Author of this article:

■ Zhang MingDeputy Director of the National Finance and Development Laboratory Deputy Director of the Institute of World Economics and Politics, Chinese Academy of Social Sciences

■Bao Hong Institute of International Affairs, The Chinese University of Hong Kong, Shenzhen

■ Wang YaoResearcher of National Finance and Development Laboratory

This paper uses a combination of literature analysis and case study to deeply explore the challenges of cryptocurrency to global financial governance. The study found that the challenges caused by cryptocurrency are mainly reflected in three aspects: first, it increases the fragility of the global financial system; second, related abuses amplify the loopholes in international financial supervision; and third, it exposes developing countries to a higher risk of currency substitution. In response to the above problems, this paper proposes policy recommendations from the aspects of exploring the construction of new financial governance institutions or frameworks, promoting the establishment of a global stablecoin regulatory mechanism, promoting the intelligent and precise regulation of cryptocurrency, and accelerating the research and development and cooperation of central bank digital currencies (CBDC). The innovation of this paper lies in: on the one hand, combining the latest cases and data, systematically refining the three core challenges of cryptocurrency to global financial governance; on the other hand, incorporating the characteristics of cryptocurrency into the analytical framework of financial fragility theory, it not only reveals its amplification channels for the fragility of the financial system, but also expands the scope of application of this theory in the context of digital finance.

The original article was published in the third issue of "Financial Regulation Research" in 2025. For the convenience of reading, it is published in two parts, the first part and the second part.

Introduction

Cryptocurrency represented by Bitcoin is a new type of emerging thing that came into being and developed rapidly during the 2008 international financial crisis. From the perspective of development motivation, cryptocurrency is based on advanced encryption technology and distributed ledger technology (especially blockchain technology), aiming to build a decentralized global digital payment and value transfer system that transcends the traditional national regulatory framework (Nakamoto, 2008). Cryptocurrency is usually used in payment settlement, financial investment and many illegal financial activities. Since its birth, it has attracted widespread attention from global financial governance institutions and academia (Li Jianjun and Zhu Yechen, 2017; Song Shuang and Xiong Aizong, 2022). With the rapid development and widespread application of cryptocurrency, its impact on global financial governance has become increasingly prominent, especially in the following three aspects: First, the popularity of cryptocurrency has had a profound impact on cross-border capital flows, financial market stability and consumer rights protection, making it a focus of concern for mainstream financial governance institutions and major countries. Among them, the Financial Stability Board (FSB) has been tracking the market risks of cryptocurrency since 2018, and regularly sorting out and updating its potential threats to global financial stability. In 2022, the FSB also issued a principle document for global stablecoin regulation for the first time. Secondly,the anonymity and cross-border nature of cryptocurrencies increase the risks of illegal financial activities such as money laundering and terrorist financing, and place higher demands on financial regulators. In fact, due to the increasing sophistication of money laundering techniques based on cryptocurrencies and the lack of effective coordination between jurisdictions, the supervision and crackdown on related criminal activities face great difficulties.Thirdly,given that the issuance and circulation of cryptocurrencies are not controlled by the central bank, their price fluctuations and changes in trading volume are believed to have a significant impact on the formulation and implementation of monetary policy. Especially after Facebook proposed the Libra plan, the challenges posed by stablecoins to macroeconomic policies have received special attention from institutions such as the Group of Seven (G7), the International Monetary Fund (IMF) and the Bank for International Settlements (BIS), and they have intensified their research on them.

