By Castle Labs, Translated by Shaw Jinse Finance. Market Outlook: By 2025, the market capitalization for tokenized real-world assets (RWAs) soared to $29 billion, representing over 380% growth over the past three years. This is certainly cause for celebration, but to put it in perspective, this represents only 0.0116% of the $250 trillion in global assets. By 2030, growth forecasts for this market range from $2 trillion (McKinsey) to $16 trillion (Boston Consulting Group), demonstrating both the enormous opportunity and the uncertainty surrounding its adoption trajectory. With trillions of dollars in RWAs expected to migrate on-chain, only providers meeting institutional standards can capitalize on this growth opportunity.

This article uses OpenEden as an example to help understand the need for "institutional-grade" products. To do this, we will first explore the opportunities and structural frictions in the RWA space, followed by an analysis of major asset classes and providers.

RWA Opportunities

This section provides an overview of the RWA opportunity, categorized by asset class, provider, and blockchain network, laying the foundation for subsequent chapters.

Along with stablecoins, real-world assets (RWAs) are the fastest-growing decentralized finance (DeFi) narrative through 2025. As early as 2018, the on-chain tokenization experiment based on Ethereum smart contracts had been registered. Despite rapid growth, RWA tokenization has previously been constrained by several bottlenecks: Regulatory fragmentation across countries, infrastructure gaps in settlement and custody, and technical and security risks (e.g., smart contract risks and cross-chain bridge attacks). In fact, the industry experienced its greatest growth in 2025. In less than a year, the total value of on-chain RWAs doubled, from $15 billion in January to over $29 billion in September, with a projected compound annual growth rate of approximately 43% through 2029. However, it's important to note that this didn't occur in isolation. It's not a standalone development, but rather the culmination of years of positioning and infrastructure development, ultimately creating an environment capable of operating at scale. In particular, the past few years have radically transformed the economic and regulatory landscape for tokenized RWAs. Following the Federal Reserve's rate hike to 5.5% in 2023, the dramatic interest rate shift redefined the economic landscape. This radically altered the risk-reward profile of many on-chain assets and lending protocols, driving capital to safer avenues, such as U.S. Treasuries, which began offering higher interest rates. Overnight, tokenized Treasuries became a high-quality, risk-adjusted investment vehicle for on-chain retail investors and Decentralized Autonomous Organization (DAO) treasuries. Web3 participants are also beginning to follow suit: a notable example is Grove, a child DAO of Sky (formerly MakerDAO), which invested $1 billion in tokenized Treasuries. All of this is fueled by changes in the regulatory landscape for RWAs and cryptocurrencies in general. Legislation such as MiCA provides clear guidance for digital asset regulation in Europe, while the OECD's Crypto-Assets Reporting Framework (CARF) provides a standardized global framework for the Automatic Exchange of Information (AEOI) regarding crypto-asset transactions. In the United States, Trump has made it clear that his government welcomes developments in this area and recently approved the GENIUS Act, a significant milestone in the adoption of stablecoins. Meanwhile, other countries like the UAE and Singapore continue to publicly support the adoption and development of cryptocurrencies in their regions. Arguably, one of the biggest highlights of on-chain RWA development is the entry of traditional financial giants. The launch of funds led by renowned institutions such as BlackRock and Franklin Templeton has further solidified the stability and legitimacy of the industry. BlackRock's BUIDL is currently the largest on-chain RWA asset, with a total value exceeding $2.2 billion. src="https://img.jinse.cn/7402215_watermarknone.png" title="7402215" alt="PRYxcqDZMl8uJPb6rCt1BQOgkLuUGbFwfgUSDThk.jpeg">

As can be seen from the above table, most of the top 10 RWA assets on the chain are related to US Treasury bonds and commodities (especially gold).

The process of on-chain tokenization has brought significant benefits to these institutional assets because they are able to use on-chain platforms to obtain DeFi liquidity while maintaining regulatory compliance.

The next section will delve deeper into what it takes for an asset to be considered “institutional grade,” focusing on the requirements of institutional investors and describing how incumbents like OpenEden are positioning themselves through their products and services.

About OpenEden

If the RWA industry is to transform into the financial infrastructure of the future, platforms must demonstrate five key aspects:

Regulatory clarity

Independent verification

Institutional custody

Transparency

Composability

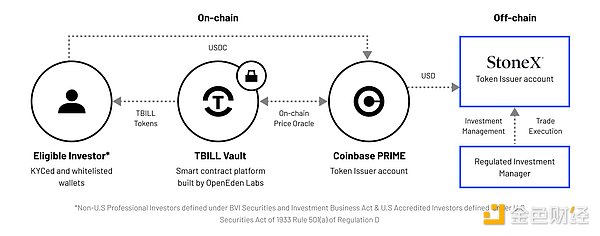

Once received, TBILL tokens will be held in the investor's wallet and kept by the investor.

Investors can redeem their tokens by joining the redemption queue, which is expected to process their order within approximately 1 day.

To give you an idea of the coordination required to launch these products, the TBILL Vault has the following features:

Token Issuer: A fund registered in the British Islands.

Investment Manager: BNY Mellon serves as the primary custodian of the investment management and underlying assets.

Fintech Service Provider: In this case, River Labs provides the technology required to run the TBILL Vault.

The fund currently has an annual expense ratio of 0.30%, and transaction fees (subscriptions and redemptions) are 5 basis points. (bps).

To increase DeFi composability, TBILL will be integrated with Aave's institutional-focused platform, Horizon.

USDO

As part of its product, OpenEden also launched "OpenDollar" (USDO), a regulated, yield-bearing stablecoin backed by U.S. Treasuries and reverse repurchase agreements.

The token is available in two different formats:

USDO: USDO is a daily-adjusted pegged token with a value set at $1 to simplify yield distribution. Users' yields are reflected in changes in balances.

cUSDO: The balance is constant. Accumulated yields are reflected in price appreciation.

Future Outlook and Conclusion

We estimate that by 2030, the scale of RWA tokenization will increase 70 to 100 times. This growth is likely to be gradual rather than linear, similar to what we are experiencing now. Growth will be limited until the infrastructure is ready for explosive growth (e.g., 2025). Future breakthroughs in custody, settlement, regulation, and asset types will usher in a new wave of applications and opportunities.

Among them, we expect that the main drivers of growth in the short term will continue to be around government bonds and money market funds, while the fastest growth in the medium and long term will be in private credit and real estate, respectively.

Cheng Yuan

Cheng Yuan

Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance