Author: Sam @IOSG

TL;DR:

Take the Stablecoin Bill as an introduction, introduce the recent public attention and discussion on RWA, and then start talking about RWA on Ethereum

Data Analysis (zksync can be a highlight)

What impact will the emergence of Etherealize have on Ethereum

Ethereum's stablecoin issuance and DeFi It has always had a strong moat. Combined with the new US policy, can RWA organically link traditional finance and DeFi? As the most trusted and decentralized blockchain, we continue to be optimistic about Ethereum's point.

Bill Catalysis and Market Attention

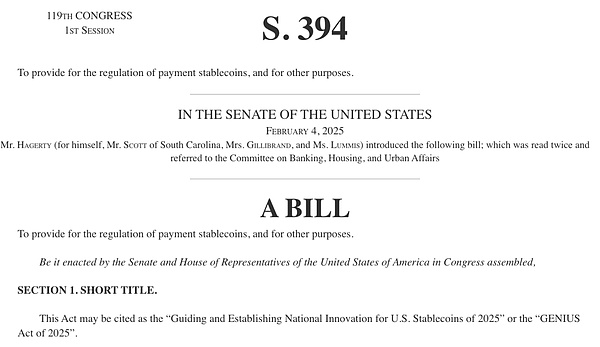

Against the backdrop of the rapid evolution of traditional finance and the regulatory environment, the recent passage of the GENIUS Act has reignited the market's interest in RWA. In addition to stablecoins and major legislative developments, the RWA space has quietly reached a number of important milestones: continued strong growth and a series of notable breakthroughs, such as Kraken's launch of tokenized stocks and ETFs, Robinhood's proposal to the SEC to give token assets the same status as traditional assets, and Centrifuge's issuance of a $400 million decentralized JTRSY fund on Solana.

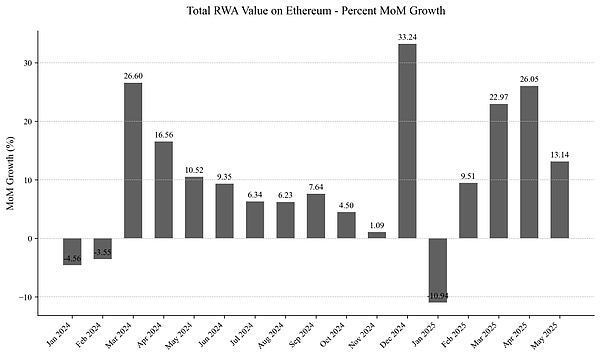

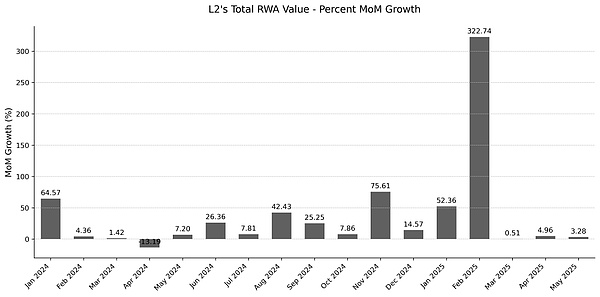

With market attention at an all-time high and wider adoption of traditional finance just around the corner, it is important to take a closer look at the current RWA landscape, especially the position of leading platforms such as Ethereum. Ethereum-based RWAs have shown amazing month-on-month growth, often maintaining high double-digit growth; 2025 growth is faster than the single-digit months in 2024. Another key factor driving this momentum is "Etherealize" as a catalyst for regulatory development and the Ethereum Foundation's listing of RWAs as a strategic priority. At this critical juncture, this article will delve into the development of RWA on Ethereum and its Layer-2 network.

