Source: Coingecko; Compiled by: Tao Zhu, Golden Finance

1. How much Bitcoin do governments hold in 2025?

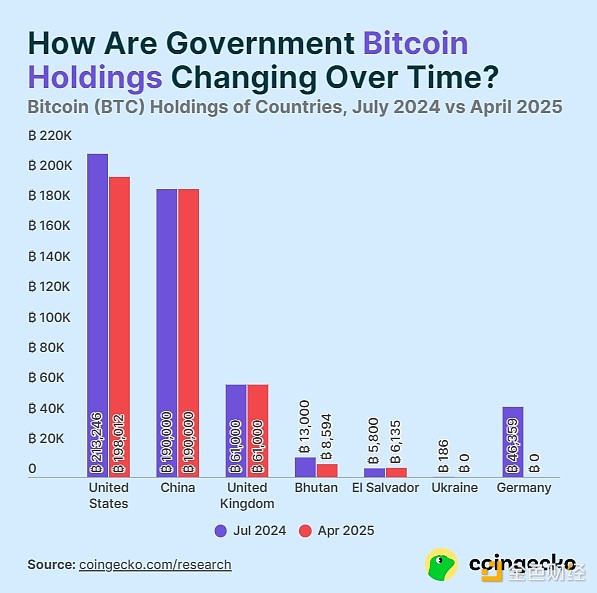

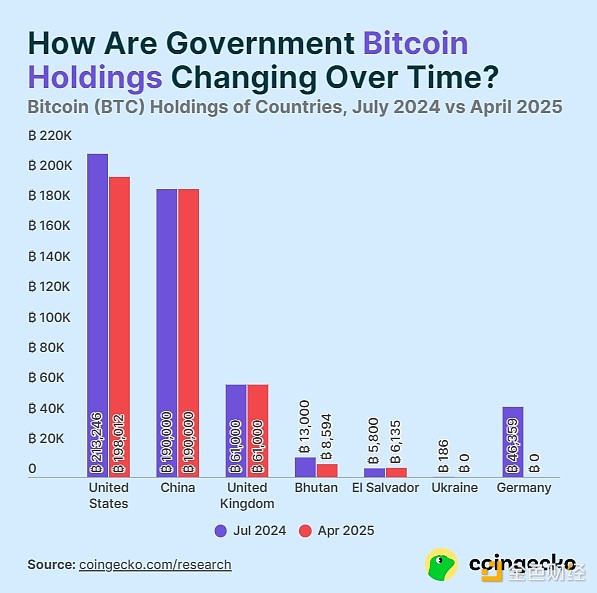

As of April 2025, governments hold more than 463,741 bitcoins, or about 2.3% of the total supply of bitcoin.This is down from the 529,591 bitcoins reported in July 2024, indicating that governments continue to participate in cryptocurrency investment. Some countries, such as El Salvador and Bhutan, have actively increased their holdings of bitcoin, while others, such as the United States and Germany, have liquidated their reserves.