To meet the above challenges, in recent years, the global governance framework formed by the G20 as the core platform and the FSB, IMF, BIS, the International Organization of Securities Commissions (IOSCO), and the Financial Action Task Force (FATF) as the pillar institutions (Song Shuang and Xiong Aizong, 2022) has continued to strengthen the supervision of cryptocurrencies through in-depth and close follow-up research, issuing regulatory guidelines, and deepening international cooperation. For example, FATF, FSB and IMF basically issue relevant research and guidance every year, and IOSCO has also issued regulatory guidelines for private currency exchanges. As the country with the strictest cryptocurrency regulation in the world, my country clearly pointed out as early as 2013 that cryptocurrency is a virtual commodity with high risks, and required domestic related companies to do a good job in risk control. Subsequently, between 2017 and 2021, my country has successively adopted a variety of measures to further strengthen the supervision of cryptocurrencies and the prevention of new financial risks, including shutting down domestic cryptocurrency exchanges and completely prohibiting the use of cryptocurrency for financing, speculation and "mining" activities. In addition, the European Union also introduced the world's first comprehensive cryptocurrency regulation, the Markets in Crypto Assets regulation bill (MiCA), in May 2023 to regulate the operation of the crypto market, improve regulatory transparency and curb illegal financial activities. However, due to the continuous innovation in the field of cryptocurrency, coupled with the joint effect of multiple factors such as political factors (intensified lobbying by industry institutions) and economic factors (extreme monetary policy of the Federal Reserve in recent years), the scope of application of cryptocurrency has been further expanded and its popularity has been further improved. The challenges brought to global financial governance have not only not been eased, but have become more severe. Especially after Trump was re-elected as the US President, his strong "deregulation" policy has further aggravated the impact of cryptocurrency on the global financial governance system, making this issue more complex and urgent to solve.

In this context, this article conducts an in-depth discussion on the core challenges posed by current cryptocurrency to global financial governance and its specific manifestations and impacts, in order to provide a reference for the adjustment of the global financial governance system and subsequent research. Based on the analysis and compilation of existing research results and the latest factual evidence, this article summarizes the core challenges of cryptocurrency to global financial governance into the following three aspects: First,cryptocurrency has formed a large-scale global investment market. The market itself has the characteristics of high volatility, contagion and difficulty in comprehensive supervision, which makes it an important destabilizing factor in the current international financial system.Second,in recent years, the use of cryptocurrency to circumvent regulation has become increasingly rampant, especially the entry of terrorist organizations and some state actors, which will significantly amplify the loopholes in the global financial governance system.Third,during this round of US dollar interest rate hikes, the adoption rate of cryptocurrency has increased rapidly, exposing more and more developing countries to the risk of currency substitution, and also posing a continuous and far-reaching challenge to their financial governance capabilities. In response to the triple challenges and the reasons behind them, this paper puts forward the following policy recommendations: explore the construction of new financial governance institutions or frameworks, promote the establishment of a global stablecoin regulatory mechanism, promote the intelligent and precise regulation of cryptocurrency, and accelerate the research and development and cooperation of central bank digital currencies (CBDCs).

Compared with existing research and practice, the marginal contribution of this paper is mainly reflected in the following two aspects: On the one hand,Based on the three main motivations for the use of cryptocurrencies, namely, investment transactions, evasion of regulation, and alternative options for sovereign currencies, this paper systematically extracts the three core challenges of cryptocurrencies to global financial governance, combined with the latest cases and data. This not only provides a clearer research framework for subsequent research and policy making, but also further enriches the research system in the field of cryptocurrency and global financial governance. On the other hand, traditional financial fragility theory mainly focuses on bank runs, asset price bubbles and credit market failures, and does not fully consider the increasingly close connection between cryptocurrencies and the traditional financial system. This paper incorporates the characteristics of cryptocurrencies such as high volatility, difficulty in regulation and cross-border circulation into the framework of financial fragility theory, which not only reveals the amplification channel of its emerging things on the fragility of the financial system, but also expands the scope of application of this theory in the context of digital finance.

