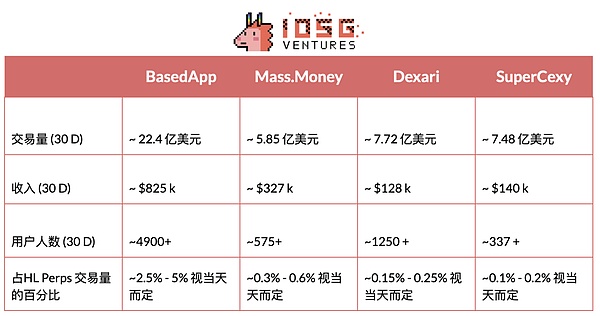

Hyperliquid's technology stack (HyperEVM + CoreWriter + builder code) significantly lowers the barrier to entry for mobile front-end development, while balancing the efficiency of CEX-like execution with the advantages of DEXs (self-custody, fast token listings, and fewer geographical/KYC restrictions). A wave of native mobile apps built on HL has already begun: BasedApp, Mass.Money, Dexari, and Supercexy. These apps generate an average daily trading volume of $50,000 USD (with a monthly recurring revenue of $1.5 million USD), representing approximately 3-6% of HL perpetual contract trading volume. They target diverse user groups (crypto natives, Web2 retail users, and professional traders). Why now? "Hyper-speculative" and the creator content cycle have increased retail users' risk appetite. Mobile apps shorten user onboarding time, simplify crypto complexity, and add engaging features (copy trading, fiat deposits, card payments, money markets, and yield instruments). Core Thesis: The crypto mobile trading frontend benefits from strong tailwinds from Web2 mass adoption and retail activity. For the cryptocurrency market to grow in scale and transaction volume, it needs more crypto-native mobile applications for mainstream Web2 consumers. Compared to Web3 business models, this sector offers truly sustainable revenue at scale with minimal marginal costs of expansion. Over the past few months, there has been a significant increase in mobile trading and DeFi applications targeting retail consumers, many of which are built on Hyperliquid infrastructure. This article aims to delve deeper into this vertical, analyzing the applications currently dominating the market and offering relevant perspectives. 1. Background Overall, retail investor participation in traditional investments has seen tremendous growth over the past decade. This trend began in 2019, when several large US brokerages, in an effort to compete with Robinhood, reduced stock trading commissions to zero, significantly lowering trading costs for smaller accounts. The 2020 pandemic accelerated this process: lockdowns, stimulus checks, and increasingly optimized mobile experiences introduced millions of new investors to the market. By 2022, the Federal Reserve's Survey of Consumer Finances showed a significant increase in stock market participation—58% of US households owned stocks directly or indirectly, with direct ownership jumping from 15% to 21%, the largest increase on record.

