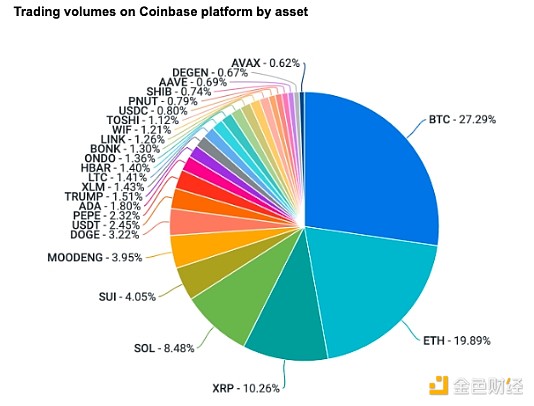

Source: Coinbase; Compiled by Wuzhu, Golden Finance

Summary

The easing of Sino-US trade relations and a US-Saudi business agreement worth $600 billion are boosting investor confidence and driving the appreciation of Bitcoin and some altcoins.

The latest regulatory news includes bipartisan progress on the GENIUS Act and the U.S. House of Representatives' discussion draft of a cryptocurrency market structure bill.

The easing of Sino-US trade relations boosted investor sentiment over the past week, and the significant rise in Bitcoin and some altcoins reflected this optimism. That optimism was reinforced earlier this week when the U.S. government reached a $600 billion business deal with Saudi Arabia, suggesting momentum remains strong in the trade diplomacy space. Th a Japanese signal that a deal could be reached by June, which could help resolve concerns surrounding advanced semiconductors, is allaying investor fears that the U.S. could fall into a recession this year. Nonetheless, the Financial Times recently reported that Japan’s stance could harden due to the July upper house elections.

Recall that after the negative U.S. GDP data for the first quarter of 2025 was released on April 30 (down 0.3% month-on-month), a technical recession seemed more likely at the time, as the weak data foreshadowed another contraction in the second quarter of 2025. However, the Atlanta Fed’s GDPNow forecast currently projects actual growth at 2.5%, up from 2.3% a week ago. From the perspective of the cryptocurrency market, the risk of a recession is that the willingness to invest tends to be lower and the willingness to save higher during such periods as economic uncertainty curbs spending.

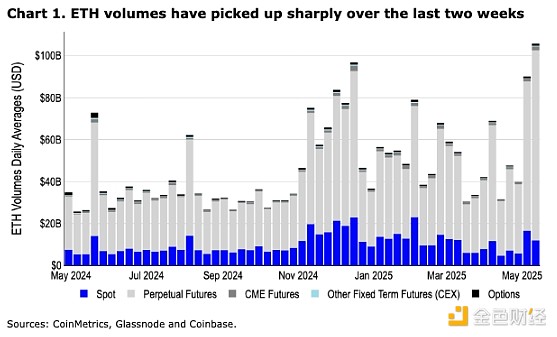

Meanwhile, ETH experienced a surge driven primarily by technicals as it caught up to peers such as BTC and SOL, reflecting a large amount of offside positions, short covering, and subsequent re-arbitrage. We believe ETH has lacked a meaningful narrative for some time, with many crypto-native institutional funds either reducing their holdings of ETH or shorting ETH as a portfolio hedge over the past 12-18 months. As such, we believe ETH has failed to reflect some major positives in the near term, including the recent Pectra upgrade and proposals from Vitalik Buterin (on RISC-V) or Ethereum Foundation researcher Dankrad Feist (EIP-9698).

