Author: Prathik Desai Translator: Block unicorn

Foreword

TRON founder Justin Sun took his blockchain empire public through a reverse merger with Nasdaq-listed toy company SRM Entertainment.

Why is a man who started his career by subverting traditional finance now queuing up at the door of Wall Street with an IPO prospectus in his hand?

Welcome to the great identity crisis of cryptocurrency in 2025.

Rush to Wall Street

The craze started with Circle. When the stablecoin giant went public this month, its shares surged 168% on its first day. The offering was 25 times oversubscribed: the public demanded 850 million shares, while only 34 million were actually issued.

Image source: TradingView

Circle is now valued at more than $33 billion, three times the reported $9 billion to $11 billion acquisition offer it received from Ripple before its IPO.

Circle's success not only rewarded early investors, but also inspired a group of crypto-native companies to consider entering Wall Street and pushed other companies to restart their shelved IPO plans.

Three days later, Gemini filed for an IPO. Now, Tron has also announced its IPO plans.

Circle provides a template that demonstrates traditional markets are willing to pay a high premium for regulated cryptocurrency exposure, while mainstream investors are eager for blockchain innovation packaged in familiar corporate structures.

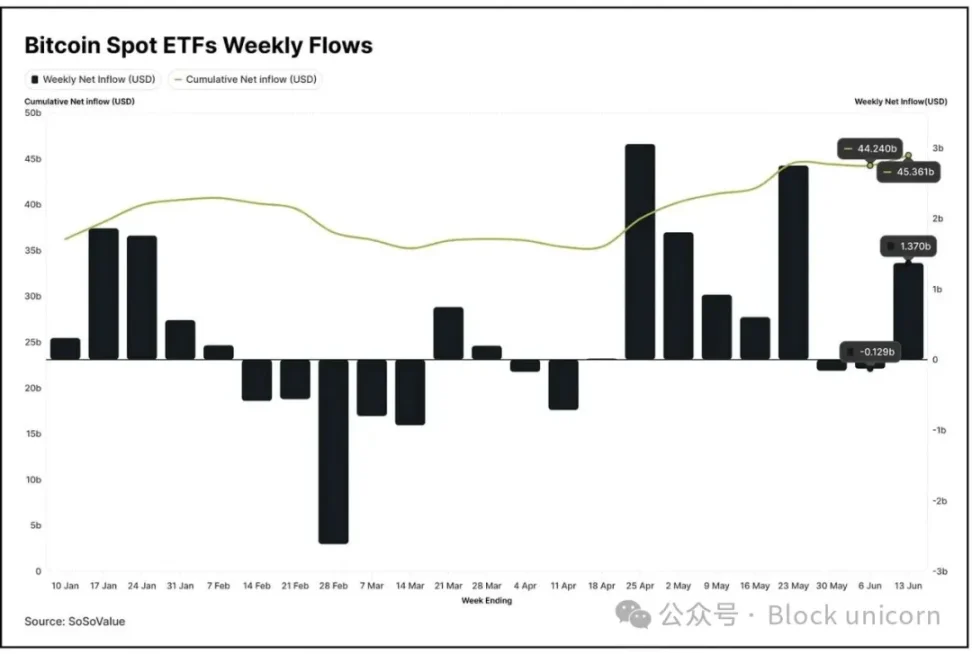

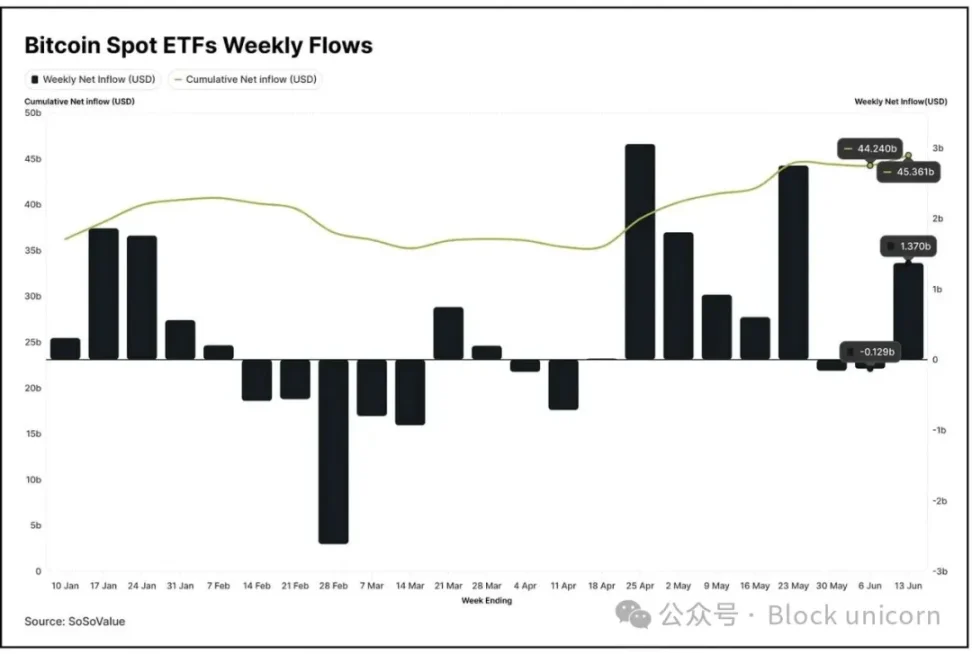

The public has embraced cryptocurrency products delivered through traditional Wall Street channels. Since January 2024, Bitcoin ETFs have seen net inflows of more than $45 billion.

