Author: Phyrex Source: X, @Phyrex_Ni

Last week, I focused on the reasons for ETH's rise. This week, I will explain it more systematically. In addition, the overlap between ETH and Russell 2000 also needs to be considered. Even from the current state, ETH still maintains a very close overlap with Russell 2000, which means that some investors have begun to bet on sector rotation. Therefore, it is not only ETH that may bring about the cryptocurrency alt season, but even Russell 2000 may also reflect the situation of the US stock alt season.

However, it is still a little early to conclude whether there will be an alt season.

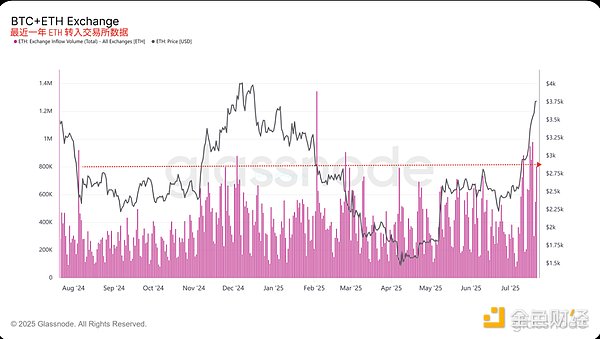

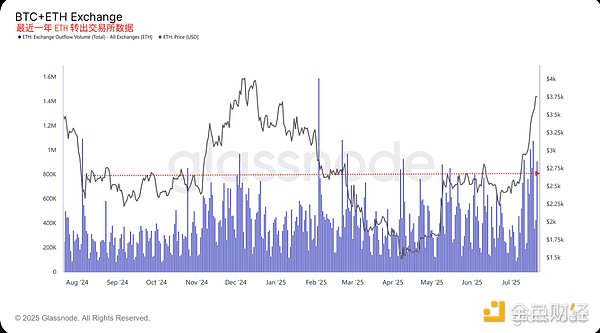

So what is the situation of ETH now? From the data transferred to the exchange, it can be clearly seen that after the price of ETH exceeded US$2,400, the ETH transferred to the exchange for sale continued to rise, especially in the past two weeks after the price of ETH exceeded US$2,500 and US$3,000, the data of ETH transferred to the exchange has been comparable to the selling volume when ETH hit US$4,000 at the end of 2024, so if we only look at the selling volume, the current pressure is indeed very large. In fact, it is not just ETH that is like this, but also BTC. The BTC that exchanges transferred in for sale also surged after the price broke through $115,000. However, compared with ETH, the selling of BTC is not very strong. Compared with the impact of $100,000 in December 2024, there is still a certain gap. This also shows that at least from the perspective of the selling situation, ETH investors will have more vigorous demand than BTC investors.

However, judging from the data of the transfer out of the exchange, ETH has increased significantly. Compared with the end of 2024, the current number of transfers out of the exchange is much higher than before. This also shows that investors in the two-week exchange have started to buy more ETH, but is this purchase volume the main reason for the increase in ETH prices? I don't think so.

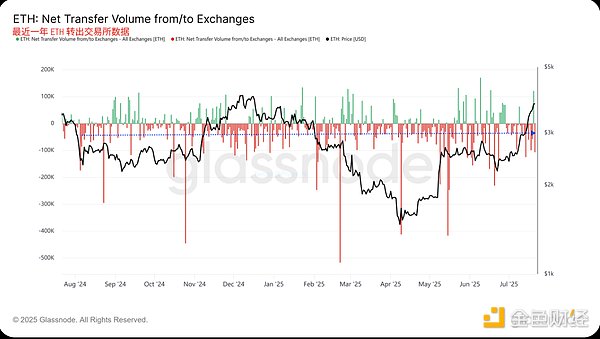

From the perspective of the net flow of ETH in exchanges in the past year, it was mainly transferred out throughout the year. In fact, the selling caused by transfers into exchanges was not very large. It feels that investors have been absorbing a large amount of funds this year, but the price of ETH has been on a roller coaster this year, and even fell below $1,400 in April, and the funds absorbed during this period are more than now. Looking at the stock data of the exchange, this data looks more obvious. Although the stock of ETH in the exchange is decreasing, the main stage of reduction is between $1,700 and $2,500. After exceeding $2,500, the amplitude of change is lower, especially after rising to more than $3,000, we can see a significant increase in purchasing power. When selling increases, purchasing power increases, which can reduce the stock of the exchange. Before that, the price rose because of the reduction in selling volume, not because of much change in purchasing power.

And from ETH on Coinbase and Binance Judging from the trading volume, although there are signs of improvement in the past two weeks, there is no substantial increase. Therefore, the same conclusion can be drawn, that is, although the purchasing power of exchanges has increased, the increase is still relatively limited. In addition to the FOMO sentiment of users, the greater possibility is the reduction in selling volume.

Of course, compared with BTC, ETH still has a part of its trading volume on the chain, which is more difficult to count, but in addition to the chain, there is another very important place, which is the purchasing power of spot ETFs. The main buyers of spot ETFs are BlackRock, Fidelity and Grayscale. Let's take a look at the trading volume of the four products of these three companies.

BlackRock

Fidelity

Grayscale

Grayscale mini

It is even much higher than the trading volume when the price of ETH rose to US$4,000 in 2024. This also shows that while the volume of changes in the exchange is not large, the purchasing power of ETFs is an important factor in the price increase, and especially for BlackRock investors, it is the key factor among the key factors.

Grayscale

Fidelity

Grayscale

The same data is not so obvious in BTC, the same is true for BlackRock, Fidelity and Grayscale, but it can be clearly seen that even IBIT, which has the highest trading volume, is maintained near the mean, not only without a significant increase, but even a slight decrease, while Fidelity and Grayscale have a significant decrease in direct trading volume, indicating that compared with ETH, although BTC's spot ETF has also brought some purchasing power, the main logic for BTC's rise is not a significant increase in purchasing power, but a very low selling volume. On the contrary, ETH can clearly see an increase in ETH's purchasing power.

So combined with the situation of Russell 2000, it should be that more investors are confident (gambling) on sector rotation, and it is not ruled out that small-cap stocks in the US stock market have shown a rotation trend first, so more funds are not only focused on small-cap stocks, but also on ETH and the altcoin sector of cryptocurrencies, hoping that sector rotation may also occur. However, whether the altcoin season can occur depends not only on the priority condition of ETH rising, but also on whether there can be overflow funds.

History has taught us several times that it is not that ETH will rise if BTC rises, and it is not that there will be an altcoin season if ETH rises. When ETH broke through $4,000, the altcoin season was only for a short time, and the increase was just average. If the purchasing power is driven by spot ETFs, then it is very likely that there will not be enough overflow funds, just like BTC at the beginning, so the altcoin season will either not appear or be short-lived.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex