Coinbase founder: Crypto world’s “iPhone moment” has arrived

Brian shared his unique perspective as an engineer and CEO, discussed Coinbase’s efforts to help developers, and his vision for on-chain development in the coming years.

JinseFinance

JinseFinance

Source: Coinbase 2025Q2 Crypto Status Report; Compiled by: AIMan@Golden Finance

Six out of ten Fortune 500 executives said their companies are working on blockchain-related projects.

The number of stablecoin holders has reached 161 million, exceeding the combined population of the world's top ten cities.

Nearly one-fifth of Fortune 500 executives said that on-chain plans are a key component of their company's future strategy, a year-on-year increase of 47%.

One-third of small and medium-sized enterprises use cryptocurrencies, twice the proportion in 2024.

The scale of tokenization of real-world assets has exceeded $21 billion by April 2025, a year-on-year increase of 245 times.

Nine out of ten Fortune 500 executives believe that the United States needs to formulate clear regulatory rules for cryptocurrency, blockchain or Web3/on-chain fields to support innovation.

Global stablecoin supply increased by 54% year-on-year.

Sixteen years after the launch of Bitcoin, the development of modern blockchain technology allows us to say with certainty that the future of money has arrived. Cryptocurrency holdings are more common than many people think: the scale of stablecoin transfers has reached unprecedented levels; more than a third of small and medium-sized enterprises use cryptocurrencies in their business; and six out of ten Fortune 500 executives say their companies are working on blockchain-related projects.

But this is just the beginning. Nearly one in five Fortune 500 executives say on-chain initiatives are a key component of their company’s future strategy (up 47% year-over-year), and more than four in five institutional investors plan to increase their exposure to crypto this year.

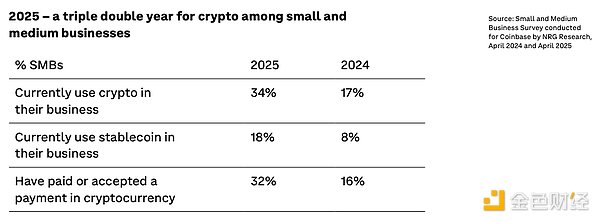

The growth of cryptocurrencies is particularly evident among small and medium-sized businesses, which form the backbone of the U.S. economy. 2025 marks a “triple-fold” in cryptocurrency adoption for SMBs. Compared to last year, double the number of SMBs using cryptocurrencies (34% in 2025 and 17% in 2024), double the number using stablecoins, and double the number paying or accepting crypto payments. Looking ahead, demand is likely to only intensify, as more than four in five SMBs believe cryptocurrencies help solve at least one financial pain point (82%) and are interested in using cryptocurrencies in their business (84%). As the adage goes, “as the mainstream grows, so does the economy.”

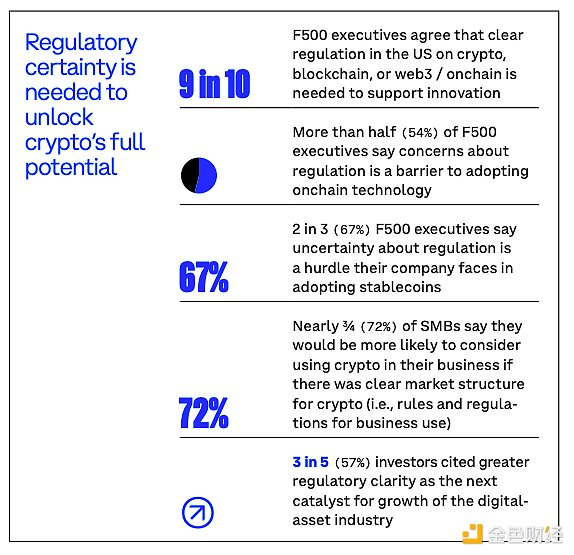

So the future of money is already here, and it’s only just beginning. But clearly, greater regulatory certainty is needed to fully realize the potential of cryptocurrencies. That’s why passing market structure and stablecoin legislation is so important to the future of cryptocurrency innovation in the United States. Nine out of ten Fortune 500 executives agree that clear regulation is needed to support innovation, more than three-fifths of investors cite greater regulatory clarity as the next catalyst for growth in the digital asset industry, and nearly three-quarters (72%) of SMEs say they would be more likely to consider using cryptocurrency in their business if the market structure of cryptocurrency (i.e., the rules and regulations for commercial use) was clearly defined.

