In today's wave of globalization, Web3 projects are moving towards the international stage at an unprecedented speed, and Chinese companies are a force that cannot be ignored. However, China's uncertainty about industry policies, lack of laws, and ambiguity in regulatory attitudes have made the development of Web3 companies hesitant. These factors work together to make Web3 projects face compliance challenges in domestic development, and many practitioners have to turn to overseas or seek breakthroughs within a limited compliance framework. However, by paying close attention to policy trends and combining the preferential policies of various countries, and rationally building a corporate compliance framework, the Web3 industry may still find a suitable development model.

Purpose of Enterprises Going Overseas

(I) Market Opportunities

The global market provides Web3 projects with a broader user base and growth potential. Especially in regions such as Asia and Europe, users have a high degree of acceptance of blockchain technology and cryptocurrency, which brings more business opportunities and development space for projects.

(II) Regulatory environment

Regulatory policies on blockchain and cryptocurrency vary significantly between countries. Some countries, such as Singapore and Hong Kong, have relatively relaxed and friendly regulatory environments, which provide greater flexibility and security for the operation and development of Web3 projects. In contrast, strict regulation in some countries may restrict the development of projects. In some countries, Web3 projects may face legal and compliance challenges. Going overseas to countries with friendlier legal environments can effectively reduce these risks and ensure the long-term stable operation of projects.

(III) Talent acquisition

Web3 is a technology-intensive field, and attracting top developers and experts is crucial to the success of the project. By going overseas, projects can find and recruit outstanding talents worldwide, thereby accelerating the innovation and development of technology and products.

(IV) Funding and Investment

Going overseas enables Web3 projects to reach more potential investors and sources of funding. Especially in regions where venture capital and cryptocurrency investment are active, such as the United States or Southeast Asia, projects are more likely to obtain financial support and promote their rapid development.

(V) Industrial Cluster Effect

Different countries and regions have gathered into different industrial clusters due to their inherent advantages in technology and policies, forming regional supply chains and providing different basic support for local Web3 companies.

(VI) Risk Diversification

Doing business in multiple countries can diversify risks and avoid major impacts on projects due to economic, political or regulatory changes in a single market, thereby enhancing the project's ability to resist risks.

Compliance and risk isolation

Web3 enterprises must give priority to the local regulatory framework when choosing overseas destinations to ensure legal and compliant operations.

(I) Compliance policies of various countries and regions

Hong Kong:

Hong Kong has implemented a virtual asset service provider (VASP) licensing system since 2023, requiring all virtual asset trading platforms (VATP) to obtain a license from the Hong Kong Securities and Futures Commission (SFC). As of January 2025, the SFC has issued operating licenses to platforms such as PantherTrade and YAX, and a total of 7 have been licensed since mid-2024. Since 2020, Hong Kong has officially licensed 10 exchanges, including 4 in December 2024, showing its cautious openness to the virtual asset industry. The licensing requirements include strict KYC processes, asset protection and cybersecurity measures, aimed at protecting investors and preventing money laundering risks.

Singapore:

The Monetary Authority of Singapore (MAS) provides regulatory support to enterprises by allowing fintech companies to test innovative products in a controlled environment through the Regulatory Sandbox. Coinbase's compliance layout in Singapore shows its regulatory-friendly adaptation: it obtained MAS's preliminary approval (In-Principle Approval) in 2022 and further obtained a full license (Major Payment Institution License) in 2023. This shows that Singapore has become an Asia-Pacific hub for Web3 companies, and Coinbase has set up its Asia-Pacific institutional business here, showing its confidence in the local regulatory environment.

Other regions: Europe, Asia-Pacific and North America:

The EU's Markets in Crypto-Assets Regulation (MiCA) will come into effect at the end of 2024, unifying the regulatory standards for crypto assets. MiCA requires crypto asset service providers to register and comply with transparency, liquidity and consumer protection standards.

In the Asia-Pacific region, Japan requires virtual asset service providers to obtain a license from the Financial Services Authority (FSA), while Australia requires them to register as digital currency exchange service providers and be regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC). In North America, the US SEC has stricter regulation of crypto assets. For example, Binance and Coinbase have faced lawsuits, but are still actively communicating with regulators to seek a clear framework.

