Source: Coinbase; Compiled by: Deng Tong, Golden Finance

After the 90-day suspension of tariffs on non-retaliatory countries, the market continues to ease, with Bitcoin prices fluctuating around $84,000.

The SOL/ETH cross hit a new high this week as crypto native investors continue to shift their positions from ETH to SOL or increase their holdings of SOL

The major token event last week was the 92% "flash crash" of Mantra's OM token on April 13

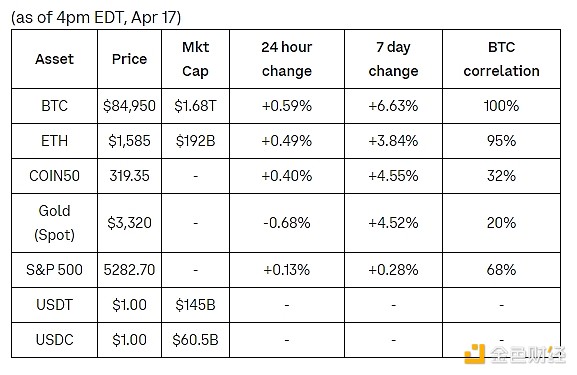

After the 90-day suspension of tariffs on non-retaliatory countries (announced on April 9), we continue to see market tensions ease, with Bitcoin fluctuating around $84,000 over the past week. The US-China trade relationship remains a key factor in market sentiment, with the White House expressing a willingness to reach a deal and China also expressing a willingness to negotiate.

That being said, Fed Chairman Jerome Powell spoke to the Economic Club of Chicago on April 16 about the impact of tariffs on the economy that are “far greater than expected,” suggesting that this could lead to a stagflationary situation in the U.S. The uncertainty surrounding macroeconomic conditions has led to some market pullbacks, but Bitcoin continues to outperform the S&P 500 and Nasdaq on a risk-adjusted basis.

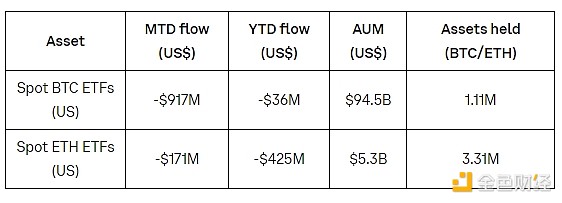

Meanwhile, we saw the SOL/ETH cross hit a new high last week (0.0848 as of April 17) as more crypto-native investors shifted their positions from ETH to SOL or increased their SOL holdings. For market participants seeking diversified beta exposure to cryptocurrencies, SOL’s decline in early April was seen as an attractive entry point. This strategic rotation is interesting as SOL has continued to significantly outperform ETH even against the backdrop of a positive market reaction to the SEC’s approval of Ethereum ETF options from BlackRock, Grayscale, Bitwise, and Fidelity.

That said, we have seen that regulatory progress in this cycle has not been enough to offset the broader macroeconomic headwinds that have weighed on crypto performance.Recently, the SEC Cryptocurrency Task Force held a roundtable on trading and announced three more roundtables on April 25, May 12, and June 6, 2025, focusing on custody, tokenization, and DeFi, respectively. Previously, it was also reported that the U.S. Securities and Exchange Commission (SEC) plans to re-evaluate its cryptocurrency guidelines in the Biden era amid ongoing regulatory adjustments under the new administration.

