Author: Bitcoin Magazine Pro; Compiler: Vernacular Blockchain

Bitcoin's recent sharp drop has triggered widespread panic in the market. With prices falling below the $50,000 mark, market sentiment has tilted sharply toward fear, and for many investors, is in a state of capitulation. However, is now really the time to panic? Or could this be a golden opportunity to buy more Bitcoin at a discount?

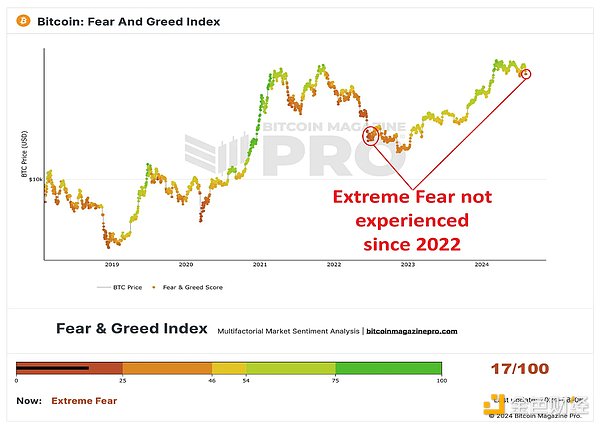

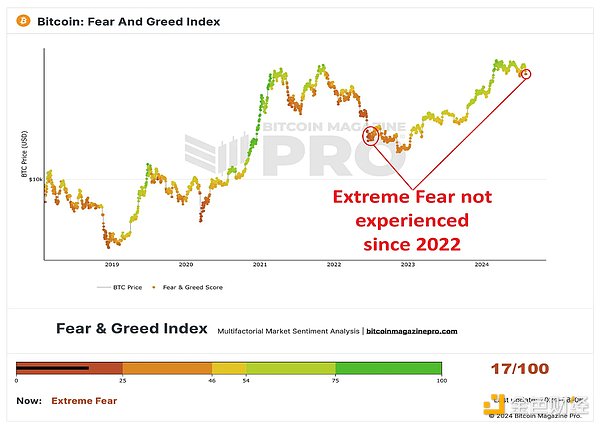

1. Market Sentiment and Fear and Greed Index

Bitcoin's Fear and Greed Index, a tool that measures the sentiment and emotions driving the Bitcoin market, has fallen to levels not seen since July 2022. It recently fell to a low of 17, marking "extreme fear." This shows that investors are very anxious, and many are wondering if the market will continue to fall. Historically, this extreme fear has often been a contrarian indicator, suggesting that now may be a good time to consider accumulation rather than distribution.

The recent downward move caught many traders off guard, especially since Bitcoin had been experiencing positive price action before, approaching $70,000 only a few days before the drop. This sudden reversal left investors unprepared and they adjusted their positions.

Figure 1: Extreme fear in the Bitcoin market, with sentiment reaching its lowest level in two years.

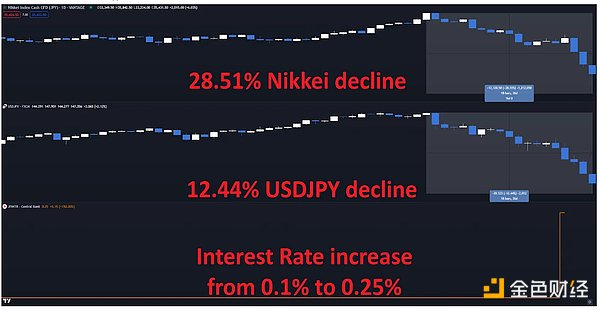

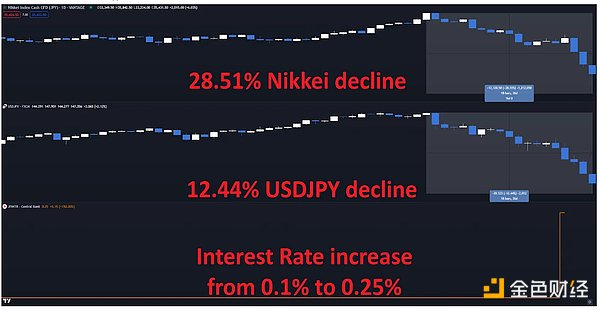

2. Yen carry trade and its impact

A key factor that led to the recent market decline was the unwinding of the yen carry trade. This strategy involves borrowing yen at low interest rates and investing in higher-yielding assets abroad, particularly U.S. stocks. However, as interest rates in Japan unexpectedly rose, many investors were forced to unwind their positions, setting off a chain reaction in global markets.

The sharp rise in interest rates in Japan caused the Nikkei 225 (Japanese stock market index) to fall sharply, and the U.S. dollar to depreciate sharply against the yen. This had a knock-on effect on other global markets, including Bitcoin, which fell sharply as investors rushed to repay their borrowings and cover their losses.

Figure 2: The Nikkei fell sharply as the yen strengthened due to the recent rise in interest rates.