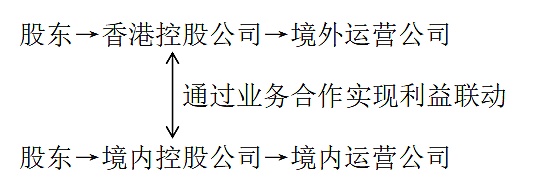

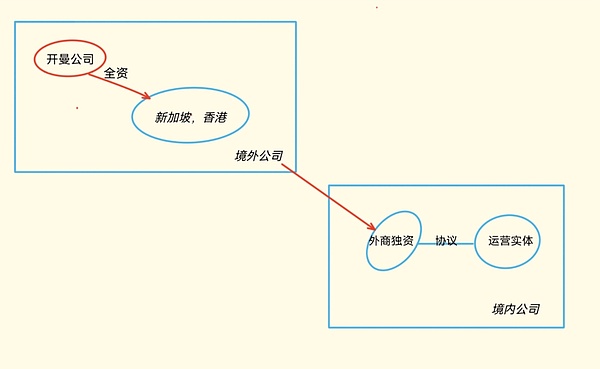

(II) Risk Isolation

The risk isolation mechanism is an important part of the Web3 project's compliance framework in cross-border operations. Its core goal is to ensure that risks in different business segments or regions will not be transmitted to each other through the reasonable design of the enterprise architecture, thereby protecting the overall stability and sustainable operation capabilities of the enterprise. In the globalized Web3 industry, the risk isolation mechanism is particularly critical due to the significant differences in regulatory policies, legal environments and market risks in different jurisdictions.

For example, separate subsidiaries are established in different countries or regions, each of which is an independent legal entity responsible for business operations in a specific market. Legal, financial and operational risks can be limited to specific entities to prevent risks from spreading to the entire corporate group. Each entity operates independently and does not interfere with each other. Even if a region faces regulatory changes or legal challenges, other entities can still operate normally. This design not only enhances the company's risk resistance, but also makes it easier to adjust strategies according to the needs of specific markets.

Place core assets (such as technology patents, intellectual property rights, brands, etc.) in a specific holding company or trust structure to protect them from the risks of the operating entity. For example, a company can register its core assets in a holding company in the British Virgin Islands (BVI) or the Cayman Islands, and place high-risk operating businesses in subsidiaries in other regions. Even if the operating entity faces litigation or financial difficulties, the core assets can still be protected, thereby ensuring the long-term development of the company.

Through contracts and agreements, the rights and obligations of each entity are clarified to ensure that risks are effectively isolated at the legal level. For example, enterprises can clearly divide the business boundaries and scope of responsibility between entities through service agreements, license agreements or fund flow agreements. This approach not only reduces the possibility of risk transmission, but also provides flexibility and transparency for enterprises to operate in compliance with global regulations.

By reasonably establishing an enterprise architecture isolation mechanism, Web3 enterprises can respond flexibly to regulatory requirements and risk challenges in different markets, ensure the security of core businesses and assets, and maintain the stability of global operations.

Main destinations for Chinese enterprises to go overseas

(I) Hong Kong

As an international financial center, Hong Kong has a mature financial infrastructure and a sound legal system, which provides a stable operating environment for Web3 companies. Compared with other regions, Hong Kong's supervision of Web3 projects is relatively loose, which makes it easier for start-ups to quickly conduct business. In particular, in recent years, the Hong Kong government has actively promoted the development of blockchain technology and created favorable development conditions for Web3 companies through policy incentives and support measures.

(II) Singapore

Singapore is Asia's leading financial technology hub, with an advanced technology ecosystem that has attracted a large number of Web3-related companies. In addition, the Singapore government is open to blockchain and Web3 technology and has formulated clear regulatory policies to help companies develop rapidly under the premise of compliance. Singapore's tax system is relatively favorable, which reduces operating costs for Web3 companies and enhances their attractiveness.

(III) BVI (British Virgin Islands)

BVI is known for its fast and simple company registration process and low registration fees, which is suitable for the rapid establishment of Web3 start-ups. BVI provides a strict privacy protection policy to ensure the security of company and shareholder information, which is very suitable for privacy-oriented Web3 projects. The local legal system is flexible and provides significant tax benefits, making it an ideal choice for offshore registration.