This is Coinbase’s seventh State of Crypto Report, which examines the adoption of cryptocurrency by enterprises, SMEs, and investors, and demonstrates the role that cryptocurrency, blockchain, and other Web3 technologies can play in updating the global financial system for the benefit of businesses and consumers.

The report covers the following:

1. More and more top U.S. companies are getting involved in on-chain businesses.

2. SMEs are adopting cryptocurrencies faster.

3. The adoption of stablecoins and other tokenized assets is expanding rapidly.

4. Institutional investors are increasing their exposure to cryptocurrencies.

5. Greater regulatory certainty is needed to unleash the full potential of cryptocurrencies.

On-chain business is huge. Among Fortune 500 executives:

Six in ten said their companies are working on on-chain plans.

Nearly half (47%) said their companies have increased their investment in on-chain technology.

The number of on-chain projects per company increased 67% year-over-year, from 5.8 to 9.7

Among the Fortune 500, on-chain initiatives and use cases are diversifying:

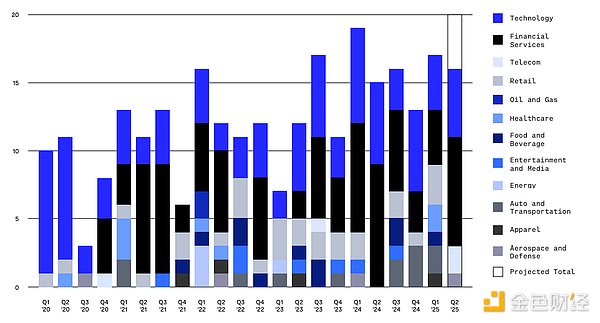

In Q1 2025, Fortune 100 companies announced 17 unique on-chain initiatives, which is on par with the second-highest quarterly activity on record, with a total of 46 unique on-chain initiatives over the past three quarters (Q3 2024-Q1 2025). While financial services and technology companies remain the industries with the most on-chain plans, the most recent three quarters (Q3 2024 – Q1 2025) show increasing participation from automotive and transportation, retail, food and beverage, and healthcare companies.

In Q1 2025, Fortune 100 companies announced 17 unique on-chain initiatives, which is on par with the second-highest quarterly activity on record, with a total of 46 unique on-chain initiatives over the past three quarters (Q3 2024-Q1 2025). While financial services and technology companies remain the industries with the most on-chain plans, the most recent three quarters (Q3 2024 – Q1 2025) show increasing participation from automotive and transportation, retail, food and beverage, and healthcare companies.

On-chain is a business imperative

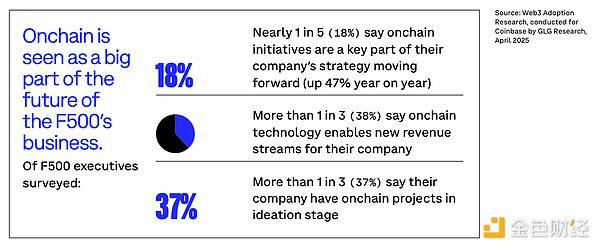

On-chain is seen as an important part of the future business of Fortune 500 companies. Among Fortune 500 executives surveyed:

18% said on-chain initiatives are a key component of their company’s future strategy (up 47% year-over-year).

More than a third (38%) said on-chain technology has enabled new revenue streams for their companies.

More than a third (37%) said their companies have on-chain projects in the conceptual stage.

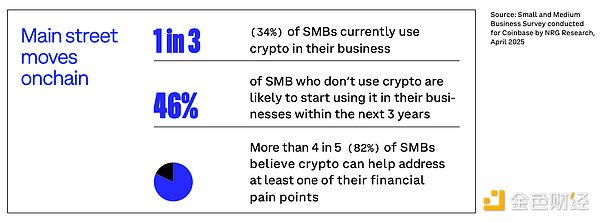

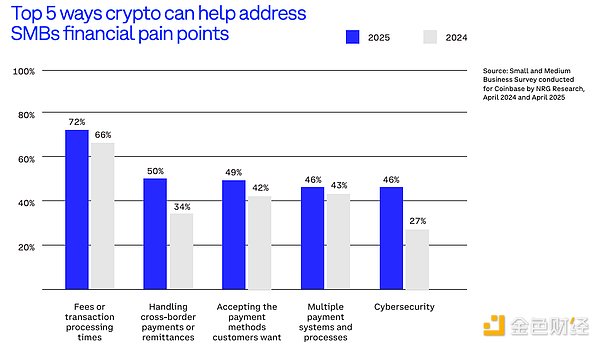

The future of money is most evident among SMEs, which are the backbone of the U.S. economy. On-chain technology, especially payment technology, is hugely attractive to businesses that see transaction fees and processing times as their primary financial pain points.