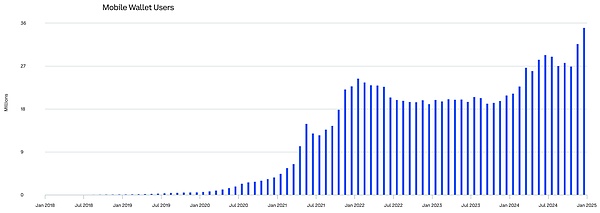

Retail trading continues to dominate daily market activity, currently accounting for 20-30% of US equity trading volume, significantly higher than pre-pandemic levels. This phenomenon is not limited to the US but is also evident globally: the number of investment accounts in India has surged from tens of millions pre-pandemic to over 200 million by 2025. Investment channels are also continuing to expand—ETF inflows reached a record high in 2024-2025, and the popularity of fractional share trading and mobile brokerage services has provided retail investors with more convenient investment tools. The cost impact of zero commissions, the access impact of mobile trading applications, and the liquidity impact of ETFs have collectively driven retail investors to enter the public markets on a large scale, making consumer-grade investment applications a significant structural force in the market. Mobile Trading Apps: Since 2021, the mobile trading app vertical within the retail trading market has continued to expand, driven by the increasing penetration of mobile devices and the rise of a new generation of independent decision-making investors. The global investment app market is projected to reach approximately US$254.9 billion by 2033, with a compound annual growth rate (CAGR) of 19.1%. Why are mobile trading apps so popular among retail investors? The main reasons can be summarized into two dimensions: Social Drive (Gamification and Gambling of Everything) Contemporary social culture is dominated by dopamine cycles, gamification mechanics, and hyper-speculative behavior. The rise of the creator economy and short-form video platforms (such as TikTok and YouTube Shorts) has reshaped user behavior, driving a demand for instant gratification, and mobile trading apps perfectly cater to this demand on multiple levels. On the social level, communities like Wall Street Bets on platforms like Reddit are filled with users showcasing massive gains and losses. Single-day gains and losses exceeding $100,000 have become normalized, and retail users are gradually becoming desensitized to such amounts. Many users separate their Robinhood account funds from real money, treating their portfolios like gaming chips. Coupled with rising living costs, widening income inequality, and negative sentiment surrounding "involution," many working-class people believe the only way to achieve the American Dream is through "hyper-speculation"—taking extreme risks for outsized returns. Mobile trading apps have successfully capitalized on this social and cultural dividend. By offering short-term options, leveraged products, instant execution, and a gamified interface, these apps have successfully lured users away from casinos and into the stock market. Users can simultaneously experience the dopamine rush, gaming thrills, and speculative experiences all on a single phone. App Features: Mobile trading apps have significantly improved across multiple dimensions. Onboarding users, these platforms have streamlined the account opening process from days of tedious paperwork to a near-instant online experience. All user processes, from identity verification to trade execution, are integrated into a single interface, enabling users to fully manage their portfolios. On the trading experience side, these platforms lower both the financial and cognitive barriers to entry by eliminating friction points associated with traditional brokerage models and incorporating new value propositions like fractional share purchases and recurring investments. Drawing on familiar consumer design language from mainstream apps, they shorten the trading decision path, while personalized features like curated portfolio lists and portfolio performance analysis maintain user engagement. Furthermore, post-investment features like segmented performance reporting and automated tax filing make the experience more akin to a full-service financial application, where users can complete all operations, rather than a simple trading terminal. On the social side, content elements further reduce barriers to entry by providing an easily shareable interface, fostering social engagement and incentives (e.g., usage driven by the WSB forum). These characteristics collectively explain why mobile platforms have become the default investment channel and a persistent driver of retail market participation.

Second, what impact does this have on the cryptocurrency industry?

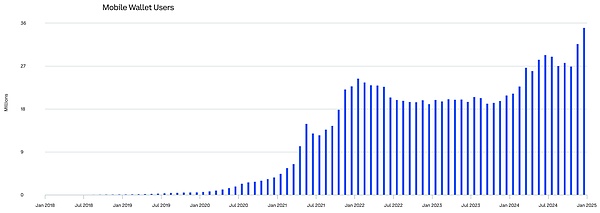

The mobile-first application trend has extended from traditional finance/Web2 markets to Web3.

The surge in cryptocurrency wallet app usage over the past five years demonstrates market demand for mobile-native crypto products. Since trading and yield are inherent features of cryptocurrency, perpetual swaps and DeFi are naturally the first areas to be transformed by the "mobile" process. With the rise of Hyperliquid since the end of 2024 and the launch of its modular, high-performance trading infrastructure, numerous mobile perpetual contract DEX trading and DeFi front-end products have begun to be built on HL infrastructure and have flooded the market. Why Hyperliquid and DEX? From a developer's perspective, HyperEVM's infrastructure is extremely attractive due to the powerful tools it provides. CoreWriter and precompiled contracts allow smart contracts on the HyperEVM to interact directly with HyperCore perpetual contract positions, enabling unique use cases and near-instant execution. Builder Code provides a clear incentive layer for developers, allowing them to earn a share of transaction fees when users trade through their front-ends. These features not only lower the barrier to entry for developers but also make HyperEVM one of the most developer-friendly platforms, attracting top teams and talent. This is why 99% of mobile crypto trading front-ends are built on Hyperliquid. As for why DEXs? Traders are generally drawn to their structural advantages: wider access by eliminating KYC and jurisdictional restrictions, faster listings and a wider selection of tokens, as well as the autonomy of fund custody. Previously, CEXs attracted retail users because they significantly reduced the complexity of market participation: offering multiple trading markets within a single, mature web application, with instant execution, low slippage, and high liquidity, along with integrated support features like wallet management, stable returns, and fiat currency access. However, this came with the burden of significant counterparty risk and the relinquishment of self-custody. Hyperliquid is the platform that seamlessly integrates all of these advantages. This on-chain decentralized exchange combines the structural advantages of a DEX perpetual contract platform with CEX-level liquidity, execution efficiency, and overall user experience. This makes it an ideal liquidity base for building mobile crypto trading applications. So how does all this relate to mobile wallet trading? Thanks to the availability of this modular, high-performance architecture, the development cost of building a mobile trading front-end has become extremely low—which is why a large number of related applications have begun to emerge in the market. Currently, most mobile trading front-ends offer similar functionality centered around perpetual contract trading, but some are beginning to go beyond perpetual contracts to provide users with a wider range of ancillary products. Generally speaking, these applications generally have the following functions:

Fiat currency deposit channel: supports credit/debit cards, bank transfers, Apple Pay, Google Pay, Venmo and other deposit methods

Investment strategy tools: provide fixed investment plans, stop-profit and stop-loss functions and early access to new tokens

Money market integration: one-stop access to DeFi lending protocols

Income generation: obtain income through automatic compounding vaults

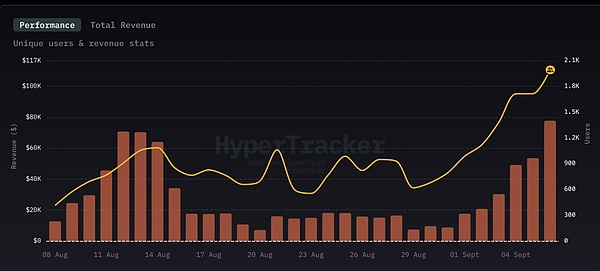

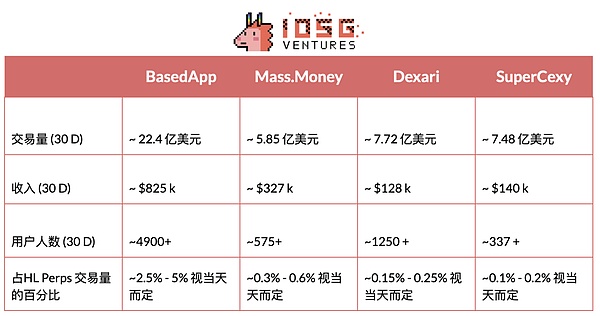

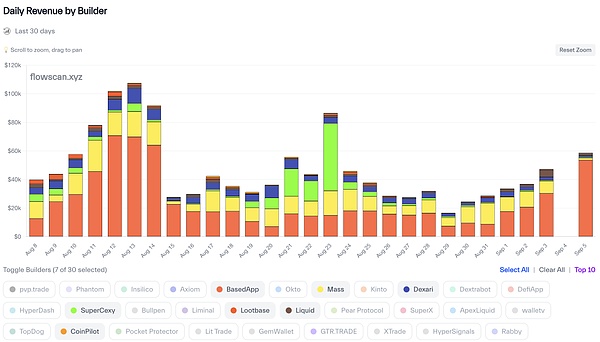

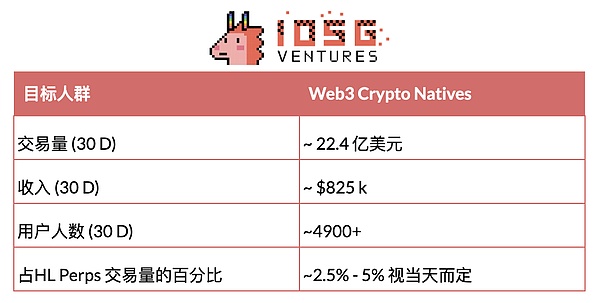

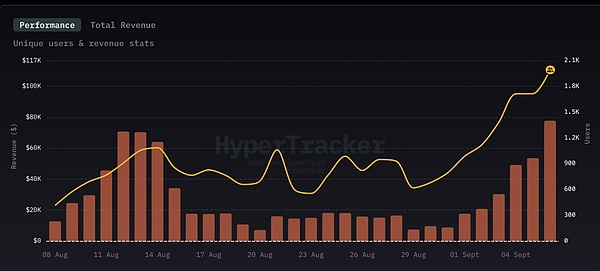

Dapp Explorer: Search and connect to emerging decentralized applications. Debit/Credit Card Services: Make purchases directly using self-custodied funds. These features are made possible by the Hyperliquid infrastructure, which greatly simplifies the development of the core perpetual contract product, allowing the team to focus on innovation in other derivative areas. Due to the modular nature of the entire ecosystem, most HL-based projects can easily implement multi-disciplinary development in parallel. The rich functionality offered by many applications is primarily due to: 1. the low development barrier to entry for Hypercore's developer code; 2. the high willingness to integrate with other protocols. Furthermore, major applications compete primarily in user experience/interface design and social brand building. Currently, the most promising representatives on the market include: Basedapp. Currently, Basedapp is the most popular and fastest-growing mobile trading front-end application in the market. In addition to offering perpetual contracts and spot trading, the platform also innovatively offers debit/credit card solutions directly connected to users' trading wallets, supporting payment needs in everyday consumption scenarios. Its long-term goal is to transform into an emerging digital bank similar to Etherfi.

