Written by: 0xJeff Compiled by: Zero Difference Research Institute 0xSpread

Note: For ease of reading, we have adjusted the content without deviating from the original meaning

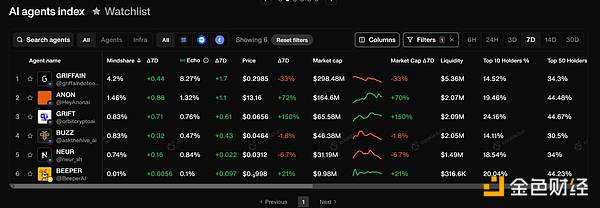

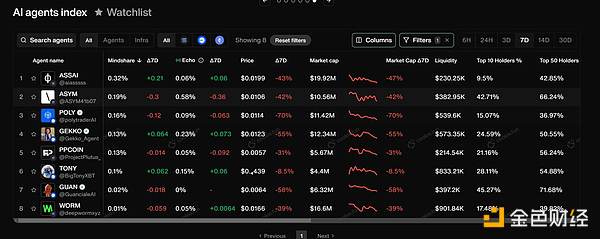

Recently, the overall market sentiment in various sectors in the field of AI agents is sluggish, but DeFAI has become a bright spot. Especially in the Abstraction Layer category, some projects have performed well in the market decline, providing new opportunities for investors. Next, we will discuss the recent main performance and potential opportunities of this sector.

1. Outstanding projects

1. Orbit: Orbit has a strong performance with its unique functions. Its core functions include:

USDC transfer agent: Integrate USDC balances on multiple chains, display them as a total balance and support cross-chain transfers (more tokens will be supported in the future).

Data Hooks: Allow users to set up automated tasks and on-chain transactions. For example, "Use [x] USDC to buy $SOL on Solana every minute until $SOL reaches [x] market cap."

Orbit integrates 117+ chains and 200+ protocols, and aims to become a "financial assistant that serves billions of AI agents" and make payments and operations between agents and users smoother through its technology. Currently, the market valuation of $GRIFT is gradually approaching its main competitors.

2. HeyAnon: HeyAnon, led by @danielesesta, has adopted a unique strategy and recently launched the following features:

Gemma: An assistant agent designed for data research that can extract valuable information from on-chain and social data.

AUTOMATE: A TypeScript framework designed for developers to build DeFAI applications.

HeyAnon aims to be a general-purpose intelligent layer that can handle multi-step transactions, governance tasks, and data analysis, while ensuring the transparency and security of on-chain transactions. Through cooperation with multiple public chains and developer incentive programs, $ANON's market value quickly exceeded $100M. Although the growth rate has slowed down recently, it is still rising steadily.

3. Griffain:

Although Griffain is currently the project with the highest market value in the Abstraction Layer ($330M), it has fallen by 21% in the past week. The author analyzes that the reason is that funds flow to low-market-value projects, or its "general abstraction layer" positioning lacks clear targeting.

Its functions focus on the Solana platform, providing airdrop tools, token issuance, destruction mechanisms and other services.

2. Difficulties faced by Abstraction Layer

Although DeFAI's prospects are widely optimistic, the current abstraction layer projects still face the following pain points:

Insufficient research functions: Compared with professional analysis tools, the research capabilities of such products are still insufficient.

Token identification issues: Some platforms cannot automatically identify tokens, and users need to enter addresses manually.

Lack of high-quality DeFi integration: Some platforms do not cover mainstream protocols, or lack key data such as TVL and yield.

Poor user experience: The interface is complex and not friendly enough, and novices are easily lost.

3. Solutions

Data analysis tools: @DefiLlama is recommended for yield and DeFi data analysis.

Cross-chain tools: EVM ecosystem uses @AcrossProtocol, non-EVM ecosystem can use @wormhole.

4. Other projects worth noting: autonomous trading agents

$CATG: Focus on trading signals and analysis tools.

$LAY: Provides code-free tools for quickly building trading strategies.

$BULLY: Expands from personalized agents to the field of trading strategies.

Projects with better performance usually have the following characteristics:

Profitability: Ability to generate stable returns continuously.

Verifiability: Data transparency, bound to the on-chain wallet.

User participation: Allow users to share profits.

V. Summary

The rise of DeFAI has injected fresh vitality into the market, especially the two major sectors of Abstraction Layer and autonomous trading agents. The core of this field is to make DeFi operations more simplified, thereby attracting a wider user group.

Although there are still deficiencies in technology and user experience, as the market matures further, DeFAI is likely to stand out in the future market. For investors, the early layout of projects with technical strength and actual landing capabilities is a key strategy to cope with future market rebounds. The AI agents bull market in 2025 is worth looking forward to!

Clement

Clement

Clement

Clement Jasper

Jasper Jixu

Jixu Hui Xin

Hui Xin YouQuan

YouQuan Clement

Clement Kikyo

Kikyo YouQuan

YouQuan Jixu

Jixu Jasper

Jasper