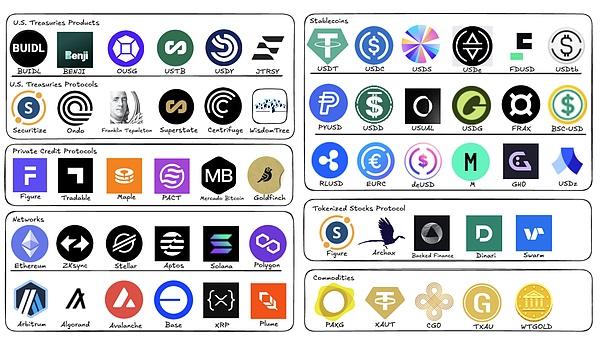

RWA Ecosystem Map, IOSG

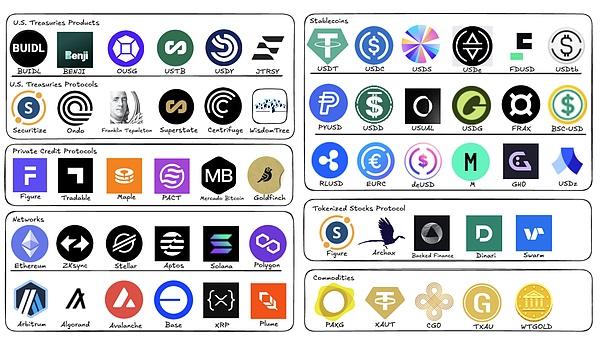

Data Analysis: Panorama of Ethereum RWA Growth

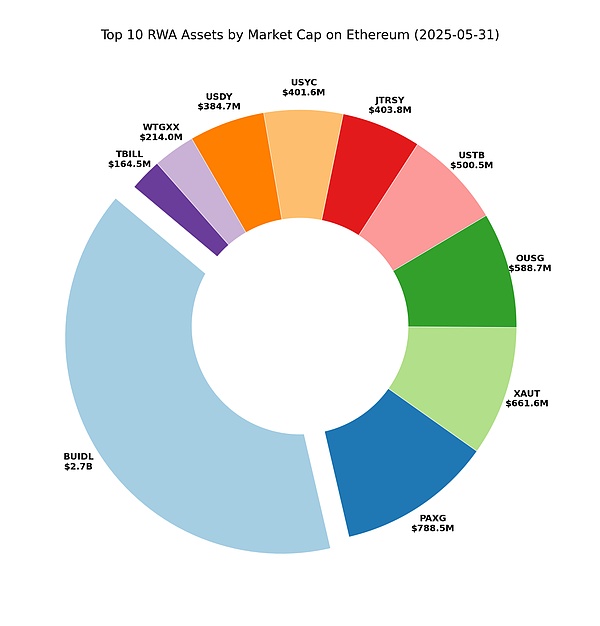

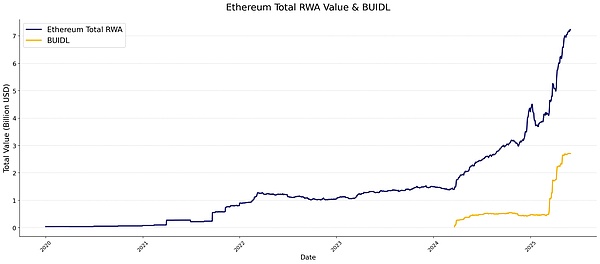

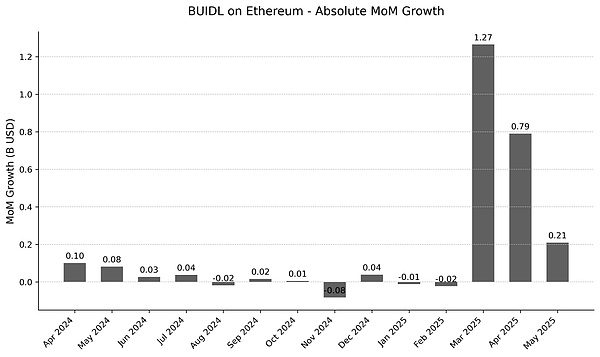

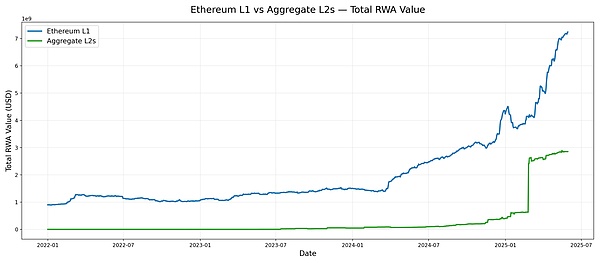

The data clearly shows that the value of Ethereum's RWA has entered a clear growth cycle. Looking at the total value of Ethereum's non-stablecoin RWA, its long-term trajectory is striking - it has remained in the $1-2 billion range for many years until it entered a rapid growth phase in April 2024. This growth momentum continues to accelerate in 2025. The core driving force comes from BlackRock's BUIDL fund, which currently has a size of $2.7 billion. As shown by the orange trend line, BUIDL has shown parabolic growth since March 2025, strongly promoting the overall expansion of the Ethereum RWA ecosystem.