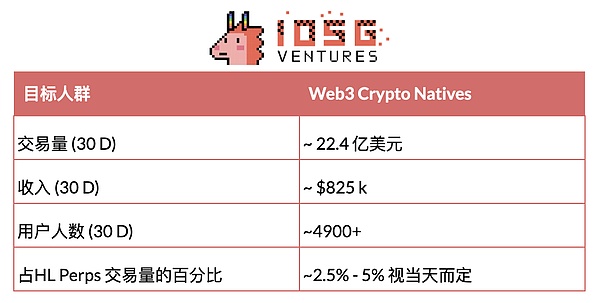

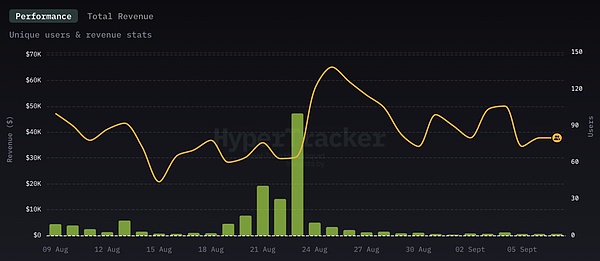

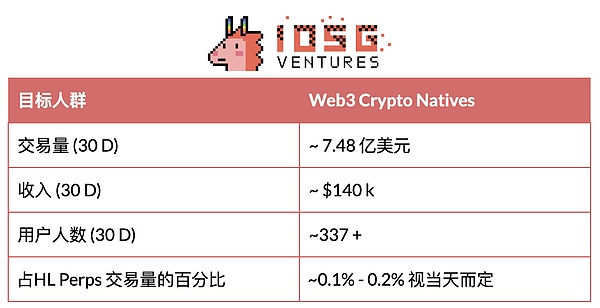

# Mass.Money

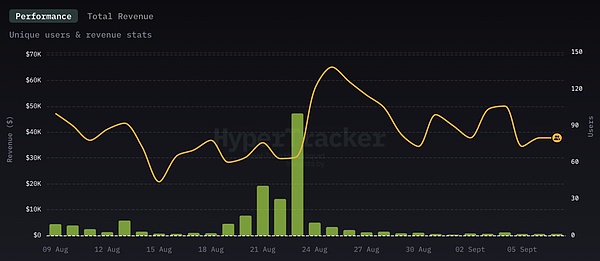

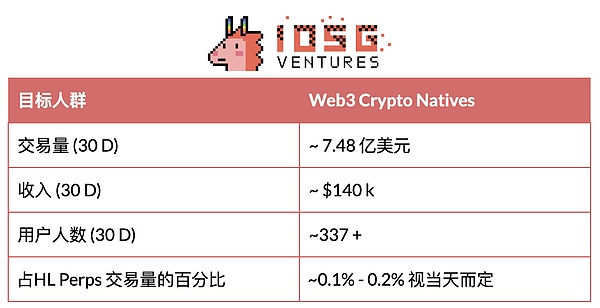

Close behind in the competition on the mobile transaction front end is Mass.money. Unlike the Based app, this platform focuses more on the Web2 retail user base, a positioning fully reflected in its product design: in addition to standard HL perpetual contracts and spot trading, it also integrates a full range of services, including Apple Pay deposit channels, social copy trading functionality, access to DeFi money markets, and cross-chain EVM spot exchange. Its interface design deeply incorporates gamification elements and borrows heavily from the design language of Web2 consumer applications. However, due to its higher fee model and broader product portfolio, its per-user revenue and transaction volume are significantly higher than those of the Based app. Following Mass.money is Dexari. This mobile trading front-end is designed for professional traders, focusing purely on trading functionality. Key features include HL perpetual contracts and spot trading, with a user experience and interface design focused on asset discovery, analytical tools, and execution efficiency. They aim to become the Axiom of mobile trading front-ends. Last but not least is Supercexy. This platform has opted for a purely mobile-first approach and is also optimizing its web-based perpetual contract DEX trading experience, striving to provide a CEX-like experience, but built entirely on Hyperliquid infrastructure. Its product suite integrates DeFi staking functionality and money market access, making it primarily a platform for Web3-native traders.

