Author: Dave

Water Margin, Chapter 75: "Song Gongming's loyalty moved the master, and the general Su held the imperial edict to recruit him." The outlaws who were once forced to Liangshan surrendered to the court under the impetus of various forces. How similar, in 2008, the information published on the first block of Bitcoin Genesis was the second aid from the British Chancellor of the Exchequer to Europe, and the words were full of Satoshi Nakamoto's criticism of the existing financial system. Now, this former Liangshan hero has also surrendered to the court and willingly become a new tool of the old capital. With the successful breakthrough of the stablecoin bill, Circle and Tron have successively hit Nasdaq, and the discussion of US stocks and cryptocurrencies on the entire network has reached its peak. This article will systematically sort out the logical line of cryptocurrency moving towards traditional finance. At the same time, in order to add a little fun, I, a hardcore investment research blogger, will also rarely mix some of my own stories in the article.

"I hate the lack of joy in life, and I am willing to love a thousand gold coins for a light smile. I hold a cup of wine for you to persuade the setting sun, and leave the evening light among the flowers."

I came into contact with Bitcoin when I was 15 years old. It was because of Satoshi Nakamoto's spirit of changing the world that I devoted myself to this industry. Now Bitcoin has transformed from the grass to the temple. I wonder what Satoshi Nakamoto's spirit in heaven would sigh if he saw this scene in the world? On second thought, I also changed from a high-spirited teenager to a bitter blogger who said that the weather was cool and it was a good autumn. Hahaha, everything is fate, and it is not up to people at all.

We should still be optimistic. Without further ado, let's get to the main text.

1. Overview of Crypto and US Stocks

In order to give you a big picture, the first chapter will briefly sort out the crypto and US stock varieties that are linked to each other, including the attempts of traditional financial services and cryptocurrency exchanges to enter each other's markets. Let's feel this inseparable situation together.

"You are forced to come and you can't be free, and the dragon and the phoenix are hard to stop. The flowers in the hall are drunk with three thousand guests, and the frost of a sword is cold in fourteen states"

1. Overview of coin stocks: I summarized it myself. There are currently three categories of cryptocurrencies in the US stock market. Some of them are subdivided into coin stocks and mining stocks, but these details are unnecessary. We call them coin stocks here, which is also a more common name in the market. The three types of currency stocks are:

Virtual currency mining business: MARA Holdings (MARA), Riot Platforms (RIOT), Hut 8 Mining (HUT)

Cryptocurrency comprehensive financial service business: Circle (CRCL) US dollar stable currency, Coinbase Global (COIN) exchange, Galaxy Digital (GLXY) comprehensive financial and technical services.

Coin hoarding business: MicroStrategy (MSTR) hoards Bitcoin, Metaplanet Inc. (3350.T) Japanese version hoards Bitcoin, Sol Strategies (HODL) Canadian listed hoards Sol. At the same time, this sector also has some broad inclusions, for example, many traditional listed companies will put cryptocurrencies into their balance sheets, classic examples are Tesla (TSLA) and Trump Media Technology Group (DJT).

