Author: Thejaswini, Source: Token Dispatch, Compiled by: Shaw Jinse Finance

Every financial advisor you meet will start you off with a sermon about compound interest.

Invest $500 per month in an index fund with an annualized return of 7%, and you'll have $1.3 million in 30 years. It sounds great, but by year 15, that $500 per month seems insignificant. Your rent has doubled, you've had children, and your definition of "enough money" has shifted from "affording guacamole" to "affording a house in a good school district." The traditional path assumes your expenses remain constant while your money grows slowly, but reality is quite the opposite.

So when you hear someone earning 15% to 20% annually in the cryptocurrency derivatives market, your first thought isn't the risk, but the timeline. Finally, a return that outpaces the rising cost of living. This fact made me want to delve deeper: a crypto protocol launched just 18 months ago has seen its circulating supply surpass $12.4 billion in a short period of time, faster than any other digital dollar in history. While USDT didn't reach $12 billion until mid-2020 (after years of slow growth), and USDC didn't surpass $10 billion until March 2021, Ethena's USDe surpassed both milestones in such a short time, a true speedrun in the financial world.

USDE is exploiting structural inefficiencies in the crypto derivatives market. This raises the core questions every investor, regulator, and competitor is asking.

How did they do this so quickly? What are the actual risks? Is this sustainable? Or is it just another high-yield experiment waiting to crash?

I have attempted to answer most of these questions. Ethena, the world's largest arbitrage exchange, has found a way to turn the cryptocurrency market's relentless demand for leverage into a money-printing machine. Here's how it works, in simple terms: By holding cryptocurrency as collateral, one shorts an equivalent amount of cryptocurrency futures contracts and pockets the difference. This creates a synthetic dollar that remains stable while simultaneously profiting from cryptocurrency's most reliable money-printing machine. Let's break this down further. When someone wants to mint USDe, they deposit a crypto asset like Ethereum or Bitcoin. But Ethena doesn't simply hold onto these assets and hope they remain stable (which, by the way, they don't). Instead, it immediately opens a short position of equal size on a perpetual swap exchange. If ETH rises by $100, their spot position will increase by $100, but their short contract position will lose $100. If ETH falls by $500, their spot position will lose $500, but their short contract will gain $500. The end result—perfect stability in USD terms. This is called a delta-neutral position. You won't lose money due to price fluctuations, but you won't gain money either. So where does the 12%-20% return come from? There are three sources. First, they stake ETH collateral and collect staking rewards (currently around 3%-4%). Second, they collect what's known as the "funding rate" from short contracts. In cryptocurrency perpetual swaps, traders pay funding fees every eight hours to maintain their positions. When there are more long positions than short positions (which happens about 85% of the time), longs pay shorts. Ethena is always on the short side and collects these fees. In 2024, the average open interest-weighted funding rate for Bitcoin was 11% and for Ethereum was 12.6%. These are the actual cash flows that leveraged traders pay to anyone willing to bet against them.

Third, they can earn income from the cash equivalents and Treasury products held in their reserves. Ethena holds liquid and stable assets with partners, who pay additional income. USDC pays loyalty rewards, while holding USDtb can earn income from BlackRock's BUIDL fund.

Taken together, these funding sources generated an average annualized return of 19% for sUSDe holders in 2024.

For the past few years, cryptocurrency funding rates have averaged 8-11% annually. Add in staking rewards and other income streams, and you have a comfortable return. Isn't that the point?

The Ethena ecosystem is powered by four tokens, each with a distinct function:

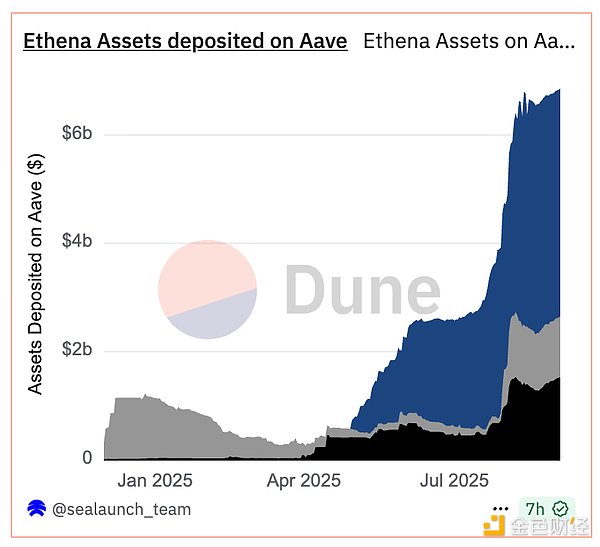

USDe is a synthetic USD unit, maintained at a target price of $1 through a delta-neutral hedge. USDe accrues no rewards unless staked, and can only be minted or redeemed by whitelisted participants. sUSDe is a yield-generating token earned by staking USDe in the ERC-4626 protocol treasury. Currently, all Ethena protocol revenue flows to sUSDe holders in the form of yield rewards. As Ethena regularly deposits protocol revenue, its value (in USDe) increases. Users can unstake and redeem USDe after a cool-down period. ENA serves as a governance token, allowing holders to vote on key protocol matters, such as eligible collateral and risk parameters. It also lays the foundation for a future ecosystem security model. sENA represents staked ENA positions. A planned "fee swap" mechanism will distribute a portion of protocol revenue to sENA holders upon reaching certain milestones. Currently, sENA receives ecosystem allocations, such as Ethereal's proposed 15% token allocation. But there's a big catch. This model only works if people are willing to spend money to go long on crypto. If market sentiment reverses and funding rates turn negative, Ethena will start paying interest instead of earning yield. Why 2025 Could Be Ethena's Breakout Year A combination of factors has made USDe the fastest-growing digital dollar in history. 1. The perpetual futures market experienced explosive growth, with open interest in major altcoins reaching an all-time high of approximately $47 billion in August 2025, and Bitcoin's open interest reaching $81 billion. Increased trading volume means more opportunities for Ethena to earn funding rate returns. 2. This accelerated growth stems from a form of financial engineering that can be described as "supercharged." Users discovered that they could stake USDe to obtain sUSDe (yield-backed), then tokenize their sUSDe holdings on Pendle (a yield derivatives platform), and then use these tokenized holdings as collateral on Aave (a lending protocol) to borrow more USDe. This cycle repeats. This creates a recursive profit cycle, allowing experienced traders to amplify their exposure to USDe's potential returns. The result? 70% of Pendle's total deposits are Ethena assets. An additional $6.6 billion worth of Ethena assets are located on the Aave platform.

Layer upon layer of leverage, all chasing those double-digit yields.

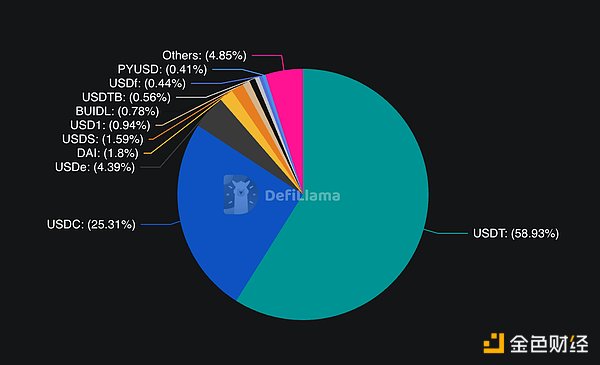

3. A special purpose acquisition company (SPAC) called StablecoinX announced plans to raise $360 million specifically for accumulating ENA tokens. This entity will use the proceeds to accumulate ENA tokens under a "perpetual capital" mandate, thereby creating a structural buyer, eliminating selling pressure, and supporting governance decentralization. 4. Ethereal Perpetual Decentralized Exchange. Built specifically on USDe, Ethereal attracted $1 billion in total value locked (TVL) before its mainnet launch. Users deposited USDe to earn points for the eventual token issuance, creating another significant drain on USDe's supply and fueling anticipation for the first large-scale application built natively on the Ethena infrastructure. 5. Ethena, in partnership with Securitize, is building a permissioned L2 converged chain designed to enable the integration of traditional finance through KYC-compliant infrastructure. Using USDe as its native fee token, this chain creates structural demand while also opening up access to institutional capital that otherwise would be unable to interact with permissionless DeFi. 6. The market expects the Federal Reserve to cut interest rates twice by the end of 2025, with an 80% probability of a September rate cut. When interest rates fall, traders typically increase risk-taking, pushing up funding rates. USDe yields are negatively correlated with the federal funds rate, meaning rate cuts could significantly increase Ethena's revenue. 7. Ethena's Fee Transition Proposal. Ethena's governance approved a five-point framework for activating revenue sharing with ENA holders. Four of the five conditions have been met: USDe supply exceeding $6 billion (currently $12.4 billion), protocol revenue exceeding $250 million (over $500 million already achieved), Binance/OKX integration (achieved), and sufficient reserves (achieved). The final requirement—maintaining a yield spread of at least 5% higher for sUSDe than for sUSDtb—remains the only obstacle for ENA holders to receive a share of the protocol's profits. These conditions are governance-determined safeguards designed to protect the protocol and sENA holders from premature or risky revenue distributions. Milestones reflect benchmarks of protocol maturity, financial health, and market integration. Ethena aims to ensure its sustainability and value before fully unlocking revenue distributions. Ethena has also been quietly cultivating partnerships with traditional financial institutions and cryptocurrency exchanges, making USDe usable everywhere from Coinbase to Telegram wallets. Institutional FOMO Unlike previous stablecoin experiments that grew purely from crypto-native use cases, USDe is attracting the attention of traditional financial institutions. Coinbase's institutional clients now have direct access to USDe. CoinList offers a 12% annualized yield on USDe through its yield program. Major custodians such as Copper and Cobo are managing Ethena's reserves. Each of these institutions is associated with institutional investors because they provide platforms, custody, or services specifically designed to support accredited investors and institutional clients in the crypto market. This model is similar to that of USDC and USDT, but on a much shorter timescale. Major stablecoin providers took years to establish institutional relationships and compliance frameworks. Ethena achieved this in just months, partly due to the mature regulatory environment and partly because the yield opportunity was too compelling to ignore. Institutional adoption brings credibility, which brings more capital, and more capital means higher funding rates, which in turn support higher returns and ultimately attract more institutions. As long as the underlying mechanism remains unchanged, it acts like a flywheel, continuing to accelerate. This speed comparison has important prerequisites. USDe doesn't need to prove to the world the practicality, security, or legitimacy of a stablecoin. In the markets it enters, USDT and USDC have already shouldered the heavy lifting in terms of institutional adoption, regulatory acceptance, and infrastructure development. The high concentration of leverage in Pendle and Aave creates what risk managers call a single point of failure. If Ethena's model fails, it will impact not only USDe holders but also the entire DeFi ecosystem that relies on Ethena's capital flow. If Ethena fails, Pendle will lose 70% of its business. Aave will face massive capital outflows. Yield strategies that rely on USDe will become ineffective. We will face a liquidity crunch across the entire DeFi system, not just the decoupling of stablecoins. The most worrying aspect of Ethena's development is how people use it. The recursive lending and borrowing loops on Aave and Pendle create leverage multipliers, amplifying both returns and risks. Users stake USDe for sUSDe, tokenize sUSDe on Pendle to obtain PT tokens, deposit PT tokens as collateral on Aave, borrow more USDe, and repeat. Each cycle amplifies their exposure to the underlying yield on USDe, as well as any volatility or liquidity issues. This is reminiscent of the CDO squared structure that led to the 2008 financial crisis. A financial product (USDe) is used as collateral to borrow more funds, creating recursive leverage that is difficult to quickly unwind. Maybe I'm just overthinking it, but if funding rates remain persistently negative, USDe could face redemption pressure. Leveraged positions would face margin calls. Protocols relying on USDe's total value locked (TVL) would experience massive outflows. Liquidations could occur faster than any single protocol can handle. Every high-yield strategy eventually faces a question: what happens when it fails? For Ethena, several scenarios could trigger liquidations. The most obvious is a persistently negative funding rate. If crypto market sentiment remains bearish for weeks or months, Ethena will begin disbursing funds rather than receiving them. Their reserves (currently around $60 million) provide some cushion, but it's not unlimited. A more serious risk is counterparty insolvency. While Ethena uses over-the-counter custody for its spot assets, they still rely on large exchanges to maintain their short contracts. If an exchange were to go bankrupt or be hacked, Ethena would need to quickly move its contract positions, potentially temporarily disrupting its delta-neutral hedge. The leverage loops of Aave and Pendle introduce additional liquidation risk. If USDe's yield suddenly declines, recursive lending positions could become unprofitable, triggering waves of deleveraging and liquidations. This could create temporary selling pressure on USDe itself. Regulatory risks are also increasing. European regulators have forced Ethena to relocate from Germany to the British Virgin Islands. As yield-generating stablecoins gain traction, they may face additional compliance requirements or restrictions. The Stablecoin Wars: Ethena represents a fundamental shift in the stablecoin competitive landscape. For years, this competition has focused on stability, applicability, and compliance. USDC and USDT compete on transparency and regulation, while various algorithmic stablecoins vie for decentralization. USDe changed the game by competing on yield. It became the first major stablecoin to offer double-digit returns to holders while maintaining its peg to the US dollar. This put pressure on competing traditional stablecoin issuers, who retain all the returns on their US Treasury holdings while offering nothing to their users. The market is responding. USDe currently holds over 4% of the stablecoin market share, second only to USDC (25%) and USDT (58%). More importantly, it is growing faster than either. Over the past 12 months, USDT has grown by 39.5%, USDC by 87%, but USDe has grown by over 200%.

If this trend continues, we could see a fundamental reshaping of the stablecoin market. Users will shift from zero-yield stablecoins to yield-yielding alternatives.

Traditional issuers will either have to share revenue with users or see their market share eroded.

Despite the risks, Ethena's momentum shows no signs of slowing down. The protocol has just approved BNB as eligible collateral, and XRP and HYPE tokens have also met the threshold for future inclusion. This will expand its potential market beyond Ethereum and Bitcoin.

The ultimate test will be whether Ethena can maintain its yield advantage while managing systemic risk. If they can, they will have created the first scalable, sustainable, yield-generating dollar in cryptocurrency history. If not, we will once again see the dangerous story of chasing yield in volatile markets.

Regardless, the speed at which USDe reached $12 billion proves that when true innovation is combined with market demand, financial products can develop faster than anyone imagined

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine Xu Lin

Xu Lin JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance Joy

Joy