RWA.xyz, IOSG

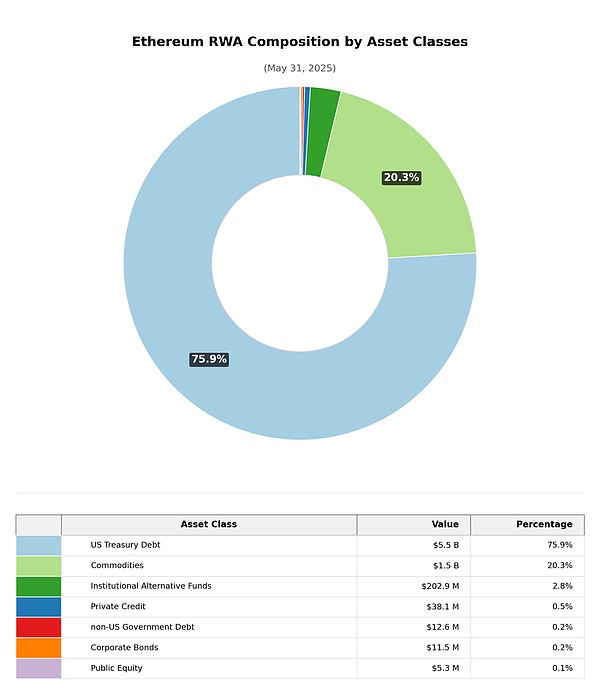

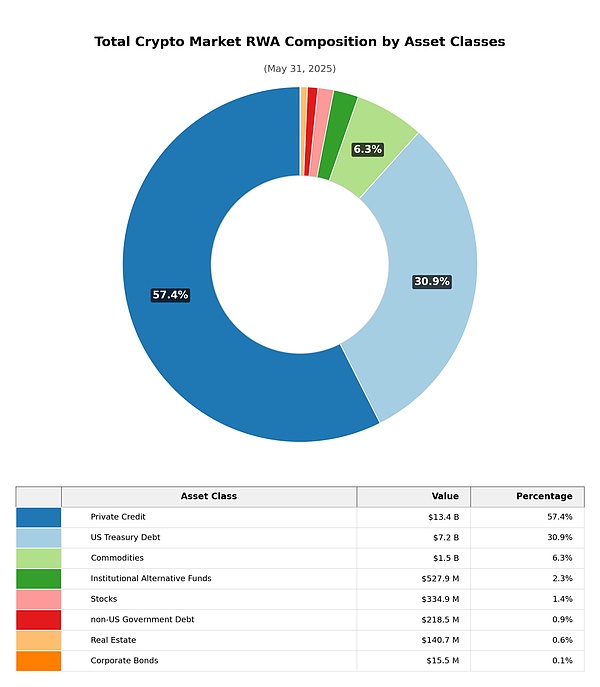

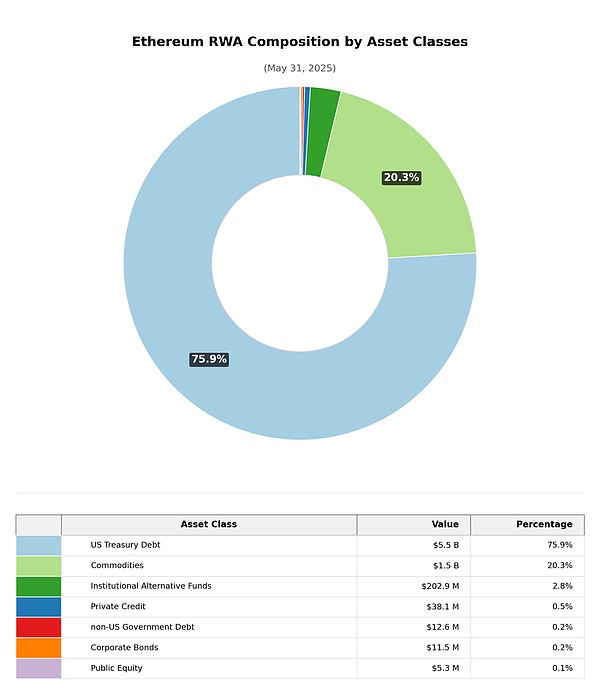

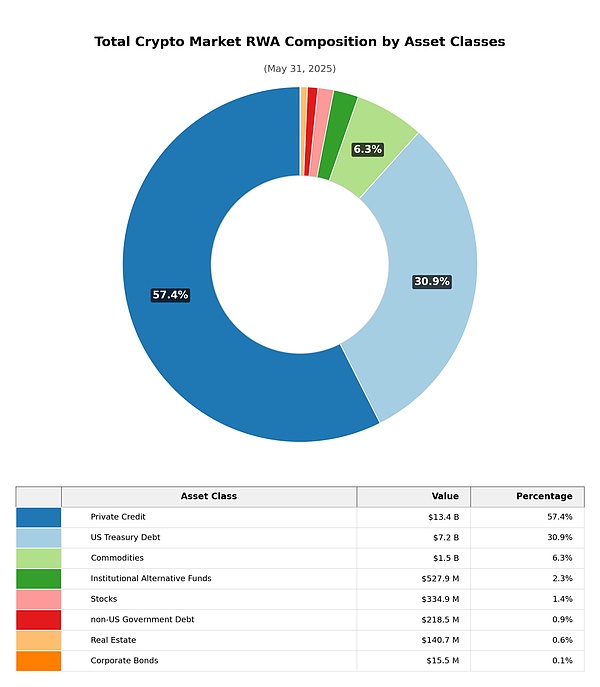

By asset class (excluding stablecoins), the market value of real world assets (RWA) on Ethereum is highly concentrated in two main categories: treasury projects (75.9%) and commodities (mainly gold, 20.3%), with other categories accounting for a small proportion. In contrast, in the RWA market value composition of the entire crypto market, private credit accounts for the highest proportion (57.4%), followed by treasury projects (30.9%).

RWA.xyz, IOSG

RWA.xyz, IOSG

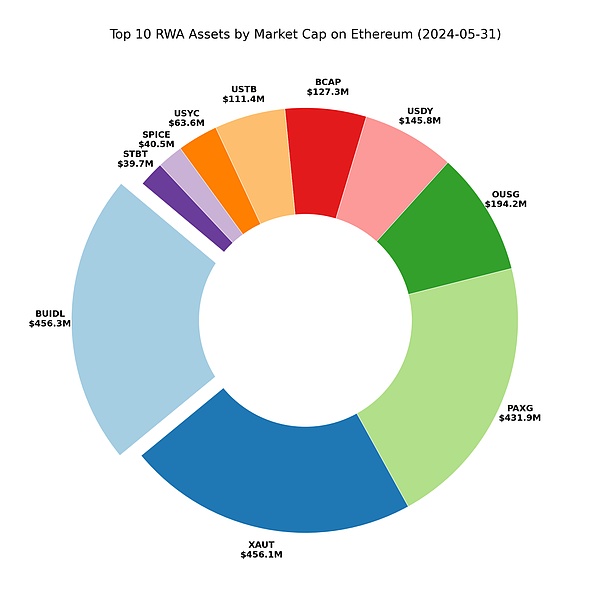

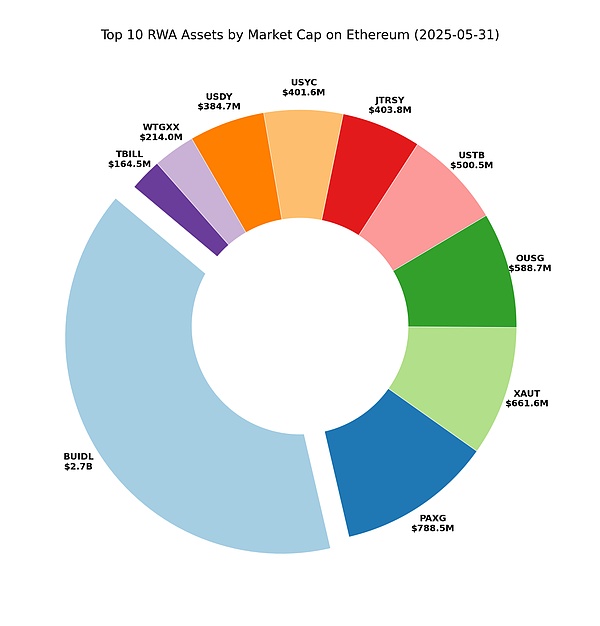

Further focusing on Ethereum RWA head assets, the pie chart clearly reveals the dominance of BUIDL. Looking back a year ago, it can be seen that at that time, the scale of BUIDL was comparable to that of PAXG, XAUT and other products, but now it has significantly surpassed them. Although the composition of the top ten projects is basically stable, the growth rate of treasury products is significantly ahead of gold products, and the market share continues to expand.

RWA.xyz, IOSG

RWA.xyz, IOSG

From the perspective of protocols, the current leaders are mainly stablecoin issuers - the top four protocols are Tether, Circle, MakerDAO (Dai stablecoin system) and Ethena. It is worth noting that the total value of the securitization protocol Securitize has significantly surpassed some stablecoin projects such as FDUSD and USDC, and has jumped to the forefront. Other securities protocols that have made it into the top ten include Ondo and Superstate.