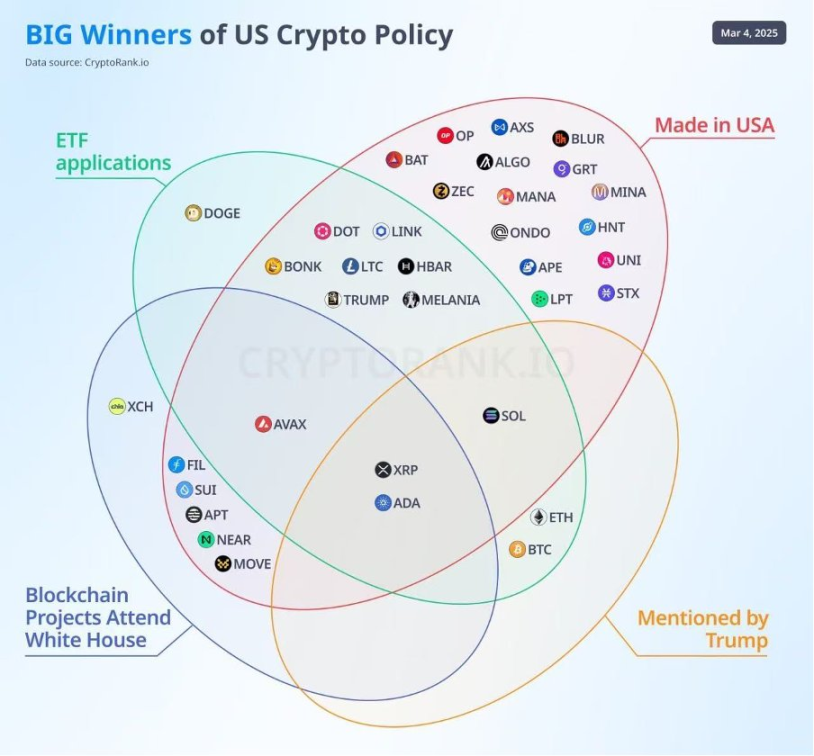

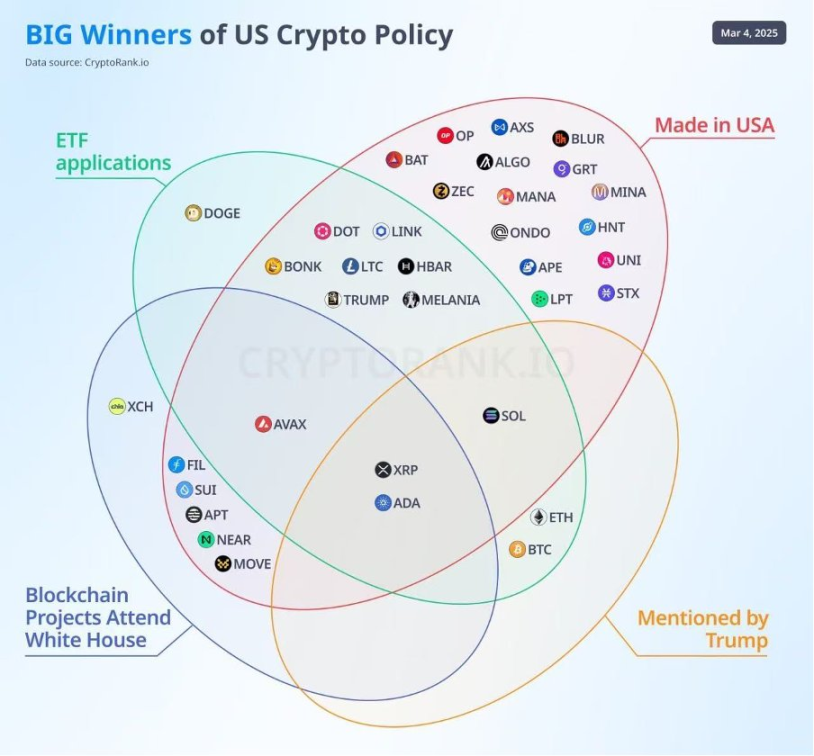

2. Blue-chip cryptocurrencies:I call the currencies recognized by the main funds blue-chip cryptocurrencies. There are many evaluation dimensions, such as those that enter the coin base coin50 index or issue ETFs, which are all large currencies. There is a very detailed chart below. The picture is a few months ago and may have some updates.

At the same time, I also list some ETF code names, and those who want to speculate can go and speculate.

Bitcoin: ProShares Bitcoin Strategy ETF (BITO), iShares Bitcoin Trust ETF (IBIT)

Ethereum ETF: Grayscale Ethereum Trust (ETHE), Bitwise Ethereum ETF

Solana: On June 13, seven major asset management companies (such as VanEck and 21Shares) submitted revised S-1 documents in response to the SEC's request for redemption and pledge. Bloomberg analysts estimate the probability of approval in 2025 to be 90%, and some reports predict that it may be approved in July.

