Author: Jay Jo, Research Analyst at Tiger Research; Translation: Jinse Finance xiaozou

Coinbase is transforming from a simple exchange to a full-stack cryptocurrency ecosystem through the Base chain and The Base application.

The company is also following the Google model, expanding its influence to the entire cryptocurrency industry by acquiring a number of cryptocurrency startups and a strong Coinbase "alumni" network.

Coinbase's strategic move will obviously promote the popularity of the cryptocurrency industry. But it also forms a new centralized architecture, leaving the difficult question of how to balance decentralized values.

1. Coinbase: Ambition beyond the Exchange

In April 2021, Coinbase became the first cryptocurrency exchange to be listed on a stock exchange. The company was listed on the Nasdaq through a direct listing. This is not only an IPO of a company, but also a symbolic turning point, which means that the cryptocurrency industry has officially entered the mainstream financial system. The company's name is also symbolic. "Coinbase" comes from Bitcoin's "Coinbase transaction" - the first transaction recorded when a new block is created, representing the moment when cryptocurrency was born. The name reflects the company's firm commitment to becoming the starting point of the cryptocurrency ecosystem. The symbolic meaning of Coinbase is not limited to the name. The company has been expanding its business scope based on its exchange business and is now building a huge ecosystem. Its launch of Ethereum L2 Base and the latest release of The Base App (TBA) at the "A New Day One" event show that Coinbase is building a full-stack cryptocurrency ecosystem from infrastructure to application layer. This article will analyze how Coinbase has grown from an exchange to an empire covering the entire cryptocurrency ecosystem and explore the significance of these changes to the industry. 2. Crypto full-stack ecosystem: exchanges, infrastructure and consumer applications 2.1 Exchanges: Coinbase's reliable cash cow Coinbase's core business is undoubtedly its exchange. The company provides cryptocurrency trading services to a variety of users, from individuals to institutions, and earns revenue through transaction fees. By 2024, transaction fee revenue will account for about 60% of total revenue, reaching about $4 billion. The relatively stable transaction fee income has become the basis for Coinbase to develop new businesses, which is similar to the development model of Amazon using AWS as a cash cow to expand diversified businesses.

In addition, the value of the exchange is also reflected in its strategic scalability. As the core deposit and withdrawal channel connecting fiat currency and cryptocurrency, the exchange has gained a huge user base and transaction data by virtue of this status. Based on this foundation, it plays the role of a strategic hub, which can naturally introduce users into a broader ecosystem. The exchange not only provides Coinbase with financial stability, but also gives it strategic scalability, becoming the core cornerstone of ecological development.

2.2 Base Chain: A strategic leap from off-chain to on-chain

Base Chain is a second-layer blockchain based on Ethereum built directly by Coinbase. Through this chain, Coinbase has expanded from exchange business to the on-chain field.

This expansion stems from the structural characteristics of the cryptocurrency ecosystem. The cryptocurrency ecosystem is divided into two environments: off-chain and on-chain. Exchanges mainly provide trading services between fiat currencies and cryptocurrencies in the off-chain environment.

However, the actual use of cryptocurrencies occurs in an on-chain environment outside of Coinbase. This includes scenarios such as cryptocurrency-based mortgage lending and governance participation. For example, after users purchase cryptocurrencies on Coinbase, they need to transfer them to the chain to participate in specific DeFi protocols. This means that Coinbase faces structural limitations and is forced to transfer users to other ecosystems.

The Base chain solves these limitations. Now even if users buy cryptocurrencies on Coinbase and withdraw them, they can still stay in the Coinbase ecosystem. Just as Apple controls both hardware and software, Coinbase is now able to manage the entire user process from exchange to infrastructure. This strategic significance is very significant.

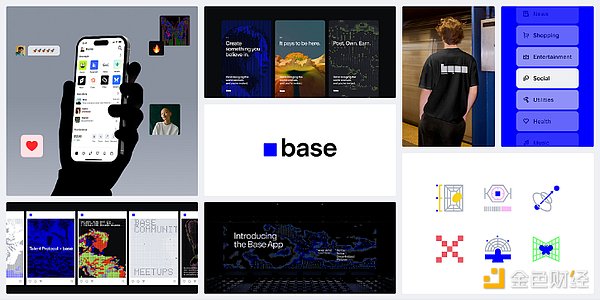

2.3 TBA: The last piece of the crypto ecological puzzle

In July 2025, Coinbase announced the launch of the on-chain super application TBA, moving towards a more ambitious vision. This strategy is not limited to acquiring users through exchanges, but also aims to provide users with a directly usable application layer through the Base infrastructure. Although there are many dApps developed based on Base, they are scattered and difficult to integrate. No matter how excellent the performance of the Base chain is or how low the cost is, if ordinary users cannot easily access it, it is difficult to generate real value.