The cryptocurrency market increases the vulnerability of the global financial system

After Bitcoin was launched to the public in early 2009, its global attention and popularity increased rapidly, and its price also expanded rapidly. In just 15 years, the price rose from close to zero to a peak price of about US$109,356 per coin (January 19, 2025). At the same time, the Bitcoin market has also developed into the world's largest cryptocurrency market by market value, with daily trading volume continuing to remain at the level of tens of billions of US dollars, becoming one of the most active financial markets in the world. As of the end of February 2025, there are more than 10,000 types of cryptocurrencies in the world, with a total market value of approximately US$2.8 trillion. The huge market size and trading activity have made cryptocurrencies an indispensable presence in the global financial governance agenda. Many studies have also confirmed that the cryptocurrency market is an important factor affecting the stability of the global financial system, especially increasing the fragility of the global financial system (Yue et al., 2021; Iyer, 2022).

(I)Key factors affecting the global financial system

From a theoretical perspective, the "interconnection" of the modern financial system has greatly increased the complexity and fragility of the financial network. In this case, abnormal fluctuations in a single market may produce a "domino effect", affecting other regions and types of financial markets in the world, and through the network structure of the financial system transmission chain, forming systemic financial risks (Yang Zihui and Zhou Yinggang, 2018). In recent years, the impact of the sharp fluctuations in the cryptocurrency market on the global financial system has become increasingly prominent, mainly due to the following three key factors: First, the high volatility of the cryptocurrency market can easily trigger panic among investors and quickly spread to other markets. Second, cryptocurrency is difficult to regulate, which exacerbates the formation and spread of risks. Third, the connection between cryptocurrency and traditional financial markets is becoming increasingly close, expanding the contagion channel through financial products (such as Bitcoin futures and crypto asset funds).

1. High volatility and contagion in the cryptocurrency market

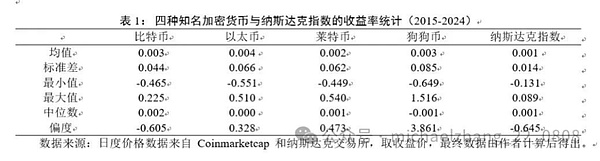

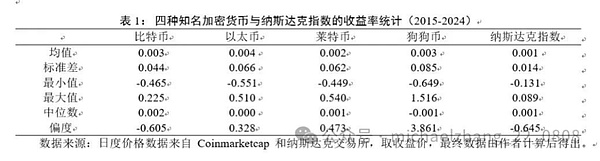

The Bitcoin market gradually satisfies the weak efficient market hypothesis over time, and its price immediately responds to public market information. Therefore, the price fluctuations are not only very violent, but also have significant volatility clustering characteristics (Urquhart, 2018). Compared with Bitcoin, there are relatively few studies on the volatility of other cryptocurrencies, and there may be differences due to factors such as market size and liquidity. However, on the whole, other cryptocurrencies also show similar volatility characteristics, reflecting high market risks and uncertainties. This paper selects four cryptocurrencies that were launched earlier and have high visibility and market liquidity, and conducts a simple comparative analysis with the volatility of the US stock market (Nasdaq Index). From Table 1, the standard deviations of the returns of Bitcoin, Ethereum, Litecoin and Dogecoin are much larger than the Nasdaq Index, which means that the former has higher volatility. The maximum value of Dogecoin's yield is as high as 1.516, which means that buying Dogecoin can theoretically achieve a maximum return of 150% per day.