RWA.xyz, IOSG

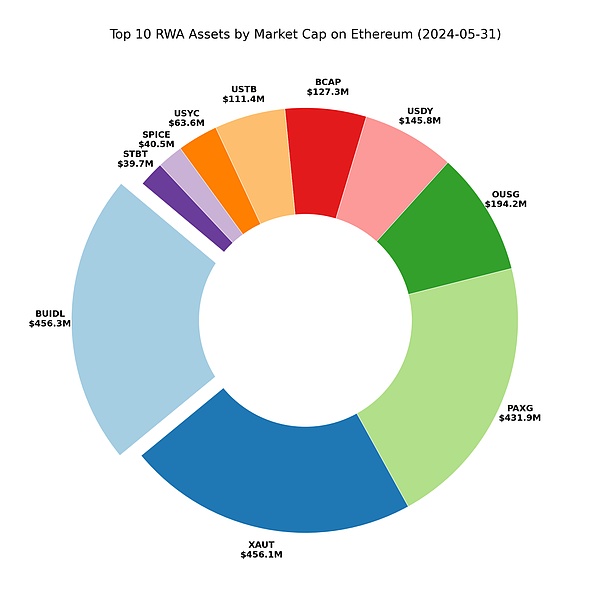

Focusing on the monthly data from the beginning of 2024 to date, the growth wave began in April 2024, with an astonishing increase of 26.6% that month - contributing a quarter of the total increase in Ethereum RWA in a single month. This momentum continued into the next three months. Although it slowed down slightly from August to December 2024, the network still maintained an increase of about $200 million per month (a month-on-month growth rate of about 5%, an annualized rate of over 60%).

In January 2025, the growth rate exploded again, soaring 33.2% month-on-month. After a brief correction in February, Ethereum maintained double-digit growth for four consecutive months, with month-on-month growth rates in April and May exceeding 20%.

RWA.xyz, IOSG

BUIDL

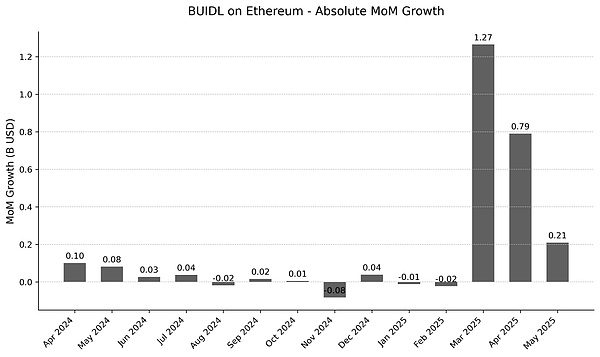

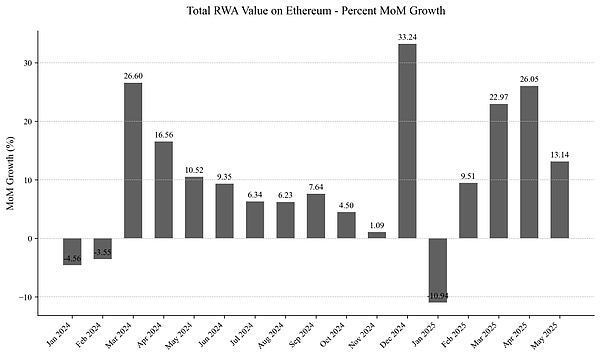

With BUIDL rapidly emerging as the largest project in the Ethereum RWA ecosystem, a careful analysis of its growth path is critical. The month-on-month growth chart reveals that the indicator remained relatively stable until March 2025, and then exploded in March 2025. However, the latest May data shows that the ultra-high-speed growth trend has slowed down slightly, but there is still an increase of US$210 million, a month-on-month increase of 8.38%. The next few months will be a key window for observation - we need to track whether its growth rate continues to slow down or continues to explode.

RWA.xyz, IOSG

BUIDL's explosive growth is due to multiple factors. Growth mainly comes from institutional demand, and the competitiveness of the product is the key driver of success: including 24/7 operation, faster settlement speed than traditional finance, and high returns under a compliant framework. It is worth noting that DeFi integration is achieving synergies and unlocking more utility, such as Ethena Labs' USDtb product - 90% of its reserves are backed by BUIDL. At the same time, the recognition of BUIDL as a high-quality collateral continues to increase, and sBUIDL launched by Securitize further unlocks DeFi integration scenarios.

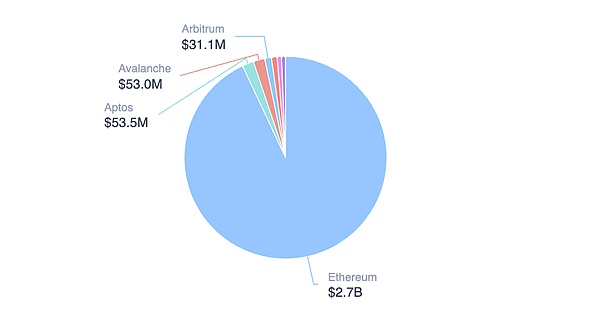

BUIDL's asset distribution is highly concentrated: about 93% is concentrated on the Ethereum mainnet, and other ecological chains are difficult to reach the scale. At the same time, with the continuous expansion of asset management scale, BUIDL's monthly dividends have continuously set new highs. In March 2025, the dividend reached 4.17 million US dollars, and by May it had soared to 7.9 million US dollars.