Strategy (formerly MicroStrategy) is trading at multiples of its Bitcoin holdings: market cap of about $106 billion, while its Bitcoin holdings are worth about $62 billion. Michael Saylor's Bitcoin bet has inspired more public companies to go the treasury investment route.

These cases reinforce a hypothesis: the fastest path to mainstream acceptance may not be for the world to move to self-custodial wallets and use DeFi protocols. Instead, the path to mass adoption should go directly through traditional financial infrastructure, making crypto accessible through channels that people already trust.

Look at the math. Traditional finance touches billions of people, while there are only 560 million crypto holders worldwide.

When ETFs introduced Bitcoin to 401(k) retirement plans and pension funds, its mainstream penetration in a year exceeded the decade of “not your keys, not your coins” preaching.

Companies that have focused on building pure crypto products for years are starting to focus on related products that can bridge the two worlds. Circle uses stablecoins to build digital payment rails and corporate treasury services. Coinbase has transcended its crypto exchange image by building institutional custody and prime brokerage services that rival traditional banks.

The IPO path provides something the crypto ecosystem lacks: access to public market capital to fund these related product lines. Need to build an enterprise-grade custody solution? Issue shares. Want to acquire a traditional fintech company? Use shares as currency. Planning to expand into regulated lending or investment management? Public market credibility opens doors that crypto-native credentials cannot.

Why Trust Trumps Ideology

Traditional finance’s overtures also solve one of crypto’s thorniest problems: institutional trust. For years, crypto companies have struggled to bridge the credibility gap that technological innovation could not cross.

When Coinbase went public in 2021, institutions viewed it as a risky bet on an emerging asset class. Today, Coinbase is included in the S&P 500 and manages billions in institutional assets, becoming a symbol of crypto’s integration into the mainstream financial system.

This trust-building mechanism works through multiple channels.

SEC regulation provides compliance assurances that pure crypto investing cannot match. Quarterly earnings calls and audited financial statements provide transparency that community governance forums cannot match. When pension fund managers can cite S&P ratings and decades of corporate law precedent, crypto becomes less a blind faith and more an asset allocation decision.

This validation goes both ways.

Wall Street’s embrace of crypto companies has provided legitimacy to the industry as a whole. When BlackRock is actively building crypto infrastructure and Fidelity is offering Bitcoin services to millions of retirement accounts, it’s hard to dismiss blockchain technology as a speculative bubble.

Beyond the philosophical evolution, there’s a practical necessity.

After the FTX crash in 2023, crypto VC funding plummeted 65%. When the second-largest exchange was exposed as a house of cards based on customer deposits, investors became cautious about writing checks.

Traditional venture capital, which once generously offered any business plan with the word “blockchain” in it, quickly dried up. Companies accustomed to throwing $50 million in Series A rounds found that when they explained the basic concepts to investors, no one listened.

The public markets remain wide open.

Institutional investors who are reluctant to invest in crypto startups are happy to buy shares in regulated, SEC-compliant crypto companies with audited financial statements and clear business models.

This funding shift has accelerated the strategic shift toward relevant products.

Our View

The emerging strategy is to build products that solve real problems, demonstrate product-market fit through crypto-native channels, and then scale through traditional financial infrastructure.

This philosophical conflict may exist, but it is not necessarily problematic.

Companies that can navigate this transition will be able to offer DeFi innovation combined with the reliability of traditional finance. They will offer the advantages of decentralization, including faster settlements, global accessibility, and programmable money, to mainstream users who will never manage private keys or understand gas fees.

The early promise of the crypto industry was to eliminate intermediaries altogether. But most people still want intermediaries, and perhaps better ones. Faster, cheaper, more transparent, and more global than traditional banks, but intermediaries nonetheless.

Crypto companies planning to build blockchain empires may not shy away from transcending ideological purity due to funding needs. Instead, they may focus on raising capital from the public to build the infrastructure that will bring the benefits of cryptocurrency to the next billion users.

From an adoption perspective, this trust-building mechanism seems to be working: traditional paths have accelerated cryptocurrency acceptance faster than pure-play crypto businesses.

Finally, crypto founders who have achieved product-market fit should not be afraid to knock on Wall Street's door when the time is right. They seem eager to get you on board.

Weatherly

Weatherly