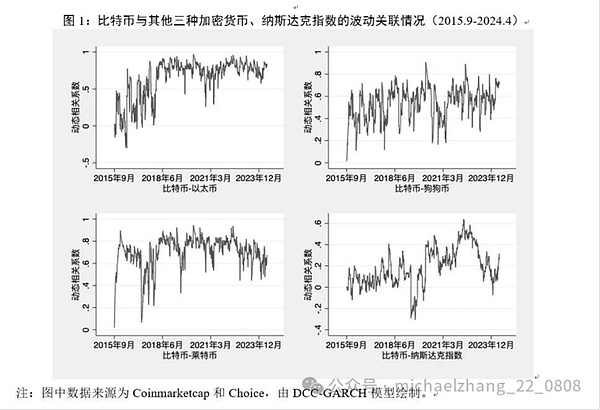

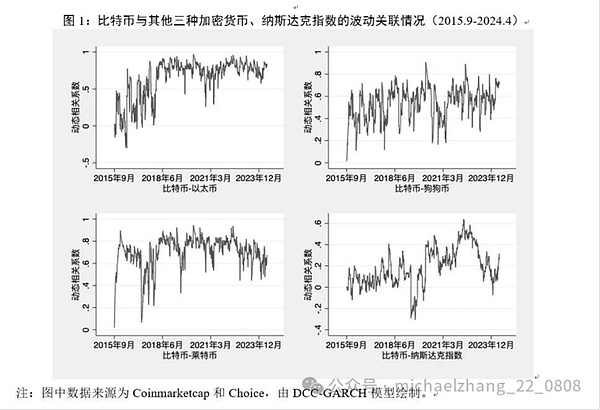

Due to its high liquidity and market share, Bitcoin plays a core role in the volatility contagion phenomenon of the overall cryptocurrency market. On the one hand, as the main contributor to the volatility spillover of the cryptocurrency market, Bitcoin's sensitivity and rapid response to news events often drive the price fluctuations of other small cryptocurrencies (Koutmos, 2018; Moratis, 2021); on the other hand, there is a significant phenomenon of common returns jump within the crypto market, indicating that the diversification of cryptocurrencies has not effectively reduced volatility risk (Yue et al., 2021). More importantly, the long-term high level of synchronous volatility between Bitcoin and major cryptocurrencies such as Ethereum and Dogecoin has further amplified the systemic risk of the market (see Figure 1). In addition, observing the volatility contagion trend between Bitcoin and the US Nasdaq Index, it can be seen that after the United States launched a large-scale stimulus measure at the end of 2020, the volatility correlation between the two has increased significantly, indicating that cryptocurrencies have brought additional pressure on the stability of the financial market.

2. Cryptocurrency market is difficult to be effectively regulated

One of the important reasons is the technical characteristics of cryptocurrency.Take Bitcoin as an example. It is not only based on anonymous digital addresses for transactions (theoretically, a person can have thousands or even more accounts), but also can rely on the Internet24 hours a day, so it can easily cross national borders and break geographical space and time restrictions. Although government regulatory measures can prevent people from using cryptocurrency exchanges, these measures cannot effectively prohibit people from using Bitcoin. The latter can be exchanged with local currencies through peer-to-peer transactions, thereby circumventing currency controls.

Another key reason is the rapid innovation and application of cryptocurrencies. This has not only led to a relative lag in research and regulation, but also a friendly regulatory attitude towards this by most economies. In recent years, the rise of new directions and new forms of digital economy such as "initial public offering of cryptocurrency (ICO)", "non-fungible tokens (NFT)", "decentralized finance (DeFi)", and "third-generation Internet (Web3.0)" have been regarded by many economies as new directions for economic growth. At the same time, most countries in the world currently allow free trading of cryptocurrencies (Borri and Shakhnov, 2020). According to data from the international statistical agency Triple-A, as of 2023, there will be more than 400 million cryptocurrency users worldwide, with an ownership rate of more than 4.2%. The camp differentiation among major countries in the global governance of cryptocurrencies has also made it difficult to implement supervision and governance (Song Shuang and Xiong Aizong, 2022).