BUIDL distribution, screenshot from RWA.xyz

Stablecoin

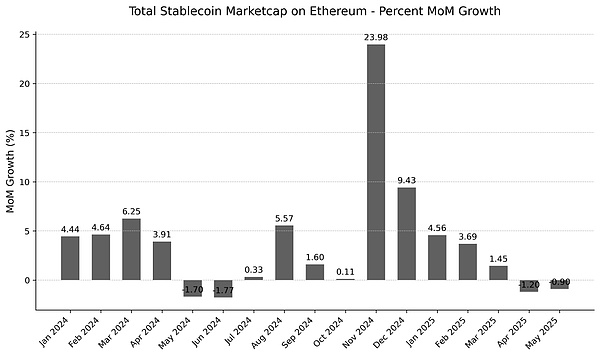

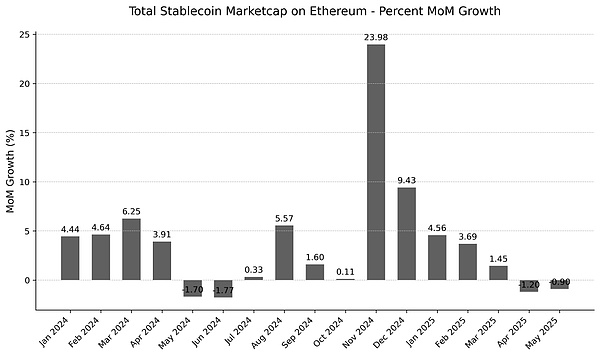

Given that the GENIUS Act will have a structural impact on the stablecoin regulatory framework, it is of great forward-looking significance to systematically examine the development trajectory of the Ethereum stablecoin market. Since 2024, the total market value of this sector has continued to show a steady upward trend. Although the growth rate is slightly slower than that of other RWA segments, it still maintains a resilient monthly growth rhythm.

RWA.xyz, IOSG

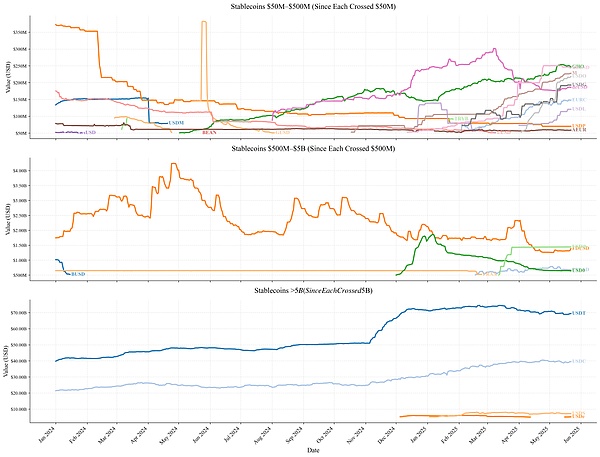

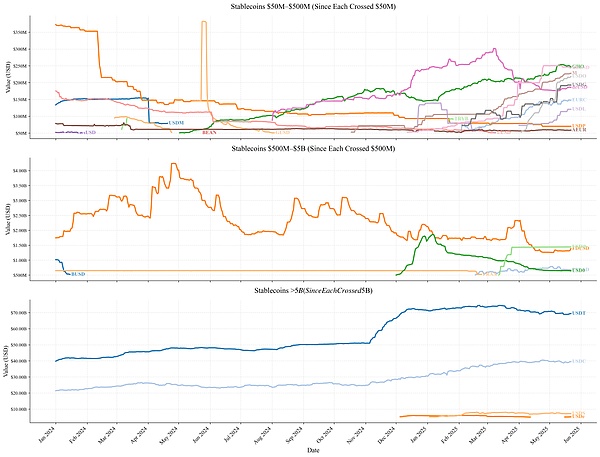

Among small projects (<$500 million), most projects experienced continuous contraction at the beginning of 2024. However, near the end of 2024, the market value of most projects continued to rise, and the market value of GHO, M, and USDO continued to grow. At the same time, a number of new stablecoin projects have emerged with a market value of over 50M. Ethereum stablecoin ecosystem projects are more diverse, and small-cap projects have continued to prosper since 2025.

In 2024, there are only FDUSD and FRAX among medium-sized projects (US$500 million to US$5 billion); BUSD dropped sharply from US$1 billion in January 2024 to less than US$500 million in March due to the termination of its issuance. However, in 2025, both USD0 and PYUSD broke through the US$500 million threshold, and medium-sized stablecoins became more diversified.

The top stablecoins (>5 billion USD) continue to be dominated by USDT and USDC: USDT stabilized at a market value of US$40 billion for most of 2024, jumped to US$70 billion in early December, and then gradually stabilized until its market value declined recently; USDC grew steadily from US$22 billion in January 2024 to US$38 billion in May 2025. At the beginning of 2025, USDS and USDe both exceeded US$5 billion, but USDT and USDC are still far ahead in market share.

RWA.xyz, IOSG

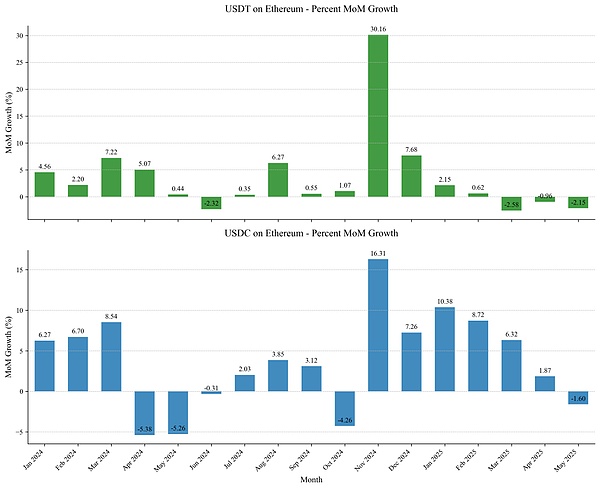

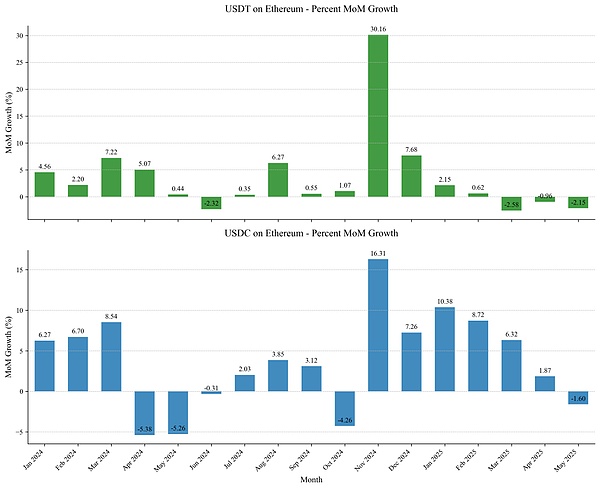

USDT and USDC occupy an absolute dominant position, directly affecting the entire stablecoin ecosystem.