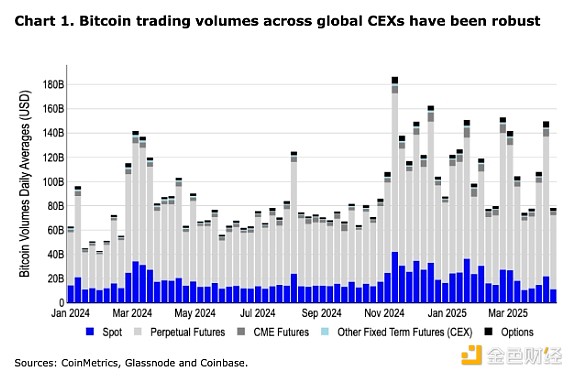

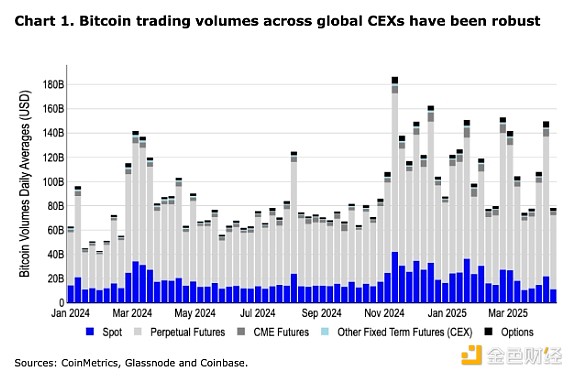

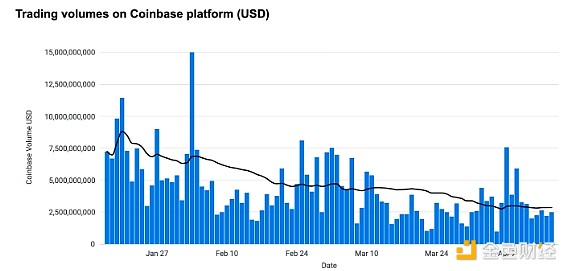

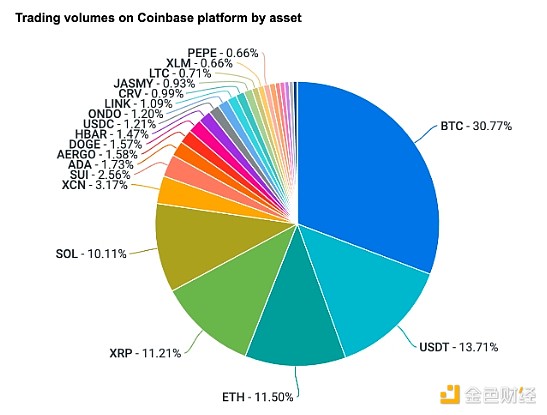

Notably, data from global centralized exchanges (CEXs) show that BTC trading volumes across products remain relatively strong despite the widespread sell-off in recent weeks, helping BTC outperform many altcoins that have been affected by reduced demand and weakening liquidity. Of course, a major token-specific event — a 92% “flash crash” of Mantra’s OM token on April 13 (down from its peak on February 23) — didn’t help. What triggered the move is unclear, but on April 16, Mantra issued an official statement on the incident.

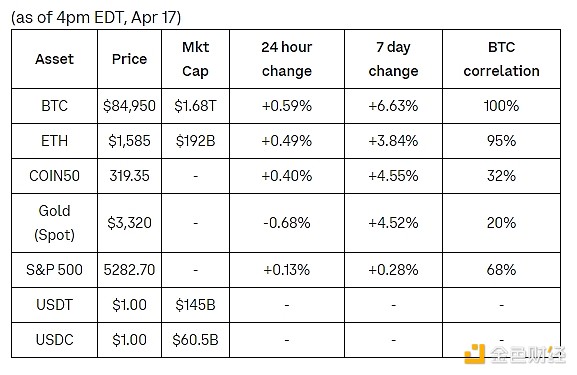

Overview of Cryptocurrency and Traditional Assets

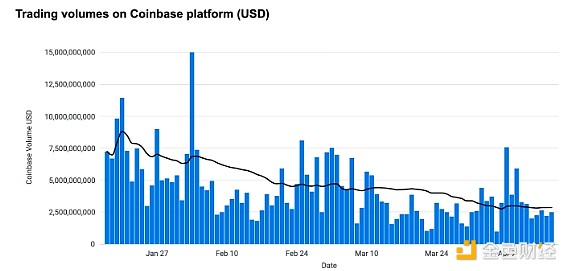

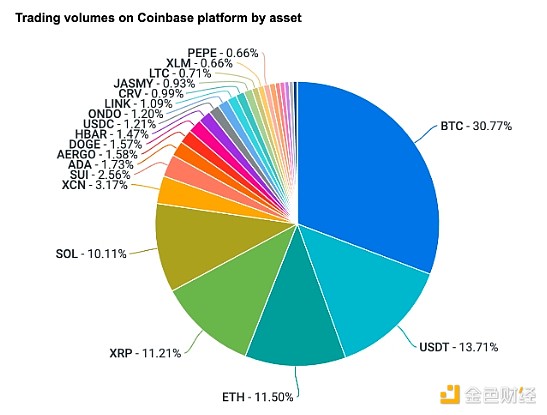

Coinbase and CES Insights

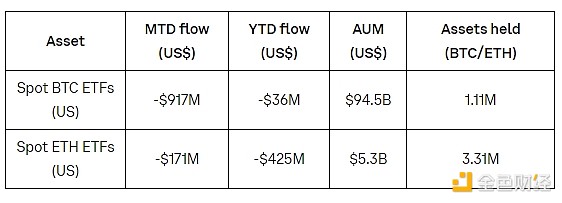

BTC has performed relatively well this week, up about 6.6% over the past seven days. In contrast, the COIN50 index is up only 4.5% over the same period. The continued bid for BTC is likely due to its "store of value" status, a weaker U.S. dollar, and gold's outperformance in traditional markets. We continue to see an emergence of BTC buyers from a variety of client segments. As Bitcoin's role in a portfolio becomes clearer, the average transaction size has also increased. At the same time, we continue to see direct sellers of ETH and buyers of the SOL/ETH cross. Trading in smaller, less liquid altcoins has slowed due to the many recent uncertainties.

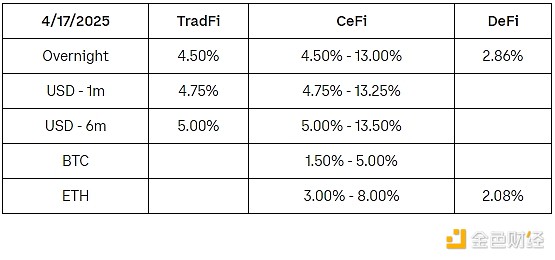

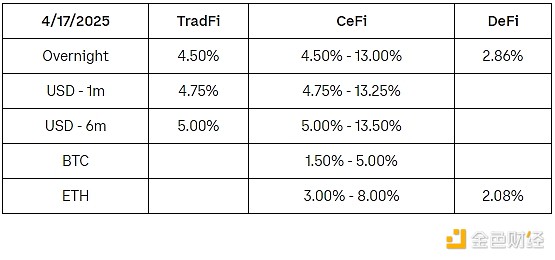

Financing interest rate

Catherine

Catherine