-shares and the tension in the Middle East. and other factors caused hot money to leave the market. However, there is a phenomenon worthy of attention in the trend of U.S. stocks: cryptocurrency concept stocks led the rise in the U.S. stock concept sector, with an increase of 5.93%. This reflects that the entire cryptocurrency sector is still bullish by major funds in the long term. The current overall trend can be regarded as a good opportunity to observe and increase positions.

3. Sectors worthy of deployment: Whether it is the traditional US stock market or the Web3 sector, AI is the most powerful sector narrative. In addition, blue-chip DeFi based on ETH is gradually gaining attention. In addition, the DePIN sector is logically consistent with the Consumer currently being advocated by Web3. DePIN is showing new popularity after cooling down for about 4 months.

2. Hot market news

2.1 Powell: If the economy develops as expected, there will be two more interest rate cuts this year, a total of 50 basis points

Fed Chairman Powell said in a speech on the economic outlook that the Federal Reserve is in no rush to cut interest rates quickly. The rate reduction process will be carried out gradually "over a period of time" and there is no need to rush into action. Decisions will be made based on data. There are two more jobs reports and an inflation report due before the November meeting, with all factors ultimately factored into the November rate decision. If the economy develops as expected, there will be two more rate cuts this year, totaling 50 basis points.

2.2 Memecoin’s rise begins to spread to Bitcoin

$PUPS $ORDI $SATS Under the leadership of $PUPS, Bitcoin Memecoin (inscriptions, runes) began to attract attention again.

2.3 Japan will evaluate its cryptocurrency regulations, which is expected to create conditions for the launch of cryptocurrency ETFs

Japan plans to evaluate its cryptocurrency regulations The review, which will take place over the next few months, could pave the way for the launch of a cryptocurrency exchange-traded fund (ETF) in the country.

A Japan Financial Services Agency (FSA) official said the review will measure the country’s current approach to cryptocurrency regulation under the Payment Services Act (PSA) Is it enough? Originally enacted in 2009, Japanese lawmakers have revised the PSA multiple times in response to changes in the financial services landscape triggered by the emergence of digital currencies.

The bill recognizes Bitcoin and other cryptocurrencies as legal property. It also requires cryptocurrency exchanges to register and comply with the country’s anti-money laundering (AML) and counter-financing of terrorism (CFT) regulations.

At the same time, Aptos Labs announced its formal acquisition of HashPalette Inc. with the aim of entering the Japanese blockchain market.

2.4 Musk changed his Twitter avatar to a personal photo with US election elements

The background is the American flag, and Musk is wearing a "MAKE AMERICA GREAT AGAIN" hat.

3. Regulatory environment

3.1 This week, the U.S. Congress went to the Center for the first time Held a hearing on DeFi

U.S. SEC Chairman: reiterated that Bitcoin is not a security and emphasized that existing laws provide SEC supervision The power of cryptocurrencies

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler once again emphasized in an interview that Bitcoin is not a security and investors are now You can express your views on Bitcoin through ETF products. Gensler declined to comment on Trump’s proposed U.S. Bitcoin strategic reserve plan, saying it was out of consideration for his duties and the election season. He insisted that existing laws give the SEC the power to regulate the cryptocurrency field, saying that "dislike of rules does not equate to no rules." Gensler also pointed out that the cryptocurrency industry faces trust-building challenges, and multiple industry leaders have been jailed or bankrupt. He emphasized that without investor protection and trust-building, it is difficult for the innovation field to survive.

This data comes from: Coinshare, Coinglass, Coinmarketcap, Sosovalue, X

This The content described in the article does not constitute investment opinions or recommendations. Before making any investment decision, you should consider your financial situation, investment objectives and experience, risk tolerance and ability to understand the nature and risks of the relevant products.

YouQuan

YouQuan