Author: Ponyo, Four Pillars Researcher; Translation: Jinse Finance xiaozou

Ever try eating instant noodles on a roller coaster? It sounds ridiculous, but it is the best metaphor for Ethena Labs' daily performance - this team of only 26 people firmly maintains the $1 anchor of the $5 billion market value stablecoin USDe in the continued turmoil of the crypto market. This article will reveal Ethena's moat, analyze its core mechanism that is difficult to replicate, and explain its strategic path to push the circulation of USDe to exceed $25 billion.

1, a sophisticated machine to hedge billions of fluctuations

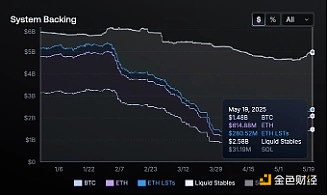

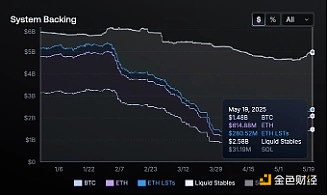

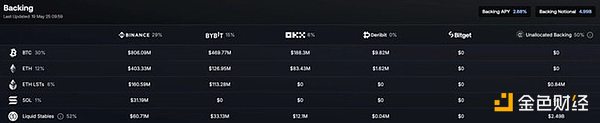

Stablecoins may seem boring (1 dollar is 1 dollar), but Ethena is a hidden mystery. It does not rely on bank dollar reserves, but builds a collateral pool through ETH, BTC, SOL, ETH liquid pledge tokens (LSTs), stablecoins and $1.44 billion in Treasury tokens USDtb, and continues to short hedge in the derivatives market. When the price of the collateral asset fluctuates, the profit and loss of the corresponding short position will offset the risk in real time.

If ETH soars by 5% and causes an imbalance in the hedging ratio, it may instantly expose tens of millions of dollars in risk exposure; when the market crashes at three in the morning, the risk control system must immediately rebalance the collateral or close the position - the fault tolerance rate is almost zero. ButEthena never lost its anchor, liquidated or had a collateral gap during the roller-coaster market in 2023-2024, processing billions of dollars of hedging every day, and it was even unscathed whenBybit was hacked.

Traditional hedge funds may need a whole floor of traders to deal with such volatility, but Ethena has achieved zero-accident operations with a minimalist team.

After several months of launch, it has become the largest counterparty of many top exchanges, and its hedging flow can even affect the market depth, but it is rarely noticed because USDe always "operates normally".

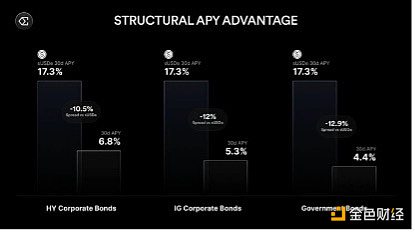

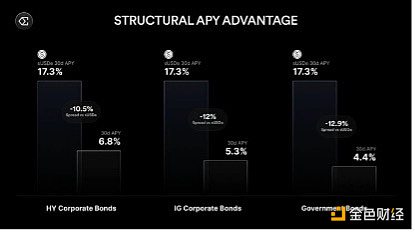

The truth about high returns:When the market is bullish,Ethena can provide double-digit annualized returns.

Some people think of the tragedy of Terra/LUNA's 20% Anchor protocol, but the essential difference is that Ethena's income comes from real market inefficiency (staking income + perpetual contract positive funding rate, etc.), rather than printing money out of thin air or unsustainable subsidies. 2. How the Delta Neutral Strategy Works When a user deposits ETH worth $1,000, he can mint an equivalent amount of USDe, and the protocol automatically opens an equivalent futures short order. When ETH falls, the short profit offsets the depreciation of the collateral, and when ETH rises, the collateral appreciation makes up for the short loss, ultimately keeping the net value of the US dollar stable. When the long leverage in the perpetual market is too high, Ethena, which holds short positions, can also charge funding rates, allowing USDe to naturally generate double-digit returns in the bull market - without the need for treasury subsidies.

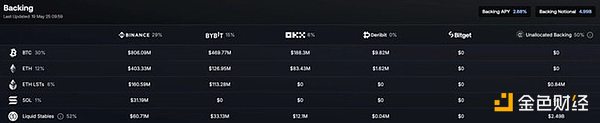

To avoid single-point risks, Ethena disperses short positions in Binance, Bybit, OKX and even decentralized perpetual agreements. The latest governance proposal shows that it will be connected to Hyperliquid to achieve dynamic hedging at the optimal liquidity point.

To handle the constant adjustments, Ethena and the trading team deployed a high-frequency trading-level automation system, and the real-time rebalancing of multi-platform collateral ensured that USDe could survive extreme volatility.

The protocol also uses over-collateralization to deal with plunges and suspends minting when the risk is too high. Through custody solutions such as Copper and Fireblocks, assets are always in real-time controllable state to avoid being stranded in the exchange hot wallet. If the exchange goes bankrupt, Ethena can quickly withdraw the collateral to eliminate single point failures.

3Unreplicable Moat

Ethena's model looks replicable on paper (delta hedging crypto assets, earning funding rates, and making profits), but in fact the protocol has established a strong moat that is enough to prevent imitators.

One of the key obstacles is trust and credit lines: Ethena hedges billions of dollars of positions over the counter through institutional-level agreements with custodians and mainstream trading platforms (Binance Ceffu, OKX). Most small projects simply cannot easily access these institutions and negotiate to support millions of dollars of short positions with the lowest exchange collateralization rate-this authority requires institutional-level legal, compliance, and operational rigor.

Also critical is multi-platform risk management. Spreading large-scale hedging across multiple exchanges requires real-time analysis capabilities comparable to Wall Street quantitative teams. Yes, anyone can replicate delta hedging on a small scale, but scaling to $5 billion (and rebalancing huge amounts of collateral across multiple platforms around the clock) is another matter. The analytical capabilities, automated systems, and credit relationships required grow exponentially with scale, making it nearly impossible for new entrants to reach Ethena's scale overnight.

Moreover, Ethena does not rely on perpetual risk-free returns. If perpetual funding rates turn negative, it will reduce its short positions and rely on staking or stablecoin returns instead. The reserve mechanism can buffer against long periods of negative rates, while countless high-yield DeFi protocols collapsed when the music stopped.

Counterparty risk is further minimized because Ethena never stores all collateral directly on a single exchange, but rather holds assets with a custodian. If a trading platform becomes unstable, Ethena can quickly close positions and transfer collateral assets off-chain to ensure that systemic risk is minimized.

Finally, Ethena’s track record in extreme volatility has strengthened its moat. USDe has experienced months of severe market fluctuations without a single de-anchor or crash. This reliability has driven new user adoption, exchange listings, and top institutional partnerships (from Securitize to BlackRock and Franklin Templeton), forming a trust snowball effect that cannot be forked and replicated. The gap between empty talk about delta hedging and 24/7 multi-billion dollar scale is the core of Ethena’s success.

4, the road to 25 billion

Ethena's growth strategy relies on the co-evolutionary self-circulating ecosystem of currency (USDe), network ("Converge" chain) and exchange/liquidity aggregation. USDe was initially driven by the native demand of DeFi (Aave, Pendle, Morpho) and CeFi (Bybit, OKX), and the next stage will be the launch of iUSDe, a regulated version for banks, funds and corporate treasuries that require a compliance framework. Even if only a small share of the huge bond market of traditional finance is attracted to inject into USDe, it can push the circulation of the stablecoin to $25 billion or even higher.

The driving force of this growth is the arbitrage mechanism between the on-chain funding rate and the traditional interest rate. As long as there is a significant yield difference, funds will flow from the low-interest rate market to the high-interest rate market until equilibrium. USDe thus becomes the hub connecting crypto returns to macro benchmarks.

Meanwhile, Ethena is developing a Telegram-based application that will provide high-yield USD savings services to ordinary users through a user-friendly interface, bringing hundreds of millions of funds into sUSDe. In terms of infrastructure, the Converge chain will weave together the DeFi and CeFi tracks, so that each new integration will amplify the liquidity and utility of USDe in a continuous growth cycle.

It is worth noting that sUSDe's returns are negatively correlated with real interest rates, which was demonstrated in the fourth quarter of 2024: when the Federal Reserve cut interest rates by 75 basis points, the fund yield jumped from about 8% to more than 20%, highlighting that the decline in macro interest rates can greatly enhance Ethena's earnings potential.

This is not a slow, gradual process, but a cyclical expansion model: wider adoption enhances USDe's liquidity and earnings potential, thereby attracting larger institutions, driving further growth in supply and more stable anchoring.

5Looking to the future

Ethena is not the first stablecoin to promise high returns or tout an innovative path. Its uniqueness lies in the fact that it truly delivers on its promise - always keeping USDe stable and anchored at $1 during the most violent market shocks. Behind the scenes, it operates like a top institution: shorting perpetual contracts and managing pledged collateral. What ordinary holders feel is just a "stable interest-bearing and always reliable" US dollar tool.

Going from $5 billion to $25 billion is no easy task. Tighter regulatory scrutiny, increased counterparty risk exposure, and potential liquidity crises may all bring new challenges. But Ethena's multi-asset collateral pool (including $1.44 billion USDtb), powerful automation system, and rigorous risk control system make it more responsive than most projects.

Finally, Ethena is showing how it can tame the volatility of the crypto market with a disciplined delta-neutral strategy at an amazing scale. This outlines a future picture: USDe will be at the heart of all financial sectors-from DeFi's permissionless boundaries, CeFi's trading terminals, to the trillion-dollar bond market of traditional finance.

Kikyo

Kikyo