Introduction

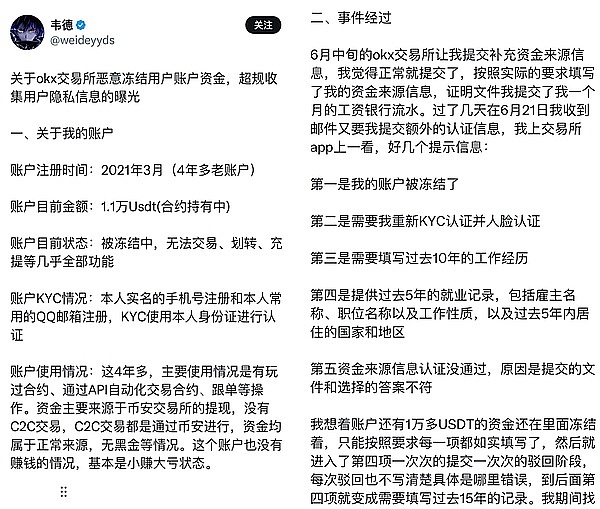

Recently, some users posted on social media that their OUYI accounts were frozen, withdrawals were restricted, or even blocked. When users apply for unblocking, the exchange requires users to provide proof of "source of income" and other evidence.

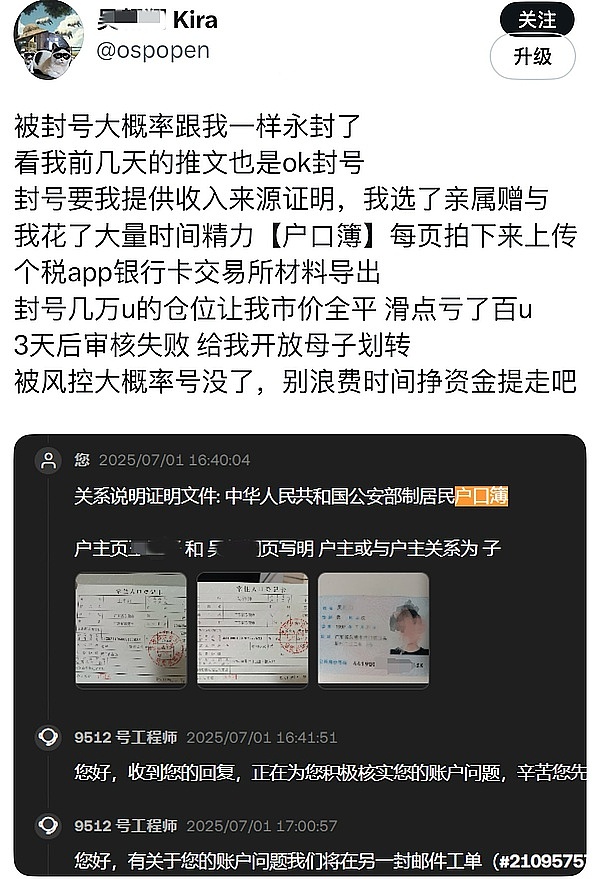

Some users also posted their experiences on OUYI in the comment section, speculating that the blogger may have been permanently blocked, and said that they spent a lot of energy to solve the problem of account unfreezing, but ultimately failed the review.

As a web3 lawyer, Lawyer Liu will try to make a legal analysis of this incident and the fund security issues encountered by mainland residents when using all centralized exchanges from an objective and neutral perspective, and deeply interpret the real risks faced by mainland Chinese residents in the field of virtual currency.

