Source: Coinbase; Compiled by: Golden Finance

Key Points:

Our previous report, "Stablecoins and the New Payments Landscape (August 2024)," examined the role of stablecoins in the global payments system and explored why traditional banking systems, credit cards, and mobile providers must adapt to customers' evolving needs.

In our subsequent report, we examined how the complexity of integrating stablecoins into the existing financial system could limit the growth of the overall stablecoin market, such as its net impact on aggregate demand for U.S. Treasuries.

Our stochastic model predicts that the stablecoin market capitalization could reach approximately $1.2 trillion by the end of 2028. We believe this does not require an unrealistically large or permanent interest rate misalignment to achieve; rather, it relies on gradual, policy-backed adoption that compounds over time.

Sustained growth in stablecoins will reduce marginal front-end funding costs, while large redemptions will tighten them. We estimate that $3.5 billion in stablecoin inflows over five days could compress three-month Treasury yields by approximately 2 basis points within 10 days and up to 4 basis points within 20 days. Substitution effects could pose downside risks to this valuation.

Finally, we believe regulatory developments such as the GENIUS Act are crucial for establishing clear reserve rules and liquidity buffers, which can mitigate the risk of large redemptions escalating into forced sales of Treasury securities.

Stochastic Growth Forecast

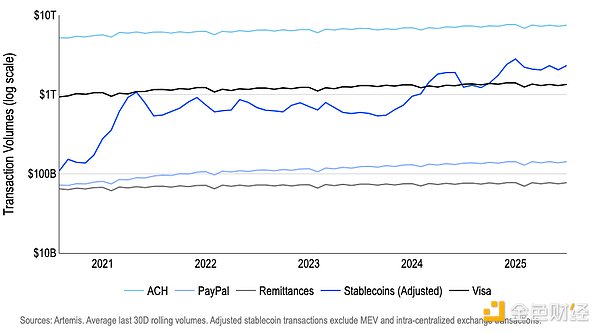

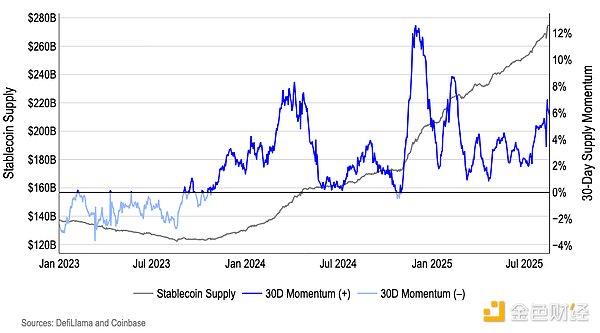

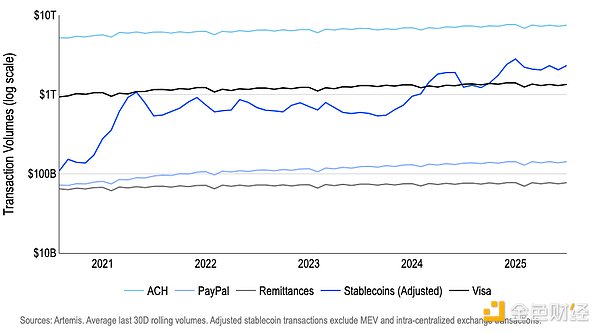

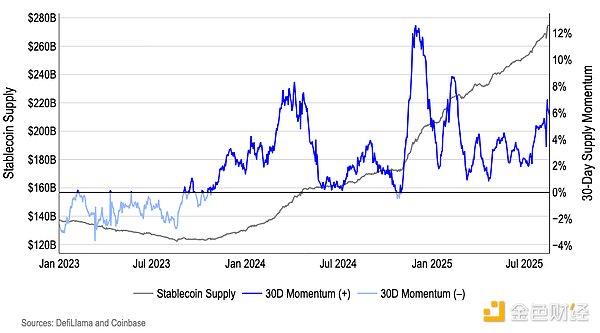

The stablecoin market is at a turning point, and its growth depends on key factors such as efficient channels, extensive distribution networks, and the evolving roles of market participants. According to Artemis data (see Figures 1 and 2), the global stablecoin market capitalization (since 2021) has grown at a compound annual growth rate of approximately 65%, exceeding US$275 billion as of mid-August 2025, and average adjusted trading volume will soar from US$10.3 trillion in the same period of 2024 to US$15.8 trillion since the beginning of 2025.

