Author: Li Dan, Zhao Yuhe, Wall Street Journal

Key Points:

As expected by the market, the Federal Reserve continued to pause interest rate cuts.

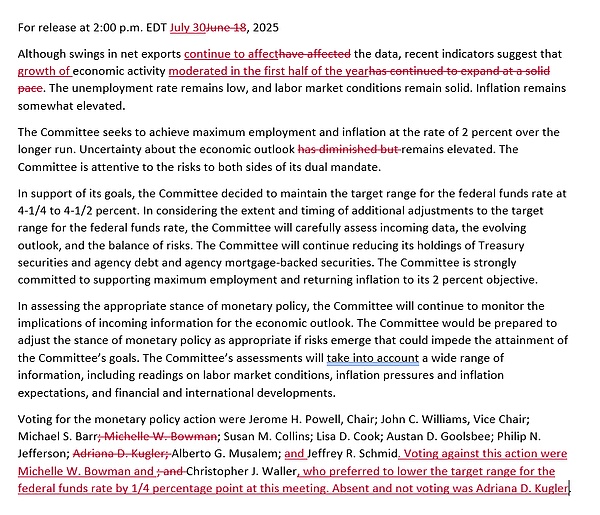

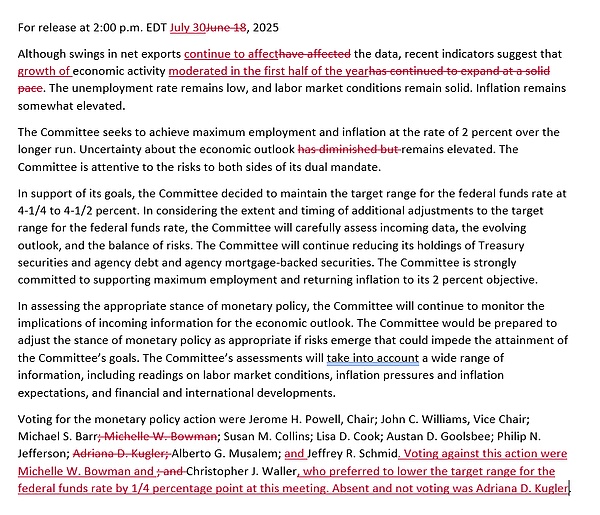

Among the FOMC voting members, Powell and nine others continued to support standing pat, while Waller and Bowman advocated a 25 basis point rate cut. Compared to the previous statement, this one removed the reference to reduced economic uncertainty and reiterated that uncertainty remains high. It no longer stated that "economic activity continued to expand robustly," instead stating that "economic growth moderated in the first half of the year." New Fed News Agency: The "rare" dissenting opinion, demanding an immediate rate cut, highlights the fraying consensus among Fed policymakers on the impact of tariffs. Economists believe this statement was more dovish than expected, increasing the likelihood of a September rate cut. It is expected that the PCE and non-farm payroll data to be released this week may exacerbate divisions within the Fed. Powell did not provide guidance on a September rate cut, saying it was too early to say whether the Fed would cut the federal funds rate in September as the financial market expected, cooling market expectations for a September rate cut. Despite US President Trump's recent first personal visit to urge a rate cut, and repeated pressure from Trump administration officials and Republicans using the "renovation scandal" to exert pressure, the Federal Reserve remained unmoved. However, this time, the Federal Reserve exposed its biggest internal disagreement on rate cuts since the start of the rate cut cycle in September last year, and adjusted its statement on economic activity in a dovish tone. On Wednesday, July 30th, Eastern Time, the Federal Reserve announced after its FOMC meeting that the target range for the federal funds rate remained at 4.25% to 4.5%. This marks the fifth consecutive FOMC meeting in which the FOMC has paused its monetary policy action. The Fed has cut interest rates three times since September of last year, by a total of 100 basis points, and has remained on hold since Trump took office in January of this year. The decision at this meeting was fully expected by investors. By Tuesday's close, CME Group tools showed that the futures market was pricing in a nearly 98% probability of the Fed keeping interest rates unchanged this week and a nearly 65% probability of a rate cut at its next meeting in September. Before the Federal Reserve announced its decision on Wednesday, even U.S. Treasury Secretary Bensonte and Trump himself predicted that the Fed would not cut interest rates this time. The Fed's internal divisions became a more compelling factor than the rate cut. Two Fed officials supported a rate cut at this meeting. This was the highest number of dissenters in an FOMC rate decision since the Fed began its rate-cutting cycle ten months ago. Nick Timiraos, a reporter known as the "New Fed News Agency," commented that this was a "rare" moment in which two officials dissented from maintaining interest rates and demanded an immediate rate cut. These dissenting opinions highlight the fraying consensus among Fed policymakers when discussing the impact of tariffs on the economy and inflation. Anna Wong, chief U.S. economist at Bloomberg Economics, believes this marks the first time since 1993 that two Fed governors have dissented from a resolution. This internal division stands out, and perhaps as a compromise, the policy statement was more dovish than the institute had expected, noting that economic growth slowed in the first half of this year. Wong predicts that the U.S. core PCE inflation data for June, released on Thursday, and the non-farm payroll data for July, released on Friday, may further exacerbate divisions within the FOMC. Bloomberg Economics believes that most FOMC members won't have sufficient confidence that inflation is moving in the right direction until the end of the year, but this dovish statement suggests a growing likelihood of a September rate cut. Notably, Powell offered no guidance on a September rate cut at the FOMC press conference, stating it was too early to say whether the Fed would lower the federal funds rate in September, as financial markets expect. He said the U.S. labor market "appears solid," while inflation remains above target. Traders interpreted these comments as discouraging an immediate rate cut. US stocks erased gains, with the S&P 500 index falling 0.1%. While the declines in stocks and bonds appear relatively mild, this marked the worst Federal Reserve policy-day performance since December. For the first time in 32 years, two board members dissented. The Fed's statement largely mirrored the previous FOMC statement in June. There were three main changes, the most notable of which was that two of the 11 members voting at this FOMC meeting dissented from the decision to pause rate cuts. This was the highest number of dissenting votes since the Fed paused its interest rate cuts this year. The statement showed that nine FOMC members, including Fed Chairman Powell, voted to keep interest rates unchanged. The two dissenters were Fed Governor Waller and Trump's nominee for Vice Chairman of the Federal Reserve for Financial Supervision, Bowman. Both advocated for a 25 basis point rate cut at this meeting. Waller and Bowman's dissenting votes were not unexpected. Since the Fed's June meeting over a month ago, Waller has publicly called for a rate cut in July several times, and Bowman also stated earlier this month that he was prepared to cut rates as early as July. Timiraos noted that Bowman's opposition marked a significant shift, as he had been a leading advocate of tighter monetary policy in recent years and opposed the Fed's rate cuts when they began last September. Timiraos suggested that Waller's support for rate cuts appeared to be an attempt to secure Trump's nomination as the next Fed chair, as he expressed support for rate cuts two weeks ago, coinciding with the primary election for the next Fed chair. This month, Waller expressed concern that interest rates were too high for an economy lacking inflationary momentum, a view shared by some economists and former Fed officials. The other two changes in the Fed's decision are both related to the economy. One of them is the statement about the uncertainty of the economic outlook.

