Recently, the Financial Services and Markets Act (FSM Art) was officially implemented on June 30, 2025, and the long-established DTSP new regulations will be officially implemented. This means that Singapore has officially ushered in its own "9.24 moment" and has begun to strictly regulate crypto assets. Unlicensed projects and a large number of practitioners will once again usher in a familiar wave of retreat. This time, where will everyone retreat?

Today, the Sister Sa team will talk to you about the provisions of Singapore's new DTSP regulations and their impact on the currency circle.

01 Po County finally ushered in its own "9.24" moment

I believe that the old people in the currency circle still remember September 24, 2021. It was on this day that ten ministries and commissions of my country jointly issued the "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Transaction Speculation", commonly referred to as the "9.24 Notice".

The "9.24 Notice" clearly states: "Virtual currency-related business activities are illegal financial activities. Virtual currency-related business activities such as the exchange of legal currency and virtual currency, the exchange of virtual currencies, the purchase and sale of virtual currency as a central counterparty, the provision of information intermediary and pricing services for virtual currency transactions, token issuance financing, and virtual currency derivatives transactions are suspected of illegal financial activities such as illegal issuance of token tickets, unauthorized public issuance of securities, illegal operation of futures business, and illegal fundraising. They are strictly prohibited and resolutely banned in accordance with the law. Those who engage in related illegal financial activities that constitute a crime shall be investigated for criminal responsibility in accordance with the law."

Since then, there has been no more currency circles in mainland my country. A large number of 9.24 refugees have fled to Singapore. In just a few months, they have not only further prospered Singapore's economy and made significant contributions to Singapore's coronation as the "Asian Currency Capital", but also raised the local price level to an unprecedented high...

However, crypto assets do have great financial risks after all. While reaping the economic dividends brought by this, Singapore will also consider corresponding supervision to minimize the "harm" of the double-edged sword. Therefore, as early as April 2022, Singapore had passed the Financial Services and Markets Act, which clarified the specific supervision methods for crypto assets, but unfortunately, it did not attract the attention of most people.

02 Which businesses require a DTSP license?

DTSP stands for Digital Token Service Providers. Generally speaking, the DTSP license regulates digital token (crypto asset) service providers operating in Singapore.

(I) Restricted business scope

According to Section 137 of the FSM Act, crypto asset service providers whose businesses meet the following criteria need to hold a DTSP license:

(1) Individuals or legal entities doing business in Singapore;

(2) Singapore-registered companies that provide digital token services to customers outside Singapore.

To put it simply: DTSP regulates entities that conduct crypto asset business in Singapore, or entities registered in Singapore that do not do business in Singapore but whose clients include customers outside Singapore.

It can be seen that the new regulations of Singapore DTSP on the crypto asset industry are strict but reasonable. They follow the basic jurisdiction principle of "people + place" and include two situations that are highly related to Singapore into the management scope.

In addition, partners need to note that the new regulations have an extremely broad definition of "doing business in Singapore". The Financial Services and Markets Act has a relatively detailed explanation of the Place of business stipulated in Article 137 (1). In short, as long as you are "physically" in Singapore, whether you are setting up a stall on the roadside or operating a crypto asset business through the Internet at home, you are "doing business in Singapore."

Some partners consulted the SA Jie team, if it is feasible to use scientific Internet technology in Singapore to jump your IP to a third country? The Sajie team believes that this kind of behavior is also illegal and will be punished if it is discovered.

