Written by: 1912212.eth, Foresight News

Recently, the overall market has been volatile and declining, and the MEME craze seems to have gradually subsided, but the meme coin TST on BNB Chain has suddenly become popular.

On February 6, the market value of TST was only US$500,000. On February 9, Binance announced its launch, and TST immediately soared to a market value of US$500 million, rising more than 100 times in 3 days. At present, TST has fallen from its highest point of US$0.52 to around US$0.17, with a retracement of more than 60%.

Originated from an educational video

Recently, the BNB Chain team produced a video tutorial on posting memes on the Four.meme platform, using the token TST as an example for demonstration. This detail was discovered and promoted by savvy Chinese community KOLs, and soon ushered in a significant increase.

The BNB Chain team quickly deleted the private key of the creator's address (holding 0.13% of the total amount of the token) after learning about the hype, and no one in the team or Binance itself holds the token. Zhao Changpeng also kept clarifying on Twitter that it had nothing to do with himself and the team. Perhaps due to its "decentralized" characteristics, the statement did not cause the price of TST to fall. Instead, it ushered in a climax of speculation again due to its popularity and volume.

However, just after it was officially launched on Binance, TST did not get out of the curse of "landing on Binance means falling", and soon fell all the way. Another BNB Chain ecological meme CHEEMS that was launched with it also could not escape the bad luck, falling from a high of $0.001884 to $0.0007.

After TST was launched on Binance, smart whales chose to take profits. However, as the new coins launched on Binance ushered in a sharp drop again, the crypto community once again questioned Binance's listing level and whether the BNB Chain ecosystem could gain momentum.

Wealth effect is weak, and the community refuses to pay for BSC

As the leading exchange in the crypto industry, Binance has won the market's applause in the past cycles with its strong wealth effect and listing effect. Now that the times have changed, VC coins on exchanges are no longer favored by the market and are generally facing a survival crisis. On the contrary, meme coins on the chain have become a wealth sanctuary that users are eager to buy.

This phenomenon has caused the altcoins on exchanges to generally rise weakly, but fall fiercely. In addition to mainstream currencies, most altcoins have experienced huge corrections in the past two months. Meme coins also ushered in a period of decline after Trump concept coins.

Binance is caught in a dilemma in its spot strategy. Tokens with higher market value often have low returns, while those with smaller market value have too high risks. Huge fluctuations may cause many investors to suffer heavy losses. In addition, since its global expansion, Binance has also been plagued by compliance issues, which have affected the advancement of many businesses.

He Yi once said that Binance has a complex listing review process, but the TST that was immediately launched this time landed on Binance within just a few days of its birth, causing some community members to question whether Binance really has a detailed review? Or is it to choose the fast track to support the BNB Chain ecosystem.

The BNB Chain that cannot be helped

Since CZ was released from prison last year, he is no longer allowed to participate in Binance's daily operations according to legal provisions. As an influential figure in the industry, the scope of his involvement is still quite wide. For example, in terms of investment business and its public chain ecology, Binance Labs has officially changed its name to YZi Labs and transformed into a large family office. Its investment scope has expanded from cryptocurrency to AI and biotechnology. In its official announcement, it stated that CZ will continue to play a key role in home investment activities, directly contacting entrepreneurs and providing guidance.

In addition, the ecological progress on BNB Chain has also attracted CZ's attention. Recently, Binance Labs invested in its ecological re-staking Kernel and DEX project THENA. The re-staking craze has never been set off again, and the price trend of THE currency shows that the community has not bought it. The price of the currency has fallen from a high of US$4.18 to US$0.47. Another ecological project, CAKE, has recently fallen to around US$1.6, not far from the historical low of US$1.05.

Behind the crisis, BNB Chain launched an AI proxy solution this year and introduced the meme startup platform Four.meme to GMGN, trying to catch the wave of memes and AI agents. The embarrassment is that it was slow to react and encountered a big market downturn.