3. From the perspective of cryptocurrencies tradfi: There are currently two relatively mature businesses in the cryptocurrency circle that are approaching traditional finance

payment. The payment track is the only cryptocurrency project with practical application value. No offense, but there is not much difference between running in Nike shoes and running in shoes that can mine. Payment is different. Using cryptocurrency for cross-border payment is indeed superior to traditional channels. At the same time, some toC project parties, such as @0xinfini, which has been very popular recently, have indeed solved the problem that people in the cryptocurrency circle have difficulty in withdrawing money and that cryptocurrency consumption can only be spent in the cryptocurrency circle, so it is a market with demand. This track has a great combination with traditional finance, first of all, in terms of supervision, and secondly, in cooperation with large banks, and in cooperation with traditional payment service providers such as visa master.

Some RWAs. Most RWAs are scams, but some RWAs are relatively mature products that are closely linked to traditional finance. For example, @Bybit_ZH provides services for trading commodities and US stocks, @binancezh provides services for trading gold tokens, etc. These trading products are all based on the original ecology of encryption and are attempts to connect with the traditional capital market.

4. Look at encryption from the perspective of tradfi: Crypto is a very dynamic business for those old fashion investors, like Warren. Currently, there are two main types of companies that start from traditional finance and extend their business to cryptocurrency:

Traditional brokerages open cryptocurrency trading: These are mainly several compliant traditional brokerages in Hong Kong. After obtaining the cryptocurrency trading license, they can allow users to directly use cryptocurrency trading to trade on their platform, such as Futu. At the same time, in a broad sense, we can also include some ETF providers, who all provide traditional asset class investors with a channel to invest in "alternative assets". (Yes, cryptocurrencies are still considered alternative assets in large funds, on the same level as antiques and calligraphy and paintings) Hedge and venture capital funds: For more professional investors, hedge funds have already begun to lay out cryptocurrencies, such as my internship at a compliant hedge fund in Hong Kong in the summer of 2024. Including some family offices and large companies will appropriately allocate crypto assets to optimize their portfolios. As of June 17, 2025, there are 18 listed companies holding Bitcoin, 5 holding Ethereum, and 2 holding Solana.

The first paragraph was really handwritten by looking up information one by one, and it took me a whole morning. If you have read it all, you will definitely sigh that you didn’t expect that these two industries are so closely connected. But do you remember that at the beginning of the birth of blockchain, a group of geeks clamored to overthrow traditional finance. How did the dragon-slaying boy suddenly seem to become a dragon? Before entering this issue, let’s tell an interesting story, the history of the Internet.

2. The Sorrow of the Internet

"If life could only be like the first meeting, why would the autumn wind make the fan sad? People's hearts change easily, but they say that people's hearts change easily"

⌨️The Internet was originally built by a group of technical geeks and pioneers who wanted to create a decentralized and open platform to oppose the monopoly of capitalists. These "hackers" believe in the "hacker ethic", emphasizing freedom of information, opposing authority and decentralization. For example, Richard Stallman founded the free software movement, advocating software sharing and opposing the control of proprietary software. (This is the reason why Microsoft was attacked by so many hackers later)

The first generation of the Internet was mainly used by academic institutions and government departments, following the principles of openness and sharing. Even in 1989, when the famous Tim Berners-Lee invented the World Wide Web (the www on our website), his design principles were still based on open standards and no copyright restrictions, aiming to promote the free flow of information.

Do you think it is very similar to the style of the currency circle from 2008 to 2016, and the cyberpunk spirit that Ethereum continues to this day. The concept of Cypherpunk was created by Jude Milhon, who is an Internet scholar. Her article "Cypherpunk Manifesto" points out that privacy is the cornerstone of freedom and the Internet should be a tool to resist surveillance.

I can't believe that the Internet, which now eavesdrops on privacy, abuses data, creates information cocoons, and randomly blocks people's accounts, once aimed to become a tool to resist surveillance.

The transformation of the Internet from an idealistic platform to a capital tool began with the commercialization wave in the 1990s. In the 1990s, policy changes such as the privatization of NSFNET in 1995 and technological advances such as the introduction of HTTPS enabled e-commerce to flourish. The growth of market demand attracted venture capital and start-ups, and the Internet changed from an academic tool to a commercial platform.

www was invented in 1989, and the Internet bubble began in 1995. The dot-com bubble occurred between 1995 and 2001. With the Netscape IPO triggering a boom, the popularity of browsers promoted e-commerce, and the stock prices of Internet companies soared. Why is it called the dot-com bubble? Because in those days, as long as your listed company added ".com" to its name, the company's valuation would soar, the market dream rate was extremely high, and .com became a buzz word. The entire market was intoxicated by the dream of low interest rates and the new economy.

However, all good things must come to an end. In March 2000, the Federal Reserve raised interest rates, the US stock valuation was slashed, the Nasdaq index plummeted 78%, and many Internet companies that were faked went bankrupt.

For comparison, the Internet bubble crisis was even more destructive than the 2008 financial crisis.

The major impact of this stage on the Internet was that the structure of participants had undergone a fundamental change, from the ivory tower to the arena. Speculators, fraudsters, and corrupt employees welcomed their feast. Afterwards, the Sarbanes-Oxley Act of 2002 strengthened the supervision of financial reports of listed companies to prevent fraud. At the same time, the SEC launched an investigation into the misconduct of investment banks (such as Goldman Sachs) in IPOs. This series of performative measures only proved the barbarity of the Internet expansion period and was not practical.

Do you think it is very similar to the style of the bull market in the cryptocurrency circle in 2017? Blockchain technology has gone from the halls of idealism to the rivers and lakes, with various CX pushes, bubble business models, and simple and crude Ponzi schemes. But that was also the time when liquidity was the most abundant, and it was the golden age in the eyes of countless old cryptocurrency circles.

?2009- Today, the Internet has completed the transformation from rivers and lakes to temples. BlackRock, Vanguard, State Street, Fidelity, the above four together hold more than 20% of the stocks of the 7 giants. Smaller Internet companies may even be held by a single institution with a 30% stake. Large technology companies such as Google, Facebook and Amazon have formed a monopoly by controlling infrastructure and data. Advertising and data collection have become the main profit models, and privacy and network neutrality, the once sacred doctrines, have long been thrown into the dust by later generations.

The Internet's comprehensive monopoly of data and comprehensive invasion of user privacy began with Google, and then the Internet giants found such a sweet business and followed suit. There is a movie called "Surveillance Capitalism". It does not ask you to monitor capitalism. Surveillance is an adjective that modifies capitalism. The movie tells in great detail how Internet giants step by step pua the masses, exchange political resources, and step onto the top of the power tower.

After a long 40 years of development, the Internet has successfully connected to capital, and to some extent it can be regarded as marrying into a wealthy family, because without the initial support of these investment institutions and the subsequent hype of large funds, the Internet business model itself cannot be smoothly popularized on a large scale.

After talking about capital, what about power? There is no need to say more. Countless examples from China and abroad can jump out of everyone's mind. Whether through the temptation of power or the threat of power, Internet giants have long been involved in political resources. If you don't believe it, you can go to Green Bubble to criticize the leaders, or criticize Ma Zong Group on Twitter, and then you can verify the statement that the Internet is succumbing to power.

Back to the cryptocurrency circle again, do you feel like the development from 2020 to now? Institutions have entered the market, and countless project parties have set their ultimate goal as joining traditional finance, such as listing. It's ironic to think about it. Isn't the reason for the invention of ICO to revolutionize IPO? While you admire Sun Ge's ceiling operation, have you ever thought about why the once unruly Internet and unruly cryptocurrency circle could not escape the fate of being recruited?

Next, let’s move on to the key part of this article, Death of Geeks: Why Cryptocurrency Will Eventually Submit to the Imperial Court

3. Death of Geeks

I graduated from high school in the summer of 2023, when RWA was a very hotly discussed topic. Since November 2023, I have firmly believed that the future of the currency circle will be integrated with traditional finance, so I went to a compliant crypto hedge fund in Hong Kong for an internship in the summer of my freshman year. The purpose was to get more exposure to traditional financial business. My friends who are familiar with me in @0xUClub also know that Dave can be said to be an alternative currency circle rebel, who actually wants to surrender to traditional finance. Now that the time has come, King of Understanding and Brother Sun have entered the room with cryptocurrency, and I still have some feelings.

"Looking up at the top of the mountain, I see the chaotic clouds and heavy rain, and the upside-down rivers and lakes. I wonder if the clouds are rain or the rain is clouds? The vast sky is destroyed in a moment by the west wind. Looking back, I hear the moon and the sky, and the world is crying out."

3.1 The real mass adoption: The Godfather's business

In The Godfather 2, the young godfather Vito Corleone confronts the local gangster boss Fanucci in Little Italy, New York in 1910. Fanucci tells Vito: "Young man, you gotta pay for protection for your business, or there『ll be trouble.』

A hundred years later, the big officials of the US Securities and Exchange Commission may have said the same thing to @cz_binance.

Mass adoption has been a long story, from the time I finished the college entrance examination to now. Why haven't any real application-level products been made? Why hasn't the cryptocurrency industry ushered in its own iPhone moment? What factors are needed for real mass adoption?

This question is a topic worth discussing. Here I will only talk about it from one perspective, business confrontation: the godfather's business. The principle of the mafia is that if you want to do business on my turf, then you have to give me some benefits. This sentence is completely applicable to discussing the mainstreaming of cryptocurrency from the perspective of business confrontation. Why is blockchain so exciting? Because it brings not only changes in business models, but also changes in distribution structures. For example, pump.fun allows everyone to participate in asset games without any threshold, which is intolerable for those institutions that monopolize asset rules, such as large investment banks. Various Dapps that return data privacy rights to users can almost cut off the financial path of many Internet giants.

If you want to do business on my turf, then you have to give me some benefits. If you don't share the profits, then the big institutions that control mainstream social resources will not allow you to do business in their business areas.

Capital has two ways to deal with this kind of new things.

The first is to suppress, such as the UK Red Flag Act, which requires each vehicle to be equipped with at least three people - two people operating in the vehicle, and one person walking 60 yards (about 55 meters) in front to guide, waving red flags (daytime) or holding lanterns (nighttime) to warn pedestrians and other vehicles. This thing protects the interests of traditional horse-drawn carriages and railways, and is a victory for the industrial lobbying group. There is also the current taxi protection law in Hong Kong. In order to protect the stupid taxi drivers who are outdated, have poor service attitudes, and deliberately take a long detour, online ride-hailing is regarded as illegal operation. The core of the first method is to eliminate the enemy, and it will indeed eliminate a group of innovations that lack vitality.

The second method is assimilation. For example, investment institutions bought Microsoft stocks, financiers such as Soros participated in political donations, and the arrogant father Ma was expelled from Alibaba and semi-taken over by state-owned assets. The core of the second method is to turn the enemy into a minister. Whether it is coercion or inducement, you must listen to my opinions in your future development.

Back to cryptocurrency, the first method of mainstream capital against cryptocurrency was suppression. The actions of the Chinese government are the most famous, seven ministries and commissions red-headed documents, nine ministries and commissions red-headed documents, and ten ministries and commissions red-headed documents, which are very fierce. But then mainstream capital found that this thing was too strong and there was no way to eliminate it, so their strategy turned into assimilation: BlackRock took the lead in ETF, and now IBIT's daily trading volume has exceeded Binance, and the pricing power is completely in the hands of traditional investment institutions. Trump held a crypto roundtable and called together the cryptocurrency leaders who occupied the mountain to hold a meeting to recruit them. Using money and power to attack, this trick is too effective.

Back to the Godfather again, this method is actually very common in the underworld, either to eliminate the enemy or to turn the enemy into a loyal younger brother. The picture below is my summary of the views of the CEOs of the eight major banks (BB) on cryptocurrencies last year. At that time, I had not charged money yet, so I could only post it in sections. I intercepted some of them, which also proved that I did start paying attention to the track combined with traditional finance very early. Welcome everyone to take a look.

3.2 Liquidity support: a bigger pusher.

Why is this round of secondary so difficult? It is getting harder and harder for cottages to rise? The root cause is that marginal liquidity has not improved. In other words, with the global money supply unchanged, the stock of funds has been exhausted, and the valve of incremental funds cannot be opened. Including the fierce competition among exchanges and the frantic solicitation of new customers that we will see later, the causes behind these superficial symptoms are all because of the shortage of existing funds and the lack of incremental funds. The currency circle has no liquidity. Without liquidity, it cannot support such a high market value. More strictly speaking, everyone has no way to exit. However, compared with traditional financial assets, the size of the currency circle is insignificant, so if it can access institutional funds, sufficient liquidity can support the bubble of many tokens now. And the participation of investors from the traditional world will also provide huge incremental funds for cryptocurrencies. This is the logic of the super bull market. 3.3 Glory Submits to Me: The End of the New Nobility If a person or a group earns a huge amount of wealth, then he must also earn matching political resources and social status. Otherwise, money, a free-flowing resource, and influence, a class-enclosed resource, will produce a huge mismatch. Mismatch often leads to crisis, such as the late Qing government. Ancient China was very rich, but they had neither international political resources nor international status, and their military strength was still very poor, so they could only become fat meat to be slaughtered.

This logic is fully used in the cryptocurrency industry. When I saw CZ, the leader who may be 10 times richer than the chairman of Goldman Sachs, was fined 4 billion US dollars and was thrown into prison, I realized very clearly that the currency circle would fully exchange political resources. For example, SBF of FTX is the second largest individual donor to Biden's campaign in 2020, second only to Bloomberg. The crypto lobby headed by Coinbase CEO and Microstratagy CEO in the United States is also quite active. This activity has a professional term called power rent-seeking, which refers to individuals or organizations obtaining economic benefits or privileges by exploiting political power, administrative resources or institutional loopholes, rather than creating wealth through productive activities. Don't look down on this operation. In fact, most of the time, underground operations are the main driving force of things.

On the other hand, those in power also need money. This is a two-way deal. Sun Ge’s operation since Trump took office is a textbook practice.

4. Old story? New era? : The future of the currency circle

I remember that in mid-2024, it was actually a bearish time. At least everyone was tortured and painful, so they began to discuss what the future direction of the industry would be. There were three mainstream arguments at the time. The first was decentralized computers, represented by the value faction represented by Ethereum. The second is crypto casinos, financial nihilism represented by local investors (many local investors were even on Ethereum at that time).The third is the compliance group, who believed that the cryptocurrency circle would definitely accept the amnesty in the future. This type of voice was a relatively small group at the time.

In fact, going back to that time point, if you put yourself in their shoes, you really had no idea. My attitude at that time was, just like saving China from the Qing Dynasty, different revolutionaries proposed different policies. Standing at that time, everyone really didn’t know which method could save China. No problem, just give it a try. I think traditional finance will definitely intervene. If I’m wrong, it doesn’t matter, because what if it succeeds?

So looking at the future from now, where will cryptocurrency go? I think @yuyue_chris teacher said it very well, Let God’s things be God’s, and let the grass be the grass. We can classify them like this. For new players in the coin circle who are accumulating original capital, on-chain, crypto-native, and fairer games will become the mainstream. For old players in the coin circle who have already achieved success, compliant, safe, and large-capacity games will become the mainstream. So we may see two polarizations. Native web3 will become more native, and mature web3 will become more mature and move towards the mainstream.

"I hope to die in the midst of flowers and wine, and I don't want to bow in front of carriages and horses."

I saw my dear Weituo teacher @thecryptoskanda posted a post two days ago. He commented on a related dog coin in the Indian air crash, and was criticized by the justice-minded beauty @yuxin_pig. Teacher Weituo is the king of the plate, and teacher Yuxin is a firm builder of Ethereum value. They are both really good mentors and friends that I want, but I see that they are quite happy to quarrel. This kind of value collision is the coin circle that I fucking like. The future of the cryptocurrency world will continue to grow amidst disagreements.

Finally, let me tell you a little about my own lessons

5. Learn from the pain, bonus or illusion?

"Don't wait, your youth will be gone, and you will be sad for nothing"

Since last fall, two trends have developed particularly well. The first is the financial nihilism crypto casino, and the second is the compliance school going mainstream. I did foresee that cryptocurrencies would move towards the mainstream in the future, but I underestimated a fatal point, which is that this opportunity is almost impossible for ordinary people to participate. I used to think that if we slowly move in this direction, there would be a lot of arbitrage space between traditional institutions and crypto assets, but I did not expect that the speed of crypto integration would be so fast, nor did I expect that participating in top-level design would be so difficult. So last November. My friends who were dedicated to playing with local dogs and chains became rich one by one, while I was still struggling to study the business, which was really painful.