The growth in November 2024 is particularly noteworthy: USDT surged 30.16% month-on-month, and USDC achieved a 16.31% increase. After this surge, there is still continued growth for several months. USDC has grown more steadily in subsequent months, with monthly growth of more than 5%. According to the issuer: Tether attributed this to "the influx of collateral assets from exchanges and institutional trading desks in response to the expected surge in trading volume"; Circle emphasized that "USDC circulation increased by 78% year-on-year... In addition to user demand, it also stems from the reconstruction of market confidence and the improvement of the standard system driven by emerging stablecoin regulatory rules."

However, the market momentum has changed significantly recently - USDT on the Ethereum chain has stagnated in the past four months, and USDC fell for the first time in May 2025 after many months of growth. This phenomenon may indicate that the market is turning to a new cycle stage.

RWA.xyz, IOSG

L2 Ecosystem

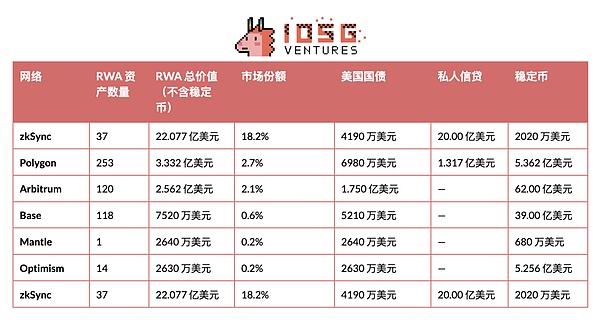

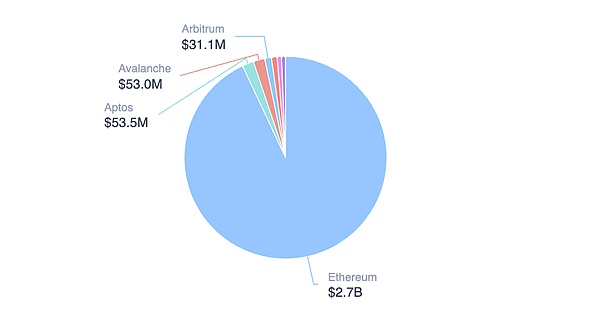

In the broader RWA ecosystem, Ethereum maintains its absolute dominance with a market share of 59.23% (excluding stablecoins), but it still faces key challenges.

Screenshot from RWA.xyz

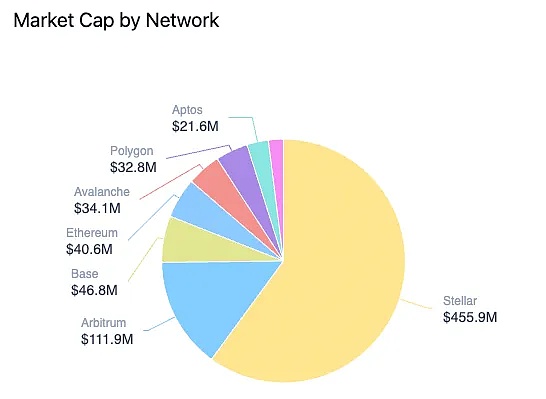

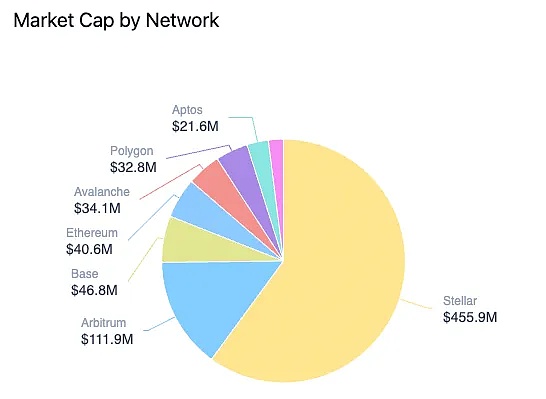

It is worth noting that zkSync jumped to the second place with the single drive of the Tradable project, while Stellar completely relied on Franklin Templeton BENJI Fund (with a scale of US$455.9 million) to occupy the third place. Although the book data of the two public chains RWA are impressive, their structural defects cannot be ignored: lack of asset diversity and reliance on a single project.

BENJI’s Composition, screenshot from RWA.xyz

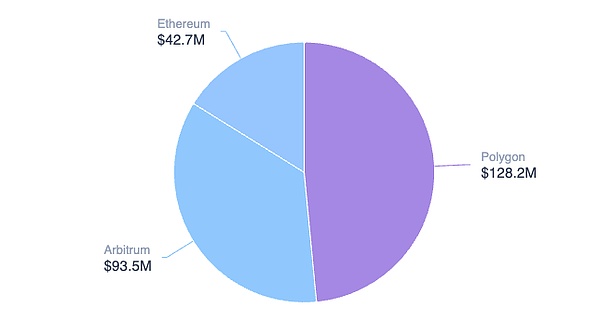

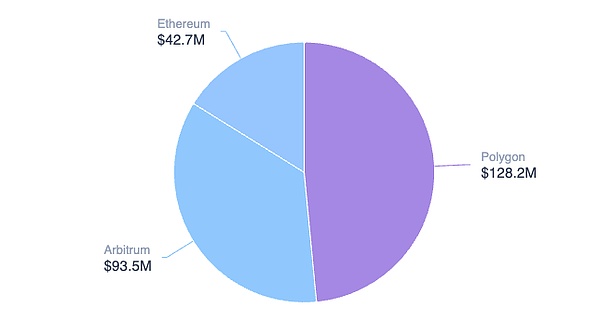

Just like the ecological characteristics shown by zkSync and Stellar, most L2 networks are currently facing the challenge of insufficient ecological diversity - their RWA market value is highly dependent on 1-2 core projects. For example, Arbitrum: Of the total market value of US$256 million, BENJI contributed US$111.9 million (43.7%), and Spiko accounted for US$93.5 million (36.5%). The two together monopolized more than 80% of the market value; Polygon also showed a similar distribution pattern, with the core market value concentrated in the two major projects of Spiko and Mercado Bitcoin.

Spiko’s Composition, screenshot from RWA.xyz

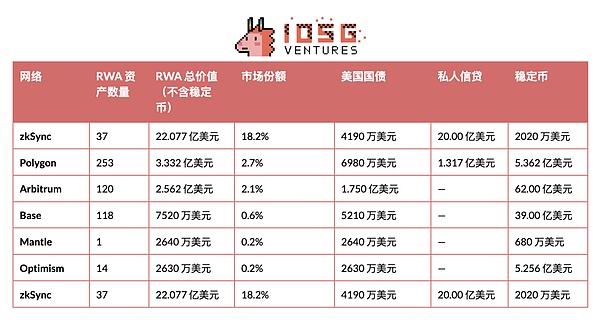

Expanding the vision to the entire L2 ecosystem, the value and market share of RWA in each network show significant differentiation (see the table below). Except for zkSync, only Polygon and Arbitrum have formed a substantial scale effect, and the rest of L2 is still in the early stages of development. The success of Polygon and Arbitrum is highly dependent on a single driving force, Spiko, which contributes about one-third of the total value of RWA in both networks.

RWA.xyz, IOSG

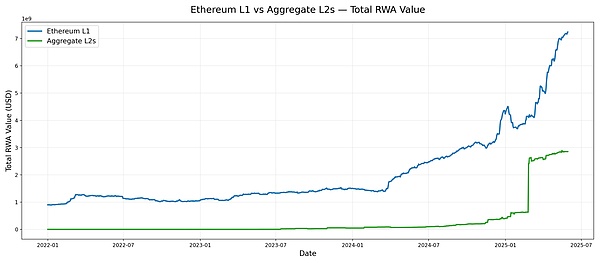

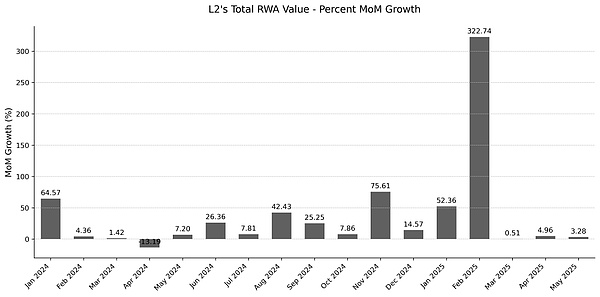

Looking at the evolution of the overall RWA market value of the Layer-2 network, its growth cycle is not completely synchronized with Layer-1: growth did not start synchronously in mid-2024. zkSync's access to the Tradable project brought a $2 billion market value increase. But even if this impact is excluded, the L2 growth trend is still established-since September 2024, the L2 network has continued to maintain a double-digit month-on-month increase. In contrast, in the previous stage, RWA expansion has always been sporadic and weak. In summary, the end of 2024 marks a turning point in the development of L2 ecosystem RWA: entering a strong growth cycle.

RWA.xyz, IOSG

Etherealize: The new engine of Ethereum RWA

As a key force in promoting the adoption of Ethereum RWA, the birth of Etherealize stems from a deep insight into the bottleneck of the industry: when breakthroughs at the protocol layer fail to be effectively transformed into physical applications, institutional participation often stagnates. To this end, Etherealize has systematically bridged the gap between technological breakthroughs and actual implementation by developing customized tools, building a strategic cooperation network, and deeply participating in policy making.

Currently, Etherealize mainly promotes the popularization and application of Ethereum RWA through market education and content dissemination, as well as data panel tools. On the one hand, the team has written and published a number of in-depth articles about Etherealize itself and the Ethereum ecosystem, and participated in interviews with many well-known podcasts and traditional financial and crypto media, and has a great influence through dialogues with industry opinion leaders; on the other hand, Etherealize actively communicates with regulatory agencies, and has successfully held a number of seminars and symposiums on digital asset compliance and regulatory issues, and continues to propose constructive solutions on how to standardize the RWA process.

Recently, Vivek Raman, founder of Etherealize, was invited to attend the hearing of the House Financial Services Committee on "American Innovation and the Future of Digital Assets", continuing to expand the important role of Ethrealize in regulatory exchanges.

Currently, Etherealize has only launched a data dashboard on the product side for market education and promotion, but the team explained in the roadmap that it will develop an SDK for institutions, etc., and is recruiting founding engineers. It is worth continuing to pay attention to Etherealize's progress in promoting RWA products.

In the next roadmap, the focus of the second quarter of 2025 is to release an institutional-level SDK, which integrates custody interfaces, compliance processes and gas optimization modules to help banks and asset management institutions build a secure and auditable issuance process, greatly reducing the threshold for traditional financial institutions to participate in Ethereum RWA.

On this basis, the third quarter will launch an enterprise-level wallet pilot project based on Noir to ensure that privacy protection reaches the enterprise level and meet the confidentiality requirements of RWA transactions through the "default privacy" mechanism.

In the fourth quarter, the vision will be turned to the international market: the team plans to establish cooperation with Singapore Digital Port and Switzerland Crypto Valley Association to localize product functions and compliance docking according to the regulatory environment and market needs in Asia Pacific and Europe.

At the same time, in order to reduce the friction between different Layer-2 networks, the team will take the lead in promoting Rollup standardization and build a unified cross-chain interface to achieve the free flow of assets, and then integrate RWA under the Ethereum ecosystem to enhance interoperability.

Finally, in order to narrow the gap between traditional financial institutions and blockchain technology, the team will continue to adhere to the 24×7 support model, providing end-to-end professional services from legal document preparation to smart contract deployment.

Ethereum RWA strategic moat

First-mover advantage

The decision-making process of traditional financial institutions is different from DeFi: regulatory review, pilot verification and proof of concept (PoC) will greatly extend the deployment cycle. In the early stages of the project, institutions mostly adopted a cautious strategy and started expansion only after the pilot results were verified. Although Ethereum's top project BUIDL occupies a dominant position, it still experienced explosive growth after nearly a year of accumulation. Ethereum's core advantage lies in its ecological first-mover position-long before the rise of the RWA wave, it has completed experimental cooperation with many top financial institutions.