The June last statement said that “uncertainty about the economic outlook has diminished, but remains elevated.”

“Uncertainty regarding the economic outlook remains elevated.”

Immediately following this sentence, the statement reiterated that the FOMC is focused on the two risks to achieving its dual mandate of maximum employment and price stability.

Another change was in the comments on economic activity.

“Although fluctuations in net exports have affected the data, recent indicators suggest that economic activity continued to expand at a solid pace.”

“Although fluctuations in net exports have affected the data, recent indicators suggest that economic growth in the first half of the year continued at a moderate pace.”

Other economic comments reiterated that the U.S. unemployment rate remains low, the labor market is solid, and inflation remains elevated. Nationwide's chief economist, Kathy Bostjancic, commented that she was surprised to see the Fed statement remove language that had previously suggested uncertainty in the economic outlook had diminished, stating instead that uncertainty remained high. While uncertainty remains high, it has been significantly reduced given the increasing clarity on trade and tariffs. Furthermore, the statement reiterated that the Fed will continue to reduce its holdings of U.S. Treasury bonds, agency bonds, and agency mortgage-backed securities (MBS). Starting in April of this year, the Federal Reserve further slowed the pace of its quantitative tightening (QT) program, reducing its balance sheet. Specifically, it lowered the monthly redemption limit on U.S. Treasury securities from $25 billion to $5 billion, while maintaining the $35 billion monthly redemption limit on agency debt and agency mortgage-backed securities. Since then, the Fed has maintained its guidance for balance sheet reduction for three consecutive meetings, indicating that the Fed continues to maintain the above-mentioned pace. The red text below indicates the deletions and additions to this resolution statement compared to the previous one.

Powell gave no guidance on September rate cut

Federal Reserve Chairman Powell did not give any guidance on the September rate cut at the press conference after the FOMC meeting, saying it was too early to assert whether the Fed would lower the federal funds rate in September as expected by the financial market, cooling market expectations for a September rate cut. Powell believes that the impact of current policy changes remains uncertain, and the current reasonable basic assumption is that the impact of tariffs on inflation will be short-term, but it may also make the inflation effect more stubborn. Specifically, Powell said that due to the impact of tariff-related news, some indicators measuring inflation expectations have risen overall recently, both market-based and survey-based expectations. However, in the longer term, most inflation expectation indicators remain consistent with the Fed's 2% target. Powell said that the Fed will continue to determine the appropriate stance of monetary policy based on the latest data, changes in the economic outlook, and the balance of various risks.

Government policy changes continue, and their impact on the economy is unclear. Higher tariffs have become more evident in the prices of some goods, but the full impact of these tariffs on overall economic activity and inflation remains to be seen.

A reasonable baseline expectation is that the impact of tariffs on inflation is likely to be one-off, resulting in a short-term increase in the price level. However, there is also the possibility that these inflationary effects will be persistent, a risk that requires close assessment and management. Powell also pointed out that the Fed is ready to further understand the economic trends and changes in various risks before adjusting its policy stance. The large amount of data in the coming months will allow the Fed to assess the balance of risks and determine the appropriate level of the federal funds rate.

Joy

Joy