During this period, many crypto companies have rushed to go public, and a large number of traditional institutions have also stepped in to take over. Everyone in the circle of friends is very excited, but after seeing the example I just gave, we have to think about one thing, is this feast a bonus or an illusion?

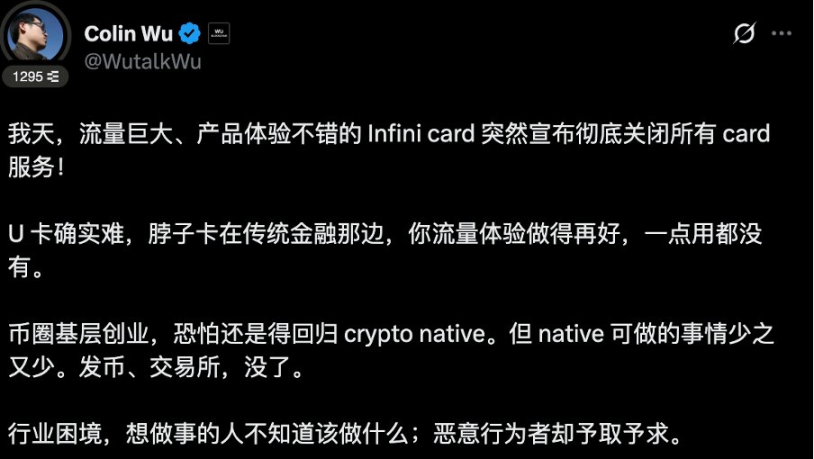

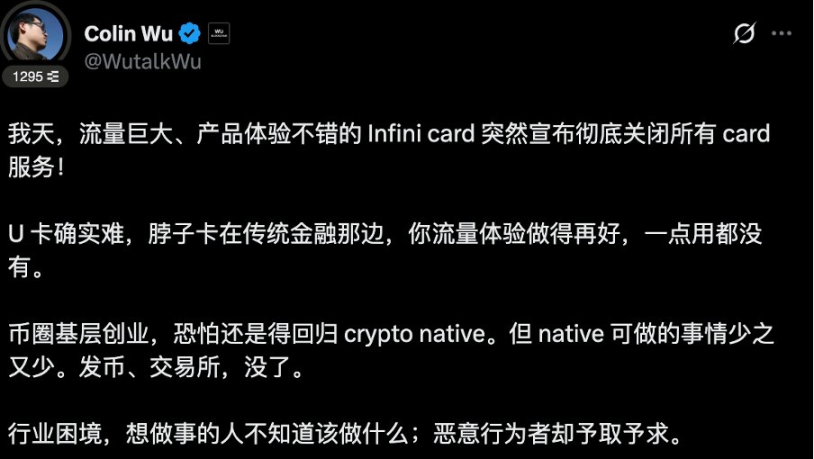

Infini's closure of the C card event has caused a lot of discussion. Wu said he posted a post

As far as the current personal wealth growth is concerned, the dividends on the business side are already very small, and there are still some opportunities on the asset side. As a sober participant, we must realize that although the cryptocurrency industry is still in its early stages, some sectors are already quite saturated, and we should always look for those sectors that are growing exponentially. How to operate specifically can only be accumulated through a large amount of actual combat. The most important take away is to reflect, not to be carried away by the mainstream voice and get excited, and to calmly think about how to seize the few bonus periods in the next step.

Conclusion:

From the perspective of the currency circle, the entire history of cryptocurrency development seems to be a Water Margin from "being forced to Liangshan" to "recruiting by imperial decree". Behind this contrast and irony, there may be the obscure operating rules of the human world. An interesting historical observation is that God has the virtue of loving life, and history often develops in a more neutral direction. Integration and compromise are the norm, and fighting and revolution are the minority.

I have written so many words without realizing it, and I have said both the real and the mysterious. Finally, to summarize, the first part gives an overview of some relatively dry investment targets. The second part tells some interesting stories. The third part starts to talk about my favorite logical reasoning.

Weatherly

Weatherly