2. How do government bitcoin holdings change over time?

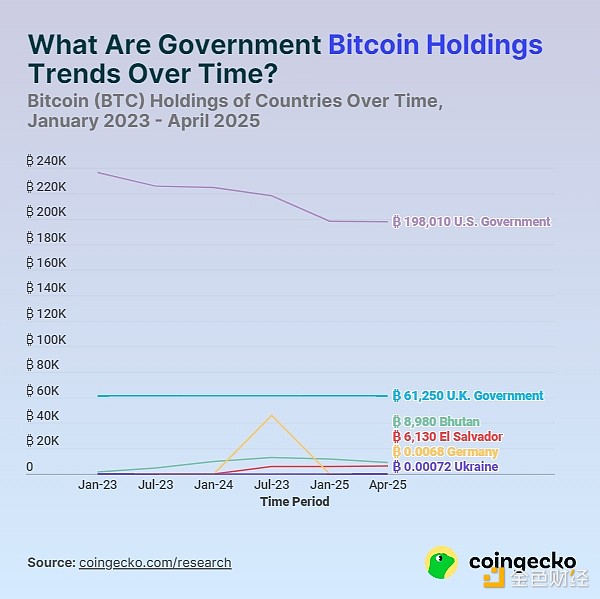

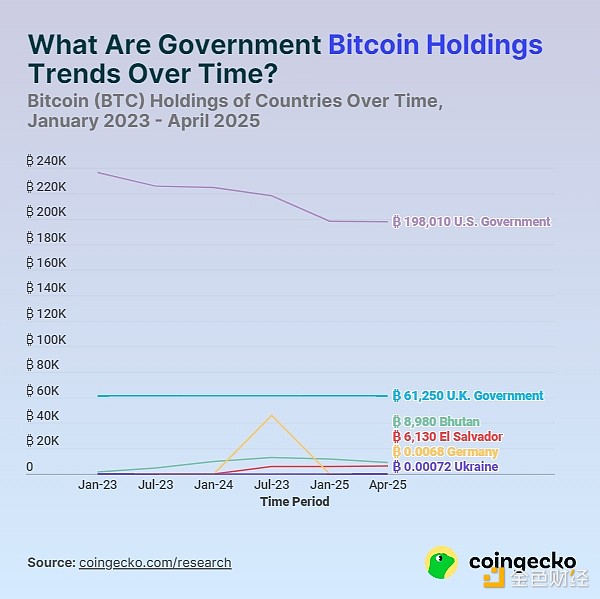

Governments have been involved in bitcoin holdings for many years, mainly through seizures, donations, active purchases and mining. This section tracks changes in government reserves between January 2023 and April 2025:

United States

The U.S. government remains the largest Bitcoin holder, holding approximately 198,012 Bitcoins (worth approximately $18.3 billion as of April 2025). However, this number is slightly down from July 2024 as the government liquidated some of its holdings. A significant development was President Donald Trump’s signing of an executive order in March 2025 to establish a “Digital Fort Knox” – a strategic cryptocurrency reserve to consolidate confiscated Bitcoin assets.

China

Despite a ban on cryptocurrency trading and mining, China remains the second-largest government Bitcoin holder, currently holding 194,000 Bitcoins (worth approximately $17.6 billion). The majority of these assets originated from the 2019 PlusToken Ponzi scheme. While China has yet to liquidate these holdings, the government remains tight-lipped about future plans.

United Kingdom

The United Kingdom holds 61,000 Bitcoins (worth approximately $5.6 billion), all acquired through crime-related seizures. The government has yet to decide whether to sell these assets, or use them for public finance needs, as has been suggested in recent policy discussions.

Bhutan

Bhutan has quietly amassed 8,594 Bitcoins (worth approximately $795.4 million), all through sustainable Bitcoin mining powered by hydroelectric power. The country continues to expand its mining operations, making it a rare example of a government accumulating Bitcoin through direct mining rather than seizure or purchase.

El Salvador

El Salvador has steadily increased its Bitcoin reserves to 6,135 BTC (about $567.8 million). The country continues to purchase 1 Bitcoin per day as part of President Nayib Bukele's long-term strategy to integrate Bitcoin into the national economy.

Ukraine

Since 2024, Ukraine has received a surge in Bitcoin donations, totaling 256 BTC (about $21.3 million). These funds have been fully liquidated and used for military and humanitarian aid in the ongoing conflict.

Germany

Germany liquidated its entire 46,359 BTC (about $3.9 billion) Bitcoin holdings in mid-2024, causing the Bitcoin price to fall by 15.7%. This case illustrates how government sales of Bitcoin can significantly affect the cryptocurrency market.

How do governments obtain Bitcoin?

Seized Assets

The United States, China, and the United Kingdom have acquired Bitcoin through law enforcement actions to combat cybercrime and fraud. The United States holds 198,012 Bitcoins, primarily from the Silk Road and Bitfinex hacks. China’s 190,000 Bitcoins came from the PlusToken Ponzi scheme, while the United Kingdom seized 61,000 Bitcoins from money laundering cases.

Active Purchases

El Salvador is the only country actively buying Bitcoin, purchasing 1 Bitcoin per day since November 2022. The country currently holds 6,135 Bitcoins and considers Bitcoin as a long-term reserve asset as part of its national financial strategy.

Mining

Bhutan uses its abundant renewable energy resources to accumulate Bitcoin through hydroelectric mining. This mining program offers a unique method of government-led Bitcoin accumulation without the need to purchase it directly on the market.

Donations

Ukraine has received over 256 bitcoins in donations from international supporters to fund military and humanitarian efforts. Most of these funds were quickly liquidated to cover emergency expenses, with only a small balance remaining in government wallets.

Why do governments sell bitcoin?

Not all governments choose to hold bitcoin for the long term—some choose to liquidate their holdings for a variety of reasons.

Budget Constraints

Countries facing fiscal deficits, such as Germany, have sold bitcoin to cover their budget deficits. In mid-2024, Germany liquidated 46,359 bitcoins, leading to a market downturn.

Market Timing

Governments may strategically sell bitcoin when prices are high to maximize gains. These sales can generate significant revenue, but they also have the potential to affect market stability.

Legal Obligations

Seized bitcoins are often forcibly liquidated. For example, the United States regularly auctions confiscated Bitcoins because national law requires that seized assets be exchanged for legal tender.

5. Governments Holding Bitcoin

The top five governments holding large amounts of Bitcoin are:

Kikyo

Kikyo