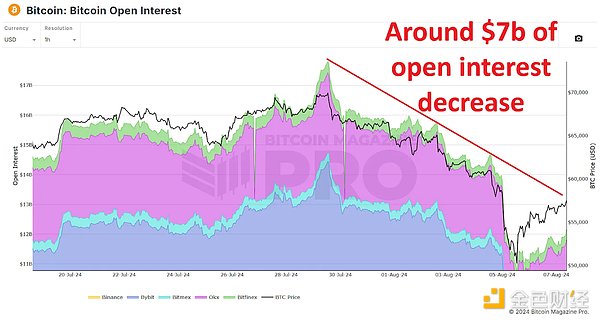

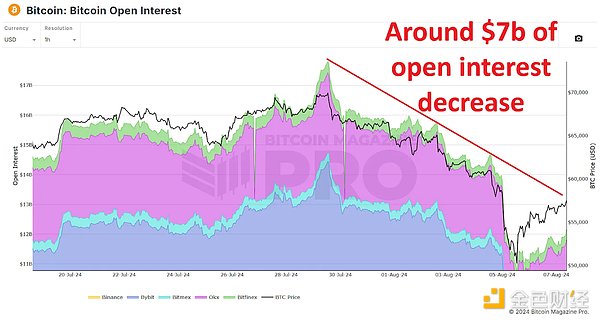

3. The impact of derivatives and deleveraging

The Bitcoin market has also experienced a massive deleveraging, especially in the derivatives market. The total open interest of Bitcoin futures, which represents the total number of open derivatives contracts, fell sharply from nearly $18 billion to less than $11 billion in just a few days. This drastic reduction indicates a large-scale deleveraging of positions, which may have exacerbated the market sell-off.

While this deleveraging may seem worrying, it is important to consider it in a broader context. Such events, while painful in the short term, can actually help build a healthier market in the long run by clearing out excessive leverage and speculation.

Figure 3: Open interest is cleared as long Bitcoin positions are liquidated.

4. Funding Rate

After a sharp drop, the funding rate for Bitcoin futures contracts turned negative, indicating that traders now expect further price declines. However, history shows that when the market is mostly positioned in one direction, especially when that direction is driven by extreme sentiment, reversals often occur. The last time the funding rate reached this negative, Bitcoin was trading at $29,000 and then quickly rose to a record high.

Figure 4: Traders are actively shorting Bitcoin in an attempt to cover their losses.

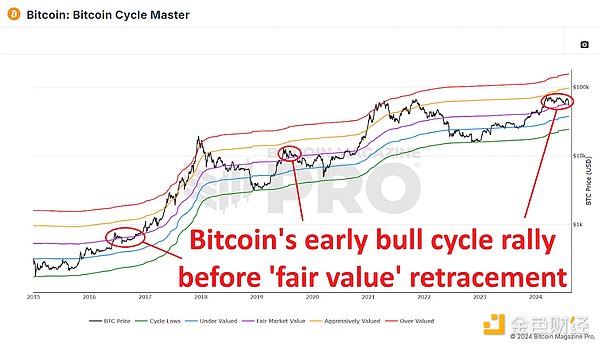

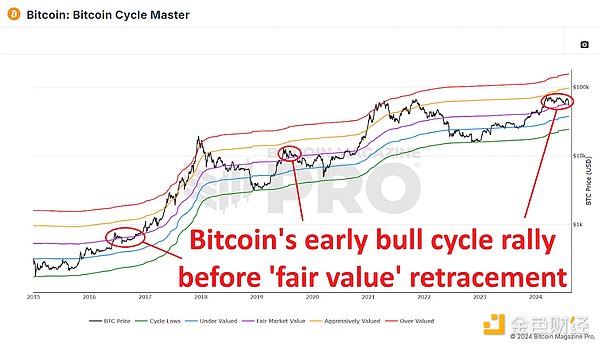

5. Is it a temporary setback or a long-term concern?

Despite the recent decline, there are several reasons to remain optimistic about Bitcoin's long-term prospects. The recent price volatility can be viewed as a natural correction within the broader bull cycle. When we take a longer-term view of Bitcoin's historical performance, such corrections are not uncommon. In previous cycles, Bitcoin often fell below its cycle-dominant fair market value before resuming its upward trajectory.

Figure 5: Bitcoin retracement to typical points at this stage in the bull cycle.

6. Conclusion

The recent retracement may be a quick and painful reminder of market volatility, but it does not necessarily mean a reversal of the long-term trend. Instead, it may be just a temporary pullback, a black swan event that, while unexpected, does not fundamentally change the long-term outlook for Bitcoin.

For those who hold a long-term perspective, this may be an opportunity to accumulate more Bitcoin while the price is lower. While it is unlikely that the market will immediately rebound to new all-time highs, the fundamental drivers behind Bitcoin's value remain strong. As the market digests recent events, a recovery may be imminent.

Xu Lin

Xu Lin