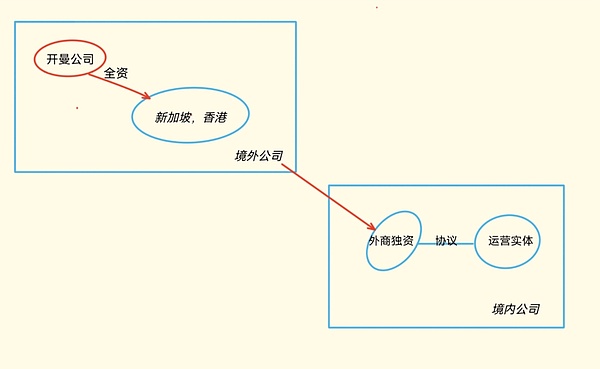

The construction of the overseas architecture

The underlying logic of the global compliance layout is to build a regionalized compliance framework by establishing different entities, and to give full play to the unique advantages of each region through shareholding or substantial control. This approach makes offshore companies no longer just a synonym for "evading regulation" or "tax havens", but through reasonable planning, they become a "strategic hub" for enterprises to build a global compliance system and optimize the allocation of funds and resources. Enterprises can flexibly build a multi-level and multi-ecological enterprise strategic system such as a single-entity architecture, a multi-entity architecture, and a parallel architecture according to the needs of different development stages to adapt to the demands of different scenarios and stages.

(I) Architecture applicability

In terms of architecture applicability, different enterprise architecture designs can meet the goals of enterprises at different development stages and business needs.

(1) Single-entity structure

The single-entity structure is suitable for start-ups or small companies that want to quickly verify their business model and focus on a single market.

This structure is simple, has low management costs, and is easy to start and operate quickly. For example, a start-up company registers a single entity in Singapore, which can quickly enter the market and enjoy local tax incentives while avoiding the complex cross-border management burden.

However, as the scale of the enterprise expands and the business becomes more complex, the shortcomings of the single-layer structure gradually become apparent. It may not be able to meet the compliance requirements of the global market, such as differences in regulatory standards in different regions, and it is difficult to achieve efficient allocation of resources and effective isolation of risks. When an enterprise needs to enter multiple markets at the same time, a single entity may face tax, legal or operational bottlenecks.

(2) Multi-entity structure

Multi-entity structure is suitable for enterprises with long business lines, complex sectors and diverse equity structures.

By establishing subsidiaries or affiliates in different jurisdictions, multi-entity structure can achieve risk isolation, tax optimization and market adaptation. For example, a technology company established a subsidiary in the EU to comply with GDPR (General Data Protection Regulation) requirements, and established a holding company in the Cayman Islands to optimize the global tax structure. This structure controls legal and financial risks in specific regions by dispersing entities, while enhancing the company's operational flexibility around the world. It supports the allocation of resources between enterprises in different markets and enhances global competitiveness through a regionalized compliance framework.

It is suitable for enterprises that have entered the expansion stage and need to cope with multi-national regulatory environments and diversified business needs. For example, some leading exchanges have established subsidiaries in Southeast Asia, Europe and North America, and launched different versions of apps to adapt to local consumer habits and legal requirements.

(3) Parallel architecture

A parallel architecture is another more complex design, which is generally a direct combination of equity or business in multiple multi-entity structures. It is particularly suitable for enterprises that need to operate multiple business segments independently.

A parallel architecture ensures that the business segments do not interfere with each other in terms of law and finance by establishing multiple independent entities. For example, a group may operate manufacturing, retail and financial services at the same time. Through a parallel architecture, an independent legal entity is established for each segment to prevent the risk of a certain segment from affecting other businesses. However, through equity control or business combination, there will still be close connections and synergies between the various segments. A Web3 company can independently operate technology development and business promotion in different regions, which not only meets local compliance requirements but also optimizes global resource allocation.

This design not only improves management clarity, but also achieves higher flexibility and stability in the global compliance layout, and is more suitable for enterprises with diversified businesses.

(II) Analysis of the advantages of the architecture

(1) Single-entity architecture

The characteristic of the single-entity architecture is that enterprises can make full use of the policy and regulatory advantages of the selected jurisdiction to achieve rapid compliance and operation. The regulatory environment in different regions provides unique opportunities for enterprises.

For example, if an enterprise values financing or the technology cluster effect, it can choose Singapore as its place of registration. Singapore's financing legal supervision is relatively loose, especially in terms of capital markets and financial innovation. This provides Web3 enterprises with flexible financing channels, which helps to quickly raise funds and promote project development. In addition, the Singapore government actively encourages the development of high-tech enterprises and provides enterprises with a number of policy support and financial incentives. Enterprises can use these policies to reduce R&D costs and accelerate technological innovation.

If an enterprise pays more attention to taxation and shareholder privacy, it can choose BVI as its place of registration. BVI is known for its strict privacy protection policy and is particularly suitable for Web3 companies that focus on information security and shareholder rights protection. Companies registered here can enjoy a high degree of commercial confidentiality protection, while benefiting from simplified regulatory requirements and a low tax rate environment.

(2) Multi-entity structure

Case: China → Singapore → Domestic company

The characteristic of a multi-entity structure is that it can organically combine the regulatory advantages of different regions and optimize compliance and operations by establishing subsidiaries or affiliated companies around the world.

For example, a BVI holding company is established to control a Hong Kong financial company, and the Hong Kong company controls a domestic operating company. The BVI company has the advantages of low tax rates and privacy protection, the Hong Kong holding company enjoys Hong Kong's financial convenience and tax incentives, and the operating company enjoys scientific research-related subsidy policies and technology industry advantages in the Chinese domestic center, optimizing the global holding structure and protecting core assets.

Through a multi-entity structure, enterprises can not only flexibly allocate resources between different markets, but also control legal and financial risks in specific regions, ensuring that the enterprise operates in compliance with regulations worldwide.

(3) Parallel structure

For example:

The regulatory characteristics of the parallel structure are its high flexibility and risk isolation capabilities, which are particularly suitable for enterprises with group-based, diversified businesses, and complex equity needs.

For example, by establishing multiple independent entities, the parallel structure ensures that each business segment does not interfere with each other in terms of law and finance, and avoids the regulatory risks of a certain segment from affecting other businesses. A Web3 enterprise may independently operate technology development and business promotion in different regions, which not only meets local compliance needs but also optimizes global resource allocation.

Although each entity operates independently, through equity control or business combination, each sector can still achieve close connection and synergy. A multinational company established a technology R&D center in Singapore and a Web3 service company in Hong Kong. The two cooperated through equity or business transactions to jointly promote technological innovation and market expansion.

The parallel structure not only improves the flexibility and stability of the enterprise in the global compliance layout, but also provides a solid foundation for the enterprise to achieve sustainable development in a complex regulatory environment.

Tax advantages of the structure

When choosing the registration location of the structure entity, it is necessary to keep abreast of the regulatory policies, technology and cost reduction and efficiency needs of various regions, as well as the in-depth cooperation between local service providers and compliance services, especially the tax differences and preferential agreements in various regions.

(I) Single Entity Structure

Single entity structure refers to an enterprise directly investing or operating overseas through a single overseas subsidiary. It is suitable for enterprises with concentrated business, small scale or single target market.

Advantages: simple structure, easy management and control.

Disadvantages: may face relatively high tax burden and lack of risk isolation mechanism.

1. Hong Kong: 8.25% tax rate for the first 2 million profits, double taxation exemption buff in more than 50 countries

Advantages:Corporate income tax (profit tax) 8.25%-16.5% (half the first 2 million Hong Kong dollars in profits), no capital gains tax, value-added tax, tax agreements signed with more than 50 countries, free foreign exchange convertibility, and convenient listing and financing;

2. Singapore: 17% tax rate, wide coverage of bilateral tax treaty network

Advantages: Corporate income tax is 17%, with tax exemption for the first three years, and bilateral tax agreements with more than 100 countries are established, which is conducive to cross-border tax avoidance;

3. BVI: Zero tax haven, strong confidentiality

Advantages: 0 corporate income tax, 0 value-added tax, 0 capital gains tax, extremely simple company registration process, and strong confidentiality of shareholder information;

(II) Multi-entity structure

The adoption of a multi-entity structure can make tax planning more effective. Domestic enterprises invest in the target investment country by establishing one or more intermediate holding companies in some low-tax countries or regions (usually Hong Kong, Singapore, BVI or Cayman). Taking advantage of the low tax rate and confidentiality of offshore companies, the overall tax burden of enterprises can be reduced, while protecting corporate information, dispersing the risks of the parent company, and facilitating future equity restructuring, sales or listing financing.

Advantages: You can take advantage of the tax incentives of various countries to reduce investment costs and support global layout.

Disadvantages: Complex management and rising tax compliance costs.

1. Top level: High confidentiality + low tax rate + free flow of capital

Registration place: Cayman Islands, British Virgin Islands (BVI) and other offshore financial centers

Functions: Shareholder and beneficiary information is protected by law to avoid single market risks (disperse geopolitical shocks).