1. How did the exchange respond?

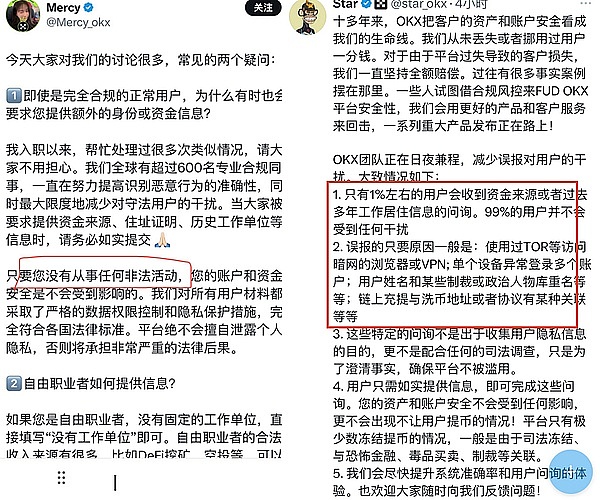

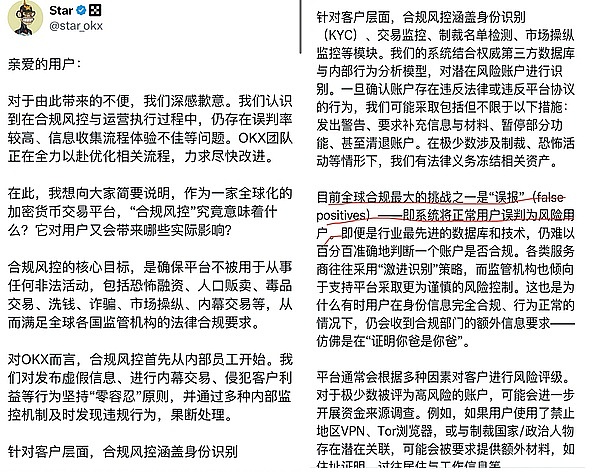

The Euro-Italian Exchange also made a timely public response to the online public opinion. For example, Mercy, an employee of OuYi, said that fully compliant and normal users may be accidentally injured when encountering the system's "identification of malicious behavior", so OuYi is improving the accuracy of identifying malicious behavior; at the same time, the employee said, "As long as you are not engaged in any illegal activities, the security of your account and funds will not be affected." OuYi's CEO Xu Mingxing wrote that due to false alarms, about 1% of users will receive "inquiries about the source of funds or past work and residence information"; the main reasons for false alarms are users using VPN access, using TOR browsers to access the dark web, abnormal logins to multiple accounts on a single device, and user names that are the same as those of certain sanctioned or political figures.

Later, the CEO of OuYi issued another statement, expressing his apologies to the users and explaining the significance and impact of "compliance risk control" of virtual currency exchanges, but also clarified the following:

"Once it is confirmed that an account has violated the law or the platform agreement, we (OuYi) may take measures including but not limited to the following:

Issuing warnings, requesting additional information and materials, suspending some functions, or even clearing accounts. In rare cases involving sanctions, terrorist activities, etc., we have a legal obligation to freeze relevant assets."

At the same time, it also explained the "false positives" (False Positives, that is, the system misjudged normal users as risky users).

Second, the legal risks of Chinese residents using overseas virtual currency exchanges

Some time ago, it was rumored that Ouyi was going to conduct an IPO on the US stock market, although the truth of this news cannot be fully determined at present. But if it is true, then it seems easy to understand that Ouyi has a strict KYC policy.

Of course, it is also possible that the IPO is false news. Then we need to interpret and analyze from a higher level the legal risks of mainland Chinese users registering virtual currency exchanges, especially those engaging in currency speculation.

There are many virtual currency regulatory policies currently applicable to mainland China (see: "Summary of Regulatory Documents on Web3.0 Industry in Mainland China"). Among them, after the "9.4 Announcement" in 2017 "drove mainland virtual currency exchanges out of the sea", the most powerful one at present is the "9.24 Notice" ("Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation").

The “9.24 Notice” systematically and comprehensively regulates the business operations of overseas virtual currency exchanges:

(i) Overseas virtual currency exchanges providing services to residents in my country through the Internet constitute illegal financial activities;

(ii) Domestic staff of overseas virtual currency exchanges, as well as legal persons, non-legal persons and natural persons who know or should know that they are engaged in virtual currency-related businesses and still provide them with marketing, payment settlement, technical support and other services, shall be held accountable in accordance with the law.

That is to say, from the perspective of regulators in mainland China, the services provided by overseas virtual currency exchanges to mainland residents are all illegal financial activities. However, since the law enforcement agencies in mainland China do not have extraterritorial law enforcement powers, there is no way to force overseas virtual currency exchanges to shut down their servers, or even to provide services to mainland residents through the Internet;

From the perspective of mainland residents, there are currently no regulations prohibiting them from using overseas virtual currency exchanges. The "9.24 Notice" only prohibits exchanges from operating in mainland China, but does not prohibit mainland residents from using exchanges.

Therefore, the current situation is that even if exchanges know that mainland China prohibits exchanges from operating, because the size of mainland China is really too large, no one will give up this big market, so exchanges will continue to provide services to the mainland. Users registered in the mainland can pass KYC even if they use a "+86" phone number, a mainland resident ID card or a Chinese passport to register.

Of course, for licensed exchanges in Hong Kong (such as OSL, HashKey, etc.) and exchanges in other countries (such as Coinbase in the United States, and even Kraken, etc.), according to China's regulatory policies, people with mainland identities, residences, and work are not supported to open accounts.

Therefore, the risk for mainland Chinese residents is that even if you can use virtual currency exchanges such as Binance and Oui normally, you need to know that according to the regulatory provisions of mainland China, the services provided by exchanges to mainland residents are illegal financial activities. Some friends may have questions, so why haven't I been "in trouble"? Don't worry, let's take a look at the analysis below by Lawyer Liu.

Third, what enlightenment can we get from the bankruptcy case of FTX Exchange to the Oui incident?

On July 4, there was an opinion in the bankruptcy plan for FTX Exchange: if the user belongs to a restricted foreign jurisdiction, the claim funds may be confiscated. Of all the funds involved in the case from "restricted countries", 82% came from China.

That is to say, if your own country does not protect virtual currency investment, it is a bit wishful thinking to expect other countries or exchanges to protect it. Therefore, web3 nomads in mainland China, especially those who play with coins, are really "Asian orphans in the coin circle".

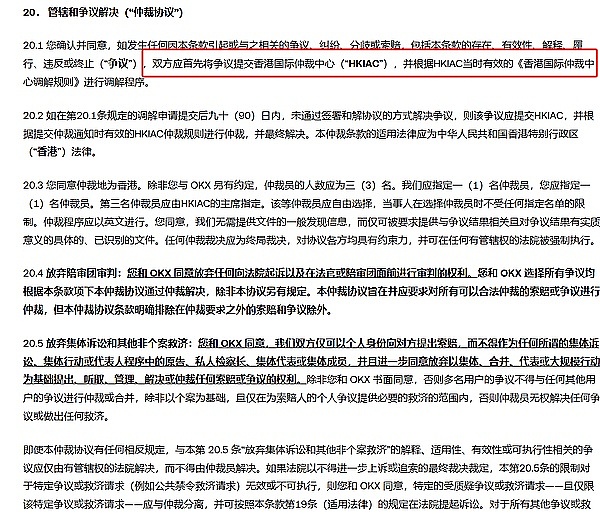

Finally, Lawyer Liu would like to say that for mainland Chinese resident users of centralized exchanges, if their accounts are frozen, it is difficult to have other means to "harden" except to cooperate with the exchange to unfreeze according to the requirements of the exchange. According to the agreement on the place of jurisdiction for legal disputes on the official website of OuYi, if you want to "sue" OuYi, you need to go to the Hong Kong International Arbitration Center, which is too costly for many ordinary users (travel, lost work time, lawyer fees, etc.)

(Source: OuYi official website)

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Davin

Davin Hui Xin

Hui Xin Jasper

Jasper Jixu

Jixu Davin

Davin Joy

Joy