TBA integrates the core elements of the crypto ecosystem - exchanges, infrastructure and applications - into a single platform to provide a seamless user experience. Users can make cryptocurrency payments and transfers, and also earn income through Farcaster social services, and use them immediately for online and offline payments, creating a new on-chain experience. Multiple services work together to form a powerful synergy to jointly build a huge on-chain economic ecosystem. As a result, the threshold for participating in the on-chain economy has been greatly lowered. This marks that the grand ecosystem that Coinbase has been building has finally completed the last piece of the puzzle.

3. Coinbase builds a crypto empire

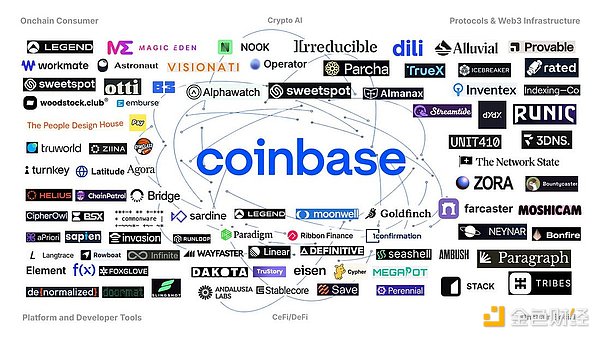

Coinbase is no longer just an exchange. Based on its exchange business, the company has successively built blockchain infrastructure and consumer applications, and eventually developed into a huge empire covering the entire cryptocurrency ecosystem.In addition, through aggressive M&A strategies, its business scope is expanding to more diverse fields - including the acquisition of token management platform LiquiFi, zero-knowledge proof technology company Iron Fish, Web3 advertising platform Spindl and cryptocurrency derivatives exchange Deribit, extending its tentacles to every corner of the Web3 industry.

These measures are like an aircraft carrier strategy that attempts to control all touch points of cryptocurrency. Its relationship with Circle, the issuer of the stablecoin USDC, is even more interesting: Coinbase is not only the main shareholder of Circle, but also can share a certain proportion of USDC interest income in addition to equity investment. The agreement even stipulates that if Circle goes bankrupt or fails to fulfill its profit distribution obligations, some USDC-related rights and interests will be transferred to Coinbase. It can be seen that Coinbase controls almost all core infrastructure in the cryptocurrency ecosystem.

Coinbase's expansion strategy is not only achieved through mergers and acquisitions. Another core strategy is to allow the Coinbase "alumni" network to permeate the entire cryptocurrency industry like the "PayPal Mafia" of the past. The company has invested in more than 40 Web3 startups founded by former Coinbase employees, and continues to build a close collaborative network by establishing partnerships. Typical cases include Polychain Capital, founded by Olaf Carlson-Wee, the first employee of Coinbase, and well-known Web3 projects such as dYdX, Farcaster, Zora, and B3, all of which were founded by Coinbase alumni.

We still regard Coinbase as an exchange, but its actual operating model is closer to Google in the Web2 era. Just as Google started with the search business and eventually dominated the entire digital field including advertising, cloud computing and mobile ecology, Coinbase also started with the exchange business and built a huge empire covering the entire cryptocurrency ecosystem.

4. The exchange-centered crypto market: pros or cons?

Coinbase is building a huge empire. The company's development path from exchange to Base chain to TBA has clear strategic intentions. But in the aggressive expansion strategy, we need to examine its industry positioning.

Cryptocurrency once held high the banner of decentralization, but now it is returning to centralization in the pursuit of convenience. Once users voluntarily enter the Coinbase ecosystem, they often find no reason to leave - this is essentially no different from the traditional financial structure.

This shift is not entirely negative. Integrated platforms like TBA do bring real benefits to users: no complicated wallet connection, no need to switch between platforms, no need to worry about high gas fees, users can access all services in one application. From earning income through social activities to actually completing payments, the entire process is seamless. Coinbase's model has clearly promoted the popularity of cryptocurrency.

But the key problem cannot be ignored: cryptocurrency was originally born for decentralization, but now it has spawned a new centralized structure because of convenience. Users voluntarily stay in the Coinbase ecosystem and lack the motivation to migrate, which is essentially no different from the traditional centralized financial system we are trying to subvert.

The market has already chosen convenience, and it is difficult to reverse this trend. The top priority is to find a balance between the convenience of centralization and the spirit of decentralization. The real challenge is how to build an ecosystem that guarantees users’ right to choose through healthy competition and continuous innovation while maintaining the core value of cryptocurrency.

Davin

Davin

Davin

Davin Jasper

Jasper Aaron

Aaron Jasper

Jasper Hui Xin

Hui Xin Kikyo

Kikyo Alex

Alex Jasper

Jasper Hui Xin

Hui Xin YouQuan

YouQuan