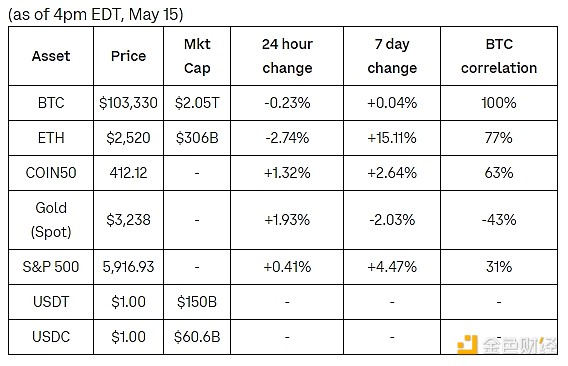

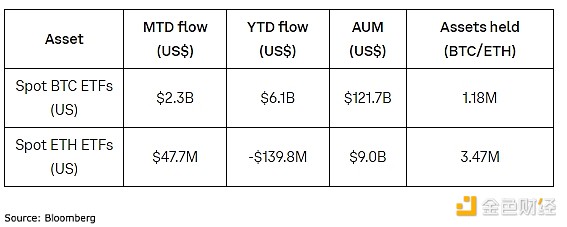

In fact, year-to-date, spot ETH ETFs have seen net outflows of nearly $140 million (compared to $6.1 billion in net inflows into spot BTC ETFs), though the funds did attract $61 million this week (May 8-14). However, we believe this indicates that despite the price action, interest in allocating to ETH more broadly remains limited. It’s important to note that May 15 is the deadline for 13-F filings (Q1 2025), but only companies with more than $100 million in funds under management are required to file. In an early sign that some institutional interest in US cash ETFs is waning (according to Reuters), the Wisconsin Investment Board has exited its holdings. On the other hand, Brown University’s endowment fund bought $4.9 million worth of IBIT stock last quarter.

Regulatory Dynamics

Recently, there has been some misleading media coverage of the U.S. Senate's stablecoin bill, the GENIUS Act. Here's what happened: Last week (May 8), the Senate failed to advance the GENIUS Act in a terminating vote (a vote to end debate on a bill or issue and move to a final vote). Many newspapers instead viewed the vote to end debate as an indefinite stalemate that could lead to a legislative policy vacuum.

In fact, the Democrats initially supported the bill in committee, but some Republican lawmakers later used procedural means (Rule 14D) to amend the bill, but this amendment was not recognized by some lawmakers from both parties. Since then, the two parties have been working to reach an agreement and add new amendments to the bill to increase transparency on stablecoins. South Dakota Senator John Thune has since requested another procedural vote on the GENIUS Act for Monday, May 19, which could result in full passage of the bill soon.

In fact, Bo Hines, executive director of the President’s Digital Asset Advisory Committee, said this week that he believes both the stablecoin bill and market structure legislation can be completed before the August 2025 recess. On May 5, U.S. House Financial Services Committee Chairman French Hill (Arkansas) and House Agriculture Committee Chairman G.T. Thompson (Pennsylvania) released a discussion draft of the cryptocurrency market structure bill. This means that the bill will require input from industry stakeholders, comments from legal experts, review by the committee, and possible amendments before it becomes law. It is worth mentioning that the bill clearly defines the jurisdictional boundaries of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) and establishes a path for registration and disclosure of cryptocurrency activities in the United States.

Overview of Cryptocurrency and Traditional Assets

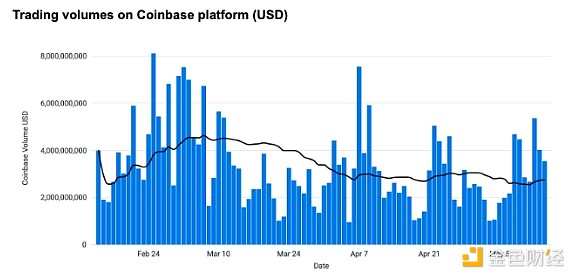

Coinbase Exchange and CES Insights

Ethereum's rally continues, up 15% over the past seven days. While this move coincides with Pectra’s update, it appears to be driven primarily by technical supply and demand factors. Ethereum’s underperformance has been going on for more than a year, causing many crypto-native funds to reduce their holdings or even short the token to hedge their risks. The recent short squeeze is likely the result of funds chasing performance and covering their positions. Elsewhere in the market, traders have been selling altcoins to lock in profits following their April rally. BTC remains favored by a variety of customer types, with fund flows heavily skewed toward the buy side.

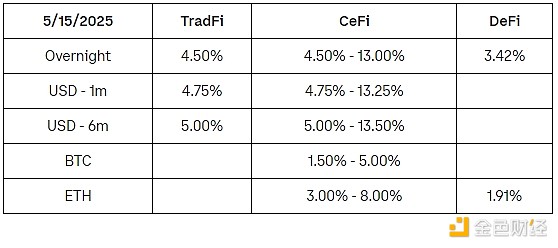

Financing interest rate

Aaron

Aaron

Aaron

Aaron Alex

Alex Alex

Alex Joy

Joy Alex

Alex Brian

Brian Hui Xin

Hui Xin Aaron

Aaron Joy

Joy Brian

Brian