One-third (34%) of SMEs currently use cryptocurrency in their business.

46% of SMEs that do not use cryptocurrency may start using it in their business within the next 3 years.

More than four-fifths (82%) of SMEs believe that cryptocurrency can help solve at least one financial pain point.

2025 is the year of "triple growth" of cryptocurrency for SMEs. Compared to last year, the number of SMEs using cryptocurrencies, the number of SMEs using stablecoins, and the number of SMEs paying or accepting cryptocurrencies have all doubled.

It is therefore no surprise that more than four-fifths of SMEs (84%) are interested in using cryptocurrencies in their business, up from nearly two-thirds (65%) a year ago.

It is therefore no surprise that more than four-fifths of SMEs (84%) are interested in using cryptocurrencies in their business, up from nearly two-thirds (65%) a year ago.

Cryptocurrencies can help solve the main financial pain points facing SMEs.

82% of SMEs said that cryptocurrency could help solve at least one pain point facing their business, up from 68% a year ago.

In 2025, more than half (57%) of SMEs believe that adopting cryptocurrencies will save money for the company, up from 42% a year ago.

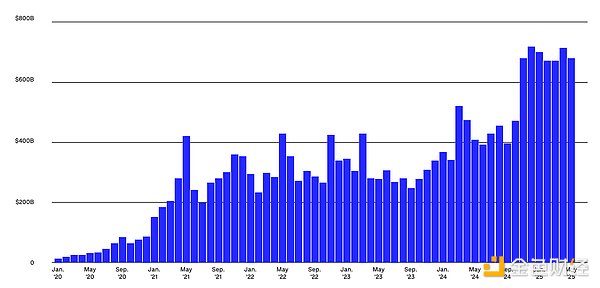

The natural transfer volume of stablecoins has reached unprecedented levels, with the highest two-month transfer volume in history occurring last year. A monthly transaction volume record of $719 billion was set in December 2024, followed by a transaction volume of $717.1 billion in April 2025.

Since the beginning of 2020, adjusted monthly stablecoin transfer volume has surged.

Since the beginning of 2020, adjusted monthly stablecoin transfer volume has surged.

Annual settlement volume of stablecoins has grown significantly since 2019, exceeding the annual settlement volume of the global remittance market and PayPal, while approaching Visa's settlement volume.

The number of stablecoin holders continues to grow, with more than 160 million holders, which is more than the combined population of the world's top ten cities, 6 times the population of the New York metropolitan area, and more than X number of daily active users in the United States. They can hold hands and circle the earth 6 times.

As of early May 2025, the stablecoin supply accounts for nearly 10% of the currency in circulation in the United States. By the end of May 2025, the total stablecoin supply had reached $247 billion, up nearly 54% from the previous year. In April 2025, USDC’s market cap reached an all-time high of $62 billion. Circle and Tether, the issuers of USDC and USDT, currently hold more U.S. Treasuries than major countries such as Germany, highlighting the growing importance of stablecoins in global financial markets.

This growth stems from a shared belief among consumers as well as Fortune 500 and SMEs that stablecoins can help solve some of the biggest financial pain points. 47% of Fortune 500 executives and 82% of SMEs said slow transaction speeds and/or high transaction fees were financial pain points, while 31% of Fortune 500 executives and 30% of SMEs said cross-border payment challenges were also financial pain points. It’s no surprise, then, that 89% of SMEs see at least one benefit from using stablecoins.

Some examples of existing financial pain points that stablecoins solve:

1. Remittance

Pain point: International remittances via wire transfers can incur significant fees (in many cases, more than 50% of the remittance amount can be consumed by fees and exchange rates) and take a long time (typically 1-5 business days to complete).

How stablecoins help: Stablecoins directly address these pain points by enabling near-instant, low-cost cross-border transfers, bypassing traditional banking intermediaries.