2. Operational layer: connecting top-level investors with bottom-level operating entities + improving investment returns + profit reservation

Registration location selection: Hong Kong/Singapore (trade compliance), Ireland/Netherlands (EU market), Dubai (Middle East market)

Function: signing a double taxation avoidance agreement (DTT) with the target investment to improve the overall investment return rate.

3. Actual operating company: business landing + direct/indirect holding

Registration location selection: local company in the target market

Function: landing production, marketing, localized services, meeting the requirements of localized operations, and selecting the registration location according to the business project.

Case: Cross-border e-commerce

Architecture design:

Operation layer: Hong Kong company (offshore trade tax exemption) + Dubai company (Middle East warehousing and logistics)

Entity layer: Mainland China factory (export tax rebate) + Brazilian subsidiary (localized sales)

As the top-level holding company, the BVI company is exempt from withholding tax on dividends from Hong Kong to BVI, and future equity transfers are exempt from capital gains tax, protecting the privacy of the founder.

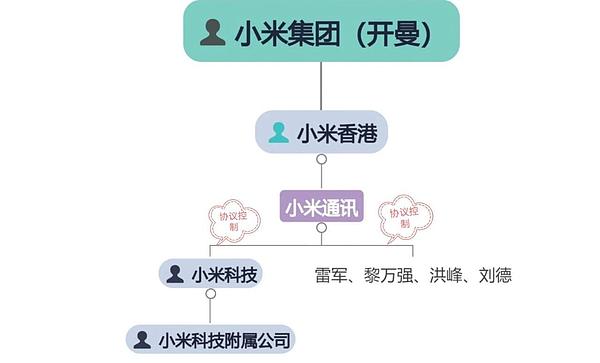

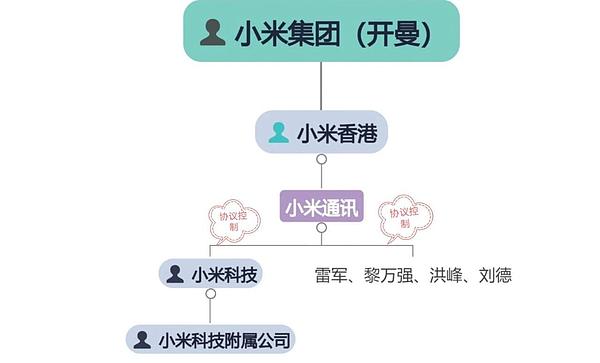

Case: Xiaomi Group

Architecture design:

Holding layer:Xiaomi Group (Cayman)

Operation layer:Xiaomi Hong Kong (global procurement + profit retention)

Entity layer:Xiaomi Communications (direct to consumers), Xiaomi Technology and Xiaomi Technology subsidiaries

Through Xiaomi Group (Cayman) holding Xiaomi Hong Kong Company, reinvest in Xiaomi Communications and other entity layers. Xiaomi Communications signed an agreement control legal document with Xiaomi Technology and its shareholders registered with the Industrial and Commercial Bureau, and controlled Xiaomi Technology and indirectly controlled Xiaomi Technology subsidiaries through the VIE agreement.

Summary

In the context of globalization, Web3 projects going overseas have become a key strategy for Chinese companies to break through domestic regulatory restrictions and expand overseas markets. By going overseas, companies can not only effectively avoid compliance risks, but also seize international market opportunities, attract high-quality resources and achieve risk diversification. For example, Hong Kong, Singapore and BVI have become ideal destinations for Web3 companies due to their relaxed regulatory environment, tax incentives and sound infrastructure.

In terms of architecture design, companies can flexibly choose single-entity, multi-entity or parallel architectures according to their own scale and goals to ensure compliance and isolate potential risks. At the same time, with the help of local policy advantages, companies can optimize capital flow through multi-entity architectures and significantly reduce tax burdens.

Looking to the future, with the global development of Web3 projects, enterprises are shifting from a single architecture to a hybrid architecture to achieve risk isolation, capital flow, strategic synergy and tax planning. By establishing multiple entities in different jurisdictions, enterprises can effectively isolate market risks and ensure compliance, while using offshore companies and holding structures to optimize capital flows, reduce tax burdens, and integrate global resources to enhance innovation capabilities and market competitiveness, and take advantage of the new opportunities brought by globalization for blockchain technology.

Joy

Joy