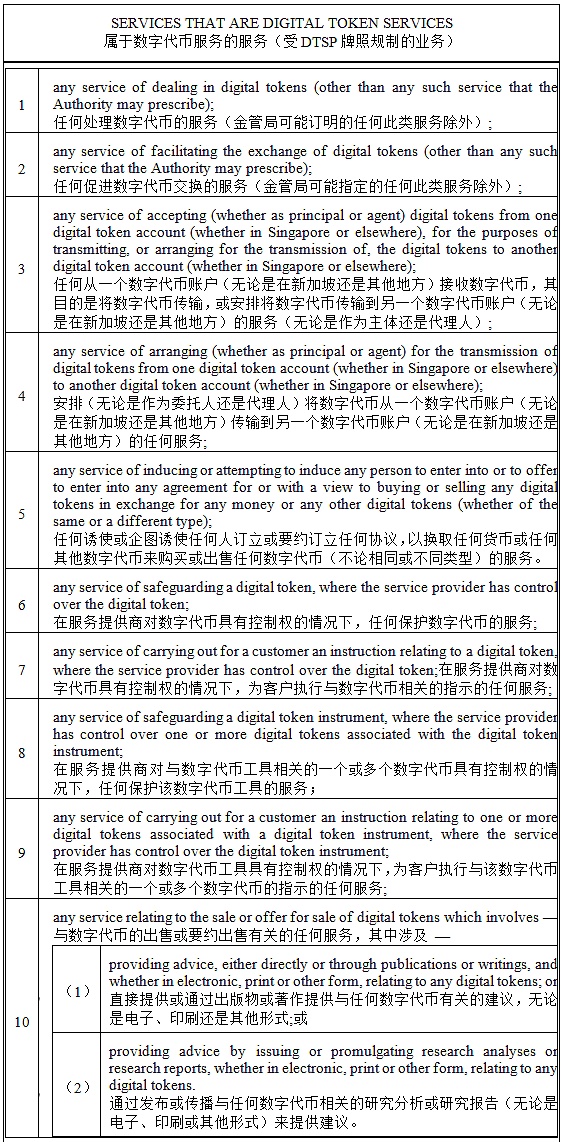

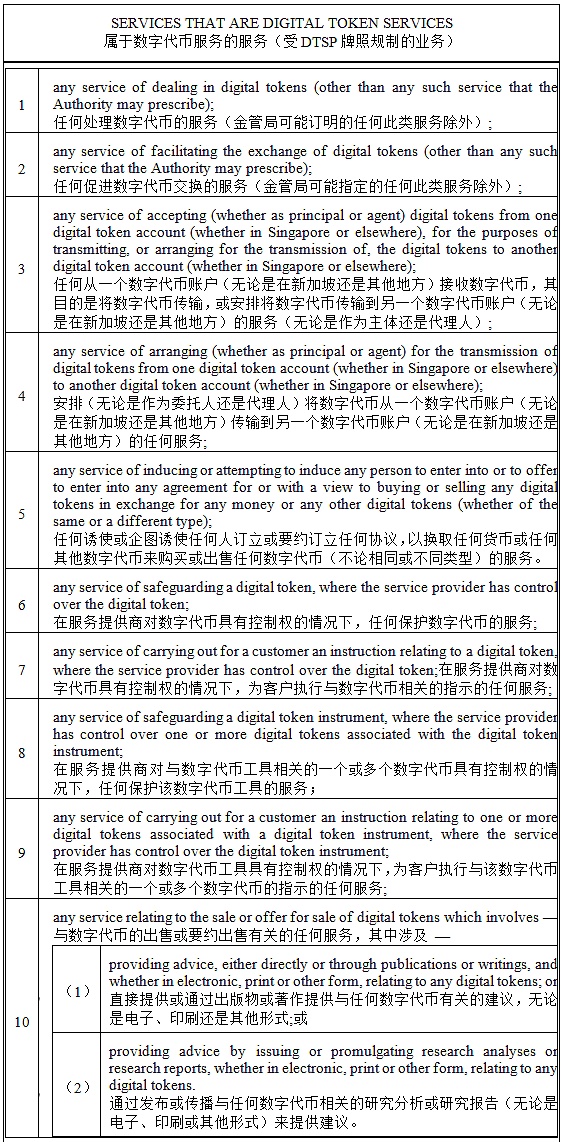

(II) Restricted business scope

In summary, trading business and financial business related to crypto assets are regulated businesses. The Sajie team has specially prepared the following table for partners to review.

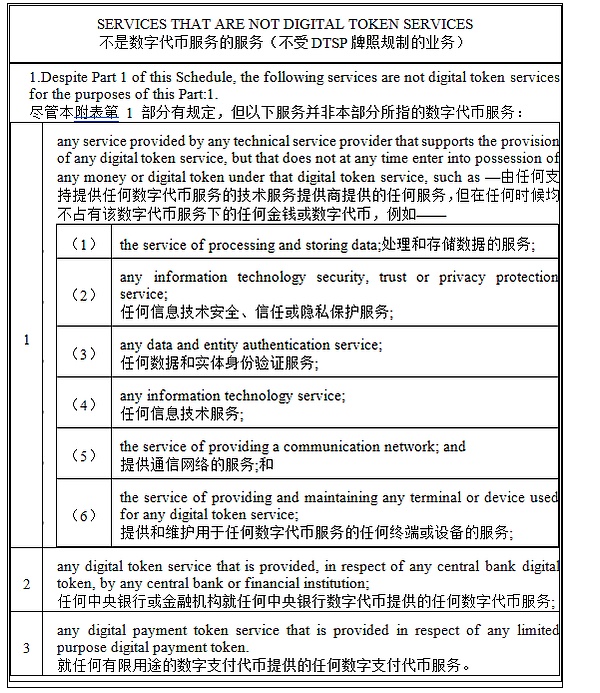

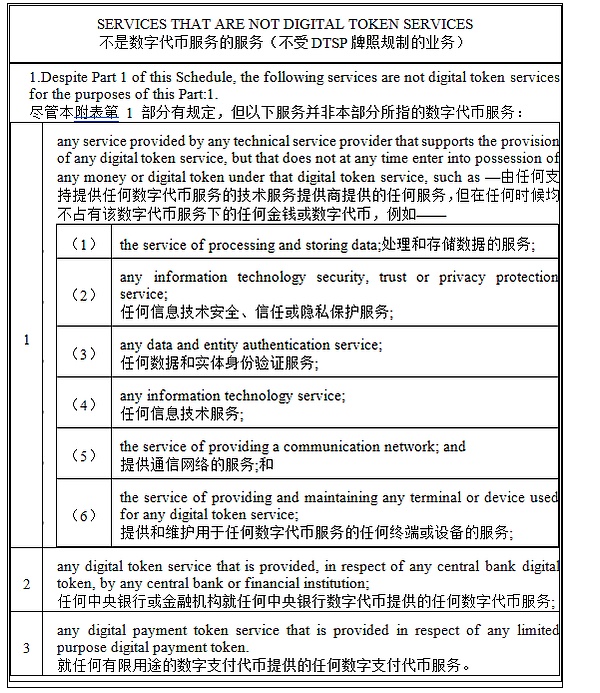

03 Which businesses are not regulated and do not require a license?

In general, pure data storage, identity authentication, network communication, and technical support services related to the operation of encrypted assets but relatively marginal are not within the scope of regulated business. For specific content, please refer to the legal translation comparison table below.

04 Written at the end

Many partners believe that Singapore's regulation this time was "suddenly launched", but it is not. As mentioned earlier, the Financial Services and Markets Act was publicly released as early as 2022 and gave a 3-year window period, but according to the observation of the Sister Sa team, most partners did not pay attention to it, and now they can only drift away again helplessly.

On a personal note, we believe that the compliance development of crypto assets will become a general trend worldwide. Therefore, partners who want to operate for a long time and uphold the concept of healthy development of the industry must attach importance to compliance construction and must arrange relevant licenses as early as possible.

In addition, for countries or regions that accept Singapore's "digital refugees", the Sister Sa team believes that in Southeast Asia, Thailand, Vietnam, Malaysia and the Philippines have all been relatively open and friendly to crypto assets in recent years and can be considered as destinations. Some crypto asset practitioners also choose to deploy in Dubai, Abu Dhabi and other regions, mainly because of the policy advantages of these regions that allow flexible flow of funds. In short, everyone has their own taste, and partners can do what they can.

The above is today's sharing, thank you readers.

Catherine

Catherine