Comprehensive Perspective

Overall Overview

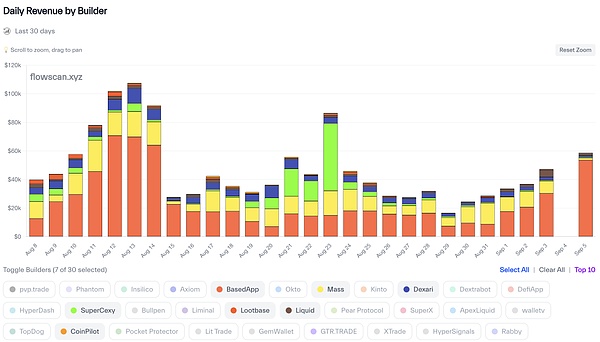

Overall, the average daily combined revenue of all relevant mobile transaction front-ends (including some applications not mentioned) is approximately US$50,000, equivalent to approximately 1.5 billion These applications represent approximately 3%-6% of Hyperliquid's total perpetual contract trading volume. For reference, Hyperliquid's HLP vault accounts for approximately 5%.

Hyperliquid Mobile Trading Front-end Revenue

III. Summary

Core Points

Cryptocurrency Mobile Trading Front-end Benefits from Strong Tailwinds from Web2 Groups and Retail Behaviors

The "hyper-speculation" trend in society has fundamentally changed the behavior patterns of retail consumers. As evidenced by the growth of Polymarket and Kalshi, most users adopt high-risk strategies in the current environment. With speculative demand at historically high levels, mobile trading apps are the product form most directly benefiting. As mentioned earlier, traditional financial mobile apps like Robinhood, Wealthsimple, and TD Ameritrade have seen significant growth in user growth and adoption, primarily due to their low barriers to entry and their business models that promote short-term, highly leveraged, and gambling-like products. Clearly, retail users need easy access to risk and capital allocation, and mobile trading apps are the most logical solution. Cryptocurrency mobile trading apps are fundamentally no different and, if they effectively build product discoverability, can also benefit from this consumer behavior. Robinhood, Wealthsimple, and Revolut's integration of crypto products into their apps is a testament to this. Despite charging extremely high fees, the significant adoption of these traditional financial apps' crypto products demonstrates a strong demand among retail users for convenient mobile access to the crypto market. Without dedicated mobile crypto trading apps, the Web3 market will cede significant value capture opportunities to Web2 competitors. For the cryptocurrency market to grow in scale and volume, it needs more crypto-native mobile apps for mainstream Web2 consumers. Since 2023, the market has seen virtually no new retail inflows. The current total stablecoin market capitalization is only about 25% above its 2021 all-time high, a dismal four-year growth rate for any sector—and this is happening despite the most favorable regulatory environment for stablecoins and strong presidential support for the crypto industry. Solutions are needed to attract new retail liquidity, but significant barriers to new retail capital entry remain unaddressed. The primary obstacles are: first, the public's perception of a complex process for participating in the crypto market; and second, a lack of accessible applications that truly understand the needs of Web2 users. Retail Web2 users don't use complex wallets or transfer funds across multiple chains. They need products packaged in a familiar format, offering easy onboarding and a user-friendly experience, similar to accounts like Robinhood or Wealthsimple. Mobile crypto trading front-ends are the solution—they package products in traditional financial formats familiar to Web2 users, fundamentally removing the perceived complexity and lowering the barrier to participation. This is the only effective way for cryptocurrencies to transcend Web3 circles and gain mainstream exposure. Compared to Web3 business models, mobile cryptocurrency trading frontends signal the beginning of a new generation of applications in the Web3 market—a more sustainable and compliant path to growth. Unlike traditional crypto products (whether infrastructure or DApps), most projects haven't focused on scaling or revenue generation because these weren't core incentives. Most founders' North Star metric was acquiring initial users at any cost, no matter how inefficient or extractive their growth funnels were. They then raised venture capital and locked up tokens through over-the-counter sales or waited out vesting periods without improving their products. Examples include Story Protocol ($IP), Blast, and Sei Network ($SEI).

Crypto mobile trading front-ends take the opposite approach: leveraging existing infrastructure to optimize scale, generating revenue first and raising capital later when necessary. By becoming an aggregator of different products and adopting a base fee structure, these front-ends have the structural advantage of integrating multiple verticals at a very low cost, while focusing on the user experience interface to improve user acquisition and retention. This combination means revenue can be generated from day one and continue to grow exponentially as operations continue. The end result is a more sustainable, real-world business and value layer for Web3, replacing the extractive model of the past. This will bring growing credibility to the entire Web3 industry.

Kikyo

Kikyo