2. Payment processing fees

Pain point: Businesses typically incur significant costs from credit card processing fees, which can range from 1.5% to 3.5% per transaction. These fees eat into profit margins, especially for small and medium-sized businesses.

How stablecoins help: Accepting stablecoin payments can bypass traditional credit card networks, reducing transaction costs.

3. Global payroll

Pain point: Managing the payroll of employees around the world involves dealing with different regulations, currencies, and banking systems.

Stablecoins help: Using stablecoins to pay salaries allows companies to quickly and securely pay employees and freelancers around the world.

4. Inflation protection

Pain point: People in countries with high inflation face a rapid decline in purchasing power and find it difficult to preserve savings or conduct financial planning. The value of local currencies may fall every day, and access to stable foreign currencies is often restricted or strictly controlled by the government, forcing people to hold depreciating assets or rely on the black market.

Stablecoins help: Stablecoins provide a solution by providing a digital asset that maintains a stable value, usually pegged to the US dollar, allowing individuals to protect their savings from inflation and trade with a more reliable means of storing value.

5. Unbanked and underbanked people

Pain point: Immigrants or individuals living in areas with limited banking infrastructure often have difficulty accessing basic financial services such as savings accounts, remittances or credit. In many cases, barriers such as document requirements, high fees or geographical isolation prevent them from participating in the formal financial system. Even in the U.S., the Federal Deposit Insurance Corporation (FDIC) found that 19 million households will be underbanked and 5.6 million will be unbanked in 2023.

How Stablecoins Can Help: Stablecoins can help bridge this gap, enabling anyone with a smartphone and an internet connection to store value, send money, and access global financial networks without the need for a traditional bank account.

This ability to solve some of the biggest financial pain points is driving interest from businesses of all sizes. Among Fortune 500 executives:

7% say their company currently uses or holds stablecoins.

Nearly three in ten (29%) say their company plans to use or is interested in stablecoins, compared to 8% in 2024, a 3.6-fold year-over-year increase.

Two-thirds say stablecoins could be part of a solution to provide customers with faster, lower-fee payments.

More than half (58%) said regulated stablecoins could reduce costs for their companies in areas such as international payments or supplier settlements.

SMEs are also excited about the potential of stablecoins:

18% of SMEs currently use stablecoins, more than double the 8% expected in 2024.

36% of SMEs said they have received requests from customers, employees or suppliers/vendors to use stablecoins (more than double the 17% a year ago).

81% of SMEs are interested in using stablecoins in their business, compared to 61% a year ago.

Stablecoins are starting to go more mainstream with Circle launching a cross-border remittance network, Ramp launching a stablecoin card, Stripe and Bridge launching “stablecoin financial accounts” in 101 countries, SWIFT enabling native stablecoin functionality, Meta re-exploring stablecoins after selling Diem, and Mesh stablecoin settlement through Apple Pay (to name a few), and this is just the beginning of the rise of stablecoins.

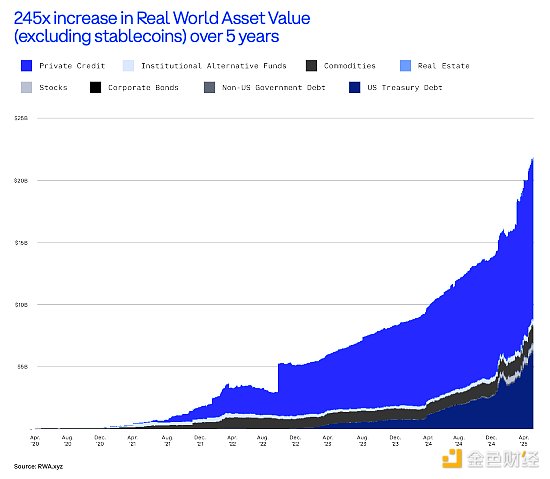

Tokenization of real-world assets has grown 245 times from $85 million in April 2020 to over $21 billion in April 2025. Private credit accounts for 61% of total tokenized assets, followed by Treasuries (30%), commodities (7%), and institutional funds (2%).

As the industry matures, real-world asset tokenization has expanded to many different business use cases, and this is expected to continue. For example:

1. Treasury/Cash Management Tokenization

Pain Points: Companies often deposit idle cash in bank accounts that yield little to no returns, or rely on manual processes to allocate funds to short-term Treasury bonds through traditional brokers or funds. This exposes them to opportunity costs, settlement delays, and lack of 24/7 liquidity. For international companies, friction is even higher due to capital controls, counterparty risks, and limited access to foreign currency-denominated assets.