Figure 1: Adjusted stablecoin transaction volumes compared to the existing system

Figure 2: Stablecoin supply now exceeds $275 billion (as of mid-August)

Forecasts of future growth are often based on assumptions about the share of global money supply that stablecoins may ultimately capture. We take a different approach. Our stochastic approach—running thousands of Monte Carlo-style simulations using an autoregressive model—suggests that the stablecoin market capitalization could reach around $1.2 trillion by the end of 2028 (see Exhibit 3). Figure 3. Model-Based Forecast of Stablecoin Market Capitalization Growth To be clear, since stablecoins' utility compounds as more consumers and businesses adopt them, their growth dynamics cannot be perfectly simulated. This leaves significant room for fluctuation in analysts' valuations. That said, data gaps remain on real-world adoption patterns, making it challenging to predict the ultimate stablecoin market size. Our weighted autoregressive AR(1) model focuses more on certain historical observations to capture long-term and localized temporal patterns:

We estimate log supply using a simple AR(1) model, but we give greater weight to the period after 2024 to reflect (1) a structurally better policy backdrop and (2) accelerating adoption trends.

We then run Monte Carlo simulations of thousands of forward paths by resampling recent growth shocks, which preserves the fatter tails of “crypto-style” noise we actually see, rather than assuming a neat bell curve.

How to Simulate Stablecoin Growth

We believe this approach is appropriate for today’s market because it captures the right economics with minimal assumptions. Stablecoin supply growth is path-dependent and persistent. Good policy and distribution mean that growth is likely to breed growth. An autoregressive AR(1) at the log-level captures this persistence without overfitting to dozens of covariates that are themselves regime-sensitive. The post-2024 weights allow the model to “learn” from the environment we care about most.

That is, our model focuses on historical observations, including: (1) recent US policy momentum (e.g., passage of the GENIUS Act, state/federal frameworks, etc.); (2) the integration of stablecoins into institutional rails; and (3) significant improvements in fiat access. We believe this is more relevant than using diluted data from an earlier, less relevant period. The residual bootstrapping step respects observed growth volatility, so our forecast intervals are statistically honest to uncertainty while still centered on the new regime.

Furthermore, we believe the $1.2 trillion path is both realistic and consistent with our front-end rate model. Growing from the current $275 billion to $1.2 trillion implies a net issuance of approximately $925 billion in U.S. Treasury securities over approximately 175 weeks, or about $5.3 billion per week (see the next section). Our model suggests that such weekly issuance would only result in a temporary decline of about 4.5 basis points in short-term interest rates (3-month yields) over two to four weeks. Because this reaction would gradually decay, the effects would not compound indefinitely. We believe that trillions of dollars in money market funds could be reallocated between Treasury securities, repurchase agreements, and the Federal Reserve's overnight reverse repurchase (O/N RRP) facility, which sets an effective floor for overnight interest rates and constrains Treasury pricing. On the supply side, the Treasury could favor issuing bills when demand is strong; on the demand side, stablecoin issuers could moderately diversify maturities around three months, either of which would further dilute the persistent downward pressure on yields. In short, we believe this forecast does not require an unrealistically large or permanent interest rate dislocation to materialize; rather, it relies on gradual, policy-supported adoption that compounds over time.

A Deeper Look at the Treasury Bond Constraint

Stablecoins have become a significant new source of demand for U.S. Treasuries and have the potential to fundamentally change the landscape of Treasury supply management. In fact, stablecoin issuers have already ranked among the top ten holders of U.S. Treasuries among all sovereign entities. In fact, the top two stablecoin issuers alone were the seventh-largest buyers of U.S. Treasuries as of June 30, 2025 (see Figure 4). Figure 4. Top Buyers of U.S. Treasuries So Far (as of June 30, 2025) However, the backing mechanisms of stablecoins raise questions about whether these instruments deplete the U.S. government's ability to issue short-term Treasury bills (T-bills) and the extent to which fund flows might affect these yields. Clearly, the issuance and redemption of stablecoins pushes the front end of the U.S. yield curve, as issuers buy T-bills when the stablecoins are issued and sell them when they are redeemed. However, modeling this impact can be complex, particularly when examining inflows and outflows. For example, we estimate that $3.5 billion in stablecoin inflows (over five days) could compress the three-month yield by approximately 2 basis points over 10 days and up to 4 basis points over 20 days. This is broadly consistent with a recent Bank for International Settlements (BIS) study (see Exhibit 5). Our baseline estimates of inflows suggest that the impact on the three-month Treasury yield is small in the first week, gradually increases over weeks 2-3, and ultimately tapers off. Our model removes common front-end drivers before estimating the "stablecoin effect." We control for forward changes in adjacent maturities (1-month and 6-month yields), as well as the recent five-day changes in 1-month, 3-month, and 6-month yields, outstanding bills (supply), Fed RRP balances (front-end cash pressure), and the VIX (risk sentiment). This avoids misidentifying the Fed meeting date, curve movements, or liquidity fluctuations as catalysts for stablecoin effects. Figure 5. Impact of $3.5 Billion in Stablecoin Inflows over 5 Days on the 3-Month U.S. Treasury Yield. That is, we isolate causality by leveraging predictors that drive flows but do not directly affect Treasury yields. Our inputs include lagged cryptocurrency market cumulative residuals (i.e., the portion of cryptocurrency returns not explained by macro/curve factors) and lagged deviations of USDT/USDC from a $1.00 peg (outlier-removed and sign-split). We then confirm that our method for identifying the direct impact of stablecoin flows on Treasury yields is statistically robust.