Ecological Accumulation

In addition to institutional cooperation, the maturity of the RWA ecosystem requires long-term precipitation. Ethereum maintains its leading position:

Breadth: Covering diversified asset issuers and protocol architecture

Depth: The market value of multiple projects has exceeded the billion-dollar level, forming a scale effect

The integration process of traditional finance and DeFi continues to deepen. Most RWA projects give priority to deploying the Ethereum mainnet, directly using the Ethereum ecosystem's mature decentralized lending, market making and derivatives protocols to improve capital efficiency. Recent cases include Ethena using BUIDL as 90% of the reserve assets for the USDtb stablecoin. The GENIUS Act's policy of forcing stablecoin reserves to tilt toward U.S. Treasuries is driving the integration of U.S. Treasuries, on-chain treasury products, and stablecoin protocols. At the same time, mainstream DeFi protocols have incorporated BUIDL into the core collateral system.

Ethereum maintains an advantage in RWA liquidity: the number of active addresses, the types of tokens, and the depth of liquidity are all leading. Although the Layer2 ecosystem has uncertainties in its collaboration mechanism, it is still the core path for expansion.

Security

Security is the cornerstone of the RWA ecosystem, and the maturity of smart contract technology is the key. As the logic of the RWA project becomes more complex, the requirements for smart contracts are also higher. In May 2025, the Cetus protocol on the Sui chain was hacked (loss of $223 million), exposing the fatal risks of oracle manipulation and contract vulnerabilities. Although the on-chain freeze recovered $162 million, this kind of passive emergency mechanism highlights the limitations of risk control. In contrast, Ethereum's core advantages lie in its more decentralized architecture, reliable operation record and prosperous developer ecosystem.

Technological Evolution

The Ethereum technology roadmap will accelerate the development of RWA. First, improve L1 performance to make up for the core gap with high-performance public chains. Second, promote L2 interoperability and focus on the application layer to open up the docking channel between traditional finance and on-chain RWA.

At the same time, Ethereum's privacy roadmap strengthens security standards and privacy protection mechanisms (such as integrating privacy tools into mainstream wallets, simplifying anti-censorship transaction processes, etc.), provides protection for RWA transactions, and builds an asset confidentiality system that meets institutional requirements.

The Genius Act: A Double-edged Sword of Regulation

While strengthening centralized control, the new stablecoin regulatory system also injects regulatory certainty into the market. Currently, Section 4(6) of the Act does not explicitly allow stablecoin issuers to pay interest to holders. Although the market may give rise to alternatives, this issue remains uncertain. At the same time, the Genius Act requires that stablecoin reserves must be 1:1 with highly liquid safe assets such as US dollars or US Treasuries.

The reserves of USDC stablecoins are almost entirely allocated to US Treasuries, which complies with the new regulations. However, other mainstream issuers must completely restructure their reserve structure, otherwise they may be forced to exit the US market. This move will directly affect specific designs such as algorithmic stablecoins and Delta Neutral stablecoins.

By anchoring collateral to US sovereign credit, regulators have greater intervention capabilities (and simultaneously drive demand for Treasuries), but loopholes in the legislation may lead to new systemic risks - as the historical lessons of the Commodity Futures Modernization Act (CFMA) of 2000.

On the positive side, the clear compliance boundaries of the bill may accelerate institutional entry: the regulatory certainty long sought by banks and asset management institutions is met. More large companies and institutions will be licensed to issue stablecoins. For example, the joint crypto stablecoin being discussed by several major US banks, or Meta reconsidering the possibility of launching a new stablecoin project.

Ethereum's resilience: a diverse ecosystem

The resilience of the Ethereum stablecoin ecosystem stems from its diversity. Since the beginning of 2025, the market value of multiple stablecoin issuers has increased significantly, and many new stablecoin projects have emerged, including a rich design dimension: a variety of collateral structures, income strategies and governance models. The GENIUS Act enforces a 1:1 reserve requirement for Treasury bonds, which puts compliance pressure on most projects, forcing them to choose: either adjust the reserve structure or temporarily withdraw from the US market.

The resilience of the Ethereum ecosystem distinguishes it from the public chain dominated by a few stablecoin/RWA projects - this reduces the risk of homogenization after the projects are generally regulated. The diversified structure forms a natural risk isolation mechanism: even if some stablecoins adjust their strategies due to compliance requirements, there will still be projects that continue to promote innovation and maintain a decentralized core, and will not completely become part of the U.S. debt system. However, subsequent development will also depend on the strategic positioning of the Ethereum Foundation and Etheralize.

Conclusion

Ethereum's RWA ecosystem has seen explosive growth in the past few months. Among them, BUIDL is the strongest driving force for the development of RWA in the near future, and a large number of treasury projects have also shown strong growth momentum. Behind the expansion of scale, treasury projects have increasingly shown a trend of integration with Ethereum's existing DeFi and RWA ecosystems, such as BUIDL as collateral for lending or stablecoin projects.

Ethereum still has a significant advantage in the RWA field. Whether it is the first-mover time advantage, security, deep ecological precipitation, grand technical roadmap updates, or BUIDL's strong lead, Layer2's diversification, and Etherealize's deep empowerment, these factors together build Ethereum's core barriers in the wave of traditional financial chain-up.

With the promotion of the Genius Act, US dollar credit is accelerating its integration into the chain world. This not only brings in a larger amount of capital, creates more revenue and growth opportunities, but also poses a challenge: it makes the underlying support of the Ethereum financial system more inclined to fiat currency (US dollar), thereby introducing fiat currency credit risk and making the on-chain settlement system an extension of the US dollar hegemony; the on-chain world is no longer an independent parallel financial system. Against the backdrop of this explosive growth, there are also hidden concerns, the core of which lies in Ethereum's exploration of its own positioning - whether it supports deep binding with the US dollar system.

Kikyo

Kikyo