Real-world asset use cases: Tokenized Treasury settlements are faster, programmable, and often provide transparent real-time reporting. Especially for Web3 native companies and decentralized autonomous organizations (DAOs), tokenized treasuries offer a way to earn yield on treasuries without moving funds off-chain.

2. Tokenization of invoices/accounts receivable

Pain points: For many businesses, especially small and medium-sized enterprises, cash flow bottlenecks can cause problems. Traditional invoice factoring solutions are slow, paperwork-heavy, and geographically restricted. Financing terms are often unfavorable, access is limited, and liquidity is fragmented among regional suppliers. This makes it difficult for growing companies to obtain short-term working capital.

Real-world asset use cases: Tokenizing invoices and accounts receivable enables companies to unlock liquidity. It can be divided and made available to global investors in real time, improving capital access and driving more efficient pricing. Smart contracts can automatically track payments and enforce terms, while potentially reducing fraud and administrative overhead.

3. Tokenization of private credit

Pain points: Traditionally, private credit has been open only to large institutions and high-net-worth investors, and its issuance and servicing are handled manually through opaque, illiquid channels and banks. For businesses, especially those in underserved regions or industries, obtaining private loans often requires navigating fragmented, high-cost funding networks with limited investor reach. For investors, participating in the private credit market requires long lock-in periods and lacks convenient exit options.

Real-World Asset Use Cases: Private credit tokenization makes it easier to tap into retail AUM by lowering issuance and investment barriers, enabling broader participation. This unlocks a deeper and more diverse pool of capital for borrowers. In addition, tokenized debt can be traded in secondary markets, providing potential exit liquidity for investors and improved pricing efficiency for issuers.

These are the pain points of scale that real-world asset tokenization can solve. As of April 2025, private credit tokenization has grown from near zero to $12 billion, with Figure leading the market and accelerating growth - with a $2.5 billion increase in market capitalization from Q4 2024 to Q1 2025 alone. The size of tokenized U.S. Treasuries has grown from less than $500 million in October 2022 to over $6 billion in April 2025, with BUIDL and BENJI becoming market leaders, holding 54% of the market and attracting a large amount of capital inflows.

2024 is a bumper year for cryptocurrencies, thanks to interest in new ETF products. Bitcoin and Ethereum ETFs are among the most successful ETFs of all time.

The top ten Bitcoin ETFs have attracted a cumulative inflow of $50 billion, twice the cumulative inflows of the top ten ETFs in history in their first year.

Although record ETF trading volume is driven by retail investors (retail investors hold 79% of Bitcoin ETFs), the speed of institutional adoption of Bitcoin ETFs has also set a record. In the first three quarters after its launch, the Bitcoin ETF surpassed other best-performing ETFs in both institutional assets under management (AUM) and the number of holders.

The Ethereum ETF attracted $3.5 billion in net inflows and also outperformed other top-performing ETFs in terms of institutional AUM and number of holders in the first quarter after its launch.

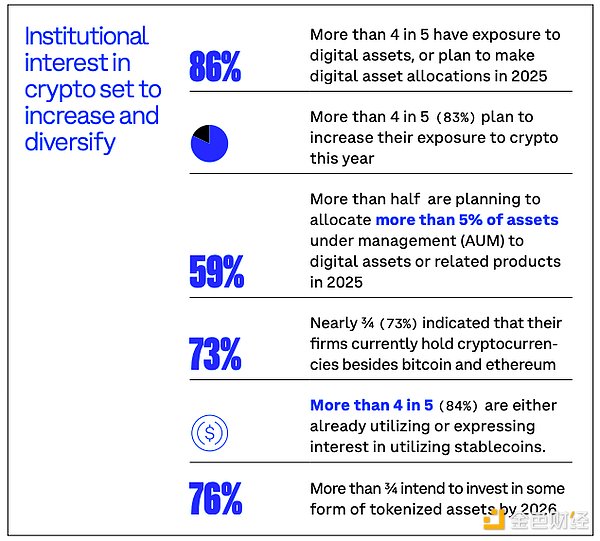

In 2025, this interest is expected to increase and diversify. In a January 2025 survey of 352 institutional investor decision makers conducted in partnership with EY-Parthenon:

More than four-fifths (86%) of institutional investors already hold digital assets or plan to allocate to digital assets in 2025.

More than four-fifths (86%) of institutional investors already hold digital assets or plan to allocate to digital assets in 2025.

More than four-fifths (83%) of institutions plan to increase their exposure to cryptocurrencies this year.

More than half (59%) of institutions plan to allocate more than 5% of their assets under management (AUM) to digital assets or related products by 2025.

Nearly three-quarters (73%) of institutions said their firms currently hold cryptocurrencies other than Bitcoin and Ethereum.

More than four-fifths (84%) of institutions are already using or have expressed interest in using stablecoins.

More than three-quarters of institutions intend to invest in some form of tokenized assets by 2026.

So far, this report has demonstrated that the future of money is not only here, but its prospects are brighter than ever. However, to unlock this potential, it is critical to increase regulatory certainty around cryptocurrencies, Web3, and blockchain technology in the United States.

Nine out of ten Fortune 500 executives agree that the United States needs clear regulatory rules for cryptocurrency, blockchain, or Web3/on-chain to support innovation.

More than half (54%) of Fortune 500 executives said concerns about regulation are an obstacle to adopting on-chain technology.

Two-thirds (67%) of Fortune 500 executives said regulatory uncertainty is an obstacle their companies face when adopting stablecoins.

Nearly three-quarters (72%) of SMEs say they would be more likely to consider using cryptocurrency in their business if there was a clear cryptocurrency market structure (i.e., rules and regulations for commercial use).

Three-fifths (57%) of investors cite greater regulatory clarity as the next catalyst for growth in the digital asset industry.

Crypto legislation is also active at the state level. Thirty-eight states have passed or are considering more than 131 different bills regarding Bitcoin and cryptocurrency. While many of the new laws are exciting, such as Arizona’s ensuring that unclaimed cryptocurrency property can be held in native form and New Hampshire and Texas’ creation of strategic Bitcoin reserves, some states are considering new regulatory regimes that would create conflicting consumer protection requirements for cryptocurrency. Federal market structure legislation is needed to provide a common baseline of legal and regulatory clarity to protect consumers and encourage innovation, regardless of the consumer’s zip code.

The United States needs to foster the growing demand for talent, rather than continue to lose it overseas.

More regulatory certainty is also needed to win the war for crypto talent. Since Ethereum launched in 2015, the number of cryptocurrency developers has grown 39% annually. This is much needed talent given the growth that cryptocurrencies are experiencing and will continue to experience.

However, while the United States still has 39% of developers (as of November 2024), its share has been cut in half since 2015. India is the second largest contributor at 12%, and has grown significantly.

Among Fortune 500 executives, concerns about available trusted talent are now a major barrier to adoption. Among small and medium-sized businesses, half say the next time they fill a finance, legal, or IT/tech position, they are likely to look for a candidate familiar with cryptocurrency. Clear cryptocurrency rules are key to keeping developers in the U.S., and key to the U.S. continuing to lead the world in cutting-edge technological innovation.

The future of money is already here, and it’s only just beginning. But if the U.S. wants to lead the way forward, we need clear rules.

Brian shared his unique perspective as an engineer and CEO, discussed Coinbase’s efforts to help developers, and his vision for on-chain development in the coming years.

JinseFinance

JinseFinanceThe messaging feature will support the 1.3 million Ethereum addresses using the wallet that are human-readable and/or ENS-enabled.

nftnow

nftnowRaoul Pal says that regulatory issues will cause top US crypto firms to leave the country

dailyhodl

dailyhodlCoinbase has explored the possibility of setting up a cryptocurrency trading platform outside of the US.

Bitcoinist

BitcoinistThe U.S. government's increased actions against the crypto industry recently.

Bitcoinist

BitcoinistCustomers have until February 16 to withdraw their funds, and deposits will be halted on January 20.

Beincrypto

BeincryptoU.S. exchange plans new sweeping cutbacks as effects of FTX bankruptcy spread.

Others

OthersCoinbase has revealed candidates for its top leadership positions as it expands into Europe.

Beincrypto

BeincryptoA tie-up between the crypto and tech giants has been lauded as affirmation for blockchain. In reality, Google is looking for new customers.

Others

OthersCryptocurrency exchange Coinbase reported experiencing a major outage in the middle of crypto prices plummeting. Users of the exchange complained ...

Bitcoinist

Bitcoinist