Risks and Uncertainties

Simulating the impact of stablecoin outflows on Treasury yields has proven significantly more difficult, as the impact of outflows is highly asymmetric compared to inflows. Such models require unique features that often affect their accuracy. For example, the Bank for International Settlements suggests that a similar $3.5 billion stablecoin outflow could lead to a yield tightening of approximately 6-8 basis points, as tight market conditions could hinder the timing of stablecoin issuers' Treasury issuance. However, limited data on tail events makes such model estimates less reliable, while regulatory changes may open up the possibility for issuers to explore alternative funding sources.

This is not intended to mitigate the risk of stablecoin outflows. Their asymmetric impact is directly related to negative decoupling, which can have nonlinear knock-on effects on Treasury bonds. One of the largest such events in recent history (among major stablecoin issuers) occurred in March 2023, when USDC briefly plummeted below 87 cents following the disclosure that 8% of its reserves were held at Silicon Valley Bank (SVB). This concentration risk itself is caused by a regulatory environment that makes it difficult for cryptocurrency-related entities to establish the extensive banking relationships necessary to mitigate redemption risk. For example, the collapse of Silicon Valley Bank (SVB) stemmed primarily from poor asset-liability management, as the bank invested heavily in long-term U.S. Treasury bonds and mortgage-backed securities using short-term, uninsured deposits. Crucially for stablecoin issuers, Operation Chokehold 2.0 forced many cryptocurrency companies to work with only a handful of crypto-friendly banks willing to do business with them. Federal regulators subsequently urged these banks to restrict deposits from cryptocurrency-related entities, which directly led to deposit instability and ultimately a run on SVB. (Evidence based on Federal Deposit Insurance Corporation (FDIC) documents obtained through a Freedom of Information Act lawsuit.) While this does not negate the decoupling event, it does suggest that this was likely an isolated case with limited explanatory power for testing the stability of stablecoins or the resilience of Treasury markets during periods of stress. Furthermore, while our analysis to date has only assumed that stablecoin issuance represents new demand for Treasury bonds, we believe that funds could be reallocated from commercial bank deposits, offshore foreign exchange, and money market funds to stablecoins, creating a substitution effect. That is, if $1 were transferred from a bank to a stablecoin issuer, this would likely constitute only a marginal net increase in demand for additional Treasury bond supply. This poses downside risks not only to our initial estimate that stablecoin inflows would compress Treasury yields by 2-4 basis points, but also to our estimate that stablecoin outflows would compress yields. Another challenge in modeling the effects of stablecoin flows stems from the evolving regulatory environment following the July approval of the GENIUS Act. The GENIUS Act, which will take effect in January 2027, protects consumer rights by imposing strict 1:1 reserve requirements (audited monthly) on 100% of the face value of outstanding stablecoins, senior bankruptcy claims for stablecoin holders, and regulatory oversight at the state or federal level. However, several unanswered questions remain regarding the future of stablecoin operations that may be resolved over the next 18 months. For example, many stablecoins are currently issued through intermediaries rather than directly by the issuer. This results in a two-tiered redemption system, in which only institutions (not retail investors) have a direct contractual relationship with the issuer, a concern raised by SEC Commissioner Caroline Crenshaw in April. Addressing this issue is likely to remain a point of contention, despite the GENIUS Act, which strengthens legal protections for stablecoin holders by requiring stablecoin issuers to publicly disclose their redemption policies. Another key issue in addressing the "run risk" posed by potential capital outflows is whether stablecoin issuers can gain access to the Federal Reserve's balance sheet (e.g., credit lines, master account), similar to the access enjoyed by banks and money market funds. The GENIUS Act does not explicitly grant stablecoin issuers access to the master account or discount window, leaving this to the Fed's discretion. However, the Act could allow these entities to operate as subsidiaries of insured banks, which could indirectly grant the Fed access if the parent company meets the requirements. Again, implementation remains crucial. Conclusion Our analysis suggests that stablecoins are poised for significant growth. Our stochastic model predicts that the stablecoin market capitalization will reach approximately $1.2 trillion by the end of 2028. This growth will be supported by an improving policy environment and accelerating adoption. Ultimately, as stablecoins continue to grow, we believe that clear reserve rules, frequent disclosures, and liquidity buffers will be critical to reducing the risk that large redemptions will devolve into a cascade of forced Treasury sell-offs. That said, we believe developments like the GENIUS Act will be crucial to mitigating run risks and building a more resilient stablecoin ecosystem.

Catherine

Catherine