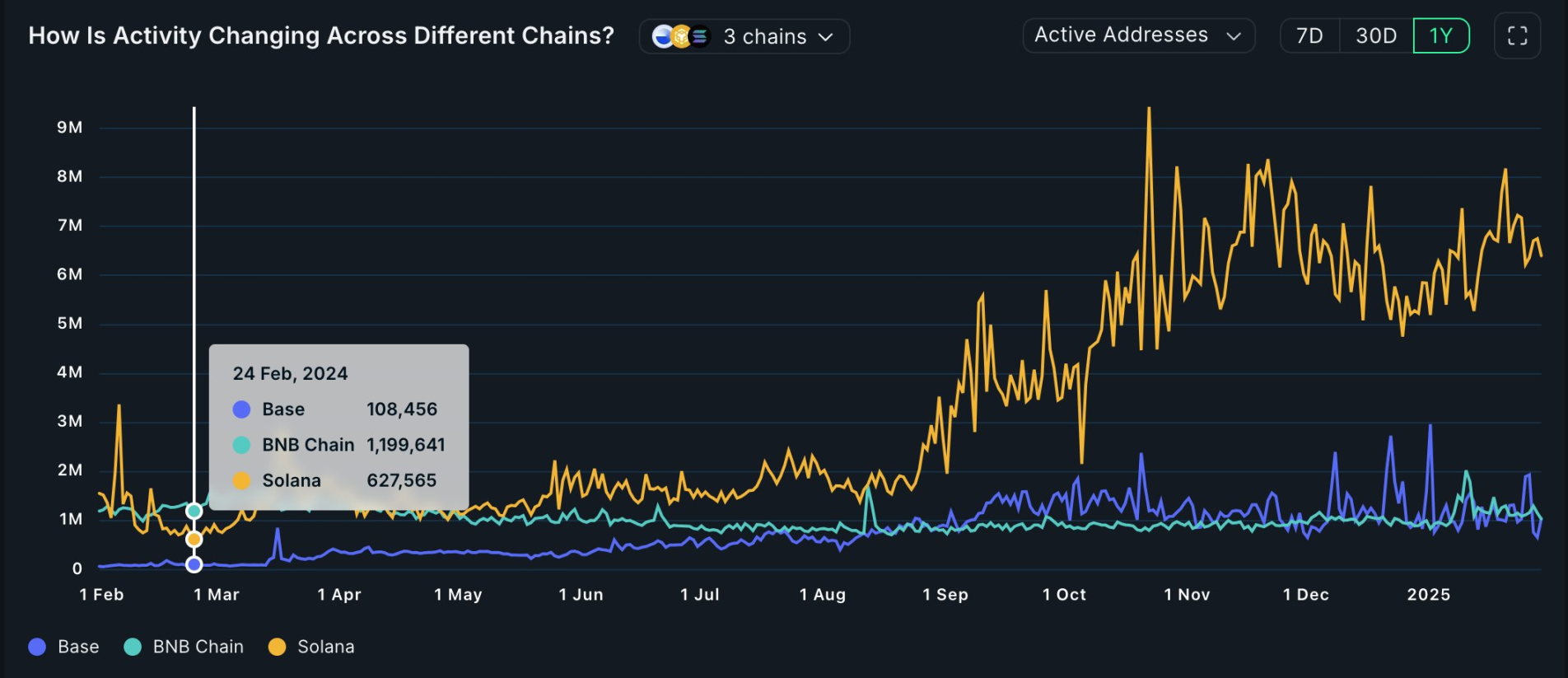

BNB Chain performed well in the previous cycle, but this cycle performed mediocrely, and it can even be said that it was left far behind. Ecosystem projects performed mediocrely, and the meme ecosystem did not improve. Compared with Solana and Base chain, the trend is obviously declining. As of January 30 this year, the number of daily active addresses of the Solana network is 6 times that of BNB Chain. Even the number of daily active addresses of L2 rookie Base has surpassed BNB Chain. About a year ago, the number of daily active addresses of BNB Chain was twice that of Solana.

The ecosystem is sluggish, the wealth effect is lacking, and CZ, as the face of the industry, can no longer sit still.

On February 7, CZ initiated a vote on "Should BNB Chain try to eliminate or actively reduce the MEV problem" and said, "I hate any type of front-running, and MEV is like that to me. In a decentralized world, no one can completely prevent it. But there are ways to reduce it."

CZ then responded to and retweeted TST-related issues and expressed his opinions on Twitter many times. The popularity of TST soared rapidly in a short period of time, and some smart addresses that bought in early made huge profits.

Following the meme, CZ also specifically talked about the issue of coin listing that the community is more concerned about. "As an observer, I think there are some problems with Binance's coin listing process. The platform first releases an announcement and then goes online 4 hours later. Although the notice period is necessary, during these 4 hours, the token price will be pushed up on DEX, and then someone will sell it on CEX."

In this regard, community members suggested that CEX could take measures such as simultaneously providing initial liquidity, incentivizing liquidity plans, and connecting with DEX liquidity pools to optimize the coin listing process. In response to netizens’ suggestions, CZ said, “I think CEX should automatically list (almost) all tokens like DEX, but I am no longer responsible for operating CEX.

Conclusion

If CEX really automatically lists almost all tokens like DEX, the CEX product positioning, listing effect, etc. involved will be questioned. CZ has recently tweeted frequently about BNB Chain and listing issues, of course, in response to community concerns, but judging from the performance of some representatives, the results are minimal.

Perhaps the root of the problem is far more than Binance itself, but involves more deep-seated problems in the entire crypto industry: crypto nihilism, one meme after another, lack of industry innovation, and selling coins as the main business of the project party...

Alex

Alex

Alex

Alex Alex

Alex Kikyo

Kikyo Alex

Alex Joy

Joy Alex

Alex Alex

Alex Joy

Joy Alex

Alex Joy

Joy