3. The cryptocurrency market is accelerating its integration into the existing financial system

The emergence and growth of cryptocurrency exchanges have greatly facilitated the transaction between cryptocurrency and legal currency, and further strengthened the connection between the markets. According to statistics from Coinmarketcap, a cryptocurrency data service provider, as of April 2024, there are 765 exchanges in the world. Most individual and institutional investors can purchase cryptocurrencies online through major exchanges, and the payment method can be credit or debit card, wire transfer or cash (through Bitcoin ATM machines). At the same time, institutional investors and financial regulators in major countries are also promoting the integration of cryptocurrencies with the traditional financial system. As early as 2017 and 2020, relevant exchanges in the United States launched Bitcoin futures contracts and corresponding options products, respectively, and built an investment product system including funds, trusts, insurance, derivatives, etc., which greatly simplified the channels for institutional investors to enter the cryptocurrency market. Morgan Stanley's research shows that in Coinbase, the world's second largest cryptocurrency exchange, the proportion of retail investors' trading volume has rapidly declined from 80% in the first quarter of 2018 to 32% in the fourth quarter of 2021. Cryptocurrency funds, custodians, etc. have become the dominant force in the market and contribute most of the trading volume. In early 2024, the U.S. Securities and Exchange Commission approved 11 Bitcoin ETF listing applications for the first time, and in July of the same year, it approved the listing of the first batch of Ethereum spot ETFs in the United States, further increasing the risk exposure of institutional investors to the cryptocurrency market. Data shows that as of December 2024, the total asset management scale of 12 Bitcoin spot ETFs has exceeded US$100 billion, and they jointly hold more than 1.1 million Bitcoins (about 5% of the total supply), surpassing Bitcoin founder Satoshi Nakamoto to become the largest Bitcoin holder. During the same period, the market size of Ethereum ETFs was about US$10.43 billion. As the new Trump administration's expectations for cryptocurrency policies become more friendly, the risk exposure of various investors will continue to increase in the future, which may lead to greater challenges in regulation and scale.

(II)The transmission channel through which the cryptocurrency market increases the fragility of the global financial system

The contagion (or volatility spillover) between financial markets is an important risk and uncertainty facing the current global financial system, and is also the main way in which the cryptocurrency market affects the fragility of the global financial system. From a theoretical perspective, the contagion mechanism between financial markets on a global scale can be roughly divided into two categories: fundamental factors and non-fundamental factors. Among them, the fundamental factor is also called the economic base hypothesis, which is based on the traditional financial theory that investors are completely rational and believes that changes in the basic variables that jointly affect the economy among countries will lead to synchronized fluctuations in financial markets. However, since the cryptocurrency market does not have an economic foundation and is full of irrational investors with speculative purposes (Cheah et al., 2015; Griffin and Shams, 2020), its volatility spillover to the financial market may be mainly through non-fundamental channels. Based on the series of studies by the FSB and related theoretical and empirical analysis, this paper sorts out three types of influence channels with general consensus, namely confidence effect, financial institution risk exposure and wealth effect. 1. Based on the confidence effect Existing research confirms that since it does not require support from the real economy and can be traded 24 hours a day, micro-participants in the cryptocurrency market are more powerful in information generation and transmission, and their response to external shocks is faster, and they lead the investor sentiment in the global financial market (Yu et al., 2019; Wang et al., 2022). When the price of cryptocurrencies changes significantly, the information shock will be quickly transmitted to other financial markets such as stocks, and a herd effect will be generated to buy or sell stocks following the fluctuations of the cryptocurrency market. In short, the cryptocurrency market has become an important "barometer" of the global financial market, especially for high-risk markets, with its all-weather trading and rapid response characteristics. When the cryptocurrency market has continuous positive returns, investor confidence will further spread to other high-risk markets such as the bond market (Umar et al., 2021). 2. Risk exposure based on financial institutions At present, Bitcoin is more of a risk asset (speculative tool) included in the allocation portfolio of institutional investors, which may lead to the adjustment of cryptocurrency positions triggering convergent changes in other risk assets such as stocks (Iyer, 2022; Wang et al., 2022). If cryptocurrencies are viewed as a hedge against stocks, negative volatility spillovers will occur when portfolios are adjusted. For example, when cryptocurrency investors suffer huge losses, they may be forced to sell traditional financial assets to manage their liquidity positions. As institutional investors surpass individual investors to become the dominant investors in the cryptocurrency market, the effects of the above channels continue to expand. The collapse of the US banking industry in March 2023 provides strong evidence that cryptocurrencies impact financial stability through the channel of financial institutions' risk exposure. Both Silvergate Capital and Signature Bank in the incident went bankrupt due to runs on cryptocurrency deposit customers, triggered by the panic caused by the bankruptcy of the cryptocurrency exchange FTX in November 2022. Specifically, since 90% of all deposits of Silvergate Capital came from deposits of cryptocurrency-related customers (about US$12 billion), Silvergate Capital was squeezed out of US$8.1 billion after the FTX incident, and it had to apply to the US Securities and Exchange Commission for a delay in submitting its 2022 annual report and declared bankruptcy on March 8, 2023. In comparison, although Signature Bank is larger (total assets of $110.4 billion at the end of 2022) and the proportion of deposits from cryptocurrency-related customers is about one-fifth, which is much lower than the level of Silvergate Capital, it still cannot avoid the result of being run and bankruptcy.

