Author: Fairy, ChainCatcher

The era of coin stocks has exploded.

Last night, Robinhood, Kraken, and Bybit successively announced the layout of US stock tokenization, and the dimensional wall of coin stock trading was officially broken.

Among them, Robinhood has thrown out a strategic combination punch, directly leaping from an Internet brokerage to a "crypto-driven all-round investment platform". At the press conference in Cannes, France, it announced a new crypto strategy matrix: US stock tokenization trading, Layer2 public chain, credit card cashback for coin purchases, etc.

As soon as the news came out, Robinhood's stock price rose 12.77%, setting a new historical high.

Robinhood VS xStocks

In the new wave of US stock tokenization, two forces are quietly colliding: on the one hand, Internet brokers represented by Robinhood are entering the encryption field, and on the other hand, encryption native exchanges such as Kraken are reversely deploying the US stock market. They are entering the "coin-stock integration" track from two directions to compete for market dominance.

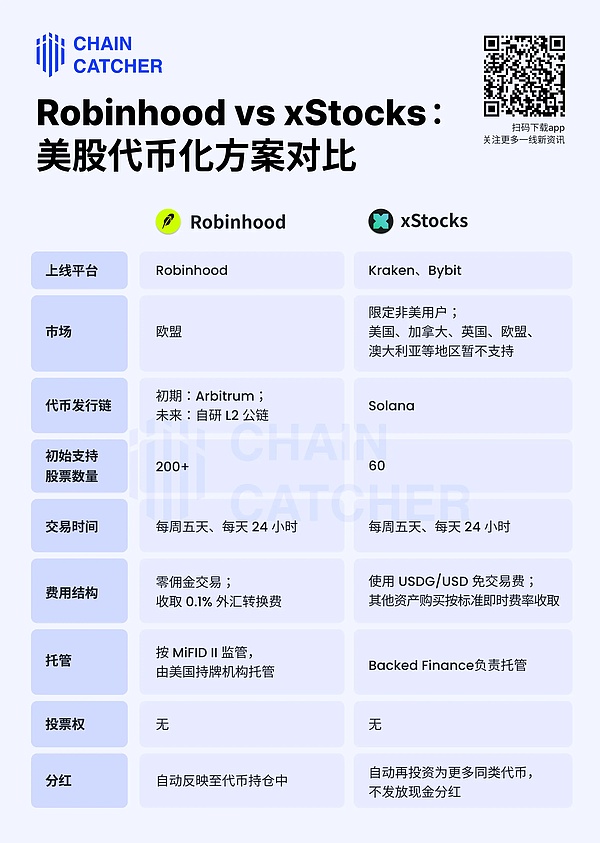

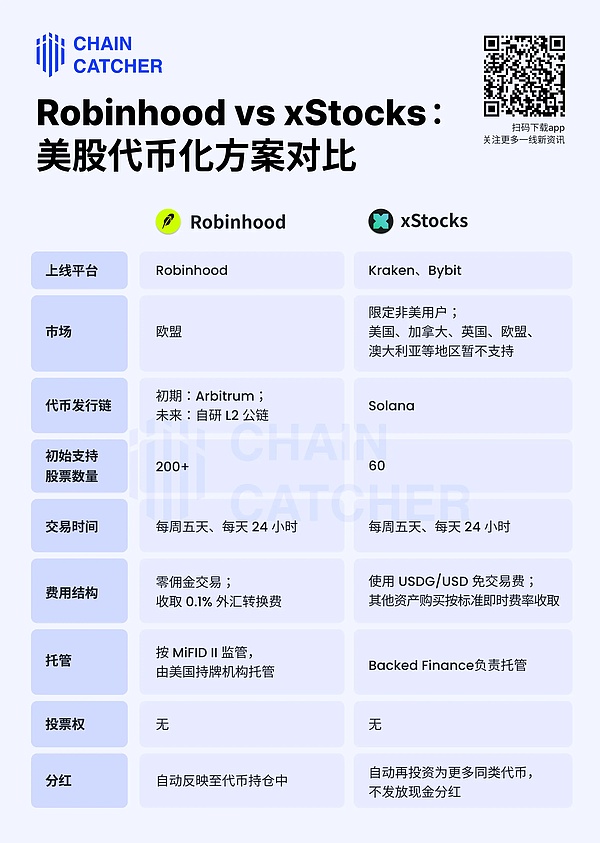

In terms of technology and market strategy, the two forces also show distinct differences. Robinhood chose Arbitrum as the token issuance chain and took the lead in supporting the EU market. In contrast, xStocks launched by Kraken is based on the Solana chain and is aimed at non-US retail customers. It has not yet covered multiple mainstream markets such as the European Union.

Here is a comparison of the two solutions:

This competition between coin and stock trading is essentially a collision and integration of two ecosystems. Internet brokerages attract traditional investors to enter the encryption field with their convenience and compliance advantages; encryption exchanges integrate traditional financial market resources to promote more open financial development. However, with the emergence of high-quality and substantive tokenized assets of high-growth companies such as OpenAI and SpaceX, the market space of the original altcoins and meme coins may be compressed.

Robinhood's new crypto strategy matrix

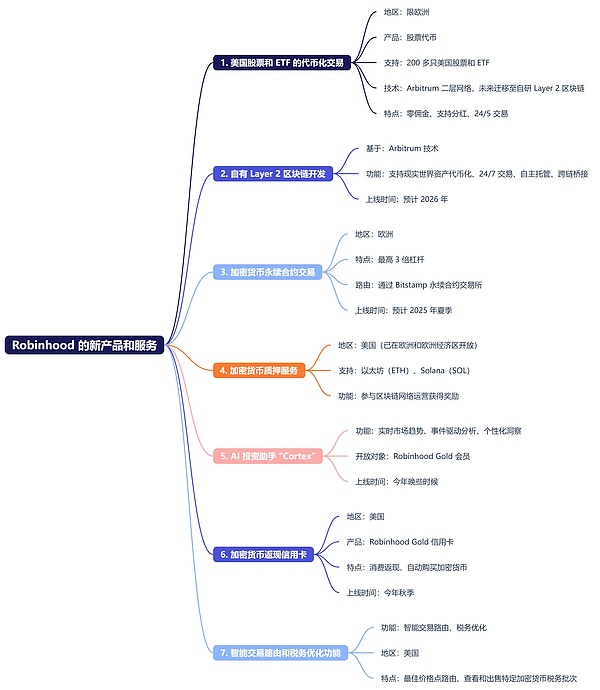

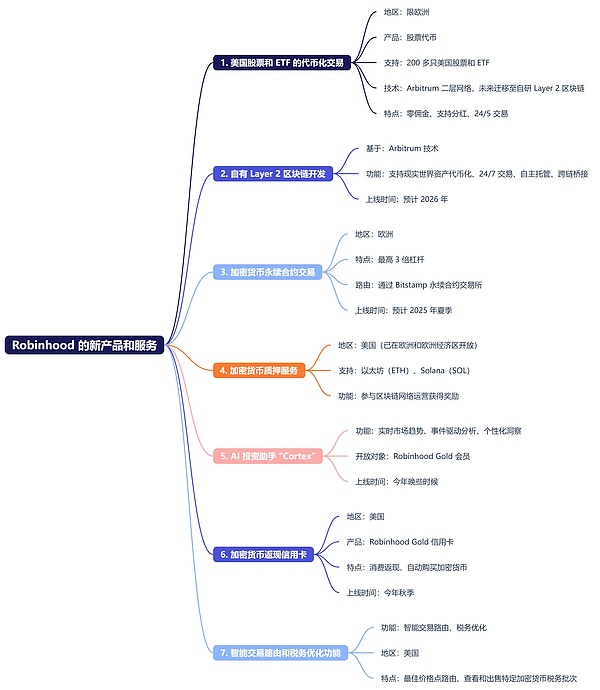

At the press conference, in addition to announcing the highlight of "U.S. stock tokenized trading", Robinhood also comprehensively outlined the new blueprint of its crypto strategy, formulated differentiated development paths for the EU and US markets, and attempted to build a complete ecosystem from trading end to infrastructure.

The EU is the current core battlefield. Robinhood has expanded its services to cover 30 EU and European Economic Area countries, reaching more than 400 million people. In addition to tokenized trading, Robinhood also simultaneously launched a crypto perpetual contract product, and directly announced the transformation of the European App into a "full-featured investment platform driven by crypto."

In the US market, Robinhood is working hard to improve the supporting service system for crypto trading: opening ETH and SOL staking services; Robinhood Gold credit cards will support automatic coin purchases with cashback; AI investment assistant "Cortex" will also be launched to provide member users with token-level intelligent analysis and real-time market interpretation. In addition, US users can view and sell specific crypto assets by tax batches to achieve more flexible tax optimization strategies.

The most strategically significant step is that Robinhood is developing its own Layer 2 blockchain. The public chain is built on the Arbitrum technology stack and will carry the issuance, trading and cross-chain bridging of all tokenized assets in the future, becoming the "landing point" and "engine" of Robinhood's crypto ecosystem. If the model runs smoothly, the digital reconstruction of the entire trillion-level TradFi market, such as bonds, futures, insurance, and real estate, will be accelerated.

Here are the seven new optimizations announced by Robinhood:

Image source: @Phyrex_Ni

Why did Robinhood decide to "All in Crypto"?

Before announcing its new encryption strategy, Robinhood had begun paving the way for its on-chain layout. In May and June 2025, the company acquired the Canadian compliant encryption platform WonderFi and the old exchange Bitstamp for US$180 million and US$200 million respectively. Robinhood's "all in" for cryptocurrencies is not a whim, but is based on its deep insight into profit structure, market trends and regulatory changes.

From the financial data, cryptocurrencies have become Robinhood's main source of income. In the first quarter of 2025, its total trading revenue was $583 million, of which crypto trading contributed $252 million, exceeding the $240 million of options trading, accounting for as much as 43%.

In terms of profit margins, the crypto business is also far ahead. According to the analysis of Zheng Di, an investor in cutting-edge technology, cryptocurrencies are already its most profitable business. The market-making rebate rate for crypto order flow is 45 times that of stocks and 4.5 times that of options. Robinhood can get an average rebate of about 0.35% for each order, and the actual implicit fee is 0.55%. Importantly, this part of the income is not limited to the rebate itself, but also includes routing premiums and slippage income.

In addition, encryption has brought new product possibilities to Robinhood, leaping from a platform for matching transactions to a provider of on-chain financial infrastructure.

For Robinhood, encryption is not only an accelerator of profits, but also a path to the next round of financial dominance. What it is betting on is not just the change in asset form, but the reconstruction of the entire financial infrastructure.

The tokenization of US stocks may be just a stepping stone. The bigger picture is a new financial order that is open and efficient with the chain as its base.

Kikyo

Kikyo