3. Based on the wealth effect

From the existing evidence, cryptocurrency investors are usually also active equity investors, who regard cryptocurrency as part of the entire wealth portfolio (Aiello et al., 2023a). Therefore, some households will increase their deposits in cryptocurrency exchanges (reinvestment of income) after obtaining positive returns on cryptocurrencies, while other households will rebalance part of their cryptocurrency returns to traditional asset investments (such as stocks). This shows that the cryptocurrency market has a wealth effect on other markets (Aiello et al., 2023b). In addition, cryptocurrency investment not only has a significant spillover effect on other financial assets, but is also transmitted to the real economy through consumption. For example, in the United States, counties with a higher proportion of cryptocurrency holdings will see higher house price growth after receiving high returns from cryptocurrency (Aiello et al., 2023a; 2023b); conversely, if cryptocurrencies have consecutive negative returns, it will also significantly impact investment in other assets.

(III) Characteristics of the impact of the cryptocurrency market on the global financial system

With the gradual maturity of the Bitcoin market,

"The relationship between cryptocurrency and financial markets" has gradually become an important research direction in the field of economics. In particular, around 2016, the academic community's research on the cryptocurrency market has increased significantly (Yue et al., 2021). Based on the existing literature, it can be found that the impact of the cryptocurrency market on the global financial system mainly presents the following three characteristics:

First, the cryptocurrency market has a wide range of volatility spillover effects on traditional financial markets.Due to the lack of economic fundamentals, the impact of sudden information and extreme events on cryptocurrencies is stronger than that on traditional financial markets, which is manifested in the fact that the price fluctuations of the cryptocurrency market to external shocks usually lead those of traditional financial markets and react more violently (Wang et al., 2022). In this context, the volatility of cryptocurrencies has been proven to spill over to a variety of financial markets such as stocks, commodities, and foreign exchange (Yue et al., 2021; Cao and Xie, 2022).

Second, this volatility spillover effect is significantly asymmetric. Asymmetry is reflected not only in the direction of volatility spillover, such as Bitcoin was found to have unidirectional volatility spillover on gold, stocks, bonds, the VIX index and crude oil (Elsayed et al., 2022); it is also reflected in the regional heterogeneity of volatility spillover effects on similar markets, that is, the cryptocurrency market has significant volatility spillover effects on the stock markets of some countries, but not in other countries (Urom et al., 2020; Cao and Xie, 2022).

Third, after the COVID-19 outbreak, the volatility spillover of the cryptocurrency market on the stock market is stronger. In horizontal comparison, under the extremely loose financial environment during the epidemic, the spillover of cryptocurrencies (including Bitcoin and stablecoins) to the stock market was significantly higher than that of key asset classes such as 10-year US Treasury bonds, gold and specific currencies (US dollar, euro, and RMB); in vertical comparison, compared with the samples from 2017 to 2019, the volatility spillover of Bitcoin to the S&P 500 index increased by about 16 percentage points from 2020 to 2021, and the volatility spillover to the MSCI Emerging Markets Index increased by 12 percentage points (Iyer, 2022).

(This article is from Financial Regulation Research2025 Issue 3)

Hui Xin

Hui Xin